Using credit card for business – Using credit cards for business can be a powerful tool, offering benefits like rewards, cashback, and travel perks. However, it’s crucial to navigate this financial landscape responsibly to maximize advantages and minimize risks. This guide will explore the advantages and disadvantages, choosing the right card, and navigating the legal and regulatory aspects.

From building credit history and managing expenses to understanding potential risks like fraud and identity theft, we’ll cover the essential aspects of using credit cards for your business. We’ll also compare credit cards to other payment methods like debit cards and prepaid cards, helping you make informed decisions for your business.

Benefits of Using a Credit Card for Business

Using a credit card for business expenses can offer several advantages, from earning rewards to building credit history. Let’s explore these benefits in detail.

Reward Points, Cashback, and Travel Benefits

Credit cards often offer rewards programs that can benefit businesses. These programs can provide valuable perks like:

- Reward points: These can be redeemed for merchandise, gift cards, travel, or even cash back. The points earned can be significant, especially for businesses with high spending volumes.

- Cashback: Some cards offer cashback on all purchases, providing a direct return on spending. The cashback percentage can vary depending on the card and the category of purchase.

- Travel benefits: Many credit cards offer travel perks like airport lounge access, travel insurance, and bonus miles for airline tickets. These benefits can be particularly valuable for businesses that travel frequently.

Building Credit History and Improving Financial Standing

Using a credit card responsibly can help businesses establish and improve their credit history. This is important for:

- Securing loans: A good credit history can make it easier for businesses to obtain loans at favorable interest rates.

- Attracting investors: Investors often look at a company’s credit history as an indicator of its financial health.

- Negotiating better terms with suppliers: Businesses with good credit may be able to negotiate better payment terms and discounts from suppliers.

