The revolving line of credit business offers a flexible financing solution for businesses of all sizes. This type of credit allows companies to access funds as needed, providing a lifeline for managing cash flow, investing in growth opportunities, or covering unexpected expenses. It acts as a safety net, empowering businesses to navigate financial challenges and seize new opportunities.

Understanding the intricacies of revolving lines of credit, including eligibility requirements, interest rates, and management strategies, is crucial for maximizing its potential. This comprehensive guide delves into the world of revolving lines of credit, providing insights that empower businesses to make informed decisions and harness the power of this valuable financial tool.

Understanding Revolving Lines of Credit

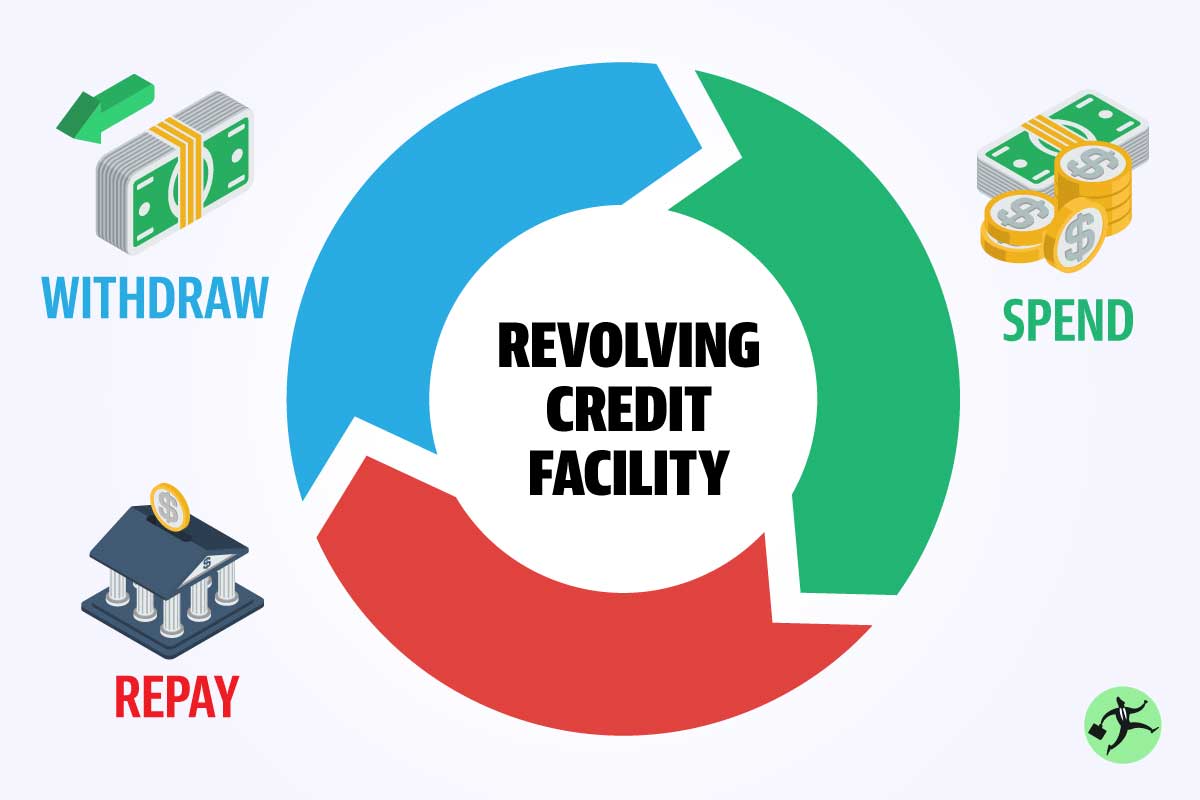

A revolving line of credit is a flexible financing option that businesses can use to access funds as needed. It’s like a credit card for businesses, allowing them to borrow up to a pre-approved limit and pay back the borrowed amount over time.

