Secured line of credit business – Secured lines of credit are a popular business financing option, offering access to funds backed by collateral. Unlike unsecured lines, secured lines typically come with lower interest rates and larger credit limits, making them attractive for businesses seeking reliable funding.

This guide delves into the intricacies of secured lines of credit, exploring their advantages, disadvantages, and best practices for successful utilization. From understanding the process of obtaining a secured line to navigating the potential risks and alternatives, we’ll provide comprehensive insights for businesses seeking to leverage this valuable financial tool.

What is a Secured Line of Credit for Business?

A secured line of credit for businesses is a type of financing that allows businesses to borrow money up to a certain limit, but requires the borrower to provide collateral to secure the loan. This collateral can be a variety of assets, such as real estate, equipment, or inventory.

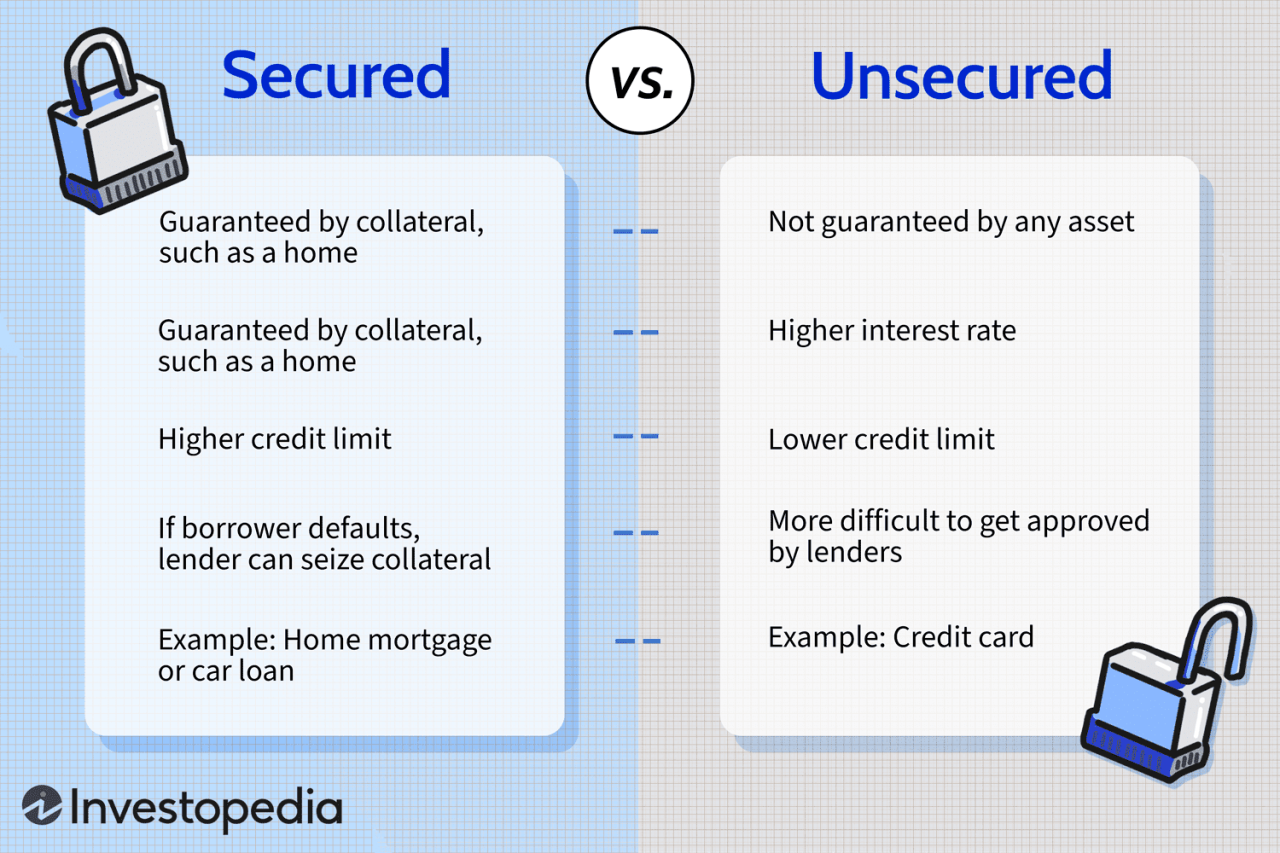

A secured line of credit differs from an unsecured line of credit in that it requires collateral. This means that if the borrower defaults on the loan, the lender can seize the collateral to recover their losses. Unsecured lines of credit, on the other hand, do not require collateral, but they typically have higher interest rates and may be more difficult to qualify for.

