How to liquidate a business credit card sets the stage for this informative guide, offering readers a clear path to manage their business credit effectively. Liquidating a business credit card can be a daunting task, but understanding the process and available options can empower you to make informed decisions. This guide will explore various liquidation methods, the impact on your financial health, and strategies for rebuilding your credit after the process.

Whether you’re facing a financial hardship, aiming to consolidate debt, or simply looking to streamline your business finances, this guide will equip you with the knowledge and tools to navigate the process of liquidating a business credit card successfully. We’ll delve into the steps involved, the considerations to keep in mind, and the importance of communication with your credit card issuer.

Understanding Business Credit Card Liquidation: How To Liquidate A Business Credit Card

Liquidating a business credit card involves taking steps to pay off the outstanding balance and close the account. This process can be complex and requires careful planning. Understanding the different scenarios that necessitate liquidation and the potential benefits and drawbacks is crucial before making a decision.

Scenarios for Liquidating a Business Credit Card

There are various scenarios that may lead to the liquidation of a business credit card. Here are some common ones:

- Business Closure: When a business shuts down, it’s essential to close all outstanding accounts, including credit cards. Liquidating the business credit card ensures that all outstanding debt is settled and prevents further interest accumulation.

- Financial Distress: If a business is facing financial difficulties and struggling to make minimum payments, liquidating the business credit card may be a viable option. This can help reduce the burden of debt and improve the company’s financial health.

- High Interest Rates: If a business credit card carries a high interest rate, liquidating it can save money in the long run. By transferring the balance to a card with a lower interest rate or consolidating debt, the business can significantly reduce its interest payments.

- Limited Credit Limit: When a business’s credit limit is insufficient to meet its financial needs, liquidating the existing card and applying for a new one with a higher limit may be a better option. This can provide the business with more financial flexibility.

Benefits of Liquidating a Business Credit Card

Liquidating a business credit card can offer several advantages, including:

- Debt Reduction: By paying off the outstanding balance, businesses can reduce their overall debt and improve their financial position.

- Improved Credit Score: Closing a business credit card account can improve the company’s credit score, particularly if the account was in good standing. A higher credit score can lead to better interest rates and loan terms in the future.

- Reduced Interest Payments: Liquidating a business credit card with a high interest rate can save the business money on interest payments. This can free up cash flow for other business needs.

- Simplified Finances: Liquidating a business credit card can simplify the company’s financial management by reducing the number of accounts and payments to track.

Drawbacks of Liquidating a Business Credit Card

While liquidating a business credit card can have benefits, it also has potential drawbacks:

- Loss of Credit History: Closing a business credit card account can reduce the company’s credit history, which can negatively impact its credit score, especially if the account was open for a long time.

- Impact on Credit Utilization: Closing a business credit card can increase the company’s credit utilization ratio, which is the amount of credit used compared to the total available credit. A higher credit utilization ratio can lower the business’s credit score.

- Limited Access to Credit: Closing a business credit card can reduce the company’s access to credit, especially if it has few other credit accounts open. This can make it difficult to obtain financing in the future.

Assessing Your Financial Situation

Before diving into the liquidation process, it’s crucial to thoroughly assess your business’s financial health. This evaluation will help you make informed decisions about the best course of action for your business credit card debt.

Analyzing Your Outstanding Balance and Interest Rates

Understanding your outstanding balance and interest rates is crucial for determining the overall cost of your business credit card debt.

* Calculate Your Total Outstanding Balance: Sum up the balances across all your business credit cards to get a clear picture of your total debt.

* Identify Interest Rates: Review each credit card statement to note the interest rate applied to your outstanding balance. Higher interest rates can significantly impact your debt burden.

* Assess Minimum Payments: Determine the minimum payment required for each card. While making only minimum payments may seem convenient, it can lead to prolonged debt and substantial interest accumulation.

* Compare Interest Rates: If you have multiple business credit cards with varying interest rates, consider transferring balances to a card with a lower interest rate. This can help you save on interest charges and reduce your overall debt faster.

* Calculate Interest Accrued: Estimate the amount of interest you’re paying annually on your outstanding balance. This calculation will help you understand the true cost of your debt.

For example, if you have a balance of $10,000 on a credit card with a 15% interest rate, you’ll pay approximately $1,500 in interest annually.

Impact of Liquidation on Your Credit Score

Liquidating a business credit card can impact your credit score, which is a numerical representation of your creditworthiness. It’s essential to understand the potential consequences and take steps to mitigate negative impacts.