Key Features and Benefits

A revolving line of credit offers several key features and benefits that make it an attractive financing option for businesses.

- Flexible Access to Funds: Businesses can borrow funds as needed, up to their credit limit, providing flexibility to meet unexpected expenses or capitalize on opportunities.

- Recurring Access: Once the borrowed amount is repaid, the credit line is replenished, allowing businesses to access funds repeatedly, as long as they maintain a good credit history.

- Interest Only Payments: Businesses only pay interest on the amount borrowed, making it more affordable than other financing options that require principal and interest payments.

- Predictable Costs: Interest rates are usually fixed or variable, providing businesses with predictable financing costs.

- Improved Credit Score: Responsible use of a revolving line of credit can help businesses build a positive credit history, which can improve their access to future financing.

Comparison with Other Forms of Business Financing

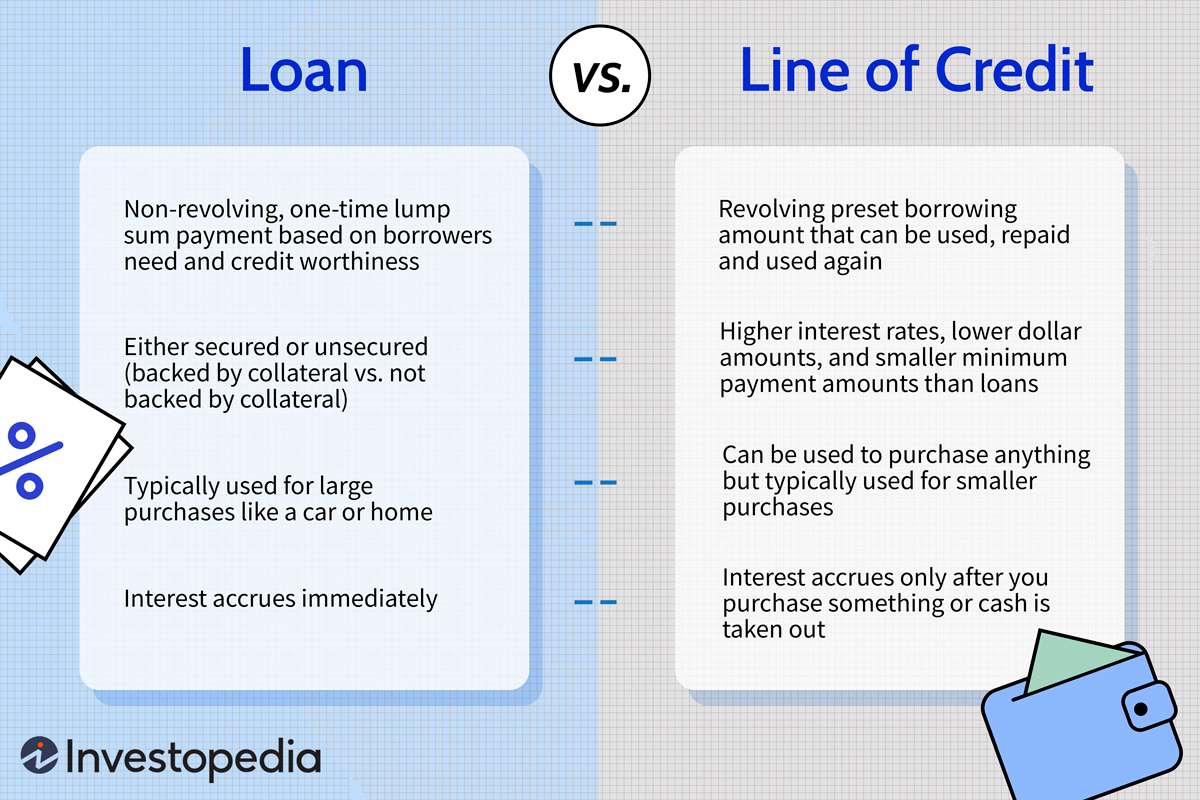

A revolving line of credit offers a unique blend of flexibility and affordability, making it a suitable option for various business needs. However, it’s essential to understand how it compares to other forms of business financing.

