How to get a credit report for a business is a crucial step for any entrepreneur looking to secure funding, establish partnerships, or simply understand their financial standing. Understanding your business credit report allows you to assess your financial health, identify potential areas for improvement, and make informed decisions that can benefit your company’s growth.

This comprehensive guide will walk you through the process of obtaining your business credit report, exploring the key credit reporting agencies, the different types of reports available, and the steps involved in accessing and understanding your credit score. We’ll also delve into strategies for building positive credit history and monitoring your report for accuracy.

Understanding Business Credit Reports

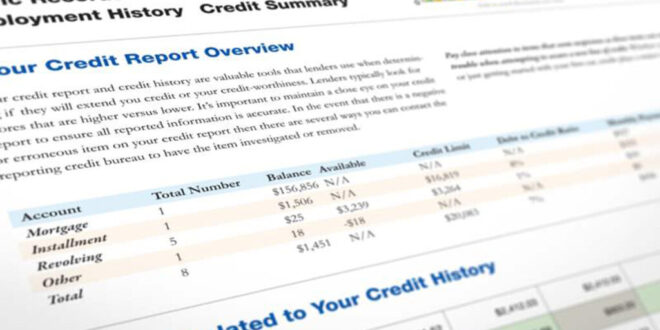

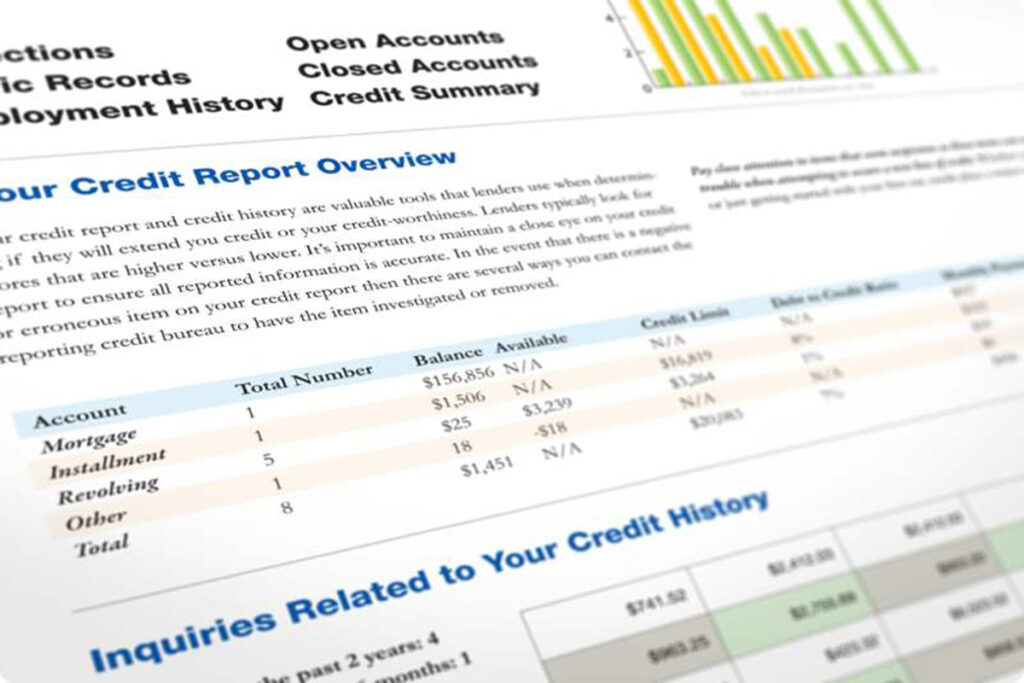

A business credit report is a comprehensive record of a company’s financial history and creditworthiness. It is a crucial document that provides lenders, suppliers, and other businesses with insights into a company’s credit risk. Just like personal credit reports, business credit reports help determine the likelihood of a business repaying its debts.

Key Components of a Business Credit Report

Business credit reports are structured to provide a detailed overview of a company’s financial health and credit behavior. They typically include the following key components:

- Payment History: This section tracks a business’s payment history on all its credit accounts, including loans, lines of credit, and trade credit. It shows how consistently the business has made payments on time and whether there have been any late or missed payments.