Advantages of a Secured Line of Credit for Businesses

Secured lines of credit offer several advantages to businesses, including:

- Lower Interest Rates: Because lenders have less risk with secured loans, they often offer lower interest rates compared to unsecured lines of credit.

- Higher Credit Limits: Lenders are more willing to extend higher credit limits to businesses that provide collateral, as they have a safety net in case of default.

- Easier Qualification: Businesses with good credit history and strong collateral may find it easier to qualify for a secured line of credit, even if they have limited business history.

- Flexibility: Secured lines of credit offer businesses flexibility in accessing funds when needed, as long as they stay within their credit limit.

Disadvantages of a Secured Line of Credit for Businesses

While secured lines of credit offer advantages, they also come with some disadvantages:

- Risk of Collateral Seizure: If a business defaults on a secured loan, the lender can seize the collateral, potentially leading to significant financial losses for the business.

- Limited Access to Funds: The credit limit on a secured line of credit is typically tied to the value of the collateral, meaning businesses may not have access to as much funding as they need.

- Complexity: The process of securing a line of credit can be more complex than obtaining an unsecured line of credit, as it involves providing collateral and undergoing a more rigorous application process.

How Secured Lines of Credit Work

Secured lines of credit provide businesses with access to funds while using a valuable asset as collateral. This ensures the lender that they will be able to recoup their funds if the borrower defaults on the loan.

Obtaining a Secured Line of Credit

The process of obtaining a secured line of credit involves several steps, including:

- Applying for the loan: This typically involves providing information about your business, including financial statements, credit history, and a business plan.

- Providing collateral: The lender will assess the value of the collateral you offer and determine the loan amount.

- Loan approval: If the lender approves your application, you will receive a loan agreement outlining the terms and conditions of the secured line of credit.

Types of Collateral

Secured lines of credit require collateral, which can be various assets. The most common types of collateral used for secured business loans include:

- Real estate: This includes land, buildings, and other properties.

- Inventory: This refers to the goods a business has for sale.

- Equipment: This can include machinery, vehicles, and other tools used for business operations.

- Accounts receivable: This represents the money owed to a business by its customers.

Uses of Secured Lines of Credit, Secured line of credit business

Businesses use secured lines of credit for various purposes, including:

- Working capital: This helps businesses manage day-to-day expenses, such as payroll, rent, and inventory purchases.

- Expansion: Secured lines of credit can finance business expansion initiatives, such as opening new locations, acquiring new equipment, or launching new product lines.

- Seasonal fluctuations: Businesses with seasonal sales cycles can use secured lines of credit to bridge cash flow gaps during periods of lower revenue.

- Emergency funding: In case of unforeseen circumstances, such as natural disasters or economic downturns, secured lines of credit can provide businesses with immediate access to funds.

Benefits of Secured Lines of Credit for Businesses

Secured lines of credit offer businesses a range of benefits, making them a valuable financial tool for managing cash flow and fueling growth. They provide a reliable source of funding, offering flexibility and peace of mind.

Working Capital Management

Secured lines of credit provide businesses with access to working capital, which is essential for day-to-day operations. This includes funding for inventory, payroll, and other expenses. Having a secured line of credit ensures businesses have the necessary funds to meet short-term financial obligations.

- Inventory Financing: Secured lines of credit can be used to purchase inventory, ensuring businesses have enough products to meet customer demand. This is especially beneficial for businesses with seasonal sales cycles or those experiencing a surge in orders.

- Payroll Management: Businesses can rely on secured lines of credit to cover payroll expenses, especially during periods of fluctuating revenue or unexpected expenses. This ensures employees are paid on time, maintaining morale and productivity.

- Operational Expenses: Secured lines of credit can be used to cover operational expenses such as rent, utilities, and marketing costs. This helps businesses manage cash flow effectively, preventing disruptions in day-to-day operations.

Cash Flow Management

Secured lines of credit provide businesses with a flexible source of funding, allowing them to manage cash flow effectively. This is crucial for businesses facing seasonal fluctuations in revenue or unexpected expenses.