| Feature | Revolving Line of Credit | Term Loan | SBA Loan | Invoice Financing |

|---|---|---|---|---|

| Flexibility | High | Low | Low | Medium |

| Interest Rates | Variable or Fixed | Fixed | Fixed | Variable |

| Loan Amount | Limited to Credit Limit | Predetermined Amount | Predetermined Amount | Based on Invoice Value |

| Approval Time | Faster | Longer | Longer | Faster |

Examples of Business Uses

Businesses can utilize a revolving line of credit for a wide range of purposes, including:

- Working Capital Management: Covering day-to-day operating expenses, such as payroll, inventory, and rent.

- Seasonal Fluctuations: Managing cash flow during peak seasons or periods of high demand.

- Unexpected Expenses: Covering unforeseen costs, such as equipment repairs or emergency supplies.

- Business Growth: Funding expansion projects, new product launches, or marketing campaigns.

Eligibility and Application Process

Securing a revolving line of credit requires meeting specific eligibility criteria and navigating a well-defined application process. Lenders carefully evaluate potential borrowers to ensure their financial stability and ability to repay the credit facility. This section delves into the common eligibility requirements, the typical application process, and the crucial documents needed to apply for a revolving line of credit.

Eligibility Criteria

Lenders assess potential borrowers based on various factors to determine their creditworthiness. These criteria help lenders gauge the risk associated with extending credit to a business. Here are some common eligibility requirements for obtaining a revolving line of credit:

- Good Credit History: Lenders typically prefer businesses with a solid credit history, demonstrating responsible financial management. A good credit score, minimal late payments, and a history of fulfilling financial obligations are crucial indicators of creditworthiness.

- Strong Financial Performance: Lenders assess the business’s financial performance, including its revenue, profitability, and cash flow. Consistent revenue growth, healthy profit margins, and adequate cash flow are positive signs for lenders.

- Collateral: Some lenders may require collateral as security for the revolving line of credit. Collateral can be assets like real estate, equipment, or inventory. Providing collateral reduces the lender’s risk and increases the likelihood of approval.

- Business Plan: A well-structured business plan outlining the business’s goals, strategies, and financial projections is essential. Lenders use the business plan to evaluate the business’s potential for success and its ability to generate revenue to repay the credit facility.

- Industry Experience: Lenders may consider the business owner’s experience and expertise in the industry. Demonstrating a strong understanding of the market, competition, and business operations is important for lenders.

Application Process

The application process for a revolving line of credit typically involves the following steps:

- Initial Contact: Begin by contacting a lender to express your interest in obtaining a revolving line of credit. This initial contact can be through phone, email, or a website inquiry.

- Application Submission: Once you have chosen a lender, you will need to complete an application form. This form will request detailed information about your business, including financial statements, credit history, and business plan.

- Document Review: The lender will review your application and supporting documents to assess your creditworthiness and the risk associated with extending credit to your business.

- Credit Approval: If the lender approves your application, you will receive a credit limit and interest rate for your revolving line of credit. The credit limit represents the maximum amount of credit available to you.

- Loan Agreement: You will need to sign a loan agreement outlining the terms and conditions of the revolving line of credit. This agreement will detail the interest rate, repayment schedule, and any fees associated with the credit facility.

Required Documents

To complete the application process, you will need to provide the lender with the following essential documents:

- Business Plan: A comprehensive business plan outlining your business’s goals, strategies, and financial projections.

- Financial Statements: Recent financial statements, including balance sheets, income statements, and cash flow statements. These documents demonstrate your business’s financial performance and stability.

- Tax Returns: Recent tax returns, such as Form 1040 for individuals and Form 1120 for corporations, provide further insight into your business’s financial history.

- Personal Financial Statements: For sole proprietorships or partnerships, personal financial statements, including your personal credit report and income information, may be required.