- Credit Utilization: This component measures the amount of credit a business is currently using compared to its total available credit. A high credit utilization ratio can indicate that a business is heavily reliant on debt, which may raise concerns about its financial stability.

- Public Records: This section includes any public records related to the business, such as bankruptcies, liens, or judgments. These records provide information about any legal or financial issues that may have impacted the business’s financial health.

- Inquiries: This section tracks all inquiries made by other businesses and lenders to access the business’s credit report. A high number of inquiries can indicate that a business is actively seeking new credit, which may suggest financial distress.

How Business Credit Reports Are Used

Business credit reports are essential tools for various stakeholders involved in business transactions. Here are some examples of how these reports are used:

- Lenders: Lenders use business credit reports to assess the creditworthiness of potential borrowers before approving loans. A strong credit report indicates a lower risk of default, making it more likely for the lender to approve the loan with favorable terms.

- Suppliers: Suppliers often use business credit reports to determine whether to extend trade credit to a business. Trade credit is a form of short-term financing where suppliers allow businesses to make purchases on credit and pay later. By reviewing the business’s credit report, suppliers can evaluate the risk of non-payment.

- Other Businesses: Businesses may use credit reports to assess the financial stability of potential partners, suppliers, or customers. This information can help them make informed decisions about business relationships and mitigate potential risks.

Obtaining Your Business Credit Report

Knowing how to obtain a business credit report is essential for understanding your company’s financial health and making informed decisions. Business credit reports are comprehensive summaries of your company’s credit history, providing insights into your payment history, credit lines, and overall creditworthiness. They are used by lenders, suppliers, and other businesses to assess your credit risk and determine if they should extend credit to you.

Obtaining Your Business Credit Report

To obtain a business credit report, you’ll need to contact one of the three major credit reporting agencies for businesses: Equifax, Experian, and Dun & Bradstreet (D&B). Each agency offers different types of business credit reports, each with its own cost and information.

- Equifax offers a variety of business credit reports, including its Business Credit Report, which provides a comprehensive overview of your company’s credit history, including payment history, credit lines, and public records. You can obtain a report online, by phone, or by mail. Equifax also offers a free trial of its business credit monitoring service.

- Experian provides a range of business credit reports, including its Business Credit Report, which offers insights into your company’s credit history, including payment history, credit lines, and public records. You can obtain a report online, by phone, or by mail. Experian also offers a free trial of its business credit monitoring service.

- Dun & Bradstreet (D&B) is the leading provider of business credit reports and offers a variety of reports, including its D&B Business Information Report, which provides a comprehensive overview of your company’s credit history, financial performance, and business operations. You can obtain a report online, by phone, or by mail. D&B also offers a variety of business credit monitoring services.

Steps Involved in Obtaining a Business Credit Report

The steps involved in obtaining a business credit report from each agency are similar. Generally, you’ll need to provide the following information:

- Your business name

- Your business address

- Your business tax identification number (TIN)

- Your business phone number

You may also be required to provide additional information, such as your business’s legal structure or the names of its owners.

Types of Business Credit Reports Available

Each credit reporting agency offers a variety of business credit reports, each with its own cost and information.

- Basic Credit Reports: These reports provide a general overview of your company’s credit history, including payment history, credit lines, and public records. They are typically the most affordable option and are a good starting point for understanding your company’s creditworthiness.

- Detailed Credit Reports: These reports provide more in-depth information about your company’s credit history, including financial statements, industry comparisons, and business risk assessments. They are typically more expensive than basic reports but provide a more comprehensive view of your company’s financial health.

- Customized Credit Reports: These reports are tailored to your specific needs and can include information about your company’s industry, competitors, and market trends. They are typically the most expensive option but provide the most valuable insights into your company’s financial health and market position.

Cost of Business Credit Reports

The cost of business credit reports varies depending on the agency, the type of report, and the level of detail provided.

- Basic Credit Reports: These reports typically cost between $20 and $50.

- Detailed Credit Reports: These reports typically cost between $50 and $150.

- Customized Credit Reports: These reports can cost hundreds or even thousands of dollars, depending on the level of customization and detail provided.

Accessing Your Business Credit Report Online

Accessing your business credit report online offers convenience and speed, allowing you to review your credit standing at any time. Several online platforms are available from the three major credit reporting agencies (CRAs): Experian, Equifax, and Dun & Bradstreet (D&B). Each platform offers different features and pricing, so it’s essential to compare them to choose the best option for your needs.

