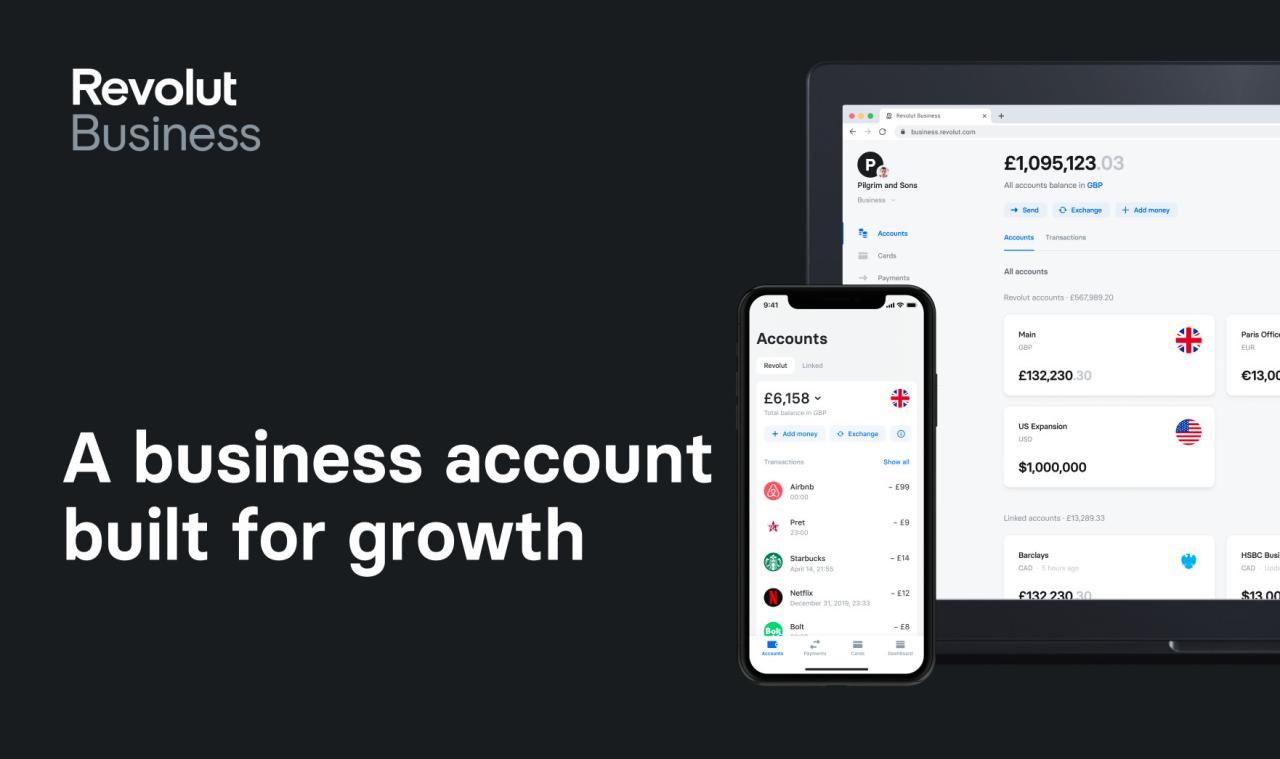

The Revolut Business Credit Card sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This card caters to the diverse needs of modern businesses, providing a blend of features, benefits, and rewards that are designed to simplify financial management and enhance growth. Whether you are a small startup or a well-established enterprise, the Revolut Business Credit Card offers a compelling proposition.

The card is designed to empower businesses by simplifying their financial management, streamlining expense tracking, and offering valuable rewards. From managing international payments and currency exchange to accessing exclusive travel perks and insurance, the Revolut Business Credit Card presents a comprehensive solution for businesses seeking to optimize their financial operations and enhance their global reach.

Revolut Business Credit Card Overview

The Revolut Business Credit Card is a valuable tool for businesses of all sizes looking to streamline their finances and maximize their spending power. This card offers a range of features and benefits designed to simplify business operations and empower entrepreneurs.

Target Audience

The Revolut Business Credit Card is tailored for businesses of various sizes, from startups and small businesses to established companies. This card caters to a diverse range of industries and sectors, including:

- Small and Medium Enterprises (SMEs): The card provides flexibility and control for managing business expenses, enabling SMEs to optimize cash flow and make informed financial decisions.

- Freelancers and Independent Contractors: This card simplifies expense tracking and provides access to business-related services, making it an ideal solution for freelancers and independent contractors.

- E-commerce Businesses: The card offers convenient online payment options and robust security features, catering to the needs of online businesses.