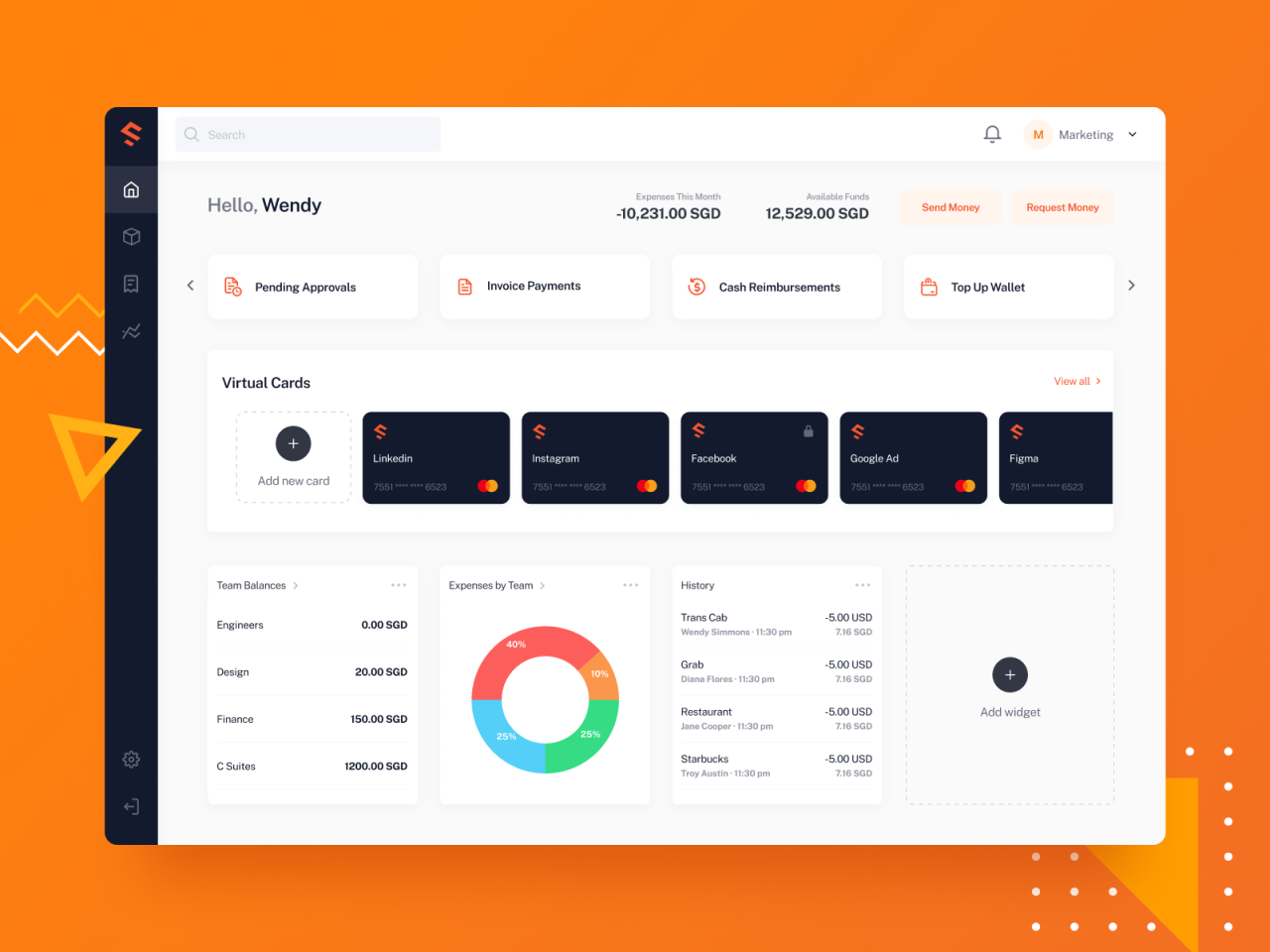

Managing Business Expenses

Credit cards can streamline and simplify the management of business expenses:

- Centralized tracking: All business expenses are consolidated on a single statement, making it easier to track spending and reconcile accounts.

- Simplified budgeting: By using a credit card, businesses can create a budget and track spending against it more effectively.

- Fraud protection: Credit card companies offer fraud protection, which can help businesses recover funds if their cards are misused.

- Extended payment terms: Some credit cards offer extended payment terms, giving businesses more time to pay off expenses and manage cash flow.

Choosing the Right Credit Card for Your Business

Navigating the world of business credit cards can feel overwhelming, with countless options catering to various needs. Choosing the right card for your business is crucial for maximizing benefits and minimizing costs.

Factors to Consider When Selecting a Business Credit Card

When selecting a business credit card, consider factors that align with your business’s financial goals and spending habits.

- Annual Fees: Annual fees can range from zero to several hundred dollars. Evaluate whether the perks offered by a card justify the annual fee.

- Credit Limits: A higher credit limit provides greater flexibility and helps avoid exceeding your limit, which can negatively impact your credit score.

- Interest Rates: A lower interest rate reduces financing costs, especially if you carry a balance. Aim for a card with a competitive interest rate.

- Rewards Programs: Some cards offer rewards such as cash back, travel miles, or points that can be redeemed for merchandise or travel. Consider the rewards structure and whether they align with your business’s spending patterns.

- Perks and Benefits: Business credit cards often offer additional benefits such as travel insurance, purchase protection, or extended warranties. Evaluate if these perks are valuable to your business.

Types of Business Credit Cards

Different types of business credit cards cater to specific needs and spending habits.

- Rewards Credit Cards: These cards offer rewards for spending, typically in the form of cash back, travel miles, or points. Choose a card that aligns with your business’s spending patterns to maximize rewards. For example, a card offering bonus points on travel expenses would be ideal for a travel agency.

- Cash Back Credit Cards: These cards offer cash back on purchases, which can be redeemed as statement credits or deposited into your account. They are beneficial for businesses with consistent spending.

- Travel Credit Cards: These cards offer perks for frequent travelers, such as bonus miles, airport lounge access, and travel insurance. For example, a travel agency might benefit from a card that offers bonus miles on airfare purchases.

- Low Interest Rate Credit Cards: These cards offer lower interest rates compared to other cards, which can be advantageous if you plan to carry a balance.

Responsible Credit Card Use for Businesses: Using Credit Card For Business

Using a credit card for your business can be a convenient and beneficial tool, but it’s crucial to use it responsibly to avoid financial pitfalls. Responsible credit card use involves establishing a budget, diligently tracking expenses, and managing debt effectively.

Budgeting and Expense Tracking

Developing a comprehensive budget is essential for any business, especially when using a credit card. By setting a budget, you can allocate funds for specific business expenses and avoid overspending. This also allows you to track your spending and identify areas where you can potentially cut costs.

A solid budget helps you make informed decisions about your business finances and ensures that you’re not spending more than you can afford.

