Wayfair business line of credit offers a powerful financial tool for merchants seeking to manage cash flow, expand inventory, and fuel business growth. This line of credit provides flexible access to funds, allowing businesses to seize opportunities and navigate seasonal fluctuations with ease.

Designed specifically for Wayfair merchants, this program empowers entrepreneurs to invest in their businesses, optimize operations, and achieve their financial goals. It offers a convenient and reliable source of capital, allowing businesses to take control of their financial future.

Wayfair Business Line of Credit

A Wayfair business line of credit can be a valuable tool for Wayfair merchants, providing them with flexible funding to manage their business needs and potentially accelerate their growth.

Purpose of a Business Line of Credit

A business line of credit allows Wayfair merchants to access a revolving credit facility that they can draw upon as needed. This can be helpful for a variety of business purposes, including:

* Managing cash flow: Businesses often experience fluctuations in their cash flow, especially during seasonal peaks or unexpected expenses. A line of credit can provide a buffer to cover these fluctuations, ensuring that the business can meet its financial obligations.

* Funding inventory: Purchasing inventory is often a significant expense for businesses, and a line of credit can help merchants acquire the products they need to meet customer demand.

* Investing in growth: Whether it’s expanding into new markets, upgrading equipment, or hiring additional staff, a line of credit can provide the funding needed to support business growth initiatives.

Key Features of Wayfair’s Business Line of Credit

Wayfair’s business line of credit program offers a range of features designed to benefit merchants:

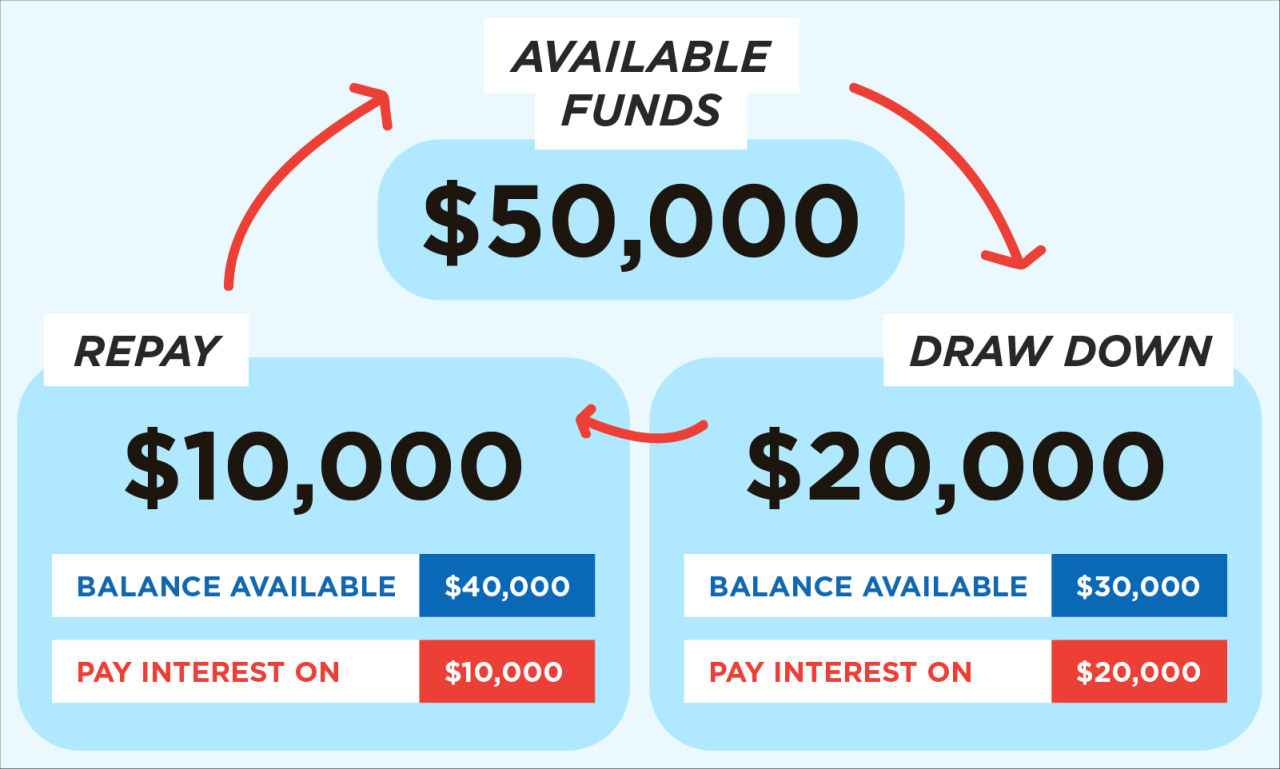

- Flexible Access: Merchants can draw on their line of credit as needed, up to their approved credit limit, giving them the flexibility to manage their cash flow effectively.

