0 apr credit card business – 0% APR credit cards can be a valuable tool for businesses looking to manage cash flow, finance large purchases, or consolidate debt. These cards offer a period of time, typically 6 to 18 months, where you can use the card without incurring any interest charges. This can be a great way to save money on interest payments and make larger purchases without straining your budget.

However, it’s important to be aware of the potential risks associated with 0% APR credit cards. If you don’t pay off the balance before the introductory period ends, you’ll be charged interest at a much higher rate. Additionally, these cards often come with fees, such as annual fees, balance transfer fees, and late payment fees. It’s important to weigh the benefits and risks carefully before applying for a 0% APR credit card.

What is a 0% APR Credit Card?

A 0% APR credit card is a type of credit card that offers a promotional period where you can borrow money without paying any interest charges. This can be a great way to save money on interest, especially if you’re planning to make a large purchase or consolidate debt.

Duration of the Introductory 0% APR Period

The introductory 0% APR period on a credit card typically lasts for a set amount of time, usually between 6 and 18 months. The exact length of the promotional period will vary depending on the credit card issuer and the specific card you choose.

Common Fees Associated with 0% APR Credit Cards

While 0% APR credit cards can be a great way to save money on interest, it’s important to be aware of the potential fees associated with them. Some common fees include:

- Annual Fees: Many 0% APR credit cards charge an annual fee, which can range from $0 to several hundred dollars per year.

- Balance Transfer Fees: If you’re using a 0% APR credit card to consolidate debt, you’ll likely be charged a balance transfer fee. This fee is typically a percentage of the amount you transfer, usually between 3% and 5%.

- Cash Advance Fees: If you take out a cash advance on a 0% APR credit card, you’ll likely be charged a cash advance fee, as well as interest from the date you take out the advance. This fee can be a percentage of the amount you withdraw or a flat fee, typically ranging from $5 to $10.

- Late Payment Fees: If you make a late payment on your 0% APR credit card, you’ll likely be charged a late payment fee. This fee can range from $25 to $35.

Benefits of 0% APR Credit Cards for Businesses

A 0% APR credit card can be a valuable tool for businesses, offering several benefits that can help manage finances and improve cash flow. By strategically utilizing these cards, businesses can gain significant advantages in managing their financial resources.

Managing Cash Flow

A 0% APR credit card can be a valuable tool for managing cash flow, especially for businesses with seasonal fluctuations in revenue. Businesses can use the card to bridge short-term cash flow gaps, such as during periods of low sales or unexpected expenses. By making purchases on the card during these times, businesses can maintain their operational expenses and avoid potentially damaging cash flow shortages. This strategy can be particularly beneficial for businesses with irregular income streams or those facing unforeseen financial challenges.

Large Purchases and Project Financing, 0 apr credit card business

Businesses can leverage the 0% APR period to finance large purchases or projects without incurring high interest costs. This can be particularly beneficial for acquiring new equipment, expanding operations, or undertaking major renovations. By spreading the cost of these purchases over the interest-free period, businesses can manage their budget effectively and avoid straining their cash flow. This approach can allow businesses to make significant investments without compromising their financial stability.

Debt Consolidation

0% APR credit cards can be a useful tool for consolidating existing debt and reducing interest payments. Businesses with multiple high-interest loans or credit cards can transfer these balances to a 0% APR card. This can result in significant savings on interest charges, allowing businesses to free up cash flow and improve their overall financial health. However, it’s crucial to develop a repayment plan and ensure the balance is paid off before the introductory period ends.

Factors to Consider When Choosing a 0% APR Credit Card

Choosing the right 0% APR credit card can significantly benefit your business, but it’s crucial to carefully consider various factors before making a decision. By comparing different options, you can find a card that aligns with your specific needs and helps you maximize your savings.

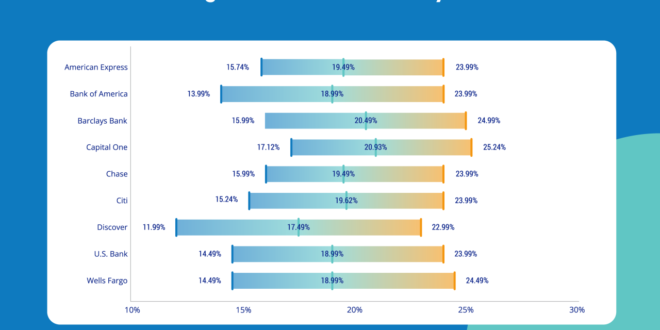

Comparing APRs, Introductory Periods, and Fees

It’s essential to compare the APRs, introductory periods, and fees offered by different 0% APR credit cards.

- APRs: The APR is the interest rate you’ll be charged after the introductory period ends. Look for cards with the lowest possible APR, as this will minimize your interest charges in the long run.

