What is the best business line of credit? It’s a question many entrepreneurs and business owners ask themselves, and the answer isn’t always simple. A business line of credit offers a flexible way to access funds when you need them, but navigating the options and understanding the terms can be challenging.

This guide will explore the different types of business lines of credit, the eligibility requirements, interest rates, and other important factors to consider when choosing the best option for your business. We’ll also discuss alternatives to business lines of credit, helping you make an informed decision that aligns with your specific needs and financial goals.

Understanding Business Lines of Credit

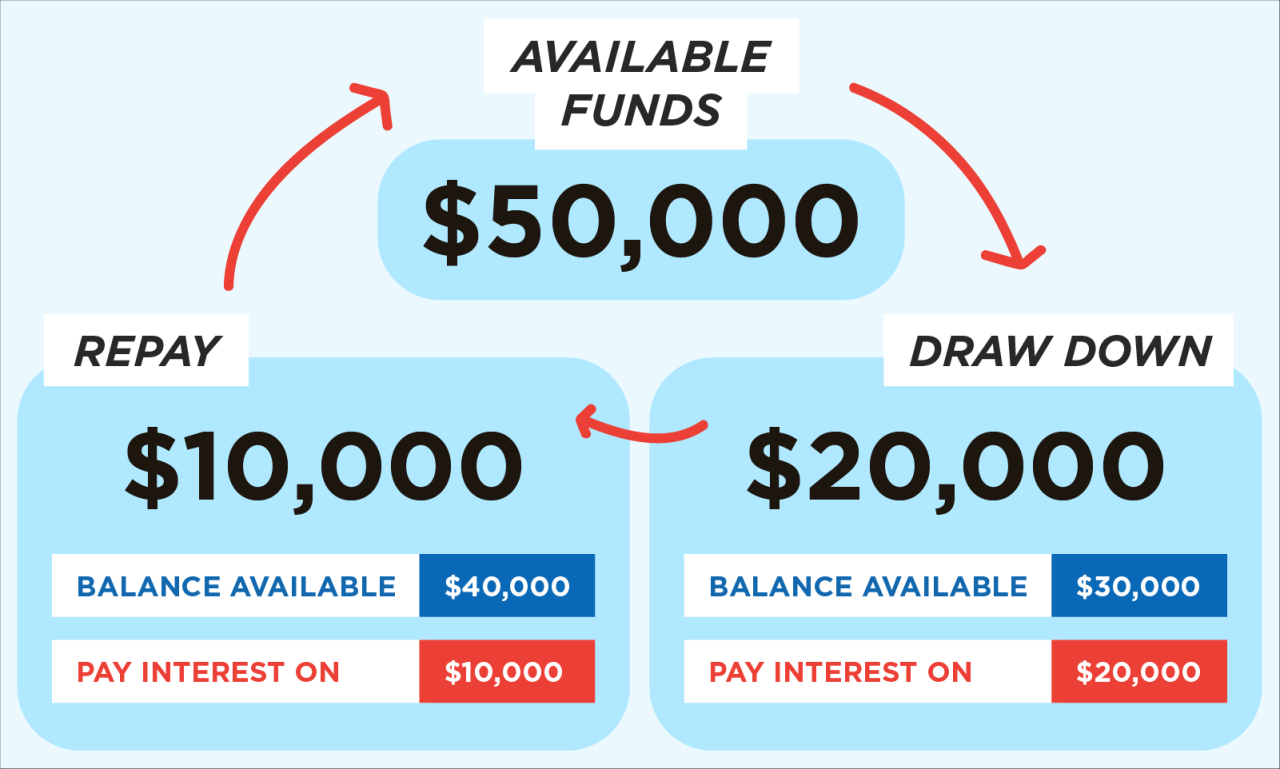

A business line of credit is a flexible financing option that allows businesses to borrow money as needed, up to a pre-approved credit limit. It’s like a revolving credit card for businesses, offering a convenient way to manage cash flow and fund short-term needs.

Key Features and Benefits

Business lines of credit provide several advantages that make them a valuable financial tool for businesses.

- Flexible Funding: Businesses can borrow only the amount they need, when they need it, making it ideal for managing unexpected expenses or seasonal fluctuations in cash flow.

- Lower Interest Rates: Compared to other forms of business financing, lines of credit often have lower interest rates, especially for businesses with good credit history.

- Improved Credit Score: Responsible use of a line of credit can help improve a business’s credit score, making it easier to access other forms of financing in the future.

