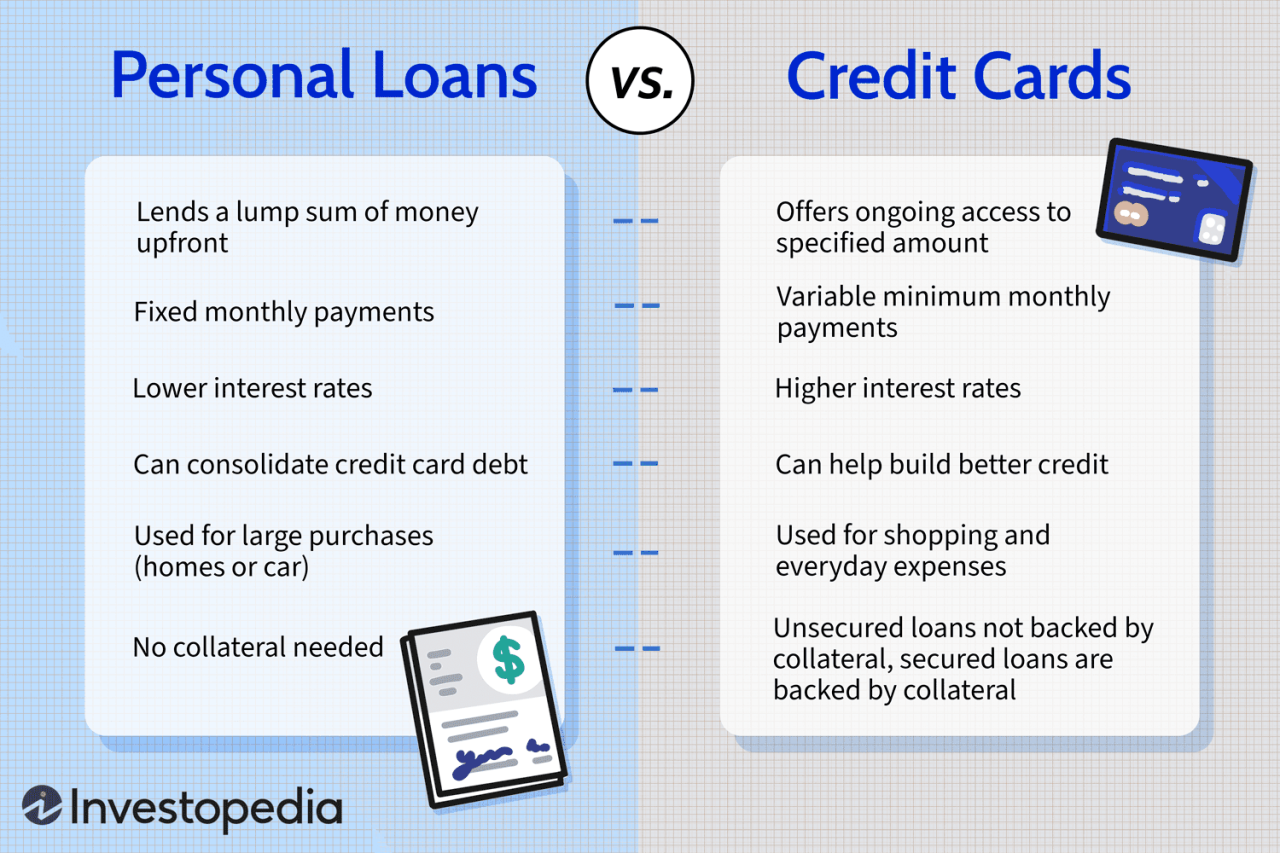

Difference between business and personal credit card – Business vs. Personal Credit Cards: Key Differences – Navigating the world of credit cards can be confusing, especially when it comes to understanding the distinction between business and personal cards. While both offer access to credit, they cater to different needs and come with unique features and considerations.

Choosing the right card depends on your specific circumstances, whether you’re a small business owner looking to manage expenses or an individual seeking rewards and financial flexibility. This guide delves into the key differences between business and personal credit cards, helping you make an informed decision.

Purpose and Usage

Business and personal credit cards serve distinct purposes, reflecting the different financial needs and goals of individuals and businesses. Understanding these distinctions is crucial for making informed decisions about which type of card is right for you.

Business Credit Card Purpose

Business credit cards are designed to support the financial operations of a company or organization. They offer a dedicated line of credit specifically for business expenses.

- Purchasing supplies and equipment: Businesses can use their credit cards to acquire essential goods and tools for their operations.