* Closing a Business Credit Card: Closing a business credit card can negatively impact your credit score if it lowers your credit utilization ratio. This ratio measures the amount of credit you’re using compared to your total available credit. A lower utilization ratio is generally favorable.

* Impact on Credit History: Closing a business credit card can shorten your credit history, which can affect your credit score. A longer credit history typically indicates a more responsible credit management approach.

* Credit Inquiries: Applying for new credit, including business credit cards, can result in hard inquiries on your credit report. These inquiries can temporarily lower your credit score.

* Late Payments: Failing to make timely payments on your business credit card can severely damage your credit score. Late payments can stay on your credit report for up to seven years.

* Debt Collection: If you fail to make payments on your business credit card, it may be sent to collections. This can significantly damage your credit score and make it challenging to obtain future credit.

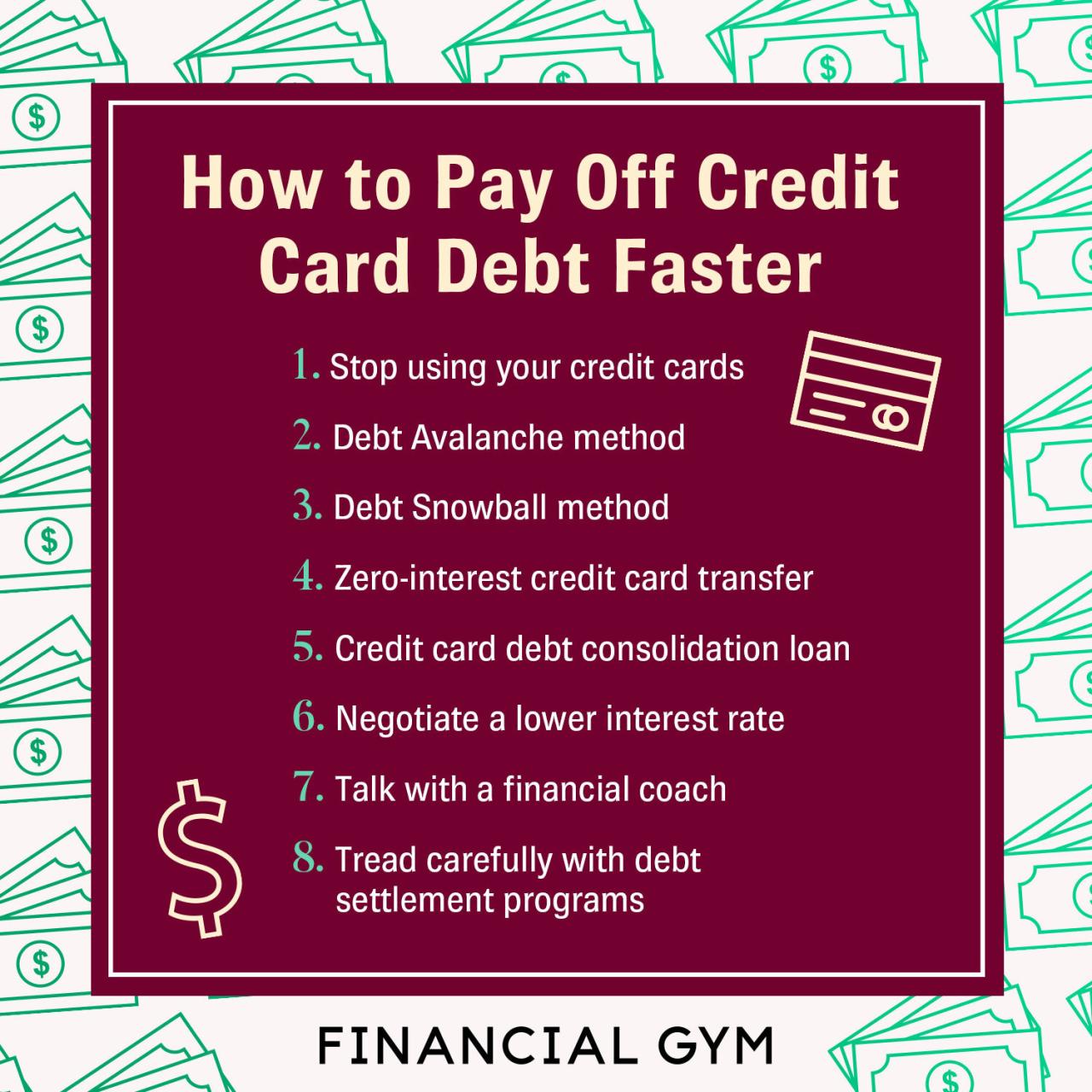

Exploring Liquidation Options

Now that you’ve assessed your financial situation and understand the potential consequences of business credit card debt, it’s time to explore different liquidation options. Each option comes with its own set of pros and cons, and the best choice for you will depend on your specific circumstances.