- Regularly review your credit card statements to ensure all transactions are legitimate and to identify any potential errors.

- Categorize your expenses by using a spreadsheet or accounting software to gain a clearer picture of where your money is going.

- Track your credit card balance and make sure you’re paying it off on time to avoid accruing interest charges.

Managing Credit Card Debt

While credit cards can be useful for short-term financing, it’s crucial to avoid accumulating excessive debt. High interest charges can quickly eat into your profits and make it difficult to manage your cash flow.

- Prioritize paying off your balance as quickly as possible to minimize interest charges.

- Consider transferring your balance to a card with a lower interest rate if available, but be aware of potential transfer fees.

- Set up automatic payments to ensure you make your minimum payments on time and avoid late fees.

Preventing Fraud and Identity Theft

Credit card fraud and identity theft are serious threats that can significantly impact your business. It’s essential to take preventative measures to protect your sensitive information.

- Monitor your credit card statements for any suspicious activity.

- Keep your credit card information secure and avoid sharing it with unauthorized individuals or websites.

- Use strong passwords for online accounts and change them regularly.

- Report any suspected fraud to your credit card issuer and law enforcement authorities immediately.

Alternative Payment Methods for Businesses

While credit cards offer a wide range of benefits for businesses, they are not the only option available. Exploring alternative payment methods can help you find the best fit for your specific needs and business model.

Comparison of Business Payment Methods

Understanding the pros and cons of different payment methods is crucial for making informed decisions. Here’s a breakdown of popular alternatives:

Debit Cards

- Pros:

- Directly linked to your business checking account, ensuring funds are readily available.

- Typically offer lower transaction fees compared to credit cards.

- Provide better control over spending, as you can only spend what’s in your account.

- Cons:

- Limited reward programs and cashback options.

- May not be accepted at all merchants, especially online.

- Can lead to overdraft fees if your account balance is insufficient.

Prepaid Cards

- Pros:

- Control over spending by pre-loading a specific amount of funds.

- Offer some protection against fraud and unauthorized transactions.

- Useful for managing expenses for specific projects or employees.

- Cons:

- Limited acceptance compared to credit or debit cards.

- May have high activation fees or monthly maintenance charges.

- No credit-building benefits or reward programs.

Business Loans

- Pros:

- Provide access to larger sums of money for significant investments or expansion.

- Can offer longer repayment terms compared to credit cards.

- Can help build business credit history.

- Cons:

- Higher interest rates than credit cards.

- Stricter eligibility requirements and lengthy application processes.

- Potential for debt accumulation if not managed responsibly.

Choosing the Right Payment Method for Your Business, Using credit card for business

The best payment method for your business depends on several factors:

Industry

- Retail: Credit cards are widely accepted and offer convenience for customers. Debit cards and prepaid cards can also be used for in-store purchases.

- Service-based: Credit cards are popular for online transactions and can be used for recurring billing. Debit cards can be used for in-person payments.

- Manufacturing: Business loans may be necessary for large investments in equipment or inventory.

Business Size

- Small businesses: Debit cards and prepaid cards can help manage expenses effectively. Credit cards can provide access to rewards and financing options.

- Medium businesses: Credit cards can offer higher credit limits and rewards programs. Business loans may be needed for expansion or major projects.

- Large businesses: Business loans and lines of credit are often used for large-scale investments and working capital needs.

Financial Needs

- Short-term funding: Credit cards or debit cards can provide immediate access to funds for smaller expenses.

- Long-term financing: Business loans offer long-term financing options for significant investments.

- Expense management: Prepaid cards can help track and control expenses for specific projects or employees.

Table of Payment Method Suitability

| Payment Method | Suitable for | Not Suitable for |

|---|---|---|

| Credit Cards | Businesses with high transaction volume, online sales, and need for rewards and financing | Businesses with limited credit history or risk aversion |

| Debit Cards | Businesses with low transaction volume, seeking low fees, and prioritizing immediate access to funds | Businesses with limited acceptance, seeking rewards programs, or needing financing options |

| Prepaid Cards | Businesses with specific project needs, employee expense management, or seeking control over spending | Businesses with high transaction volume, needing credit-building benefits, or requiring significant financing |

| Business Loans | Businesses with significant investment needs, seeking long-term financing, and building business credit | Businesses with poor credit history, unable to meet strict eligibility requirements, or seeking short-term funding |

Legal and Regulatory Considerations

Using credit cards for business transactions comes with legal implications that require careful consideration. It is essential to understand the tax implications, compliance requirements, and potential legal risks associated with credit card use.