Online Platforms for Accessing Business Credit Reports

Here is a table comparing the online platforms offered by each CRA:

| CRA | Platform Name | Features | Pricing | Special Offers/Discounts |

|---|---|---|---|---|

| Experian | Experian Business Credit Report | Provides access to Experian’s business credit report, including financial information, payment history, and public records. | Varies depending on the type of report and subscription plan. | May offer discounts for multi-year subscriptions or for specific industries. |

| Equifax | Equifax Business Credit Report | Offers access to Equifax’s business credit report, including credit scores, trade lines, and payment history. | Varies depending on the type of report and subscription plan. | May offer discounts for multi-year subscriptions or for specific industries. |

| Dun & Bradstreet (D&B) | D&B Business Credit Report | Provides access to D&B’s comprehensive business credit report, including financial information, payment history, and business risk scores. | Varies depending on the type of report and subscription plan. | May offer discounts for multi-year subscriptions or for specific industries. |

Benefits and Drawbacks of Online Platforms

Here is a table outlining the benefits and drawbacks of accessing your business credit report online:

| Benefit | Drawback |

|---|---|

| Convenience and speed | May require a subscription fee |

| Access to detailed information | May not be as comprehensive as a traditional report |

| Easy to compare different CRAs | May not be suitable for all businesses |

Understanding Your Business Credit Score

A strong business credit score is crucial for securing financing, obtaining favorable terms from suppliers, and building a positive reputation in the business community. Lenders and suppliers use your business credit score to assess your creditworthiness and determine the risk associated with extending credit to you. A higher credit score indicates a lower risk, making it easier to access loans, lines of credit, and other forms of financing at competitive rates.

Business Credit Score Methodology, How to get a credit report for a business

Each credit reporting agency uses its own proprietary scoring model to calculate a business credit score. While the specific factors and weights may vary, they generally consider the following key elements:

- Payment History: This is the most important factor, accounting for a significant portion of your score. Late or missed payments can severely damage your credit score.

- Credit Utilization: This refers to the amount of credit you are using compared to your available credit limits. A high utilization ratio can negatively impact your score.

- Credit Mix: Having a mix of different types of credit, such as loans, lines of credit, and credit cards, can demonstrate a healthy credit profile.

- Credit History Length: A longer credit history generally indicates a more established and reliable business, which can positively influence your score.

- Public Records: Negative public records, such as bankruptcies or lawsuits, can significantly lower your credit score.

Improving Your Business Credit Score

There are several steps you can take to improve your business credit score:

- Pay Bills on Time: This is the most effective way to improve your credit score. Set up reminders or automatic payments to ensure timely payments.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This shows lenders that you are managing your credit responsibly.

- Build Positive Credit History: Obtain trade credit from suppliers and pay your invoices promptly. This will establish a positive credit history and demonstrate your creditworthiness.

- Monitor Your Credit Report Regularly: Check your credit report from each of the major credit reporting agencies at least annually for any errors or inaccuracies.

- Dispute Errors: If you find any errors on your credit report, contact the credit reporting agency and dispute them promptly.

Ending Remarks: How To Get A Credit Report For A Business

By understanding the intricacies of business credit reports, you can empower your business to make informed financial decisions, build a strong credit profile, and ultimately achieve greater financial stability and success. Whether you’re seeking funding, expanding your operations, or simply aiming for a more robust financial foundation, navigating the world of business credit reports is a crucial step in the journey.

Key Questions Answered

What is the difference between a personal credit report and a business credit report?

A personal credit report reflects your individual credit history, while a business credit report tracks the financial activity of your company. They are separate entities and are evaluated differently.

How often should I check my business credit report?

It’s recommended to review your business credit report at least annually, or more frequently if you’re actively seeking financing or experiencing any financial changes.

What are some common errors that can appear on a business credit report?

Common errors include incorrect account information, inaccurate payment history, or outdated information. It’s important to dispute any errors you find to ensure your report is accurate.

Can I get a free business credit report?

While some agencies may offer limited free reports, most require a fee for accessing your business credit report. However, you may be eligible for a free report if you’re a small business owner.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!