- Competitive Interest Rates: Wayfair aims to offer competitive interest rates on its business line of credit, helping merchants manage their borrowing costs.

- Simplified Application Process: The application process for Wayfair’s business line of credit is designed to be streamlined, making it easier for merchants to access the funding they need.

Eligibility Criteria

To be eligible for Wayfair’s business line of credit, merchants typically need to meet certain criteria:

- Active Wayfair Merchant Account: Merchants must have an active and in good standing Wayfair merchant account.

- Strong Business Performance: Wayfair will assess the merchant’s financial health and track record of sales, including factors such as revenue, profitability, and credit history.

- Good Credit Score: A good credit score is generally required to qualify for a business line of credit, demonstrating the merchant’s ability to manage debt responsibly.

Benefits of a Wayfair Business Line of Credit

A Wayfair Business Line of Credit can be a valuable tool for merchants seeking to streamline their operations and enhance their business growth. It offers several advantages that can help businesses manage cash flow, optimize inventory, and ultimately, achieve their expansion goals.

Managing Cash Flow and Inventory

A Wayfair Business Line of Credit can be instrumental in managing cash flow and inventory effectively. By providing access to flexible funding, businesses can:

- Secure necessary inventory: A business line of credit allows merchants to purchase the necessary inventory to meet demand without tying up their working capital. This ensures that they have sufficient stock on hand to fulfill orders and avoid stockouts, which can lead to lost sales and customer dissatisfaction.

- Bridge seasonal fluctuations: Businesses that experience seasonal peaks and troughs in demand can use a business line of credit to manage cash flow effectively. During periods of high demand, they can draw on the line of credit to purchase additional inventory and meet customer needs. During slower periods, they can pay down the line of credit, ensuring financial stability.

- Take advantage of bulk discounts: Businesses can leverage a business line of credit to take advantage of bulk discounts offered by suppliers. This can lead to significant cost savings and improve profit margins.

Contributing to Business Growth and Expansion

A Wayfair Business Line of Credit can provide the financial flexibility needed for businesses to grow and expand their operations. This can be achieved through:

- Investing in marketing and advertising: A business line of credit can be used to finance marketing and advertising campaigns to reach new customers and increase brand awareness. This can lead to increased sales and market share.

- Expanding product offerings: Businesses can use a business line of credit to introduce new products or expand their existing product lines. This can help diversify revenue streams and cater to a wider customer base.

- Opening new locations: For businesses looking to expand geographically, a business line of credit can provide the necessary capital to open new stores or distribution centers. This can help reach new markets and increase revenue.

Applying for a Wayfair Business Line of Credit

Applying for a Wayfair business line of credit is a straightforward process that can provide your business with valuable funding for inventory and other business needs. To get started, you’ll need to gather some basic information and documentation.

The Application Process

To apply for a Wayfair business line of credit, you’ll need to visit the Wayfair Business website and follow these steps:

- Create an Account: If you don’t already have a Wayfair Business account, you’ll need to create one. This process is quick and easy, and it will allow you to access all of the features of the Wayfair Business platform.

- Submit an Application: Once you’ve created an account, you can submit an application for a business line of credit. The application form will ask for basic information about your business, including your business name, address, and contact information.

- Provide Documentation: You’ll also need to provide some documentation to support your application, such as your business tax ID number, bank statements, and credit reports. This information will help Wayfair assess your business’s financial health and determine your creditworthiness.

- Review and Approval: Once you’ve submitted your application and supporting documentation, Wayfair will review it and make a decision on your eligibility for a business line of credit. The approval process typically takes a few business days.

Required Documentation, Wayfair business line of credit

To ensure a smooth application process, be prepared to provide the following documentation:

- Business Tax ID Number: This number is essential for verifying your business’s legal status and identifying you for tax purposes.

- Bank Statements: Recent bank statements will help Wayfair assess your business’s cash flow and financial stability. This provides insights into your business’s financial health and ability to repay the line of credit.

- Credit Reports: A good credit history is crucial for securing a business line of credit. Credit reports provide a detailed overview of your business’s borrowing and repayment history, helping Wayfair assess your creditworthiness.

- Business License: This document verifies that your business is legally operating and complies with relevant regulations.

Tips for Maximizing Approval Chances

Here are some tips to increase your chances of approval:

- Maintain a Strong Credit History: A good credit history is crucial for securing a business line of credit. Make sure to pay your bills on time and keep your credit utilization low.

- Provide Accurate and Complete Information: Submitting a well-organized application with all the necessary information is crucial for a successful approval. Be sure to double-check your application for accuracy and completeness.

- Demonstrate a Solid Financial History: Provide accurate and up-to-date financial statements that reflect your business’s strong financial performance.

