New small business line of credit – New small business lines of credit set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. A line of credit can be a valuable tool for small businesses, providing flexible access to funding for short-term needs and unexpected expenses. Unlike traditional loans, which offer a lump sum upfront, lines of credit provide a revolving credit limit that can be drawn upon as needed, offering businesses the flexibility to manage cash flow and seize opportunities as they arise.

Understanding the different types of lines of credit available, the eligibility criteria, and the process of applying and managing them are essential for small business owners looking to leverage this financial tool. By carefully assessing your business needs, comparing lender offerings, and adhering to responsible borrowing practices, you can unlock the potential of a line of credit to propel your business towards success.

Understanding New Small Business Lines of Credit

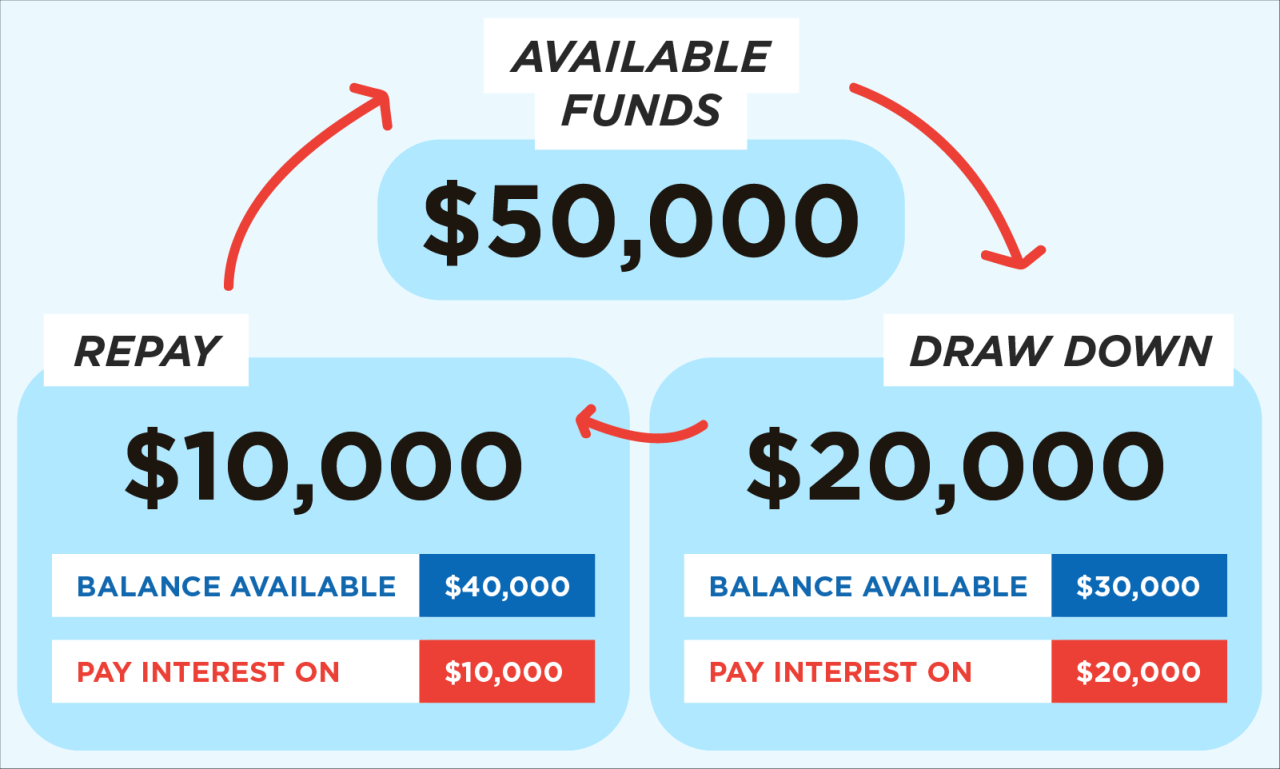

A new small business line of credit is a flexible financing option that can provide your business with the working capital it needs to grow and thrive. Unlike traditional loans, a line of credit offers you access to a predetermined amount of funds that you can draw on as needed, paying interest only on the amount you use. This makes it a highly versatile tool for managing cash flow and taking advantage of unexpected opportunities.