- Collateral Documents: If you are using collateral to secure the revolving line of credit, you will need to provide documentation for the collateral, such as property deeds or equipment purchase agreements.

Evaluation Factors

Lenders carefully evaluate various factors when assessing a business’s application for a revolving line of credit. These factors include:

- Credit History: Lenders analyze your business’s credit history, including your credit score, payment history, and outstanding debt. A strong credit history indicates responsible financial management and a lower risk for the lender.

- Financial Performance: Lenders examine your business’s financial statements to assess its revenue, profitability, and cash flow. Consistent revenue growth, healthy profit margins, and adequate cash flow are positive indicators of financial stability.

- Business Plan: Lenders review your business plan to evaluate your business’s goals, strategies, and financial projections. A well-structured business plan demonstrates your understanding of the market, your competitive advantage, and your ability to generate revenue.

- Industry Experience: Lenders may consider the business owner’s experience and expertise in the industry. Demonstrating a strong understanding of the market, competition, and business operations is important for lenders.

- Collateral: If you are using collateral to secure the revolving line of credit, lenders will assess the value and liquidity of the collateral. Collateral reduces the lender’s risk and increases the likelihood of approval.

- Debt-to-Equity Ratio: Lenders evaluate your business’s debt-to-equity ratio, which measures the proportion of debt financing compared to equity financing. A lower debt-to-equity ratio indicates a lower risk for the lender.

- Repayment Capacity: Lenders assess your business’s ability to repay the revolving line of credit. This includes analyzing your cash flow, revenue projections, and debt service coverage ratio.

Interest Rates and Fees

Understanding the interest rates and fees associated with a revolving line of credit is crucial for making informed financial decisions. These costs directly impact the overall cost of borrowing and can vary significantly between lenders.

Interest Rates

Interest rates for revolving lines of credit are determined by several factors, including:

- Your credit score: A higher credit score generally leads to lower interest rates. Lenders perceive borrowers with strong credit history as less risky, making them eligible for more favorable terms.

- The lender’s risk assessment: Each lender has its own criteria for assessing risk. Factors like your debt-to-income ratio, income stability, and credit history are considered to determine your risk profile.

- Market interest rates: Interest rates for revolving lines of credit are influenced by prevailing market conditions. When the Federal Reserve raises interest rates, lenders typically adjust their rates accordingly.

- The amount borrowed: Lenders may offer lower interest rates for larger loan amounts, as they perceive larger loans as less risky. However, this is not always the case.

- The type of line of credit: Different types of revolving lines of credit, such as business lines of credit or personal lines of credit, may have different interest rates based on the perceived risk associated with each type.

Fees

Revolving lines of credit often come with various fees, which can add to the overall cost of borrowing. These fees may include:

- Annual fee: Some lenders charge an annual fee for maintaining a revolving line of credit, regardless of whether you use it or not. This fee is usually a fixed amount.

- Origination fee: This is a one-time fee charged at the time you open the line of credit. It is usually a percentage of the total credit limit.

- Interest rate markup: Some lenders may charge a higher interest rate for using the line of credit for specific purposes, such as cash advances.

- Late payment fee: A fee charged for making payments after the due date. This fee can be significant, especially if you have a history of late payments.

- Overdraft fee: A fee charged if you exceed your credit limit. This fee can be substantial and should be avoided.

Comparison of Interest Rates and Fees

It is important to compare interest rates and fees offered by different lenders before choosing a revolving line of credit.

| Lender | Interest Rate (APR) | Annual Fee | Origination Fee | Late Payment Fee | Overdraft Fee |

|---|---|---|---|---|---|

| Bank A | 7.99% | $50 | 1% of credit limit | $35 | $35 |

| Bank B | 9.99% | $0 | 2% of credit limit | $25 | $25 |

| Credit Union C | 6.99% | $0 | 0% of credit limit | $20 | $20 |

Managing a Revolving Line of Credit

A revolving line of credit can be a valuable financial tool, but it’s essential to manage it responsibly to avoid accumulating debt and high interest charges. Effective management involves understanding your credit limit, using it strategically, and making timely payments.

