Staples credit application for business provides a convenient way for businesses to purchase office supplies and equipment, offering potential savings and streamlined purchasing processes. This guide delves into the details of applying for a Staples credit account, exploring its benefits, features, and how it compares to other business credit options.

Whether you’re a small startup or a larger enterprise, understanding the intricacies of a Staples credit account can help you make informed decisions about managing your business finances and acquiring essential supplies.

Staples Credit Application Overview

The Staples credit application for businesses provides a convenient and efficient way to manage your office supplies purchasing needs. It offers a streamlined process to access credit and enjoy the benefits of a Staples credit account.

Eligibility for a Staples Credit Account

The Staples credit account is designed to cater to the needs of various businesses. To be eligible, your business must meet specific criteria. These criteria ensure that the credit account is a valuable tool for businesses that regularly purchase office supplies.

- Registered Businesses: The applicant business must be legally registered and operate within the United States.

- Business Type: The Staples credit account is available to a wide range of businesses, including corporations, partnerships, sole proprietorships, and non-profit organizations.

- Financial Standing: The applicant business must demonstrate a sound financial standing, including a positive credit history and stable revenue streams.

Benefits of a Staples Credit Account

Having a Staples credit account offers several advantages for businesses looking to streamline their office supply purchases.

- Convenient Purchasing: The credit account allows businesses to make purchases at Staples stores and online without needing to pay upfront. This streamlines the purchasing process and eliminates the need for immediate cash payments.

- Flexible Payment Options: Staples credit account holders have the flexibility to choose a payment plan that suits their business needs. They can opt for monthly payments or utilize the available credit limit for larger purchases.

- Exclusive Offers and Discounts: Staples credit account holders often receive exclusive discounts, promotions, and early access to new products. These benefits can lead to significant cost savings on regular office supply purchases.

- Simplified Budgeting: By using a credit account, businesses can consolidate their office supply expenses into a single monthly payment. This simplifies budgeting and improves financial planning.

- Rewards Programs: Some Staples credit accounts offer rewards programs that allow businesses to earn points or cashback on their purchases. These rewards can be redeemed for discounts, merchandise, or other benefits.

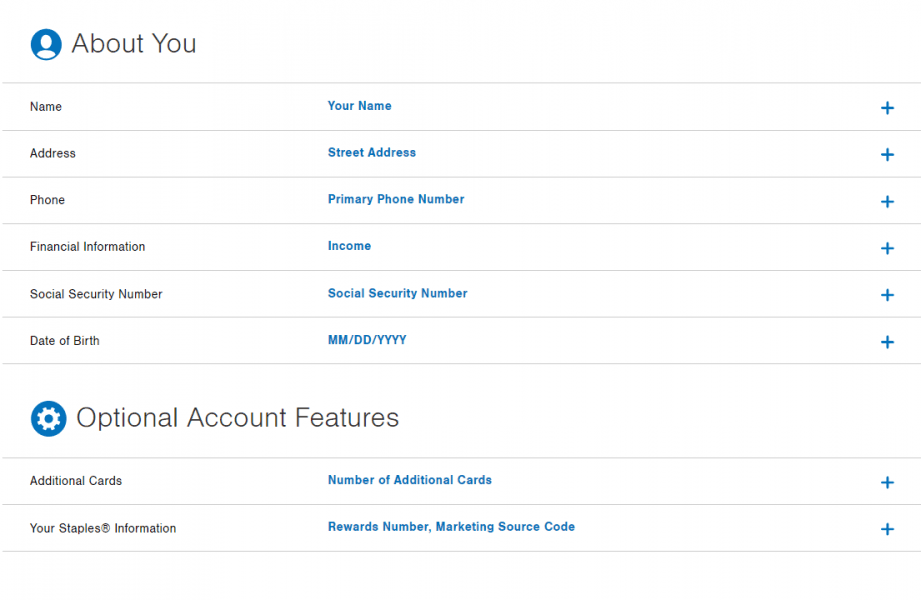

Application Process

Applying for a Staples credit account is a straightforward process that requires minimal effort. The process is designed to be user-friendly and efficient, allowing businesses to quickly access the credit they need to purchase supplies and equipment.

