Starting a business credit line can be a game-changer for entrepreneurs, offering access to crucial funding for growth and expansion. This guide delves into the world of business credit lines, providing a comprehensive overview of everything you need to know from eligibility criteria to managing your line effectively.

Building a solid business credit history is essential for securing loans, obtaining favorable terms, and establishing a strong financial foundation. Understanding the intricacies of business credit lines can empower you to make informed decisions and navigate the financial landscape with confidence.

Understanding Business Credit Lines

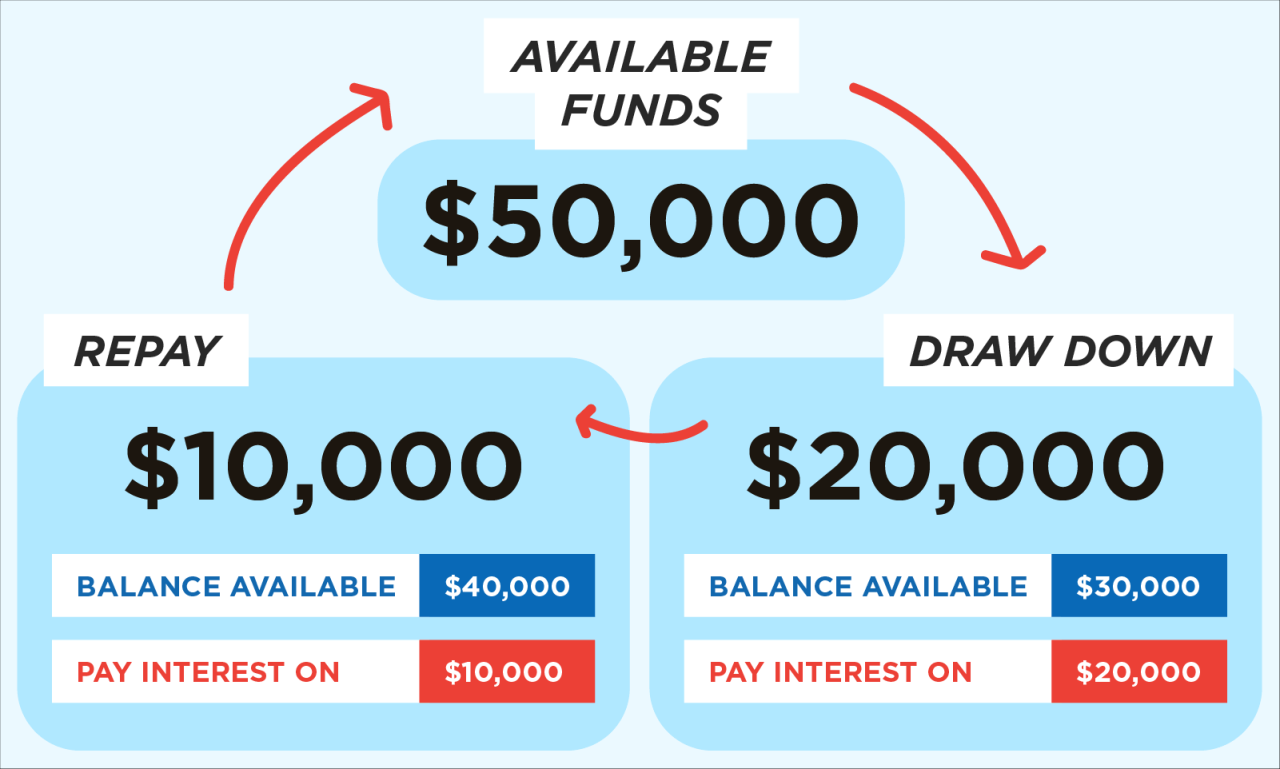

A business credit line is a revolving line of credit that allows businesses to borrow money up to a pre-approved limit. It’s similar to a credit card, but it’s designed for businesses rather than individuals.

Key Differences between Business and Personal Credit Lines

A business credit line is separate from a personal credit line. It is built upon the financial health of your business rather than your personal credit score. This means that your business’s credit history and financial performance will be evaluated to determine your eligibility and borrowing limit. You can build your business credit by paying bills on time, establishing business accounts, and obtaining business credit cards.

Benefits of Establishing a Business Credit Line

- Funding for Growth: Business credit lines provide flexibility for businesses to cover short-term expenses, invest in new equipment, or fund seasonal fluctuations in revenue.