Benefits of a New Small Business Line of Credit

A new small business line of credit offers numerous benefits, including:

- Flexibility: Access funds as needed, only paying interest on the amount used.

- Predictability: Know the interest rate and repayment terms upfront.

- Convenience: Quick and easy access to funds for short-term needs.

- Improved Credit Score: Responsible use can boost your credit score.

Key Features of New Small Business Lines of Credit

New small business lines of credit differ from traditional loans in several key ways:

- Revolving Credit: You can borrow and repay funds multiple times within the credit limit.

- Variable Interest Rates: Interest rates may fluctuate based on market conditions.

- Draw Period: A specific time frame during which you can access funds.

- Repayment Period: A set period for repaying the outstanding balance.

Types of Small Business Lines of Credit, New small business line of credit

There are several types of small business lines of credit available, each with its own features and requirements:

- Unsecured Lines of Credit: These lines of credit are not backed by collateral, making them easier to obtain but potentially carrying higher interest rates.

- Secured Lines of Credit: These lines of credit are backed by collateral, such as equipment or inventory, which may result in lower interest rates but require a higher credit score and financial history.

- Merchant Cash Advances: These are short-term loans based on a percentage of your business’s future sales, offering quick access to funds but often with high interest rates.

- Invoice Factoring: This option allows you to sell your invoices to a factoring company at a discount, providing immediate cash flow but typically charging high fees.

Eligibility Criteria for a New Small Business Line of Credit

To qualify for a new small business line of credit, you’ll generally need to meet certain eligibility criteria:

- Good Credit Score: Lenders typically require a good credit score, often above 680.

- Strong Financial History: Demonstrate consistent revenue and profitability over time.

- Solid Business Plan: A well-written business plan outlining your company’s goals and strategies.

- Collateral (for Secured Lines): If applying for a secured line of credit, you’ll need to provide acceptable collateral.

Assessing Your Business Needs

Before diving into the specifics of a line of credit, it’s crucial to understand why your business needs one in the first place. A line of credit can be a valuable tool, but it’s essential to use it strategically and responsibly.

Identifying Your Business Needs

A line of credit can be a valuable resource for businesses facing various challenges. Here are some common reasons why a business might require a line of credit:

- Seasonal Fluctuations: Businesses with seasonal peaks and troughs in demand may need a line of credit to bridge cash flow gaps during slow periods. For example, a retail store might need a line of credit to cover expenses during the off-season.

- Unexpected Expenses: Unforeseen events, such as equipment breakdowns, natural disasters, or legal issues, can create unexpected expenses. A line of credit can provide the necessary funds to address these situations without disrupting operations.

- Business Growth: Expanding your business may require additional capital for inventory, marketing, or hiring. A line of credit can provide the flexibility to finance these growth initiatives.

- Working Capital Management: Businesses need sufficient working capital to manage day-to-day operations. A line of credit can help businesses cover expenses like payroll, rent, and utilities.

- Inventory Financing: Businesses that carry significant inventory may need a line of credit to finance the purchase of raw materials or finished goods.

Analyzing Cash Flow Patterns

Understanding your business’s cash flow patterns is essential for determining whether a line of credit is necessary and how much you might need. This involves tracking your income and expenses over time.

- Income: Analyze your sales revenue, recurring income, and other sources of income. Identify any seasonal patterns or trends in your income.

- Expenses: Track all your business expenses, including payroll, rent, utilities, supplies, and marketing. Categorize your expenses to identify areas where you might be able to reduce costs.

- Cash Flow Projections: Create a cash flow projection for the next few months or years. This projection should account for expected income and expenses, as well as any anticipated changes in your business. A cash flow projection can help you identify potential cash flow gaps and determine how much funding you might need from a line of credit.

Creating a Budget Projection

A budget projection is a critical tool for assessing your business’s financial needs. It provides a roadmap for your short-term and long-term financial goals.

- Short-Term Budget: This budget covers the next few months or quarters and focuses on your immediate financial needs. It should include your expected income and expenses, as well as any anticipated changes in your business.

- Long-Term Budget: This budget covers a longer period, such as a year or more. It Artikels your long-term financial goals, such as expanding your business, acquiring new equipment, or investing in research and development.