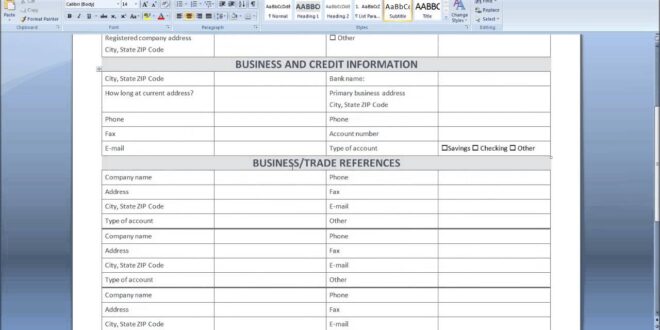

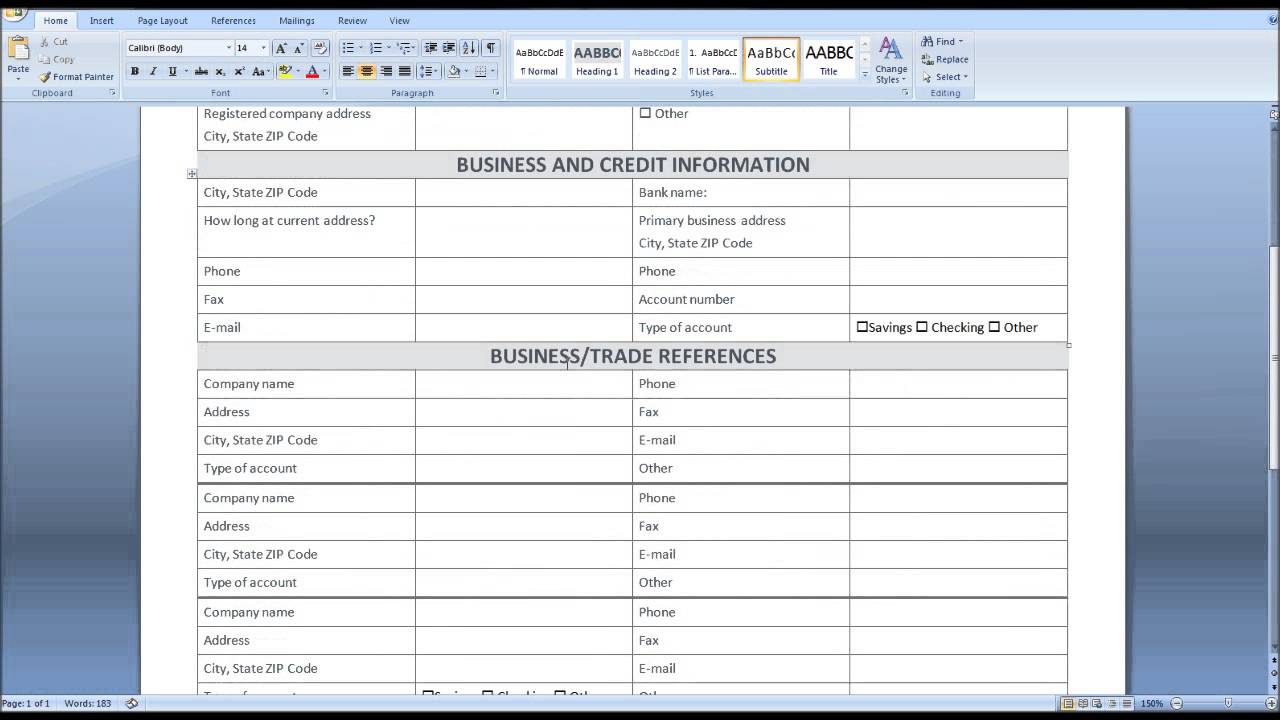

Required Documentation

The documentation required for a Staples credit application is essential for assessing your business’s financial health and creditworthiness. These documents provide Staples with the necessary information to make an informed decision regarding your credit application.

- Business Information: This includes the business name, address, phone number, and contact person. It’s essential to provide accurate and up-to-date information to avoid any delays in the application process.

- Tax Identification Number (TIN): Your TIN, such as an Employer Identification Number (EIN) or Social Security Number (SSN), is crucial for verifying your business’s identity and tax status. It allows Staples to confirm that your business is registered and operating legally.

- Financial Statements: Staples typically requires recent financial statements, such as income statements and balance sheets, to assess your business’s financial performance and stability. These documents provide insight into your business’s revenue, expenses, assets, and liabilities.

- Bank References: Providing bank references allows Staples to verify your business’s banking history and financial standing. It helps them understand your business’s cash flow and overall financial health.

- Credit History: Staples may request a credit report to assess your business’s creditworthiness. This report provides information on your business’s past credit behavior, including payment history and outstanding debts.

Creditworthiness Evaluation Criteria

Staples uses a comprehensive approach to evaluate your business’s creditworthiness. The evaluation process considers various factors, including your business’s financial history, credit score, and overall financial health.

- Financial Performance: Staples examines your business’s financial statements to assess its profitability, cash flow, and overall financial stability. This includes evaluating revenue growth, expense management, and the ratio of debt to equity.

- Credit History: Staples reviews your business’s credit report to understand its past credit behavior. This includes examining payment history, credit utilization, and any outstanding debts. A positive credit history, characterized by timely payments and responsible credit utilization, indicates a low risk to Staples.

- Industry and Market Conditions: Staples considers the industry and market conditions in which your business operates. Factors such as industry growth, competition, and economic trends can influence your business’s financial performance and creditworthiness.