- Predictable Costs: Interest rates and fees are typically fixed for a specific period, providing businesses with predictable financing costs.

- Build Business Credit: Regular and timely payments on a line of credit can help establish a strong business credit history, which is essential for securing future loans and financing.

Types of Business Lines of Credit

There are various types of business lines of credit available, each with its own features and suitability for different business needs.

- Revolving Lines of Credit: These lines of credit allow businesses to repeatedly borrow and repay funds up to their credit limit, similar to a credit card. They provide ongoing access to funds for short-term needs.

- Non-Revolving Lines of Credit: These lines of credit offer a fixed amount of funding that can be used once and then must be repaid before further borrowing is allowed. They are often used for specific projects or investments with a defined timeline.

- Secured Lines of Credit: These lines of credit require collateral, such as real estate or equipment, to secure the loan. This reduces risk for lenders and often results in lower interest rates. However, businesses face the risk of losing their collateral if they default on the loan.

- Unsecured Lines of Credit: These lines of credit do not require collateral. Lenders base their decision on the business’s creditworthiness, financial history, and other factors. While they offer flexibility, unsecured lines of credit typically have higher interest rates.

Eligibility and Requirements

Securing a business line of credit requires meeting specific eligibility criteria and providing necessary documentation to demonstrate your business’s financial health and creditworthiness. Lenders assess these factors to determine the risk involved in extending credit to your business.

Eligibility Criteria

Lenders typically evaluate businesses based on several key factors to determine their eligibility for a line of credit. These criteria ensure that the business is financially stable and capable of repaying the borrowed funds.

- Time in Business: Lenders often prefer businesses that have been operating for a certain period, typically at least two years, to demonstrate stability and a track record of generating revenue.

- Credit Score: A good credit score, both for the business and its owners, is essential. This indicates responsible financial management and a lower risk of default.

- Revenue and Profitability: Lenders analyze your business’s revenue and profitability to assess its ability to generate sufficient cash flow to cover loan payments.

- Debt-to-Equity Ratio: Lenders consider the ratio of your business’s debt to its equity to determine its financial leverage and overall risk.

- Collateral: Some lenders may require collateral, such as assets like equipment or real estate, to secure the line of credit. This reduces the lender’s risk in case of default.

Documentation Required

To apply for a business line of credit, lenders typically require various documents to verify your business’s financial information and creditworthiness.

- Business Plan: A comprehensive business plan outlining your company’s mission, goals, market analysis, and financial projections.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements to demonstrate your business’s financial performance.

- Tax Returns: Copies of recent business tax returns to verify your revenue and profitability.

- Personal Credit Report: Lenders may request your personal credit report to assess your overall financial responsibility.

- Bank Statements: Bank statements to demonstrate your cash flow and transaction history.

- Business Licenses and Permits: Documentation verifying your business’s legal status and compliance with regulations.

Creditworthiness Factors

Lenders evaluate your business’s creditworthiness based on various factors that indicate your ability to repay the loan.

- Credit History: Your business’s past credit performance, including payment history, credit utilization, and any defaults or bankruptcies.

- Debt-to-Income Ratio: The ratio of your business’s total debt to its income, indicating your ability to manage existing debt obligations.

- Cash Flow: Your business’s ability to generate sufficient cash flow to cover loan payments and operating expenses.

- Industry Trends: The overall health and stability of your industry, which can influence your business’s future prospects.

- Management Team: The experience, expertise, and track record of your management team, which can impact your business’s success.

Interest Rates and Fees

Understanding the interest rates and fees associated with a business line of credit is crucial for determining its overall cost and suitability for your business. These factors directly impact your borrowing costs and can significantly influence your financial planning.

Interest Rate Determination

Interest rates on business lines of credit are determined by a variety of factors, including your creditworthiness, the current market interest rates, and the lender’s specific policies.

- Credit Score: Lenders assess your business’s credit history and score to determine your creditworthiness. A higher credit score generally indicates a lower risk for the lender, resulting in a lower interest rate.

- Debt-to-Income Ratio: This ratio reflects your business’s ability to repay its debts. A lower debt-to-income ratio suggests better financial health, potentially leading to a lower interest rate.

- Market Interest Rates: Interest rates are influenced by broader economic conditions and the Federal Reserve’s monetary policy. When market interest rates rise, lenders may adjust their rates accordingly.