- Introductory Periods: The introductory period is the time you have to pay off your balance before interest starts accruing. Cards with longer introductory periods give you more time to pay off your debt without incurring interest charges. For example, a card with a 12-month introductory period allows you to pay off your balance within a year without paying interest.

- Fees: Many 0% APR credit cards come with various fees, such as annual fees, balance transfer fees, and cash advance fees. It’s important to compare these fees across different cards and choose one with the lowest overall fees. Some cards might offer a balance transfer fee waiver for a limited time, which can be beneficial if you’re planning to transfer an existing balance.

Creditworthiness Requirements

The creditworthiness requirements for different 0% APR credit cards can vary significantly.

- Credit Score: Cards with lower APRs and longer introductory periods often require a higher credit score. If you have a good credit score, you’ll have access to more competitive offers.

- Credit History: Your credit history, including the length of your credit history and your payment history, also plays a role in determining your eligibility for a 0% APR credit card.

- Income: Some credit card issuers may consider your income when assessing your creditworthiness.

Balance Transfer Credit Cards vs. Purchase Credit Cards

There are two main types of 0% APR credit cards: balance transfer credit cards and purchase credit cards.

- Balance Transfer Credit Cards: These cards are specifically designed to help you consolidate debt by transferring balances from other credit cards. They typically offer a 0% APR introductory period for balance transfers, allowing you to pay off your debt without accruing interest.

- Purchase Credit Cards: These cards allow you to make purchases and enjoy a 0% APR introductory period on those purchases. They can be useful for making large purchases, such as equipment or inventory, and paying them off over time without interest charges.

Potential Risks of 0% APR Credit Cards

While 0% APR credit cards offer a tempting opportunity to save on interest charges, it’s crucial to understand the potential risks associated with them. Failing to pay off the balance before the introductory period ends can lead to substantial financial burdens.

High Interest Charges After Introductory Period

The biggest risk of 0% APR credit cards is the high interest rate that kicks in after the promotional period ends. This rate can be significantly higher than the average interest rate on other credit cards, making it difficult to manage your debt if you haven’t paid off the balance. For instance, a card with a 0% APR for 12 months might have a standard APR of 20% after that period. If you haven’t paid off the balance by then, you’ll start accruing interest at that rate, potentially leading to a significant debt burden.

Consequences of Missed Payments

Missing payments on your 0% APR credit card can have severe consequences.

- Late Fees: You’ll likely incur late payment fees, which can range from $25 to $35 per missed payment. These fees can quickly add up, further increasing your debt burden.

- Increased Interest Rate: Missing payments can damage your credit score, making it harder to qualify for future loans and potentially leading to higher interest rates on existing debt.

- Account Closure: If you continue to miss payments, the issuer may close your account, leaving you with no access to credit and further damaging your credit score.

Exceeding the Credit Limit

Exceeding your credit limit can also lead to penalties and negative impacts on your credit score.

- Over-limit Fees: You may be charged an over-limit fee, which can range from $25 to $39 per occurrence. These fees can add up quickly, especially if you regularly exceed your limit.

- Negative Impact on Credit Score: Exceeding your credit limit can lower your credit score, making it more difficult to qualify for future loans and potentially leading to higher interest rates on existing debt.

- Account Closure: If you consistently exceed your credit limit, the issuer may close your account, leaving you with no access to credit and further damaging your credit score.

Risks Associated with Using Credit Cards for Business Expenses

Using credit cards for business expenses can come with additional risks.

- Potential for Fraud: Business credit cards are susceptible to fraud, and if your card is compromised, it could lead to significant financial losses. It’s important to take precautions to protect your card and report any suspicious activity immediately.

- Overspending: It’s easy to overspend when using a credit card, especially if you’re not careful about tracking your expenses. Overspending can lead to debt and financial strain on your business.

- Negative Impact on Business Credit: Missing payments or exceeding your credit limit on your business credit card can negatively impact your business credit score, making it harder to secure loans or lines of credit in the future.

Final Wrap-Up

0% APR credit cards can be a helpful tool for businesses, but it’s essential to understand the terms and conditions carefully. By carefully considering the benefits, risks, and alternatives, you can make an informed decision about whether a 0% APR credit card is the right financing option for your business.

FAQ Corner: 0 Apr Credit Card Business

How do I qualify for a 0% APR credit card?

Credit card issuers have varying eligibility requirements. Generally, you’ll need good credit and a history of responsible credit card use.

What happens if I don’t pay off the balance before the introductory period ends?

You’ll be charged interest at the card’s standard APR, which is typically much higher than the introductory 0% APR.

Are there any other fees associated with 0% APR credit cards?

Yes, there are often fees such as annual fees, balance transfer fees, and late payment fees.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!