- Professional Services Firms: Businesses in professional services, such as consulting and accounting, can leverage the card’s expense management tools and travel benefits.

Comparison with Other Business Credit Cards

The Revolut Business Credit Card stands out in the market by offering a unique combination of features and benefits. Here’s a comparison with other popular business credit cards:

| Feature | Revolut Business Credit Card | Other Business Credit Cards |

|---|---|---|

| Annual Fee | No annual fee | May have annual fees |

| Rewards Program | Cashback rewards | Points, miles, or other rewards |

| Travel Benefits | Airport lounge access, travel insurance | May offer travel benefits |

| Expense Management Tools | Detailed expense tracking, real-time spending insights | May have limited expense management features |

| International Spending | No foreign transaction fees | May charge foreign transaction fees |

The Revolut Business Credit Card provides a comprehensive solution for businesses seeking a no-fee card with attractive rewards, travel benefits, and advanced expense management capabilities.

Eligibility and Application Process

The Revolut Business Credit Card is a valuable tool for businesses looking to manage their finances efficiently. To determine your eligibility and guide you through the application process, we’ll cover the necessary criteria and steps involved.

Eligibility Criteria

To apply for the Revolut Business Credit Card, you must meet certain criteria. These criteria are designed to ensure that the card is a suitable financial product for your business.

- Registered Business: Your business must be legally registered and operating in a supported country.

- Business Account: You must have an active Revolut Business account.

- Credit History: Revolut assesses your business’s credit history to evaluate your creditworthiness. A strong credit history increases your chances of approval.

- Financial Stability: Your business should demonstrate financial stability, including consistent revenue and healthy cash flow.

- Business Type: Revolut may have specific eligibility requirements based on your business type. For example, certain industries may have stricter criteria.

Application Process

The application process for the Revolut Business Credit Card is straightforward and can be completed online. Here are the steps involved:

- Login to Your Revolut Business Account: Access your Revolut Business account through the mobile app or website.

- Locate the Credit Card Application: Navigate to the section dedicated to credit cards or business loans within your account.

- Submit Your Application: Complete the online application form, providing accurate information about your business and financial details.

- Review and Approval: Revolut will review your application. The approval process may take a few business days.

- Card Delivery: Once approved, your Revolut Business Credit Card will be delivered to your registered business address.

Tips for Increasing Approval Chances

To maximize your chances of approval, consider these tips:

- Maintain a Strong Credit History: Pay your business bills on time and manage your credit responsibly.

- Provide Accurate Information: Ensure that all the information you provide in your application is accurate and up-to-date.

- Demonstrate Financial Stability: Show that your business has a steady revenue stream and healthy cash flow.

- Meet Eligibility Requirements: Carefully review the eligibility criteria and ensure that your business meets all the requirements.

- Contact Revolut for Clarification: If you have any questions about the application process or eligibility criteria, contact Revolut’s customer support for clarification.

Fees and Charges

Understanding the fees associated with the Revolut Business Credit Card is crucial for making informed financial decisions. It’s important to consider how these fees might impact your overall spending and compare them to other business credit cards to find the best option for your business needs.

Annual Fees

The Revolut Business Credit Card has a transparent fee structure with no annual fee. This is a significant advantage compared to many other business credit cards that often charge hefty annual fees, which can add up over time. The absence of an annual fee can save your business money in the long run, allowing you to allocate those funds to other critical areas.

Transaction Fees

The Revolut Business Credit Card charges a small transaction fee for purchases made with the card. This fee is usually a percentage of the transaction amount and varies depending on the currency used. The exact percentage can be found on the Revolut website or in the Revolut app. While a small transaction fee might seem insignificant at first glance, it’s important to consider its cumulative impact on your overall spending, especially for businesses that make frequent purchases.

Foreign Transaction Fees

The Revolut Business Credit Card does not charge foreign transaction fees, making it an attractive option for businesses that frequently conduct transactions in multiple currencies. Eliminating foreign transaction fees can save you money when making international purchases or paying suppliers in different currencies.

Comparison with Other Business Credit Cards

Compared to other business credit cards, the Revolut Business Credit Card stands out for its lack of annual fees and foreign transaction fees. However, it’s essential to compare the overall fee structure, including transaction fees, interest rates, and other potential charges, with other business credit cards before making a decision. Factors such as the credit limit, reward programs, and other benefits should also be considered in your evaluation.

Rewards and Perks

The Revolut Business Credit Card offers a rewards program designed to help businesses earn cashback on their everyday spending. This program rewards cardholders with points that can be redeemed for various benefits.

The rewards program is straightforward: earn points on every eligible purchase made with your Revolut Business Credit Card. These points accumulate over time, and you can redeem them for a variety of rewards, including cashback, travel credits, and gift cards.