- Improved Credit Score: Establishing a business credit line and managing it responsibly can help build your business’s credit score, making it easier to secure loans and other financing in the future.

- Access to Capital: A business credit line offers a reliable source of funding, providing peace of mind for unexpected expenses or opportunities.

- Better Interest Rates: Business credit lines often have lower interest rates than personal loans or credit cards, saving businesses money on borrowing costs.

Common Types of Business Credit Lines

There are various types of business credit lines, each with its own features and benefits.

- Unsecured Business Credit Lines: These lines of credit are not backed by collateral, making them easier to obtain but often come with higher interest rates.

- Secured Business Credit Lines: These lines of credit require collateral, such as equipment or real estate, to secure the loan. They typically have lower interest rates due to the reduced risk for lenders.

- Revolving Lines of Credit: These lines of credit allow businesses to borrow and repay funds repeatedly, as long as the credit limit is not exceeded.

- Term Lines of Credit: These lines of credit have a fixed repayment term, meaning businesses must repay the borrowed funds within a specific timeframe.

Eligibility Criteria for Business Credit Lines

Securing a business credit line requires meeting specific eligibility criteria. Lenders evaluate various factors to assess the risk associated with lending to your business. Understanding these criteria helps you prepare a strong application and increase your chances of approval.

Credit Score Requirements and Financial History Analysis, Starting a business credit line

Lenders consider your business’s creditworthiness to determine its ability to repay the credit line. This involves analyzing your credit score and financial history.

* Credit Score: Your business credit score reflects your past borrowing and repayment behavior. A higher score indicates a lower risk to lenders. Lenders typically prefer businesses with credit scores above a certain threshold, which varies depending on the lender and loan type.

* Financial History: Lenders review your business’s financial statements, including income statements, balance sheets, and cash flow statements. These documents provide insights into your revenue, expenses, assets, and liabilities. Lenders analyze trends and patterns in your financial data to assess your financial health and ability to manage debt.

* Debt-to-Income Ratio: This ratio measures your business’s total debt obligations relative to its income. Lenders prefer a lower debt-to-income ratio, indicating a healthy financial position and ability to handle additional debt.

A good debt-to-income ratio for a business is generally considered to be below 40%, though it can vary depending on the industry and lender.

Business Plan Presentation and Revenue Projections

A well-structured business plan is essential for demonstrating your business’s viability and growth potential. It Artikels your business model, target market, competitive landscape, and financial projections.

* Business Model: Lenders want to understand how your business generates revenue and its overall structure. A clear and concise explanation of your business model helps them assess the sustainability and profitability of your operation.

* Revenue Projections: Lenders evaluate your revenue projections to gauge your future earning potential and ability to repay the credit line. Realistic and well-supported projections, based on market research and industry trends, strengthen your application.

* Industry Analysis: A thorough analysis of your industry provides insights into market trends, competition, and growth opportunities. Lenders want to understand the industry’s overall health and your business’s competitive position within it.

A strong business plan demonstrates your understanding of the market, your business strategy, and your financial goals. It serves as a roadmap for your business and helps lenders assess your long-term viability.

Managing a Business Credit Line

Managing a business credit line effectively is crucial for your company’s financial health. Just like managing your personal credit, understanding your credit utilization and maintaining a healthy credit score is essential for securing favorable terms and accessing future funding.

Monitoring Credit Utilization and Credit Score

Credit utilization refers to the amount of credit you’re using compared to your total available credit. Maintaining a low credit utilization ratio is vital for building a strong credit score. This ratio is calculated by dividing your total outstanding credit balance by your total credit limit. Aim to keep your credit utilization below 30%, ideally below 10%.

A healthy credit score demonstrates your financial responsibility and trustworthiness to lenders. It can impact your interest rates, loan approval chances, and even your business insurance premiums. You can monitor your business credit score through credit bureaus like Experian, Equifax, and Dun & Bradstreet.

Comparing Credit Line Providers

Choosing the right credit line provider is crucial. Comparing features like interest rates, annual fees, and other terms is essential.

| Provider | Interest Rate | Annual Fee | Other Features |

|---|---|---|---|

| Provider A | 10% – 15% | $100 | Cash back rewards, early repayment discount |

| Provider B | 8% – 12% | $50 | Variable interest rates, online account management |

| Provider C | 12% – 18% | $0 | No annual fee, flexible repayment options |

It’s important to consider your business needs and financial situation when choosing a provider. For example, if your business requires a high credit limit with low interest rates, a provider like Provider B might be suitable. However, if you’re on a tight budget and prioritize low annual fees, Provider C might be a better option.