- Travel and entertainment: Business credit cards often offer rewards and perks for travel-related expenses, such as airline tickets, hotel stays, and car rentals.

- Employee expenses: Companies can provide employees with business credit cards to manage expenses related to work, such as travel, meals, and client entertainment.

- Building business credit: Using a business credit card responsibly can help establish a positive credit history for the business, which can be beneficial for obtaining loans and financing in the future.

Personal Credit Card Purpose

Personal credit cards are primarily intended for individual use. They offer a line of credit that individuals can use for various personal expenses.

- Everyday purchases: Personal credit cards are commonly used for daily expenses such as groceries, gas, and dining.

- Large purchases: Individuals may use their credit cards to make significant purchases, such as electronics, furniture, or travel.

- Building personal credit: Responsible use of a personal credit card helps establish a good credit score, which is essential for obtaining loans, mortgages, and other financial products.

- Rewards and perks: Many personal credit cards offer rewards programs that provide cash back, travel miles, or other benefits for spending.

Eligibility and Application: Difference Between Business And Personal Credit Card

Both business and personal credit cards have specific eligibility requirements and application processes. Understanding these differences can help you determine which type of card is best suited for your needs.

Business Credit Card Eligibility

Business credit card eligibility is often more stringent than personal credit card eligibility. Issuers typically look at a combination of factors to assess your business’s creditworthiness.

- Business Credit History: This is the most important factor. Lenders will review your business’s credit history, including payment history, credit utilization, and any outstanding debts. If your business has a short or limited credit history, you may need to provide additional documentation to prove your creditworthiness.

- Personal Credit Score: Your personal credit score can also be considered, especially if your business is a sole proprietorship or partnership. A higher personal credit score can improve your chances of getting approved for a business credit card.

- Business Revenue and Profitability: Lenders will typically require you to provide financial statements, including profit and loss statements and balance sheets, to demonstrate your business’s financial health. They will want to see a consistent revenue stream and profitability.

- Time in Business: Most business credit cards require a minimum time in business, typically a year or more. This helps lenders assess the stability and longevity of your business.

- Business Type and Industry: Some industries may have higher approval rates than others, depending on the perceived risk associated with that industry.

Personal Credit Card Eligibility

Personal credit cards are generally easier to obtain than business credit cards. Lenders typically consider these factors:

- Credit Score: Your credit score is the primary factor in determining your eligibility for a personal credit card. A higher credit score indicates a lower risk to the lender, making you more likely to be approved.

- Income and Employment History: Lenders will assess your income and employment history to ensure you have the financial means to repay your debt. A stable income and long-term employment history can strengthen your application.

- Credit History: Your credit history, including your payment history and credit utilization, will be reviewed. A good credit history with a low credit utilization rate will improve your chances of approval.

- Debt-to-Income Ratio: This ratio measures your monthly debt payments relative to your monthly income. A lower debt-to-income ratio indicates that you have more disposable income, making you a more attractive borrower.

Application Process

The application process for both business and personal credit cards is generally similar, but there are some key differences:

- Business Credit Card Application: You will typically need to provide more detailed information about your business, including your business’s legal structure, tax identification number, and financial statements. You may also need to provide personal financial information, such as your social security number and credit history.

- Personal Credit Card Application: You will need to provide basic personal information, such as your name, address, social security number, and income. You may also be asked to provide details about your employment history and credit history.

Credit Limits and Fees

The credit limit and fees associated with business and personal credit cards can vary significantly, impacting how you manage your finances. Understanding these differences is crucial for making informed decisions about which type of card best suits your needs.

Credit Limits, Difference between business and personal credit card

Credit limits represent the maximum amount you can borrow on your card. Business cards generally offer higher credit limits compared to personal cards. This is because businesses often have higher expenses and require greater borrowing capacity.

- Business Cards: Credit limits typically range from $5,000 to $100,000 or more, depending on the business’s revenue, credit history, and other factors.

- Personal Cards: Credit limits usually fall between $500 and $10,000, although higher limits are available for individuals with excellent credit scores.

Fee Structures

Both business and personal cards come with various fees, which can add up over time. It’s essential to compare fees across different cards and choose one that aligns with your spending habits.

Annual Fees

Annual fees are charged annually for the privilege of using the card.

- Business Cards: Annual fees are typically higher than personal cards, ranging from $95 to $500 or more. Some cards may offer a waived annual fee for the first year.

- Personal Cards: Annual fees can range from $0 to $100, with many cards offering no annual fee.

Transaction Fees

Transaction fees are charged for specific actions like cash advances, balance transfers, or foreign currency transactions.