- Financial Needs Assessment: Compare your budget projection to your current financial resources. This assessment will help you determine whether you need a line of credit to meet your short-term or long-term financial goals. For example, if your budget projection shows that you will need additional funds to cover expenses during a busy season, a line of credit could be a valuable resource.

Understanding the Risks and Rewards

While a line of credit can be a valuable tool, it’s essential to be aware of the associated risks and rewards.

- Risks:

- Interest Costs: Lines of credit typically carry interest charges. If you don’t manage your debt responsibly, interest costs can accumulate quickly.

- Credit Score Impact: Using a line of credit can impact your business’s credit score. If you don’t make payments on time, your credit score could suffer, making it more difficult to obtain financing in the future.

- Overspending: It’s easy to overspend when you have access to a line of credit. This can lead to debt accumulation and financial problems.

- Rewards:

- Flexibility: A line of credit provides flexibility in managing your business’s finances. You can access funds as needed and only pay interest on the amount you use.

- Improved Cash Flow: A line of credit can help you manage cash flow gaps and avoid financial strain.

- Business Growth Opportunities: A line of credit can provide the capital you need to invest in your business’s growth.

Finding the Right Lender: New Small Business Line Of Credit

Securing a small business line of credit is a crucial step for many entrepreneurs, but finding the right lender can be a daunting task. With numerous options available, it’s important to carefully evaluate the offerings and choose a lender that aligns with your business needs and goals.

Comparing Lender Offerings

Small business lenders come in various shapes and sizes, each offering unique financing solutions. To make an informed decision, it’s essential to compare and contrast the offerings of different lenders. This involves understanding their loan products, interest rates, fees, repayment terms, and eligibility requirements.

- Banks: Traditional banks often offer small business lines of credit, but they can be more stringent with their eligibility criteria and may have higher interest rates compared to other lenders.

- Credit Unions: Credit unions are member-owned financial institutions that typically offer competitive rates and more personalized service to small businesses.

- Online Lenders: Online lenders have gained popularity in recent years due to their streamlined application processes and quicker approval times. However, it’s important to research their reputation and fees carefully.

- Alternative Lenders: Alternative lenders, such as factoring companies and merchant cash advance providers, offer financing solutions for businesses that may not qualify for traditional bank loans. These options often come with higher interest rates and fees.

Essential Factors to Consider

Choosing the right lender involves a thorough evaluation of several key factors. This checklist will guide you in making a well-informed decision.

- Interest Rates: Interest rates are a crucial consideration, as they directly impact the cost of borrowing. Compare rates from different lenders to find the most favorable option.

- Fees: Lenders often charge various fees, such as origination fees, annual fees, and late payment fees. Understand all applicable fees and factor them into your overall borrowing cost.

- Repayment Terms: Repayment terms, including the loan duration and monthly payments, should be flexible enough to fit your cash flow and business needs.

- Eligibility Requirements: Each lender has specific eligibility criteria, such as minimum credit score, time in business, and revenue requirements. Ensure your business meets the lender’s requirements before applying.

- Customer Service: A lender with excellent customer service can be invaluable, especially when you need assistance or have questions about your loan. Research the lender’s reputation and customer reviews.

- Industry Expertise: Consider working with a lender that understands your industry and business goals. They can provide tailored advice and financing solutions that cater to your specific needs.

Understanding Interest Rates, Fees, and Repayment Terms

Interest rates, fees, and repayment terms are critical components of any loan agreement. It’s essential to fully understand these elements to make an informed decision and avoid unexpected costs.

- Interest Rates: Interest rates are expressed as a percentage of the loan amount. They represent the cost of borrowing money and can vary depending on the lender, loan type, and your creditworthiness.

- Fees: Fees are additional charges associated with the loan, such as origination fees, annual fees, and late payment fees. These fees can add significantly to the overall cost of borrowing.

- Repayment Terms: Repayment terms dictate the duration of the loan and the frequency of payments. They should be flexible enough to accommodate your cash flow and business needs.

Benefits of Working with an Industry-Specific Lender

Working with a lender that specializes in your industry can provide significant advantages for your business. These lenders possess in-depth knowledge of the industry’s unique challenges and opportunities, enabling them to offer tailored financing solutions and valuable insights.