- Bridging Shortfalls: Secured lines of credit can bridge short-term cash flow gaps, preventing businesses from facing financial distress. This is particularly helpful during periods of slow sales or unexpected delays in payments.

- Managing Seasonal Fluctuations: Businesses with seasonal sales cycles can rely on secured lines of credit to manage cash flow during slow periods. This allows them to continue operating smoothly and invest in future growth.

- Unexpected Expenses: Secured lines of credit provide a safety net for businesses facing unexpected expenses such as repairs, legal fees, or natural disasters. This helps businesses avoid financial strain and maintain operational stability.

Business Growth

Secured lines of credit can provide businesses with the financial resources they need to expand operations, invest in new equipment, or develop new products and services. This access to capital can accelerate business growth and create new opportunities.

- Expansion and Investment: Secured lines of credit can be used to finance expansion projects, such as opening new locations or investing in new equipment. This can lead to increased revenue, market share, and profitability.

- Product Development: Secured lines of credit can support the development of new products or services, allowing businesses to innovate and stay competitive. This can lead to increased sales and market share.

- Strategic Acquisitions: Secured lines of credit can provide the necessary funding for strategic acquisitions, allowing businesses to expand their reach and market share.

Considerations for Choosing a Secured Line of Credit

Choosing the right secured line of credit for your business involves careful consideration of your specific needs, the terms offered by lenders, and the collateral you are willing to pledge. Here are some key factors to keep in mind when evaluating secured lines of credit:

Determining Your Business Needs

It’s crucial to assess your business’s financial requirements before exploring secured lines of credit. Consider the following factors:

- Purpose of the loan: Clearly define the reason for seeking a secured line of credit. Whether it’s for working capital, expansion, or a specific project, understanding your intended use will help you determine the appropriate loan amount and terms.

- Loan amount: Estimate the total amount you need to borrow. Ensure the line of credit offers sufficient funds to cover your anticipated expenses. Overestimating your needs can lead to unnecessary interest payments, while underestimating can leave you short.

- Repayment terms: Consider the repayment schedule and duration. Choose a line of credit with terms that align with your cash flow and business cycle. Shorter repayment terms generally come with higher interest rates, while longer terms may result in lower interest rates but accrue more interest over time.

Comparing Lenders and Interest Rates

Once you’ve determined your business needs, you can start comparing different lenders and their offerings.

- Interest rates: Interest rates can vary significantly between lenders. Compare APRs (Annual Percentage Rates) and factor in any additional fees or charges. Consider factors such as your credit score, loan amount, and collateral value when assessing interest rates.

- Fees: Be aware of potential fees associated with secured lines of credit, such as origination fees, annual fees, and late payment penalties. Factor these costs into your overall borrowing costs.

- Loan terms: Compare the loan terms, including the repayment period, grace period, and any prepayment penalties. Choose a lender with terms that suit your business’s financial situation and cash flow.

Evaluating Terms and Conditions

Thoroughly review the terms and conditions of the secured line of credit agreement before signing.

- Collateral requirements: Understand the specific collateral required by the lender. Ensure you are comfortable pledging the asset and its value is sufficient to cover the loan amount.

- Draw period: The draw period is the timeframe during which you can access funds from the line of credit. Ensure the draw period aligns with your business needs.

- Repayment schedule: Review the repayment schedule, including the minimum payment amount, due date, and any penalties for late payments.

Risks and Drawbacks of Secured Lines of Credit

While secured lines of credit offer advantages, they also come with potential risks and drawbacks. It’s crucial to understand these aspects before committing to a secured line of credit to make informed decisions.

Potential Risks and Consequences of Defaulting

Defaulting on a secured line of credit can have significant consequences for your business.

- Loss of Collateral: The most significant risk is the loss of your collateral. If you fail to repay the loan, the lender can seize and sell your collateral to recover their losses. This can result in a substantial financial loss for your business, potentially jeopardizing its future.

- Damage to Credit Score: A default on a secured line of credit can severely damage your business credit score. This can make it difficult to obtain financing in the future, as lenders may view you as a high-risk borrower.

- Legal Action: The lender may take legal action to recover the outstanding debt. This could involve lawsuits, judgments, and even wage garnishment. These legal proceedings can be costly and time-consuming, further impacting your business.

Alternatives to Secured Lines of Credit

While secured lines of credit offer a valuable financing option for businesses, they may not be the best fit for every situation. Fortunately, a range of alternative financing methods cater to diverse business needs and risk profiles.