- Business Cards: May have higher transaction fees for cash advances, balance transfers, and foreign currency transactions compared to personal cards.

- Personal Cards: Transaction fees vary depending on the card issuer and the specific transaction. Some cards offer lower or no fees for certain transactions.

Credit Utilization

Credit utilization refers to the percentage of your available credit you are currently using. A high credit utilization ratio can negatively impact your credit score.

- Business Cards: Maintaining a low credit utilization ratio is essential for both personal and business credit scores. High utilization can impact your business’s ability to secure loans or financing.

- Personal Cards: A high credit utilization ratio can lower your credit score, potentially affecting your ability to get loans, mortgages, or even rent an apartment.

Rewards and Benefits

Both business and personal credit cards offer rewards and benefits that can add value to your spending. These perks can range from cash back and travel points to insurance coverage and purchase protection. Understanding the differences in rewards and benefits between the two card types can help you choose the best option for your needs.

Business Credit Card Rewards

Business credit cards often focus on rewards that align with the needs of business owners and professionals. Here are some common rewards programs offered on business credit cards:

- Cash Back: Many business cards offer cash back rewards on purchases, often at a higher rate than personal cards. These rewards can be redeemed for cash, statement credits, or merchandise.

- Travel Points: Business cards may offer travel points that can be redeemed for flights, hotels, and other travel expenses. These points can be particularly valuable for businesses that travel frequently.

- Discounts: Some business cards offer discounts on business-related expenses, such as office supplies, software, or advertising. These discounts can help businesses save money on essential purchases.

- Bonus Categories: Many business cards offer bonus rewards for spending in specific categories, such as dining, travel, or office supplies. This can help businesses maximize their rewards on their most common expenses.

Personal Credit Card Rewards

Personal credit cards typically offer a wider range of rewards programs, catering to a broader range of consumer needs. Some common rewards programs offered on personal credit cards include:

- Cash Back: Similar to business cards, personal credit cards offer cash back rewards on purchases, often at varying rates depending on the card and spending category.

- Travel Points: Many personal credit cards offer travel points that can be redeemed for flights, hotels, and other travel expenses. These points can be accumulated quickly through everyday spending.

- Gift Cards: Some personal credit cards offer rewards in the form of gift cards to popular retailers or restaurants. These rewards can be convenient for purchasing specific items or experiences.

- Merchandise: Certain personal credit cards offer rewards that can be redeemed for merchandise, such as electronics, appliances, or home goods.

Benefits Comparison

While both business and personal credit cards offer rewards, the benefits they provide often differ significantly.

- Business Credit Cards: Business credit cards often offer benefits tailored to business needs, such as purchase protection for business equipment, extended warranties, and travel insurance for business trips. They may also provide access to business travel programs or discounts on business services.

- Personal Credit Cards: Personal credit cards typically focus on benefits that cater to individual needs, such as travel insurance for personal trips, purchase protection for personal items, and extended warranties on consumer goods. They may also offer benefits like roadside assistance, identity theft protection, or cell phone insurance.

Impact on Credit Score

Both business and personal credit cards can impact your credit score, but in different ways. Understanding how each card type affects your credit is essential for building a strong credit history and achieving your financial goals.

Impact of Business Credit Card Usage on Business Credit Score

Business credit cards are designed to help businesses build and manage their credit. A business credit card’s impact on a business credit score is directly related to the responsible use of the card.

- Payment History: Paying your business credit card bills on time is crucial. Late payments negatively impact your business credit score. A consistent record of timely payments demonstrates financial responsibility and can help improve your credit score.

- Credit Utilization Ratio: This ratio represents the amount of credit you’re using compared to your total available credit. Keeping your utilization ratio low (ideally below 30%) can positively impact your business credit score. A high utilization ratio suggests that your business may be overextended financially.

- Credit Mix: Having a mix of credit accounts, such as business credit cards and business loans, can demonstrate responsible credit management. This diversity in your credit portfolio can improve your business credit score.

Impact of Personal Credit Card Usage on Personal Credit Score

Personal credit cards are used to build and manage personal credit. Your personal credit score is influenced by factors like your payment history, credit utilization, and the length of your credit history.

- Payment History: Timely payments are essential for maintaining a good personal credit score. Late payments can significantly lower your score, making it more difficult to obtain loans or credit in the future.

- Credit Utilization Ratio: A low credit utilization ratio (below 30%) is generally considered favorable for your personal credit score. This indicates that you are not using a large portion of your available credit, which can signal financial responsibility.