- Loan Amount and Term: Larger loan amounts and longer terms may result in higher interest rates due to the increased risk for the lender.

- Collateral: If you provide collateral (assets that secure the loan), you may be eligible for a lower interest rate, as the lender has a greater assurance of repayment.

Common Fees, What is the best business line of credit

Business lines of credit often come with various fees that can add to the overall cost of borrowing.

- Annual Fee: This is a fixed fee charged annually for maintaining the line of credit, regardless of usage.

- Transaction Fee: A fee charged for each transaction made using the line of credit, such as withdrawals or purchases.

- Interest Charges: The primary cost associated with a business line of credit. Interest is calculated based on the outstanding balance and the applicable interest rate. Interest can be calculated using a variable or fixed rate structure.

Interest Rate Structures

- Variable Interest Rate: This rate fluctuates based on changes in a benchmark rate, such as the prime rate or LIBOR. When the benchmark rate increases, the variable interest rate on your line of credit will also rise, and vice versa.

- Fixed Interest Rate: This rate remains constant for the duration of the loan term, providing predictability and stability in your monthly payments. However, fixed rates are typically higher than variable rates, reflecting the lender’s assumption of interest rate risk.

Usage and Management

A business line of credit offers flexibility and convenience in managing your company’s finances. Understanding how to access funds and manage this credit facility effectively is crucial for maximizing its benefits.

Accessing Funds

Accessing funds from a business line of credit is typically a straightforward process. You can withdraw funds as needed, up to your approved credit limit, through various methods:

- Online Banking: Most financial institutions offer online banking platforms where you can request funds directly from your line of credit account.

- Mobile App: Many banks have mobile apps that allow you to access and manage your business line of credit on the go.

- Checks: You can request checks drawn from your line of credit account to make payments or purchase goods and services.

- Wire Transfers: For larger transactions, you can initiate wire transfers from your line of credit to other accounts.

- Debit Card: Some banks offer debit cards linked to your business line of credit, allowing you to make purchases and withdraw cash.

Best Practices for Managing a Business Line of Credit

Effective management of a business line of credit ensures you benefit from its flexibility without incurring excessive interest charges or jeopardizing your credit score. Here are some best practices:

- Set a Budget and Stick to It: Determine your specific financial needs and set a clear budget for how you’ll use the line of credit. This helps you avoid overspending and ensures you can repay the borrowed funds.

- Track Your Usage: Regularly monitor your line of credit balance and the amount of funds you’ve withdrawn. This helps you stay aware of your borrowing activity and avoid exceeding your credit limit.

- Pay More Than the Minimum: While making minimum payments is the bare minimum, paying more than the required amount helps reduce your overall interest charges and accelerate your repayment process.

- Consider a Revolving Credit Strategy: Some businesses prefer a revolving credit strategy, where they continuously draw on and repay their line of credit. This can be beneficial for managing cash flow and avoiding large, lump-sum payments.

- Review Your Credit Line Periodically: As your business grows, your credit needs may change. Review your credit line periodically and consider requesting an increase if necessary.

Importance of Repayment Strategies

Maintaining a strong credit score is vital for your business’s financial health. This allows you to access better interest rates and terms on future loans. Here’s why repayment strategies are crucial:

- Avoid Late Payments: Late payments negatively impact your credit score and can lead to higher interest charges and penalties.

- Keep Your Credit Utilization Low: Your credit utilization ratio, calculated by dividing your total credit card debt by your total credit limit, influences your credit score. Aim to keep this ratio below 30% to maintain a good credit score.

- Develop a Repayment Plan: Establish a clear repayment plan that aligns with your business’s cash flow. This ensures you make timely payments and avoid accumulating excessive debt.