Comparing Liquidation Methods

To help you make an informed decision, here’s a table comparing various liquidation methods:

| Method | Description | Pros | Cons |

|—|—|—|—|

| Balance Transfer | Transferring your outstanding balance to a new credit card with a lower interest rate. | Lower interest rate, potentially saving on interest charges. | May involve transfer fees, the new card may have a higher APR after the introductory period. |

| Debt Consolidation | Combining multiple debts, including your business credit card debt, into a single loan with a lower interest rate. | Simplifies payments, may offer a lower interest rate. | May require a good credit score, may not be available to all borrowers. |

| Payment Plans | Negotiating a payment plan with your credit card issuer to make smaller monthly payments over a longer period. | Provides more manageable payments, can avoid default. | May result in higher total interest charges, may not be available for all borrowers. |

| Debt Settlement | Negotiating with your creditors to settle your debt for a lower amount than what you owe. | Can significantly reduce your debt, may avoid legal action. | May damage your credit score, may not be accepted by all creditors. |

| Bankruptcy | Filing for bankruptcy to discharge your debts. | Eliminates most of your debts, provides a fresh start. | Significant negative impact on your credit score, can affect your future borrowing ability. |

Pros and Cons of Liquidation Methods

It’s essential to weigh the pros and cons of each liquidation method before making a decision.

| Method | Pros | Cons |

|—|—|—|

| Balance Transfer | – Lower interest rate, potentially saving on interest charges. | – May involve transfer fees, the new card may have a higher APR after the introductory period. |

| Debt Consolidation | – Simplifies payments, may offer a lower interest rate. | – May require a good credit score, may not be available to all borrowers. |

| Payment Plans | – Provides more manageable payments, can avoid default. | – May result in higher total interest charges, may not be available for all borrowers. |

| Debt Settlement | – Can significantly reduce your debt, may avoid legal action. | – May damage your credit score, may not be accepted by all creditors. |

| Bankruptcy | – Eliminates most of your debts, provides a fresh start. | – Significant negative impact on your credit score, can affect your future borrowing ability. |

Key Considerations for Choosing a Liquidation Option, How to liquidate a business credit card

The best liquidation option for you will depend on several factors, including:

| Consideration | Description |

|—|—|

| Credit Score | A good credit score may qualify you for lower interest rates on balance transfers or debt consolidation loans. |

| Debt Amount | A large debt amount may make bankruptcy more appealing, while a smaller debt may be manageable with a payment plan. |

| Income and Expenses | Your income and expenses will determine your ability to make monthly payments. |

| Financial Goals | Consider your long-term financial goals, such as buying a home or starting a new business, and how a liquidation option might affect them. |

| Credit Card Terms | Review your credit card agreement to understand your options, such as payment plans or hardship programs. |

| Legal and Tax Implications | Consult with a financial advisor or attorney to understand the legal and tax implications of each liquidation option. |

Concluding Remarks

Liquidating a business credit card can be a significant step, but with careful planning and a clear understanding of the options available, it can be a strategic move for your business. By assessing your financial situation, exploring liquidation methods, and communicating effectively with your credit card issuer, you can navigate this process with confidence and set your business on a path toward financial stability. Remember to prioritize rebuilding your credit score and maintaining good financial habits to ensure a strong financial future for your business.

FAQ Corner

What is the difference between liquidating a business credit card and closing it?

Liquidating a business credit card involves paying off the outstanding balance, while closing it means terminating the account. Liquidation focuses on paying off debt, while closing the account removes it from your credit history.

What if I can’t afford to liquidate my business credit card?

If you can’t afford to liquidate your business credit card, you can explore options like debt consolidation, payment plans, or seeking professional financial advice.

Will liquidating a business credit card affect my business’s credit score?

Liquidating a business credit card can impact your credit score, especially if you close the account and have limited other credit history. However, if you manage the process carefully and maintain good credit habits, the impact can be minimized.

How long does it take to liquidate a business credit card?

The time it takes to liquidate a business credit card depends on the chosen method and your financial situation. It can range from a few months to several years, depending on the outstanding balance and payment plan.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!