No doc unsecured business line of credit offers a unique approach to business financing, promising quick access to funds without the usual mountain of paperwork. This type of financing appeals to entrepreneurs and businesses seeking flexible, fast funding options. However, understanding the intricacies of no doc unsecured business lines of credit is crucial for making informed decisions and maximizing its benefits.

These lines of credit typically require minimal documentation, allowing businesses to apply and potentially receive funds faster than traditional loans. However, they often come with higher interest rates and may have limitations on borrowing amounts. While the “no doc” aspect may seem attractive, it’s essential to weigh the benefits against the potential drawbacks and ensure responsible borrowing practices.

What is a No Doc Unsecured Business Line of Credit?

A no-doc unsecured business line of credit is a financing option that allows businesses to access funds quickly and easily, without the need for extensive documentation or collateral. It is a popular choice for small businesses that need working capital to cover short-term expenses, such as inventory purchases, payroll, or marketing.

No Doc and Unsecured Defined

“No doc” refers to the minimal documentation required to qualify for this type of financing. This means that lenders may not require traditional financial statements, such as income statements, balance sheets, or tax returns. Instead, they may rely on alternative data, such as bank statements or credit card statements, to assess the borrower’s creditworthiness.

“Unsecured” means that the loan is not backed by any collateral. This means that the lender is taking on more risk, as they have no recourse to assets if the borrower defaults on the loan.

Key Features of a No Doc Unsecured Business Line of Credit

No doc unsecured business lines of credit typically have the following features:

* Quick and Easy Approval: Because less documentation is required, the approval process for a no-doc unsecured business line of credit can be much faster than for a traditional loan.