- Credit Mix: Similar to business credit, having a mix of credit accounts (e.g., credit cards, personal loans) can positively impact your personal credit score. This demonstrates that you can manage different types of credit responsibly.

Relative Importance of Each Card Type for Building Credit

Both business and personal credit cards are valuable tools for building credit. However, their importance can vary depending on your specific needs and goals.

- Business Credit: Building a strong business credit score is essential for obtaining business loans, securing leases, and establishing credibility with suppliers and vendors. A strong business credit score can open doors to various financial opportunities for your business.

- Personal Credit: A good personal credit score is crucial for obtaining personal loans, mortgages, and even credit cards. It also influences your ability to secure apartment leases, utilities, and insurance policies. A good personal credit score can provide you with better interest rates and loan terms, ultimately saving you money.

Reporting and Tracking

Keeping track of your credit card spending and activity is crucial for managing your finances effectively, whether you’re using a business or personal credit card. Both types of cards offer various reporting and tracking methods, each with its own advantages and disadvantages.

Business Credit Card Reporting and Tracking

Business credit cards often provide detailed reporting and tracking features to help business owners monitor their expenses and manage their finances. Here are some common methods used for business credit cards:

- Online Account Access: Most business credit card issuers offer secure online portals where cardholders can access their account statements, transaction history, and other important information. These portals usually provide comprehensive reporting features, allowing businesses to filter transactions by date, merchant, category, and other criteria.

- Mobile Apps: Many credit card companies also offer mobile apps that allow business owners to manage their accounts on the go. These apps provide access to account statements, transaction history, and other important information, making it easy to track spending and manage finances from anywhere.

- Email Notifications: Card issuers often send email notifications for various account activities, such as transaction alerts, payment due reminders, and fraud alerts. These notifications can help businesses stay informed about their credit card activity and prevent potential issues.

- Paper Statements: While online access is becoming increasingly popular, some businesses may still prefer to receive paper statements. These statements provide a physical record of credit card activity and can be useful for accounting and record-keeping purposes.

Personal Credit Card Reporting and Tracking

Personal credit cards also offer various reporting and tracking methods, similar to business credit cards. Here are some common procedures for personal credit cards:

- Online Account Access: Like business cards, most personal credit cards provide secure online portals where cardholders can access their account statements, transaction history, and other important information. These portals usually offer various reporting features, allowing individuals to filter transactions by date, merchant, category, and other criteria.

- Mobile Apps: Many credit card companies offer mobile apps that allow individuals to manage their accounts on the go. These apps provide access to account statements, transaction history, and other important information, making it easy to track spending and manage finances from anywhere.

- Email Notifications: Card issuers often send email notifications for various account activities, such as transaction alerts, payment due reminders, and fraud alerts. These notifications can help individuals stay informed about their credit card activity and prevent potential issues.

- Paper Statements: While online access is becoming increasingly popular, some individuals may still prefer to receive paper statements. These statements provide a physical record of credit card activity and can be useful for personal budgeting and record-keeping purposes.

Ease of Access to Credit Card Statements and Transaction History

Generally, both business and personal credit cards offer similar levels of ease of access to credit card statements and transaction history. Most credit card issuers provide secure online portals and mobile apps that allow cardholders to access their account information anytime and anywhere. However, some differences may exist depending on the specific credit card issuer and its policies. For example, some issuers may offer more advanced reporting features or provide faster access to statements and transaction history for business credit cards.

Ending Remarks

In conclusion, the choice between a business and personal credit card boils down to your individual needs and goals. Business cards provide valuable tools for managing company finances, while personal cards offer rewards and benefits for everyday spending. Understanding the distinctions between these card types empowers you to make a choice that aligns with your financial objectives and enhances your overall financial well-being.

Clarifying Questions

What are the typical interest rates for business and personal credit cards?

Interest rates vary widely depending on the card issuer, your credit score, and the card’s specific features. Generally, business cards tend to have higher interest rates than personal cards, reflecting the higher risk associated with business lending.

Can I use a business credit card for personal expenses?

While it’s technically possible to use a business credit card for personal expenses, it’s not recommended. Doing so can complicate your accounting and potentially lead to tax issues. It’s best to keep business and personal expenses separate for clarity and compliance.

What are the advantages of using a business credit card for a sole proprietorship?

A business credit card can be beneficial for a sole proprietorship by providing separate financial records for business expenses, building business credit, and potentially offering rewards programs tailored to business needs. However, it’s crucial to ensure compliance with tax regulations and maintain clear financial records.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!