TransUnion small business credit reports are more than just a collection of numbers; they are a powerful tool that can shape the financial destiny of your business. These reports provide a comprehensive snapshot of your company’s creditworthiness, influencing everything from loan approvals and interest rates to attracting investors and securing business partnerships.

Understanding how these reports work and how to leverage them to your advantage is crucial for any small business owner seeking to navigate the complex financial landscape. This guide will delve into the intricacies of TransUnion small business credit reports, empowering you with the knowledge and strategies to build a strong financial foundation for your company.

Introduction to TransUnion Small Business Credit Reports

Small business credit reports are crucial for the financial health of any business, providing a comprehensive view of a company’s creditworthiness. They act as a vital tool for lenders, investors, and suppliers to assess risk and make informed decisions about extending credit or providing funding. TransUnion, one of the leading credit reporting agencies, plays a significant role in providing accurate and reliable small business credit reports, helping businesses navigate the complex world of finance.

Components of a TransUnion Small Business Credit Report

TransUnion small business credit reports offer a detailed picture of a company’s financial standing, encompassing various aspects that influence its creditworthiness.

- Business Information: This section provides basic details about the business, including its legal name, address, phone number, and industry. This helps establish the identity and nature of the business.

- Credit History: This section Artikels the business’s past credit performance, including its payment history, outstanding balances, and credit limits. It provides insights into how the business has managed its credit obligations in the past.

- Public Records: This section includes any public records associated with the business, such as liens, judgments, and bankruptcies. These records indicate potential legal or financial issues that could impact the business’s creditworthiness.

- Trade Lines: This section lists the business’s trade lines, which are its accounts with suppliers and vendors. It shows the payment history for these accounts, reflecting the business’s ability to pay its bills on time.

- Inquiries: This section records inquiries made by other businesses or lenders about the company’s credit history. It indicates the level of interest in the business and can help assess its potential for growth.

- Credit Score: This section provides a numerical representation of the business’s overall creditworthiness, based on the information contained in the report. The credit score helps lenders and investors quickly assess the risk associated with lending to or investing in the business.

Obtaining a TransUnion Small Business Credit Report

You can obtain a TransUnion Small Business Credit Report through various methods, each with its own process and associated fees. Understanding these options will help you choose the best approach for your needs.

Accessing a TransUnion Small Business Credit Report

There are multiple ways to access your small business credit report. These methods offer flexibility and convenience, allowing you to choose the option that best suits your preferences and circumstances.

- Online Access: TransUnion provides a dedicated online platform where you can request and access your small business credit report. This method is generally considered the most convenient and efficient option. You can typically complete the process within minutes and receive your report electronically. However, you may need to create an account or log in to access the platform.

- By Phone: You can also obtain your small business credit report by calling TransUnion directly. This option allows you to speak with a customer service representative who can guide you through the process. However, it may require additional time and effort compared to online access.

- Through a Third-Party Provider: Many third-party providers offer access to small business credit reports, including TransUnion reports. These providers often offer additional services, such as credit monitoring and business credit score analysis. However, you should carefully consider the reputation and fees associated with each provider before making a decision.

Fees Associated with Obtaining a TransUnion Small Business Credit Report

TransUnion charges fees for accessing your small business credit report. The cost can vary depending on the method you choose and any additional services you request.

Fees for obtaining a small business credit report from TransUnion can range from $20 to $50 or more, depending on the method used and any additional services requested.

- Online Access: TransUnion typically charges a fee for accessing your small business credit report online. This fee can vary depending on the specific report you request and any additional services you select.

- By Phone: Similar to online access, TransUnion charges a fee for obtaining your small business credit report by phone. The cost may be similar to the online fee or slightly higher.

- Through a Third-Party Provider: Third-party providers often charge fees for accessing TransUnion small business credit reports. These fees can vary widely depending on the provider and the services included. It’s essential to compare fees and services from multiple providers before making a decision.

Understanding the Components of a TransUnion Small Business Credit Report

A TransUnion small business credit report provides a comprehensive overview of a business’s financial health, offering insights into its creditworthiness and ability to repay debts. Understanding the different components of this report is crucial for businesses seeking financing, as lenders use this information to assess risk and determine loan terms.