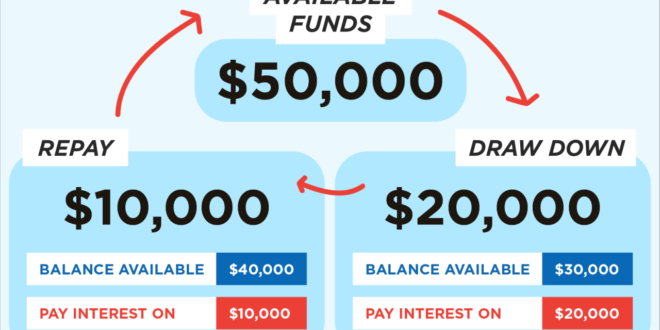

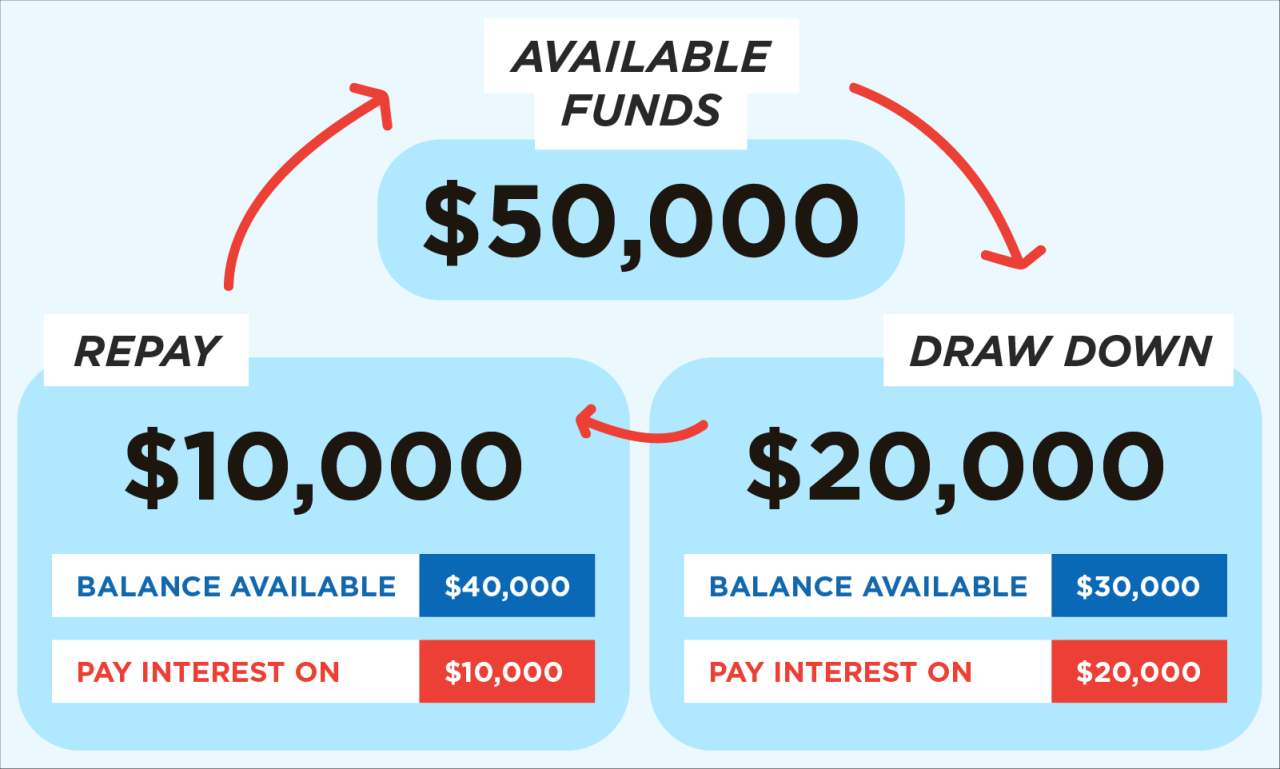

* Flexible Access to Funds: Borrowers can access funds as needed, up to their approved credit limit.

* Variable Interest Rates: Interest rates on no-doc unsecured business lines of credit are typically variable, meaning they can fluctuate over time.

* Higher Interest Rates: Since lenders are taking on more risk, no-doc unsecured business lines of credit typically have higher interest rates than traditional loans.

* Shorter Repayment Terms: No-doc unsecured business lines of credit typically have shorter repayment terms than traditional loans.

Situations Where a No Doc Unsecured Business Line of Credit Might Be Suitable

A no-doc unsecured business line of credit may be a suitable financing option for businesses that:

* Have a Strong Credit History: Lenders typically require borrowers to have a good credit score to qualify for a no-doc unsecured business line of credit.

* Need Short-Term Funding: No-doc unsecured business lines of credit are ideal for businesses that need funds for short-term expenses, such as inventory purchases, payroll, or marketing.

* Are Unable to Provide Traditional Financial Statements: Businesses that are new or have limited financial history may not be able to provide traditional financial statements. A no-doc unsecured business line of credit can be a good option for these businesses.

* Are Willing to Accept Higher Interest Rates: Because no-doc unsecured business lines of credit carry higher interest rates, borrowers need to be willing to accept these higher costs.

Eligibility Criteria and Requirements: No Doc Unsecured Business Line Of Credit

Securing a no-doc unsecured business line of credit often involves a streamlined application process with less stringent documentation requirements compared to traditional loans. While lenders may not demand extensive financial statements, they still evaluate your business’s creditworthiness and ability to repay the loan.

Eligibility Criteria

Lenders typically consider various factors to determine your eligibility for a no-doc unsecured business line of credit. These factors include:

- Business Age and Revenue: Lenders often prefer businesses that have been operating for a certain period, usually at least two years, and demonstrate consistent revenue generation.

- Credit History: A strong credit score is crucial, as lenders rely heavily on your past credit performance to assess your ability to repay the loan.

- Industry and Business Model: The industry in which your business operates and your business model can influence lender decisions. Some industries may be considered higher risk than others.

- Debt-to-Income Ratio: Lenders assess your existing debt obligations to ensure you have sufficient capacity to take on additional debt.

- Collateral: While no-doc unsecured lines of credit do not require collateral, some lenders may offer better terms if you provide assets as collateral.

Documentation Requirements

As the name suggests, no-doc unsecured business lines of credit typically require minimal documentation. However, lenders may still request some basic information to verify your identity, business details, and creditworthiness. This can include:

- Business License and Tax ID: Proof of your business’s legal registration and tax identification number.

- Personal Identification: Government-issued ID, such as a driver’s license or passport, to verify your identity.

- Bank Statements: Recent bank statements to demonstrate your business’s financial activity and cash flow.

- Credit Report: A personal or business credit report to assess your credit history and score.