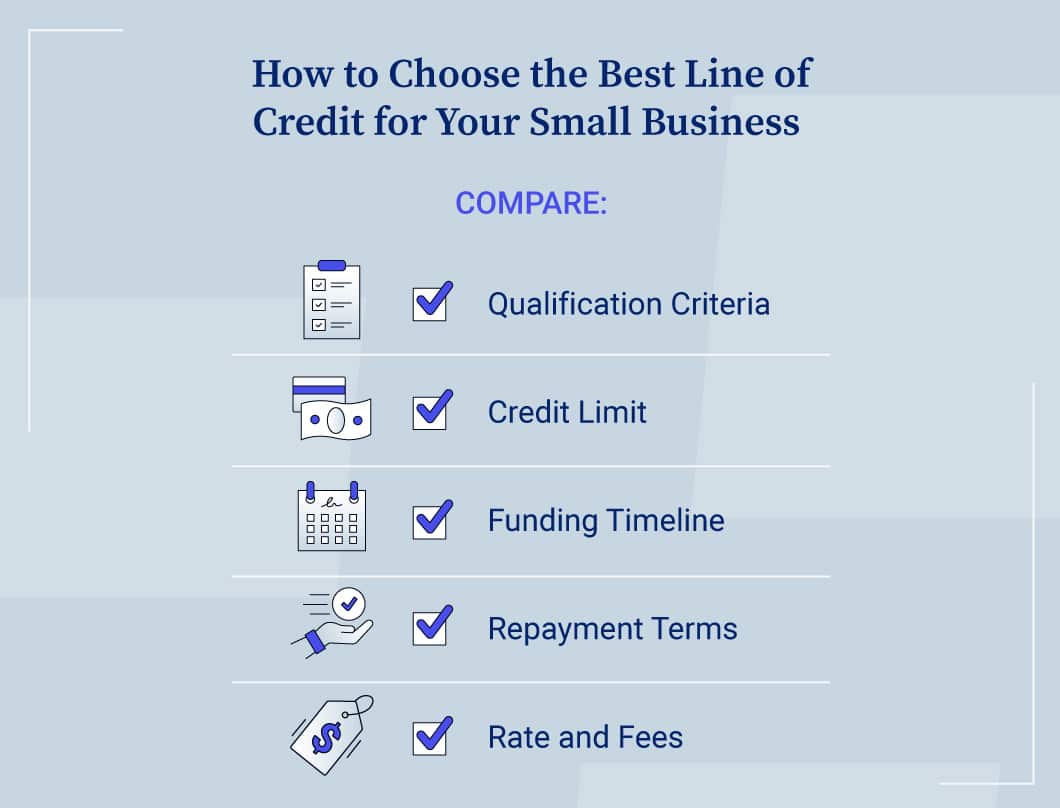

Comparing Business Lines of Credit

Choosing the right business line of credit can be challenging, as various lenders offer different terms and conditions. To make an informed decision, it’s crucial to compare offerings from different lenders.

Comparing Business Line of Credit Offerings

To facilitate the comparison process, here’s a table showcasing key features of business line of credit offerings from several prominent lenders:

| Lender | Interest Rate | Fees | Eligibility Requirements | Loan Terms | Pros | Cons |

|---|---|---|---|---|---|---|

| Bank of America | Variable, starting at 6.50% | Annual fee, transaction fees | Good credit history, strong business revenue | Up to $100,000, flexible repayment options | Widely available, competitive rates | Higher fees, strict eligibility criteria |

| Chase | Variable, starting at 7.00% | Annual fee, transaction fees | Good credit history, established business | Up to $50,000, flexible repayment options | Competitive rates, user-friendly platform | Limited loan amounts, higher fees |

| Wells Fargo | Variable, starting at 7.25% | Annual fee, transaction fees | Good credit history, strong business revenue | Up to $150,000, flexible repayment options | High loan limits, competitive rates | Strict eligibility criteria, complex application process |

| Kabbage | Fixed or variable, starting at 8.00% | Origination fee, monthly fee | Good credit history, strong business revenue | Up to $250,000, flexible repayment options | Fast approval process, online platform | Higher interest rates, limited loan amounts |

| Lendio | Variable, starting at 7.50% | Origination fee, monthly fee | Good credit history, strong business revenue | Up to $500,000, flexible repayment options | Access to multiple lenders, competitive rates | Higher fees, complex application process |

Note: Interest rates and fees can vary based on individual creditworthiness and business performance. It’s crucial to review the specific terms and conditions of each lender before making a decision.

Alternatives to Business Lines of Credit: What Is The Best Business Line Of Credit

A business line of credit is a valuable tool for businesses seeking flexible financing, but it might not be the perfect fit for every situation. Exploring alternative financing options can help you find the best solution for your specific needs and circumstances.

Business Loans

Business loans offer a lump sum of money that you can use for various purposes, such as purchasing equipment, expanding operations, or covering working capital needs. They typically come with fixed interest rates and repayment terms, providing predictability and financial stability.

- Types of Business Loans: There are various types of business loans, including term loans, SBA loans, equipment loans, and working capital loans, each tailored to specific business needs.