Key Sections of a TransUnion Small Business Credit Report

The TransUnion small business credit report is organized into distinct sections, each providing valuable information about the business’s financial standing.

- Business Information: This section contains basic details about the business, such as its legal name, address, phone number, and date of incorporation. This information helps lenders verify the identity and legitimacy of the business.

- Trade Lines: Trade lines represent the business’s credit accounts, including loans, credit cards, and lines of credit. Each trade line includes details like the account type, credit limit, current balance, payment history, and date of account opening. This section provides a detailed picture of the business’s credit utilization and debt management practices.

- Payment History: This section records the business’s payment history for all its credit accounts, showing whether payments were made on time or late. A consistent history of on-time payments indicates a reliable borrower, while late payments can negatively impact credit scores and make it harder to obtain financing.

- Public Records: This section includes any public records associated with the business, such as bankruptcies, liens, and judgments. These records can reveal past financial difficulties or legal issues that may raise concerns for lenders.

- Inquiries: This section lists recent inquiries made by lenders to access the business’s credit report. Each inquiry represents a potential credit application, and too many inquiries can negatively impact credit scores.

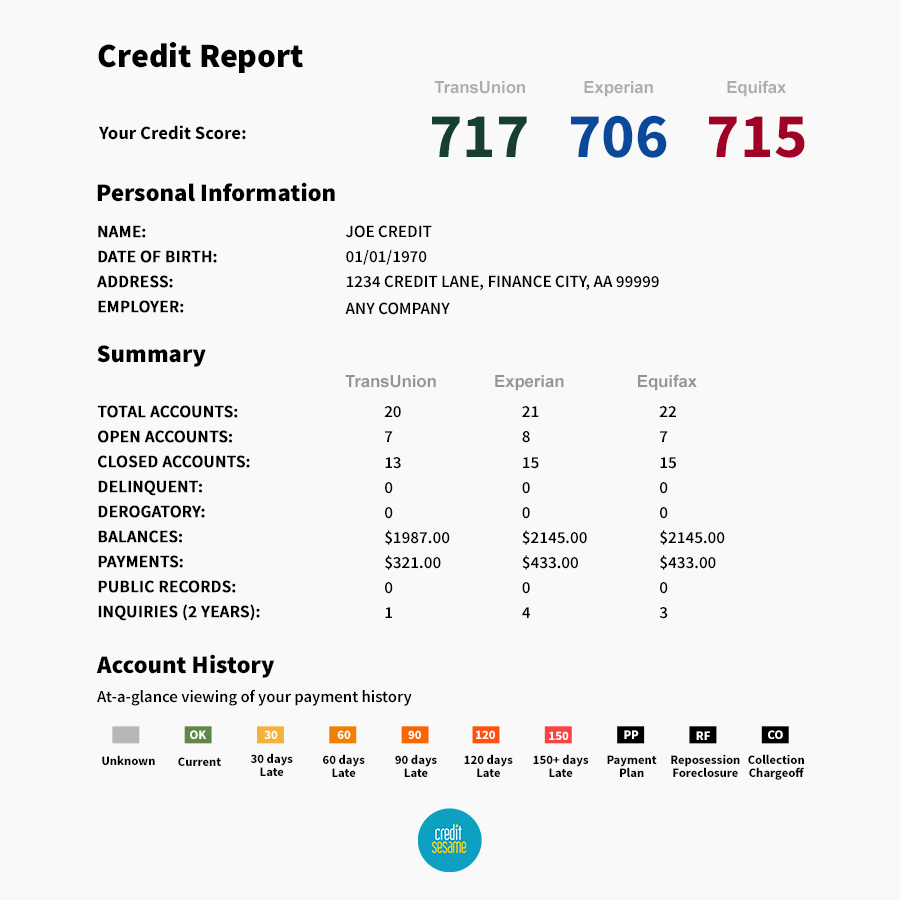

- Credit Scores: The report includes various credit scores, each designed to measure different aspects of the business’s creditworthiness. These scores are calculated using a complex formula that considers factors like payment history, credit utilization, and debt levels.

Understanding Credit Scores

Credit scores are numerical representations of a business’s creditworthiness. Different credit scoring models exist, with each using a unique formula to calculate the score.

- Paydex Score: This score is a widely used measure of a business’s payment history, ranging from 1 to 100. A higher Paydex score indicates a better payment history and a lower risk for lenders.