Tax Implications

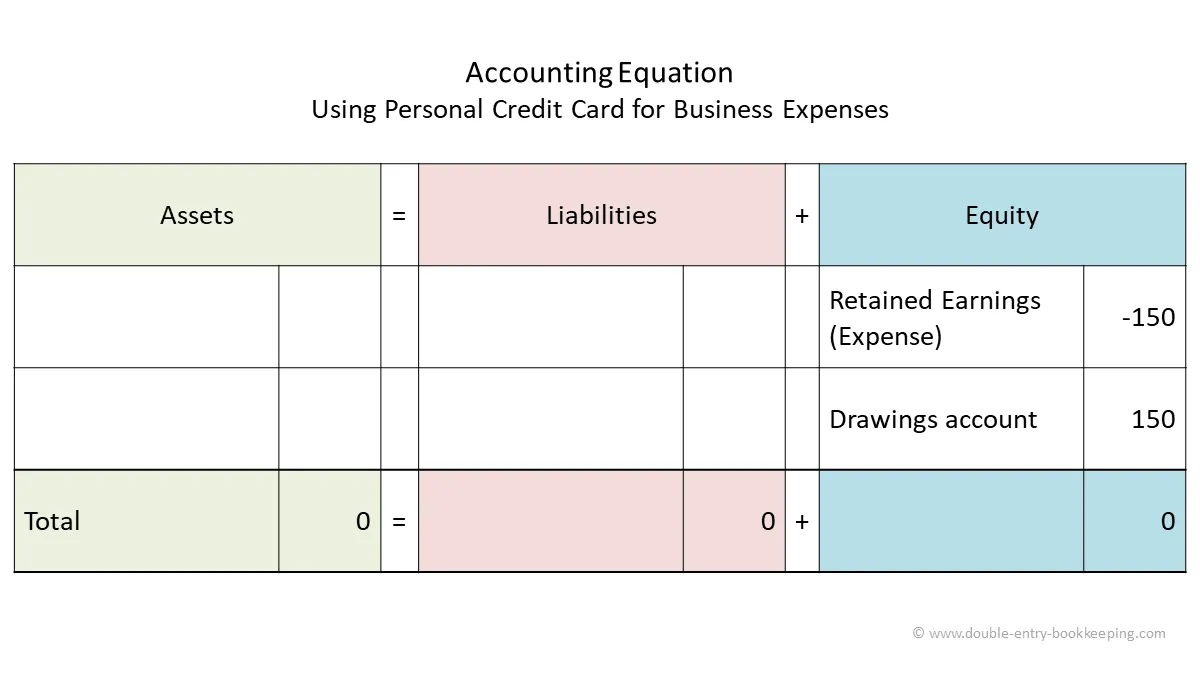

Understanding the tax implications of using credit cards for business transactions is crucial. The Internal Revenue Service (IRS) considers credit card transactions as business expenses. However, specific rules and regulations govern how these expenses are recorded and reported for tax purposes.

- Recordkeeping: Businesses must maintain detailed records of all credit card transactions, including the date, amount, vendor, and purpose of the purchase. This documentation is crucial for tax reporting and audits.

- Expense Deductions: Businesses can generally deduct credit card expenses related to business operations. However, certain expenses, such as personal use, may not be deductible.

- Reporting: Businesses must report credit card transactions on their tax returns, typically using Form 1040 Schedule C or Form 1065 for partnerships.

Last Recap

Using credit cards for business can be a valuable tool when approached strategically. By understanding the benefits, risks, and legal considerations, businesses can leverage credit cards to enhance their financial management and achieve greater success. Remember to choose the right card for your specific needs, use it responsibly, and stay informed about the latest regulations and best practices.

Expert Answers

What are the tax implications of using a credit card for business?

Credit card transactions are subject to the same tax regulations as other business expenses. It’s essential to keep accurate records of all transactions for tax purposes.

How do I report credit card transactions for tax purposes?

You can report credit card transactions on your business tax return using the appropriate forms and schedules. Be sure to keep all receipts and statements as documentation.

What are the best ways to prevent credit card fraud?

To minimize the risk of fraud, consider using a business credit card with fraud protection features, monitor your account activity regularly, and report any suspicious transactions immediately.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!