- Income Verification: Depending on the lender, you may be required to provide documentation that verifies your business’s income, such as tax returns or recent profit and loss statements.

Creditworthiness Assessment

Lenders employ various methods to assess creditworthiness in the absence of extensive documentation. These methods can include:

- Credit Score Analysis: Lenders heavily rely on your credit score and credit history to gauge your creditworthiness. A higher credit score typically indicates a lower risk of default.

- Bank Statement Review: By analyzing your bank statements, lenders can assess your cash flow, transaction history, and overall financial health.

- Business Model Analysis: Lenders may evaluate your business model, industry trends, and competitive landscape to determine the potential for success and profitability.

- Industry Expertise: Some lenders have specialized expertise in specific industries, allowing them to better assess the risks and opportunities associated with your business.

- Alternative Data Sources: Lenders may leverage alternative data sources, such as online reviews, social media presence, and industry publications, to gain insights into your business’s reputation and performance.

Benefits and Drawbacks

A no doc unsecured business line of credit can be a valuable tool for businesses seeking quick and flexible funding. However, it’s crucial to understand both the advantages and disadvantages before deciding if it’s the right option for your company.

Benefits of a No Doc Unsecured Business Line of Credit

- Speed and Convenience: No doc unsecured business lines of credit are known for their fast approval and funding processes. This is because lenders typically don’t require extensive documentation, streamlining the application and review process.

- Flexibility: These lines of credit offer businesses the ability to access funds as needed, providing flexibility to meet unexpected expenses or capitalize on new opportunities. Businesses can borrow and repay funds as required, making it an adaptable financing solution.

- No Collateral Requirement: A key benefit of no doc unsecured lines of credit is that they don’t require collateral. This means businesses can access funds without putting up assets like property or equipment, preserving their valuable resources.

Drawbacks of a No Doc Unsecured Business Line of Credit

- Higher Interest Rates: Since lenders assume a higher risk with no doc unsecured lines of credit, they often charge higher interest rates compared to secured or traditional business loans.

- Limited Borrowing Amounts: The amount of money a business can borrow through a no doc unsecured line of credit is typically limited, especially for new or smaller businesses. Lenders may assess creditworthiness and business history to determine the borrowing limit.

- Potential Usage Restrictions: Some lenders may place restrictions on how the funds from a no doc unsecured line of credit can be used. These restrictions can vary, so it’s essential to review the terms and conditions carefully.

Comparison with Traditional Business Loans

- Interest Rates: Traditional business loans often offer lower interest rates than no doc unsecured lines of credit. This is because lenders have more information about the borrower’s financial situation and have collateral to secure the loan.

- Borrowing Amounts: Traditional business loans typically allow for higher borrowing amounts compared to no doc unsecured lines of credit. This is because lenders have more confidence in the borrower’s ability to repay the loan, as they have a more comprehensive understanding of their financial standing.

- Loan Terms: Traditional business loans often have longer repayment terms than no doc unsecured lines of credit. This can provide businesses with more time to repay the loan and manage their cash flow effectively.

Conclusive Thoughts

No doc unsecured business lines of credit can be a valuable tool for businesses needing quick access to funds, especially those with strong credit histories. However, careful consideration of the associated risks and responsible borrowing practices are essential for navigating this financing option effectively. Understanding the nuances of no doc unsecured business lines of credit and comparing them to alternative financing options empowers businesses to make informed decisions that align with their financial goals.

Query Resolution

What are the typical interest rates for no doc unsecured business lines of credit?

Interest rates for no doc unsecured business lines of credit are generally higher than traditional loans due to the increased risk for lenders. The specific rate depends on factors like your credit score, business history, and the lender’s policies.

How do I know if a no doc unsecured business line of credit is right for me?

Consider your credit score, business needs, and risk tolerance. If you have good credit, need quick funding, and can manage the higher interest rates, a no doc unsecured business line of credit might be suitable. However, if you have poor credit or need a large loan amount, traditional financing might be a better option.

Are there any fees associated with no doc unsecured business lines of credit?

Yes, no doc unsecured business lines of credit often come with fees, such as origination fees, annual fees, and late payment fees. These fees vary depending on the lender and the specific terms of the agreement.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!