- FICO Small Business Scoring Service (SBSS): This model is based on a variety of factors, including payment history, credit utilization, and public records. The score ranges from 0 to 300, with higher scores indicating better creditworthiness.

- Dun & Bradstreet (D&B) PAYDEX Score: This score is similar to the Paydex score, focusing on the business’s payment history. It is also based on a scale of 1 to 100, with higher scores representing better payment performance.

Importance of Trade Lines, Payment History, and Public Records

- Trade Lines: Trade lines provide insights into the types of credit accounts a business uses, its borrowing capacity, and its debt management practices. A diverse range of trade lines with a history of responsible borrowing can enhance creditworthiness.

- Payment History: Consistent on-time payments are crucial for building a strong credit history. Late payments can negatively impact credit scores and make it challenging to secure financing.

- Public Records: Public records provide a glimpse into a business’s past financial difficulties or legal issues. Lenders carefully examine these records to assess the potential risks associated with lending to the business.

Utilizing TransUnion Small Business Credit Reports for Business Decisions

A TransUnion Small Business Credit Report provides valuable insights into your business’s financial health, helping you make informed decisions and navigate the business landscape effectively. By understanding the information contained within the report, you can secure loans, negotiate favorable terms, and attract investors, ultimately leading to sustainable growth and success.

Securing Loans and Negotiating Better Terms

A strong credit score is crucial for securing loans and obtaining favorable terms from lenders. A TransUnion Small Business Credit Report provides lenders with a comprehensive overview of your business’s creditworthiness, allowing them to assess your risk profile and determine the appropriate loan terms.

- Improved Loan Approval Rates: A good credit score significantly increases your chances of getting loan approval. Lenders are more likely to approve loans for businesses with a strong credit history, as it demonstrates financial responsibility and a lower risk of default.

- Lower Interest Rates: Businesses with excellent credit scores often qualify for lower interest rates on loans. This translates into significant cost savings over the life of the loan, freeing up more capital for growth and expansion.

- Access to Larger Loan Amounts: A favorable credit score can unlock access to larger loan amounts, allowing you to pursue more ambitious projects and expand your operations. Lenders are more willing to extend larger loans to businesses with a proven track record of responsible financial management.

Attracting Investors and Securing Business Partnerships

Investors and potential business partners often rely on credit reports to evaluate the financial health and stability of businesses. A positive credit score demonstrates your business’s trustworthiness and ability to manage finances effectively, making it more attractive to investors and partners.

- Enhanced Credibility: A good credit score enhances your business’s credibility in the eyes of investors and potential partners. It signals that you are a reliable and responsible business entity, making you a more attractive investment opportunity.

- Increased Investment Opportunities: Investors are more likely to invest in businesses with strong credit scores, as it indicates a lower risk of losing their investment. A positive credit score can open doors to new investment opportunities and access to capital.

- Stronger Business Partnerships: Partnerships are built on trust and confidence. A good credit score demonstrates your financial stability and trustworthiness, making you a more desirable partner for businesses seeking collaborations and joint ventures.

Hypothetical Scenario

Imagine you are a small business owner considering expanding your operations. You need to secure a loan to finance the expansion, but you are unsure about your creditworthiness. By obtaining a TransUnion Small Business Credit Report, you can gain valuable insights into your business’s credit score, payment history, and overall financial health.

- Scenario: Your report reveals a good credit score and a history of timely payments. This information strengthens your loan application, increasing your chances of approval and potentially securing a lower interest rate. You can confidently approach lenders with the knowledge that your business is financially sound and creditworthy.

- Alternative Scenario: If the report highlights areas for improvement, such as late payments or outstanding debts, you can take proactive steps to address these issues. This might involve negotiating payment plans with creditors or seeking professional financial advice to improve your credit score. By addressing these issues, you can improve your chances of securing the loan and achieving your business goals.

Maintaining a Positive Credit Score

A strong credit score is crucial for any business, especially for small businesses. It impacts your ability to secure loans, lines of credit, and even favorable rates on utilities and other services. By maintaining a positive credit score, you can improve your business’s financial standing and unlock opportunities for growth.