Best Practices for Managing a Business Credit Line

- Pay on Time: Late payments can negatively impact your credit score. Set up automatic payments or reminders to ensure timely payments.

- Keep Utilization Low: Aim to keep your credit utilization ratio below 30%. This demonstrates responsible credit management.

- Review Statements Regularly: Check your statements for any errors or unauthorized charges. This helps prevent fraudulent activity.

- Understand Your Terms: Carefully review the terms and conditions of your credit line, including interest rates, fees, and repayment options.

- Budget Wisely: Only use your credit line for business-related expenses. Avoid using it for personal expenses or unnecessary purchases.

- Maintain Good Financial Records: Keep track of your credit line usage and payments. This helps you monitor your financial health and avoid overspending.

Alternatives to Traditional Business Credit Lines: Starting A Business Credit Line

Not every business qualifies for a traditional business credit line. Fortunately, there are a variety of alternative financing options available for businesses that may not meet the stringent requirements of banks or other traditional lenders.

Crowdfunding Platforms

Crowdfunding platforms offer businesses a way to raise capital directly from individuals. These platforms connect businesses with potential investors who can contribute to a project or venture in exchange for equity, rewards, or simply the satisfaction of supporting a business idea.

- Equity Crowdfunding: Businesses offer equity in their company to investors in exchange for funding. This option is typically for businesses seeking significant capital investments.

- Rewards-Based Crowdfunding: Businesses offer rewards to investors in exchange for their contributions. These rewards can range from products or services to exclusive access or experiences.

- Donation-Based Crowdfunding: Businesses raise funds through donations from individuals who believe in their mission or cause.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers with individual investors who are willing to provide loans. These platforms offer a more flexible and potentially lower-cost alternative to traditional bank loans.

- Lower Interest Rates: P2P lending platforms can often offer lower interest rates than traditional lenders because they operate with lower overhead costs.

- Faster Approval Times: P2P lending platforms typically have faster approval times than traditional lenders.

- More Flexibility: P2P lending platforms can offer more flexible loan terms, such as shorter loan terms or different repayment schedules.

Government-Backed Loan Programs

Government-backed loan programs are designed to help small businesses access financing. These programs often offer lower interest rates, longer repayment terms, and less stringent eligibility requirements than traditional bank loans.

- Small Business Administration (SBA) Loans: The SBA offers a variety of loan programs for small businesses, including 7(a) loans, 504 loans, and microloans.

- State and Local Programs: Many states and local governments offer their own loan programs for small businesses. These programs may have specific eligibility requirements and funding amounts.

Small Business Grants

Small business grants are non-repayable funds that can be used to start or grow a business. These grants are often awarded based on specific criteria, such as industry, location, or business plan.

- Federal Grants: The federal government offers a variety of grants for small businesses, including the Small Business Innovation Research (SBIR) program and the Small Business Technology Transfer (STTR) program.

- State and Local Grants: Many states and local governments offer their own grants for small businesses. These grants may have specific eligibility requirements and funding amounts.

- Private Grants: Private organizations and foundations also offer grants to small businesses. These grants may be specific to certain industries or causes.

Last Word

Securing a business credit line is a significant step towards achieving your entrepreneurial goals. By carefully considering your eligibility, diligently applying, and responsibly managing your credit, you can unlock a powerful tool for business success. Remember, building a strong credit history is an ongoing process that requires commitment and attention. By following the guidelines Artikeld in this guide, you can lay the groundwork for a thriving business and a secure financial future.

FAQ Explained

What is the difference between a business credit line and a personal credit line?

A business credit line is specifically designed for businesses, separate from your personal credit. It allows you to borrow money for business purposes and is assessed based on your business’s financial performance.

How can I improve my business credit score?

Pay your bills on time, maintain a healthy credit utilization ratio, and establish positive credit history by using your business credit line responsibly.

What are some common mistakes businesses make when applying for a business credit line?

Common mistakes include providing incomplete or inaccurate information, failing to demonstrate financial stability, and neglecting to research lenders and compare terms.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!