Exploring these alternatives allows you to choose the financing solution that aligns best with your company’s goals and financial standing.

Comparison of Secured Lines of Credit with Other Financing Methods

Understanding the nuances of different financing options is crucial for making informed decisions. Let’s compare secured lines of credit with other popular methods, highlighting their strengths and weaknesses:

- Unsecured Lines of Credit: Unsecured lines of credit differ from secured lines by not requiring collateral. They are typically based on your business’s creditworthiness and financial history. While they offer flexibility, they often come with higher interest rates due to the increased risk for lenders.

- Business Loans: Business loans provide a fixed sum of money with a predetermined repayment schedule. Unlike lines of credit, they are not revolving and cannot be repeatedly accessed once the funds are used. Business loans can be secured or unsecured, impacting interest rates and eligibility requirements.

- Equipment Financing: Equipment financing is a specialized form of lending that allows businesses to acquire equipment with loan payments based on the equipment’s value. It is often secured by the equipment itself, offering lower interest rates compared to unsecured loans.

- Invoice Factoring: Invoice factoring is a financing option where a company sells its outstanding invoices to a factoring company at a discount. This provides immediate cash flow but comes with a fee. It is particularly useful for businesses with recurring invoices and a stable customer base.

- Merchant Cash Advances: Merchant cash advances provide a lump sum of money based on a business’s future credit card sales. The repayment is typically structured as a daily or weekly percentage of sales, making it a flexible option for businesses with consistent revenue streams.

Suitability of Alternative Financing Options

The suitability of alternative financing options depends heavily on specific business needs and circumstances. Let’s delve into the factors to consider when evaluating different options:

- Creditworthiness: Businesses with strong credit scores and a history of timely payments are more likely to qualify for unsecured loans, lines of credit, and favorable interest rates.

- Collateral: The availability of collateral, such as real estate or equipment, is a key factor in securing loans or lines of credit. Secured options often offer lower interest rates due to the reduced risk for lenders.

- Cash Flow: Businesses with stable and predictable cash flow are better positioned to manage loan repayments. Options like merchant cash advances or invoice factoring can be advantageous for businesses with consistent revenue streams.

- Loan Purpose: The intended use of the funds influences the choice of financing. For example, equipment financing is ideal for acquiring specific equipment, while business loans may be more suitable for expansion or working capital needs.

- Repayment Terms: Repayment terms, including interest rates, loan duration, and payment schedules, vary significantly across financing options. It’s crucial to compare these terms carefully and choose an option that aligns with your business’s financial capacity.

Best Practices for Using a Secured Line of Credit

A secured line of credit can be a valuable tool for businesses, but it’s crucial to use it responsibly to maximize its benefits and avoid potential pitfalls. Following best practices ensures you leverage this financial resource effectively and maintain a healthy financial standing.

Budgeting

Effective budgeting is fundamental to using a secured line of credit wisely. It helps you track expenses, anticipate future needs, and avoid overextending your borrowing capacity.

- Create a Detailed Budget: A comprehensive budget Artikels your income and expenses, providing a clear picture of your financial situation. This helps you determine how much you can comfortably borrow and repay.

- Track Expenses Carefully: Monitor your spending closely to identify areas where you can cut costs or adjust your budget. This helps you stay within your borrowing limits and avoid unnecessary debt.

- Allocate Funds Strategically: Use the secured line of credit for specific business purposes, such as inventory purchases, equipment upgrades, or working capital needs. Avoid using it for non-business expenses or impulsive purchases.

Repayment

A well-defined repayment plan is essential for managing your secured line of credit effectively. This ensures you stay on top of your obligations and avoid accumulating excessive interest charges.

- Make Regular Payments: Set up automatic payments or reminders to ensure timely repayments. This helps you avoid late fees and maintain a positive credit history.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum payment to reduce your outstanding balance and interest charges more quickly.

- Consider a Shorter Repayment Term: If feasible, opt for a shorter repayment term, which generally results in higher monthly payments but lower overall interest costs.

Monitoring

Regular monitoring of your secured line of credit is crucial to ensure you’re using it responsibly and maintaining financial control.

- Review Your Account Regularly: Check your account statements for accuracy and identify any discrepancies or unusual activity. This helps you catch errors and address any issues promptly.