Strategies for Effective Management

Managing a revolving line of credit effectively requires a proactive approach to ensure responsible utilization and minimize potential risks. Here are some key strategies:

- Set a Budget and Stick to It: Create a budget that Artikels your income and expenses, and allocate a specific amount for revolving credit usage. This helps prevent overspending and keeps your borrowing within manageable limits.

- Use It for Short-Term Needs: Revolving lines of credit are best suited for short-term financing, such as covering unexpected expenses or bridging a temporary cash flow gap. Avoid using it for long-term purchases, as the accumulating interest can significantly increase your overall cost.

- Pay More Than the Minimum: Making only the minimum payment can prolong the repayment period and lead to higher interest charges. Aim to pay more than the minimum amount each month to reduce your balance quicker and minimize interest accumulation.

- Monitor Your Credit Utilization Ratio: Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. Keeping this ratio low (ideally below 30%) can positively impact your credit score.

- Consider a Balance Transfer: If you have high-interest debt on other credit cards, transferring it to a revolving line of credit with a lower interest rate can help save on interest charges. However, ensure you carefully evaluate the terms and fees associated with balance transfers.

Minimizing Interest Charges and Fees

Minimizing interest charges and fees associated with a revolving line of credit is crucial for managing your finances efficiently. Here are some effective strategies:

- Shop Around for the Best Rates: Compare interest rates and fees offered by different lenders to find the most favorable terms.

- Avoid Late Payments: Late payments can result in hefty late fees and negatively impact your credit score. Set reminders or use automatic payments to ensure timely payments.

- Pay Your Balance in Full: If possible, pay your entire balance each month to avoid accruing interest. This strategy can significantly reduce your overall interest costs.

- Look for Promotional Offers: Some lenders offer introductory periods with lower interest rates or zero interest charges. Utilize these offers to your advantage if they align with your financial goals.

Maintaining a Good Credit Score

Maintaining a good credit score is essential for accessing favorable financial products and securing lower interest rates. Using a revolving line of credit responsibly contributes to a healthy credit score:

- Pay Your Bills on Time: Timely payments are the most significant factor influencing your credit score. Aim to pay all your bills, including your revolving line of credit, on time.

- Keep Your Credit Utilization Ratio Low: As mentioned earlier, a low credit utilization ratio (below 30%) demonstrates responsible credit management and positively impacts your score.

- Avoid Closing Old Accounts: Closing old credit accounts, even if you’re not using them, can negatively impact your credit score. Older accounts contribute to a longer credit history, which is a positive factor.

Potential Risks of Overusing a Revolving Line of Credit

Overusing a revolving line of credit can lead to significant financial burdens and negatively impact your credit score. Here are some potential risks:

- High Interest Charges: Accumulating high balances can result in substantial interest charges, increasing your overall debt burden.

- Damage to Your Credit Score: High credit utilization ratios and missed payments can significantly lower your credit score, making it challenging to access future credit at favorable rates.

- Financial Stress: Unmanageable debt can lead to financial stress, impacting your overall well-being and potentially affecting your ability to meet other financial obligations.

Alternatives to Revolving Lines of Credit

While revolving lines of credit offer a flexible financing option, other financing options might better suit your business needs. Exploring these alternatives allows you to make an informed decision that aligns with your financial goals and risk tolerance.

Comparison of Financing Options

This section compares revolving lines of credit with other financing options, highlighting their advantages and disadvantages.

| Financing Option | Advantages | Disadvantages |

|---|---|---|

| Revolving Line of Credit |

|

|

| Term Loan |

|

|

| Business Credit Card |

|

|

| Equipment Financing |

|

|

| Invoice Financing |

|

|

Other Financing Options

In addition to the options mentioned above, several other financing options might be available to businesses, such as:

- SBA Loans: These loans are backed by the Small Business Administration and offer favorable terms for small businesses. They are often used for working capital, equipment purchases, and real estate.