- Benefits: Business loans provide a predictable repayment structure, fixed interest rates, and a clear understanding of the total cost of borrowing. They are also suitable for large, one-time expenses or long-term investments.

- Drawbacks: Business loans often require a strong credit history, collateral, and a comprehensive business plan. The approval process can be lengthy, and the fixed repayment schedule might not be flexible enough for fluctuating business needs.

Merchant Cash Advances

Merchant cash advances (MCAs) provide businesses with immediate funding based on their future credit card sales. These advances are typically repaid through a fixed percentage of daily sales, making them an attractive option for businesses with consistent revenue streams.

- How MCAs Work: A merchant cash advance provider assesses a business’s credit card sales history and provides a lump sum of funding. The repayment is then deducted as a percentage of daily sales, typically through a debit card terminal.

- Benefits: MCAs offer fast funding, require minimal documentation, and are suitable for businesses with predictable sales. They are often available to businesses with less-than-perfect credit histories.

- Drawbacks: MCAs come with high interest rates, which can be disguised as fees or a “factor rate.” The repayment schedule can be burdensome for businesses with fluctuating sales, and the lack of transparency in pricing can lead to unexpected costs.

Invoice Financing

Invoice financing allows businesses to access cash upfront by selling their unpaid invoices to a financing company. This option provides immediate liquidity and helps businesses manage cash flow without waiting for customers to pay.

- Process: A business submits its unpaid invoices to a financing company, which assesses the creditworthiness of the customer. The financing company then provides a percentage of the invoice value as a loan, with the remaining balance paid upon customer payment.

- Benefits: Invoice financing offers quick access to cash, improves cash flow, and helps businesses manage working capital. It is particularly beneficial for businesses with long payment terms or a high volume of invoices.

- Drawbacks: Invoice financing typically comes with fees and interest charges, and the financing company may require a percentage of the invoice value as collateral. The approval process can be time-consuming, and the financing company may have specific requirements for the invoices.

Crowdfunding

Crowdfunding allows businesses to raise capital from a large number of individuals through online platforms. This approach can be an effective way to access funding for innovative projects or businesses with a strong community following.

- Types of Crowdfunding: There are various crowdfunding models, including equity crowdfunding, reward-based crowdfunding, and donation-based crowdfunding, each with different terms and benefits.

- Benefits: Crowdfunding offers an alternative to traditional financing sources, allows businesses to engage with their target audience, and can provide valuable market validation. It can also be a cost-effective way to raise capital.

- Drawbacks: Crowdfunding campaigns require significant effort to promote and reach potential investors. There is no guarantee of success, and the regulatory landscape for crowdfunding can be complex.

Comparison Table

| Financing Option | Pros | Cons |

|---|---|---|

| Business Loan | Predictable repayment, fixed interest rates, suitable for large expenses | Requires good credit, collateral, and a business plan, lengthy approval process |

| Merchant Cash Advance | Fast funding, minimal documentation, suitable for businesses with consistent sales | High interest rates, repayment based on daily sales, lack of transparency in pricing |

| Invoice Financing | Quick access to cash, improves cash flow, beneficial for businesses with long payment terms | Fees and interest charges, collateral requirements, time-consuming approval process |

| Crowdfunding | Alternative to traditional financing, engages with target audience, provides market validation | Requires effort to promote, no guarantee of success, complex regulatory landscape |

Final Summary

Ultimately, the best business line of credit for you depends on your individual circumstances, creditworthiness, and business goals. By carefully evaluating your options, understanding the terms and conditions, and choosing a lender that aligns with your needs, you can access the funding you require to fuel your business’s growth and success. Remember to leverage your credit wisely, manage your debt responsibly, and maintain a healthy credit score to ensure continued access to financing opportunities in the future.

Questions Often Asked

What are the typical interest rates on business lines of credit?

Interest rates on business lines of credit vary depending on factors such as your credit score, the lender, and the type of line of credit. Generally, interest rates for business lines of credit are higher than those for personal loans, but lower than those for short-term loans like merchant cash advances.

How much can I borrow with a business line of credit?

The amount you can borrow with a business line of credit is determined by your creditworthiness and the lender’s policies. It’s important to note that you’ll typically have a credit limit, which is the maximum amount you can borrow.

What happens if I don’t make my payments on time?

If you fail to make your payments on time, you may be subject to late fees, penalties, and a negative impact on your credit score. It’s crucial to make payments on time to avoid these consequences.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!