- Monitor Your Credit Score: Keep an eye on your credit score, as it can be affected by your secured line of credit usage. Aim for a healthy credit score to access better interest rates and terms in the future.

- Assess Your Borrowing Needs: Periodically evaluate your business needs and adjust your borrowing limits accordingly. This ensures you have access to the necessary funds without overextending yourself.

Real-World Examples of Secured Lines of Credit in Business

Secured lines of credit are a powerful tool for businesses looking to access funding. They offer a flexible and reliable way to manage cash flow and fund growth initiatives. To understand how these lines of credit work in practice, let’s explore some real-world examples.

Examples of Secured Lines of Credit in Business

Here are a few real-world examples of how businesses have utilized secured lines of credit:

| Business Type | Industry | Loan Amount | Usage |

|---|---|---|---|

| Small Restaurant | Food Service | $50,000 | The restaurant used the secured line of credit to purchase new equipment, such as a high-capacity oven and a commercial dishwasher, to expand its menu and service capacity. |

| Startup Technology Company | Technology | $200,000 | The startup used the secured line of credit to cover operating expenses during the initial stages of product development and market testing. |

| Retail Store | Retail | $100,000 | The retail store used the secured line of credit to purchase inventory during peak seasons, such as the holiday season, to ensure adequate stock levels. |

Each of these examples demonstrates how a secured line of credit can be a valuable tool for businesses in various industries. These lines of credit provide a flexible source of funding that can be used for a wide range of purposes, from short-term cash flow needs to long-term growth initiatives.

Resources for Businesses Seeking Secured Lines of Credit: Secured Line Of Credit Business

Finding the right secured line of credit can be a significant step for your business. Thankfully, various resources can guide you through the process and provide valuable information.

Resources for Businesses Seeking Secured Lines of Credit

Numerous resources can help businesses navigate the world of secured lines of credit. These resources can provide guidance on the application process, eligibility criteria, and factors to consider when choosing a secured line of credit.

Online Resources

- SBA (Small Business Administration): The SBA offers various resources for small businesses, including information on secured lines of credit. The SBA website provides comprehensive guidance on accessing financing options, including secured lines of credit.

- Website: https://www.sba.gov/

- SCORE (Service Corps of Retired Executives): SCORE is a non-profit organization that provides free business mentoring and counseling to entrepreneurs. SCORE mentors can offer valuable insights into securing funding, including secured lines of credit.

- Website: https://www.score.org/

- U.S. Chamber of Commerce: The U.S. Chamber of Commerce provides information and resources for businesses of all sizes, including guidance on financing options. Their website offers articles and insights into secured lines of credit.

- Website: https://www.uschamber.com/

- NerdWallet: NerdWallet is a personal finance website that provides information on various financial products, including secured lines of credit. They offer articles and comparisons of different lenders and their offerings.

- Website: https://www.nerdwallet.com/

Financial Institutions

- Banks: Banks are a primary source for secured lines of credit. They offer various loan products, including secured lines of credit, tailored to different business needs.

- Credit Unions: Credit unions are member-owned financial institutions that often offer competitive rates and flexible terms for secured lines of credit. They may have more personalized service than larger banks.

- Online Lenders: Online lenders have become increasingly popular for business financing, including secured lines of credit. They often have faster approval times and may offer more flexible eligibility criteria.

Industry Associations

- Industry-specific associations: Many industries have associations that offer resources and information to their members, including guidance on financing options. These associations may have partnerships with lenders or offer educational programs on securing funding.

Ending Remarks

Secured lines of credit can be a powerful tool for businesses looking to access capital and manage cash flow effectively. By carefully considering the risks and benefits, understanding the terms and conditions, and adhering to best practices, businesses can harness the potential of secured lines to achieve their financial goals and drive growth.

FAQ Insights

What is the typical interest rate for a secured line of credit?

Interest rates for secured lines of credit vary depending on factors like credit score, loan amount, and collateral type. Generally, they are lower than unsecured lines, but it’s crucial to compare rates from multiple lenders.

How long does it take to get approved for a secured line of credit?

The approval process can take anywhere from a few days to several weeks, depending on the lender and the complexity of the application. It’s essential to provide all necessary documentation promptly.

What happens if I default on a secured line of credit?

In case of default, the lender has the right to seize the collateral used to secure the loan. It’s vital to understand the consequences of default and make every effort to repay the loan as agreed.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!