- Industry Expertise: Industry-specific lenders understand the nuances of your business and can provide tailored advice on financing options that align with your specific needs.

- Stronger Relationships: Lenders with industry expertise often have established relationships with businesses in your sector, giving them valuable insights into market trends and best practices.

- Targeted Solutions: These lenders can offer specialized financing solutions that address the unique challenges faced by businesses in your industry.

Applying for a New Line of Credit

Once you’ve decided a line of credit is right for your business, it’s time to start the application process. This involves gathering the necessary documentation, crafting a compelling business plan, and presenting your financial projections to potential lenders.

Gathering Necessary Documentation

A successful line of credit application relies on a comprehensive collection of documents that showcase your business’s financial health and growth potential.

- Personal Financial Statements: Lenders want to assess your personal financial stability, which is often linked to your business’s success. Provide your personal income tax returns, bank statements, and credit reports to demonstrate your creditworthiness.

- Business Financial Statements: These documents paint a clear picture of your business’s current financial position. Prepare your business income statement, balance sheet, and cash flow statement, ensuring they’re up-to-date and accurately reflect your business’s financial performance.

- Business Plan: A well-structured business plan is crucial for convincing lenders of your business’s viability and repayment capacity. It should Artikel your business’s goals, strategies, and financial projections, including your expected revenue, expenses, and profit margins.

- Business Licenses and Permits: Demonstrate that your business operates legally and adheres to relevant regulations by providing copies of your business licenses and permits.

- Collateral: Some lenders may require collateral to secure the line of credit, which acts as a safety net in case of default. This could include assets like real estate, equipment, or inventory.

Crafting a Compelling Business Plan

A strong business plan is your roadmap to success, and it’s crucial for securing a line of credit.

- Highlight Growth Potential: Present a compelling narrative that Artikels your business’s future growth trajectory, including market trends, expansion plans, and innovative strategies. This demonstrates your ability to generate revenue and repay the loan.

- Repayment Strategy: Clearly explain how you plan to repay the line of credit, outlining your projected cash flow, revenue streams, and expense management. This instills confidence in lenders that you can manage the debt responsibly.

- Financial Projections: Provide detailed financial projections that illustrate your business’s expected revenue, expenses, and profitability over the loan term. These projections should be realistic and supported by market data and industry trends.

Communicating Your Business Needs Effectively

Clear and concise communication is key to a successful application.

- Articulate Your Needs: Clearly state the purpose of the line of credit and how it will contribute to your business’s growth. Highlight specific projects, investments, or opportunities that the loan will support.

- Present Financial Projections: Share your financial projections, demonstrating your ability to manage the loan responsibly and repay it on time. Back up your projections with data and market research.

- Answer Questions Honestly: Be prepared to answer questions from lenders about your business, its financial health, and your repayment strategy. Provide honest and transparent answers to build trust and credibility.

Maintaining a Good Credit Score and Business History

Your credit score and business history are crucial factors in the lending decision.

A good credit score reflects your responsible financial management and makes you a more attractive borrower.

- Credit Score: A good credit score demonstrates your ability to manage debt responsibly. Work towards improving your credit score by paying bills on time, keeping credit utilization low, and avoiding unnecessary credit applications.

- Business History: A strong business history, including positive financial performance and a track record of meeting financial obligations, increases your chances of approval.

Managing Your Line of Credit

A line of credit is a powerful financial tool that can help your small business grow. However, responsible management is crucial to ensure you maximize its benefits and avoid potential pitfalls. This section provides a step-by-step guide to effectively manage your line of credit, helping you navigate its intricacies and make informed financial decisions.

Strategies for Minimizing Interest Charges

Minimizing interest charges is a key aspect of managing your line of credit effectively. Here are some strategies to help you achieve this:

- Pay your balance in full each month: This is the most effective way to avoid interest charges altogether. By paying off the entire balance before the due date, you eliminate any interest accrual.

- Take advantage of grace periods: Most lines of credit offer a grace period, which is the time you have to pay your balance before interest starts accumulating. Utilizing this grace period can help you avoid unnecessary interest charges.