- Venture Capital: This is a form of equity financing where investors provide capital in exchange for a stake in the business. It is typically available to high-growth companies with strong potential.

- Angel Investors: Similar to venture capital, angel investors are individuals who invest in early-stage companies. They often provide not only capital but also mentorship and guidance.

- Crowdfunding: This involves raising funds from a large number of individuals, often through online platforms. It can be used for various purposes, such as product development, marketing, and expansion.

Case Studies and Real-World Examples

Revolving lines of credit can be powerful financial tools for businesses, but their effectiveness depends on how they are used. To illustrate this, we will examine real-world examples of how businesses have successfully utilized revolving lines of credit, as well as instances where businesses have encountered challenges. We will also discuss the impact of revolving lines of credit on various industries.

Successful Utilization of Revolving Lines of Credit

Businesses can leverage revolving lines of credit to address a range of financial needs, from bridging short-term cash flow gaps to funding seasonal growth.

- Retail Businesses: A clothing retailer may use a revolving line of credit to purchase inventory for seasonal sales, such as back-to-school or holiday shopping. By having access to funds when needed, the retailer can stock up on popular items and capitalize on increased demand.

- Manufacturing Companies: A manufacturing company may utilize a revolving line of credit to finance the purchase of raw materials or equipment, allowing them to meet production demands and maintain a steady supply chain. This flexibility can be crucial during periods of increased orders or unexpected disruptions.

- Service Businesses: A service-based business, such as a marketing agency, might use a revolving line of credit to cover operational expenses during slow periods or to take advantage of new opportunities that require upfront investments.

Challenges with Revolving Lines of Credit

While revolving lines of credit can be beneficial, they can also present challenges if not managed carefully.

- High Interest Rates: Revolving lines of credit typically come with higher interest rates compared to other forms of financing, such as term loans. If a business carries a large balance for an extended period, the accumulated interest can significantly impact profitability.

- Over-reliance and Debt Accumulation: Businesses that rely too heavily on revolving lines of credit may find themselves in a cycle of debt, where they are constantly borrowing to cover expenses and interest payments. This can lead to financial instability and make it difficult to secure other forms of financing.

- Credit Score Impact: Excessive borrowing and late payments can negatively impact a business’s credit score, making it harder to obtain future loans or credit lines.

Impact on Different Industries, Revolving line of credit business

Revolving lines of credit have had a significant impact on various industries, influencing their growth, resilience, and overall financial health.

- Construction: Revolving lines of credit are crucial for construction companies, enabling them to manage fluctuating cash flows, purchase materials, and meet project deadlines. They can help contractors weather seasonal fluctuations and ensure project completion.

- Technology: In the tech industry, revolving lines of credit can be used to fund research and development, acquire new technologies, and support rapid growth. This flexibility allows tech companies to adapt quickly to changing market demands and invest in innovation.

- Healthcare: Healthcare providers often utilize revolving lines of credit to manage working capital, invest in equipment upgrades, and cover unexpected expenses. They can also help hospitals and clinics navigate the complexities of healthcare financing and billing cycles.

Epilogue

By carefully evaluating their financial needs, comparing different lenders, and implementing effective management strategies, businesses can leverage revolving lines of credit to achieve their financial goals. This flexible financing option empowers businesses to navigate challenges, seize opportunities, and drive sustainable growth.

Question Bank: Revolving Line Of Credit Business

What is the difference between a revolving line of credit and a term loan?

A revolving line of credit allows you to borrow and repay funds repeatedly, while a term loan provides a fixed amount of money with a set repayment schedule.

How can I improve my chances of getting approved for a revolving line of credit?

Maintaining a good credit score, demonstrating a strong business history, and providing a solid financial plan can increase your chances of approval.

What are some common fees associated with a revolving line of credit?

Common fees include annual fees, interest charges, transaction fees, and late payment penalties.

What are the risks of overusing a revolving line of credit?

Overusing a revolving line of credit can lead to high interest charges, damage your credit score, and potentially hinder your business’s financial stability.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!