- Showcase Your Business’s Growth Potential: Highlight your business’s future plans and potential for growth. This can demonstrate your commitment to your business and its long-term success.

Using a Wayfair Business Line of Credit

A Wayfair business line of credit can be a valuable tool for businesses that need flexible financing for their inventory and operational needs. To use it effectively, it’s important to understand the process of drawing funds, making repayments, and managing credit utilization.

Drawing Funds

Drawing funds from a Wayfair business line of credit is a straightforward process. Once you’ve been approved for a line of credit, you can access funds through your Wayfair Business Account. You can use these funds to purchase a wide range of products, from furniture and home décor to office supplies and equipment.

Making Repayments

Repayments on a Wayfair business line of credit are typically made on a monthly basis. You’ll receive a statement detailing your balance, minimum payment due, and interest charges. It’s important to make your payments on time to avoid late fees and potential damage to your credit score.

Managing Credit Utilization

Credit utilization refers to the amount of credit you’re currently using compared to your total available credit. It’s a key factor in determining your credit score. Aim to keep your credit utilization below 30% to maintain a healthy credit score.

For example, if you have a $10,000 credit limit, you should try to keep your outstanding balance below $3,000.

Avoiding Penalties

Wayfair may charge penalties for late payments, exceeding your credit limit, or other breaches of the terms of your agreement. To avoid these penalties, it’s important to:

- Make your payments on time.

- Monitor your credit utilization and avoid exceeding your credit limit.

- Review the terms of your agreement carefully and adhere to them.

Comparison to Other Financing Options

Choosing the right financing option for your business can be a complex decision. Wayfair’s business line of credit is just one option among many. It’s essential to compare Wayfair’s offering with other financing solutions to determine which best suits your specific needs and financial situation.

Comparison of Financing Options

This section provides a comparison of Wayfair’s business line of credit to other common financing options available to merchants. We’ll explore the pros and cons of each option, considering factors like interest rates, fees, and terms.

Key Features and Benefits

| Financing Option | Pros | Cons |

|---|---|---|

| Wayfair Business Line of Credit |

|

|

| Merchant Cash Advance |

|

|

| Small Business Loan |

|

|

| Business Credit Card |

|

|

Case Studies and Examples: Wayfair Business Line Of Credit

Seeing how other businesses have benefited from a Wayfair Business Line of Credit can provide valuable insights and inspiration for your own business. Here are some real-world examples of how Wayfair merchants have successfully utilized their business line of credit.

Case Studies of Wayfair Business Line of Credit Success

These case studies demonstrate how a Wayfair Business Line of Credit can help businesses overcome challenges and achieve growth.

- Case Study 1: “The Furniture Fixer” – A small furniture repair and restoration business faced a surge in demand during the holiday season. They needed to purchase additional materials and tools to meet the increased orders but lacked the upfront capital. The Wayfair Business Line of Credit provided them with the necessary funds to purchase the inventory and meet the customer demand. This allowed them to expand their business and increase their revenue during the peak season.

- Case Study 2: “The Home Decor Haven” – A home decor retailer wanted to expand their product offerings to include a new line of high-end furniture. However, they were hesitant to invest a large sum of money upfront. The Wayfair Business Line of Credit enabled them to purchase the new furniture inventory on favorable terms, allowing them to test the market and expand their product line without significant financial risk.

- Case Study 3: “The Kitchen & Bath Boutique” – A small kitchen and bath design firm faced a project delay due to unexpected supply chain issues. This delay put their cash flow in jeopardy, as they had already purchased materials for the project. The Wayfair Business Line of Credit provided them with a short-term loan to cover their immediate expenses and bridge the gap until the project was completed.

End of Discussion

Wayfair’s business line of credit stands as a valuable resource for merchants looking to unlock growth potential and achieve financial stability. With its flexible access to funds, tailored features, and potential for increased profitability, it empowers businesses to navigate the dynamic world of e-commerce with confidence. By leveraging this line of credit strategically, Wayfair merchants can overcome financial hurdles, seize opportunities, and propel their businesses to new heights.

Quick FAQs

What are the typical interest rates for a Wayfair business line of credit?

Interest rates for Wayfair business lines of credit vary based on factors like creditworthiness, loan amount, and repayment terms. It’s best to contact Wayfair directly for personalized rate information.

How long does it take to get approved for a Wayfair business line of credit?

The approval process can vary depending on the individual application. However, Wayfair aims to process applications efficiently. Contact Wayfair directly for estimated timelines.

What are the minimum requirements for eligibility for a Wayfair business line of credit?

Eligibility criteria may include factors like business history, revenue, credit score, and other financial indicators. It’s recommended to contact Wayfair for specific requirements.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!