- Negotiate a lower interest rate: If you have a good credit history and a strong relationship with your lender, you may be able to negotiate a lower interest rate on your line of credit. This can significantly reduce your overall interest payments.

- Consider a shorter repayment term: While a longer repayment term may seem more manageable, it often results in higher overall interest charges. A shorter term may require larger monthly payments, but it will save you money on interest in the long run.

Maximizing Your Borrowing Capacity

Understanding how to maximize your borrowing capacity within your line of credit is crucial for managing your business finances effectively. Here are some strategies:

- Maintain a good credit score: A higher credit score signifies a lower risk to lenders, often leading to better interest rates and higher credit limits. Consistent on-time payments and responsible credit usage contribute to a strong credit score.

- Keep your credit utilization low: Credit utilization refers to the percentage of your available credit that you are using. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management and potentially increase your borrowing capacity.

- Review your credit limit periodically: As your business grows, you may need a higher credit limit to accommodate increased expenses. Regularly review your credit limit and consider requesting an increase if necessary.

- Pay down existing debt: Reducing your overall debt load can improve your credit score and potentially increase your borrowing capacity on your line of credit.

Monitoring Your Account Activity

Regularly monitoring your line of credit account activity is crucial for staying on top of your finances and preventing potential issues.

- Review your monthly statements: Check your statements carefully for any discrepancies or unauthorized transactions. Ensure all transactions are accurate and reconcile them with your own records.

- Track your spending: Keep track of your line of credit usage to avoid exceeding your credit limit and incurring additional fees. Use budgeting tools or spreadsheets to monitor your spending and ensure you stay within your allocated limits.

- Set up alerts: Many lenders offer account alerts that notify you of specific activities, such as approaching your credit limit, overdue payments, or unusual transaction patterns. These alerts can help you proactively manage your account and avoid potential problems.

Making Timely Payments

Making timely payments is essential for maintaining a good credit score and avoiding late fees.

- Set up automatic payments: Automating your payments ensures you never miss a deadline and helps you avoid late fees. You can set up automatic payments through your bank or directly with your lender.

- Make payments ahead of schedule: If possible, try to make payments before the due date to avoid any potential delays or processing issues. This also demonstrates responsible credit management and can improve your credit score.

- Contact your lender if you anticipate difficulty making a payment: If you anticipate difficulty making a payment on time, reach out to your lender as soon as possible. They may be able to work with you to create a payment plan or explore other options to avoid late fees or negative impact on your credit score.

Consequences of Exceeding Your Credit Limit or Defaulting on Payments

Exceeding your credit limit or defaulting on payments can have significant negative consequences for your business.

- Late fees and penalties: Exceeding your credit limit or making late payments can result in substantial late fees and penalties. These fees can quickly add up and significantly impact your bottom line.

- Damage to your credit score: Late payments and defaults can negatively affect your credit score, making it more difficult to obtain future financing at favorable terms. A lower credit score can also impact your ability to secure loans, leases, or even business insurance.

- Potential legal action: In extreme cases, lenders may take legal action to recover unpaid balances, which can result in court judgments, wage garnishment, or even asset seizure. This can severely damage your business and personal finances.

Closing Notes

Navigating the world of small business financing can be daunting, but understanding the ins and outs of new lines of credit empowers you to make informed decisions. By carefully evaluating your business needs, choosing the right lender, and managing your line of credit responsibly, you can unlock the potential of this valuable financial tool to fuel your growth and achieve your business goals.

FAQ Compilation

What are the typical interest rates for a small business line of credit?

Interest rates for small business lines of credit vary depending on factors such as your credit score, business history, and the lender. Generally, rates range from 5% to 15% or higher, with lower rates offered to businesses with strong credit and financial performance.

How do I know if I qualify for a small business line of credit?

Lenders typically evaluate your business’s credit history, financial statements, revenue, and industry. A good credit score, strong financial performance, and a well-defined business plan can improve your chances of approval.

What are some common fees associated with a line of credit?

Common fees include origination fees, annual fees, and interest charges. Be sure to review the terms and conditions carefully to understand all associated costs.

What are the potential risks of using a line of credit?

Risks include incurring high interest charges if you don’t pay down the balance promptly, damaging your credit score if you default on payments, and potentially overextending your borrowing capacity.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!