Timely Payments, Transunion small business credit report

Making timely payments is the most significant factor in maintaining a positive credit score. Lenders report your payment history to credit bureaus, and late payments can significantly hurt your score. It’s essential to establish a system for tracking due dates and ensuring payments are made on time.

Set up automated payments or reminders to avoid missing deadlines.

Managing Debt Levels

Keeping your debt levels manageable is another crucial factor in maintaining a good credit score. High debt utilization can negatively impact your score, indicating that your business may be overextended financially.

A good rule of thumb is to keep your credit utilization ratio below 30%.

Monitoring Credit Activity

Regularly monitoring your credit activity is essential to identify any errors or fraudulent activity that could impact your score.

- Check your credit report regularly for any discrepancies.

- Be cautious of unsolicited credit offers, as these can potentially harm your credit score if you don’t carefully consider them.

- Report any suspicious activity to the credit bureau immediately.

Common Mistakes That Can Negatively Impact a Business’s Credit Score

Several common mistakes can negatively impact a business’s credit score.

- Late payments: Even a single late payment can significantly harm your credit score.

- High debt utilization: A high credit utilization ratio, indicating that you’re using a significant portion of your available credit, can lower your score.

- Opening too many credit accounts: Opening multiple credit accounts in a short period can negatively impact your score.

- Closing credit accounts: Closing credit accounts can negatively impact your credit score, especially if you have a long history with the account.

- Ignoring credit report errors: Errors on your credit report can negatively impact your score. It’s crucial to check your credit report regularly and dispute any errors you find.

Dispute Resolution and Credit Report Accuracy

It’s crucial to ensure the accuracy of your TransUnion small business credit report as it can significantly impact your ability to secure loans, lines of credit, and other financial products. Inaccuracies can negatively affect your credit score and hinder your business’s financial growth. This section Artikels the process for disputing errors and ensuring the accuracy of your credit report.

Disputing Inaccuracies

If you discover inaccuracies or errors in your TransUnion small business credit report, you have the right to dispute them. TransUnion has a formal process for resolving these issues, and following the steps Artikeld below will help ensure a timely resolution.

Filing a Dispute

- Review your credit report carefully: Identify any inaccuracies or errors in your report, such as incorrect account information, late payments that weren’t your fault, or accounts that don’t belong to your business.

- Gather supporting documentation: Compile any relevant documents that support your dispute, such as copies of payment receipts, contracts, or correspondence with creditors. This will strengthen your case and help expedite the resolution process.

- Submit a dispute online, by mail, or by phone: TransUnion offers multiple ways to file a dispute. You can submit your dispute online through their website, by mail using their dispute form, or by phone.

- Complete the dispute form accurately and thoroughly: Provide all the necessary information about the disputed items, including the account number, date of the error, and any supporting documentation.

- Follow up on your dispute: After submitting your dispute, TransUnion will investigate the issue. You should receive a confirmation of your dispute and updates on the progress of the investigation.

Resolution Process

TransUnion will investigate the disputed items and contact the relevant creditors to verify the information. If the investigation finds that the information is inaccurate, TransUnion will correct the error in your credit report. If the investigation finds that the information is accurate, you will be notified and given an opportunity to provide further information.

Resources and Contact Information

- TransUnion Website: Visit TransUnion’s website to access their online dispute form, learn about their dispute process, and find contact information.

- TransUnion Phone Number: Call TransUnion’s customer service line to file a dispute over the phone.

- TransUnion Mailing Address: Send your dispute by mail to TransUnion’s mailing address, which can be found on their website.

Ultimate Conclusion: Transunion Small Business Credit Report

By understanding the components of your TransUnion small business credit report, utilizing it strategically for business decisions, and actively maintaining a positive credit score, you can unlock a world of financial opportunities for your company. Remember, a strong credit profile is the cornerstone of a thriving business, and TransUnion small business credit reports are the key to achieving it.

FAQ Section

How often is my TransUnion small business credit report updated?

TransUnion updates small business credit reports monthly, reflecting the most recent credit activity.

Can I access my TransUnion small business credit report for free?

While TransUnion offers a free annual credit report for consumers, there is typically a fee associated with obtaining a small business credit report. However, some third-party providers may offer free trial periods or limited access to reports.

What are the main factors that affect my small business credit score?

Key factors influencing your small business credit score include payment history, credit utilization, length of credit history, and the number of hard inquiries.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!