- Business Plan: If your business is new or has a limited credit history, Staples may request a business plan. This document Artikels your business’s goals, strategies, and financial projections, providing insight into your business’s future potential and ability to repay its debts.

Credit Account Features

The Staples credit account offers a variety of features designed to make your business purchases more convenient and manageable. Here are some of the key aspects you should consider:

Credit Limits

The credit limit assigned to your Staples credit account will depend on several factors, including your business’s credit history, annual revenue, and the length of time your business has been operating. Staples assesses these factors to determine the appropriate credit limit that aligns with your business needs.

Payment Terms, Staples credit application for business

Staples provides flexible payment terms to accommodate your business’s cash flow. You can choose from various payment options, including:

- Net 30: This option allows you to pay your balance in full within 30 days of the invoice date. This is a common payment term for businesses that have established credit histories and consistent cash flow.

- Net 60: This option extends your payment window to 60 days from the invoice date. This may be a suitable choice for businesses with longer payment cycles or seasonal fluctuations in revenue.

Interest Rates and Fees

The interest rates and fees associated with your Staples credit account are determined by your creditworthiness and the specific account terms. It’s crucial to review the terms and conditions carefully to understand the charges you may incur. Some common fees include:

- Annual Percentage Rate (APR): This is the annual interest rate charged on your outstanding balance. The APR can vary based on your credit score and the account’s terms.

- Late Payment Fee: If you fail to make your minimum payment by the due date, a late payment fee may be applied to your account.

- Over-Limit Fee: If you exceed your credit limit, an over-limit fee may be assessed. It’s essential to monitor your spending and ensure you stay within your assigned credit limit.

Payment Methods

Staples offers various convenient payment methods to manage your account effectively. You can choose from the following options:

- Online Payments: You can make payments directly from your bank account through the Staples website. This option is quick, secure, and available 24/7.

- Phone Payments: You can make payments over the phone by calling Staples customer service. This option provides flexibility for businesses that prefer to manage their payments through phone calls.

- Mail Payments: You can send a check or money order to the address provided on your invoice or statement. This option is suitable for businesses that prefer traditional payment methods.

Account Management

Managing your Staples credit account is straightforward and can be done through various convenient options. Whether you prefer online or offline methods, Staples provides a user-friendly experience to ensure you stay on top of your account activity.

Online Account Management

Online account management offers a wide range of features, allowing you to conveniently manage your Staples credit account from the comfort of your home or office.

- View account balance and transaction history: You can easily access your account balance and review past transactions, giving you a clear picture of your account activity.

- Make payments: Pay your bill online using various methods, including debit cards, credit cards, and bank accounts.

- Update contact information: Ensure your contact information is up-to-date by making changes directly through your online account.

- Set up payment reminders: Avoid late payments by setting up email or text message reminders to alert you when your payment is due.

- Manage your credit limit: Depending on your account type, you may have the option to request a credit limit increase online.

Offline Account Management

While online account management provides a comprehensive range of features, Staples also offers convenient offline options for those who prefer traditional methods.

- Make payments by phone: Contact Staples customer service by phone to make a payment using your credit card or bank account.

- Make payments by mail: Send a check or money order to the address provided on your monthly statement.

- Contact customer service: Reach out to Staples customer service for assistance with account inquiries, payment issues, or other concerns.

Account Activity Tracking

Staples provides several ways to stay informed about your account activity and ensure you’re up-to-date on your account status.

- Monthly statements: You’ll receive a detailed monthly statement outlining your account balance, recent transactions, payment due date, and other important information.

- Email or text message alerts: You can sign up for email or text message alerts to receive notifications about account activity, such as payment due dates, late payment reminders, or credit limit changes.

- Online account access: Regularly logging into your online account provides you with real-time updates on your account balance, transaction history, and any recent changes or notifications.

Account Issue Resolution

Staples is committed to providing excellent customer support and resolving any account issues promptly and efficiently.

- Online help center: Access a comprehensive online help center with FAQs, articles, and troubleshooting guides to address common account issues.

- Customer service phone line: Contact Staples customer service by phone for personalized assistance with account inquiries, payment issues, or other concerns.

- Live chat: For immediate assistance, connect with a customer service representative through live chat on the Staples website.

Ending Remarks

Securing a Staples credit account can be a valuable tool for businesses seeking to optimize their purchasing processes and manage cash flow. By carefully considering the application process, understanding the credit account features, and comparing it to other business credit options, businesses can make an informed decision about whether a Staples credit account aligns with their needs and financial goals.

Answers to Common Questions: Staples Credit Application For Business

How long does it take to get approved for a Staples credit account?

The approval process typically takes a few business days, but can vary depending on the complexity of the application and the information provided.

What is the minimum credit score required for a Staples credit account?

Staples does not publicly disclose a specific minimum credit score requirement. However, having a good credit history generally increases your chances of approval.

Can I use my Staples credit account for online purchases?

Yes, you can use your Staples credit account for online purchases on the Staples website and mobile app.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!