Points Accumulation

The Revolut Business Credit Card rewards program is based on a simple point system. You earn points for every £1 spent on eligible purchases. The number of points earned per £1 spent varies depending on the category of the purchase.

- Travel: Earn 2 points per £1 spent on flights, hotels, and car rentals.

- Dining: Earn 1 point per £1 spent at restaurants and cafes.

- Other Purchases: Earn 1 point per £1 spent on all other eligible purchases.

Redeeming Points

You can redeem your accumulated points for a variety of rewards, including:

- Cashback: Redeem your points for cashback directly to your Revolut Business account.

- Travel Credits: Use your points to book flights, hotels, or car rentals with a travel partner.

- Gift Cards: Redeem your points for gift cards to popular retailers and restaurants.

Maximizing Rewards

Businesses can maximize their rewards by focusing on spending in categories that earn the highest points. For example, booking flights and hotels through the Revolut Business Credit Card can significantly boost your point accumulation. Additionally, using the card for business-related expenses, such as office supplies, software subscriptions, and marketing services, can also contribute to your rewards.

Value Proposition

The Revolut Business Credit Card rewards program compares favorably to other business credit cards. While some cards offer higher point earning rates, the Revolut Business Credit Card stands out with its flexibility in redemption options and its user-friendly interface. The card also provides a range of other benefits, such as travel insurance and purchase protection, making it a comprehensive solution for businesses.

Security and Fraud Protection

Revolut Business Credit Card prioritizes security and offers robust fraud protection measures to safeguard your business and its finances. It features various security features, including zero-liability policies, advanced fraud detection systems, and data encryption protocols, providing a comprehensive approach to protecting your transactions and sensitive information.

Zero Liability Policy

The Revolut Business Credit Card offers a zero-liability policy, meaning you are not responsible for unauthorized transactions made on your card. If your card is lost, stolen, or used fraudulently, Revolut will cover all unauthorized charges. This policy provides peace of mind and ensures you are not financially burdened in case of fraudulent activity.

Advanced Fraud Detection Systems, Revolut business credit card

Revolut employs sophisticated fraud detection systems that constantly monitor your card activity for suspicious patterns. These systems use machine learning algorithms and real-time data analysis to identify and flag potential fraudulent transactions. If a suspicious transaction is detected, Revolut will immediately contact you for verification and take necessary steps to prevent further unauthorized activity.

Data Encryption and Security Protocols

Revolut uses industry-standard encryption protocols to protect your card data during transactions and while stored on their systems. This ensures that your sensitive information, including your card number, expiry date, and CVV, is encrypted and protected from unauthorized access.

Multi-Factor Authentication

To enhance security, Revolut implements multi-factor authentication (MFA) for sensitive actions, such as logging into your account or making large transactions. This requires you to provide an additional verification code, usually sent to your mobile device, before completing the action. This extra layer of security adds an additional barrier against unauthorized access to your account.

Secure Card Management

Revolut provides a secure online portal where you can manage your card, including setting spending limits, enabling and disabling transactions, and reporting lost or stolen cards. This allows you to have complete control over your card and its usage, enhancing security and peace of mind.

Cardholder Data Protection

Revolut is committed to protecting your cardholder data and adheres to strict data privacy regulations, such as the General Data Protection Regulation (GDPR). They employ robust security measures, including data encryption, access control, and regular security audits, to ensure that your personal and financial information is protected.

Comparison with Other Business Credit Cards

Revolut’s security measures are comparable to, or even exceed, those offered by other leading business credit cards. Many other cards also offer zero-liability policies, advanced fraud detection systems, and data encryption protocols. However, Revolut’s comprehensive approach, including features like multi-factor authentication and secure card management, sets it apart and provides a more robust security experience.

Customer Support and Resources

Revolut Business strives to provide comprehensive customer support to its cardholders, ensuring a smooth and hassle-free experience. They offer various channels for assistance and have a wealth of online resources to answer common queries.

Customer Support Channels

Revolut Business provides multiple channels for customers to access support. These channels are designed to cater to different preferences and urgency levels.

- Live Chat: Available 24/7 on the Revolut Business app and website, offering instant support for quick inquiries and assistance.

- Email Support: For more detailed inquiries or complex issues, customers can contact Revolut Business via email. Response times vary depending on the complexity of the issue, but generally, customers can expect a response within 24 hours.

- Phone Support: Revolut Business offers phone support for urgent matters or issues that require immediate attention. The phone number is available on their website and app, and customer service representatives are available to assist during business hours.

Online Resources and FAQs

Revolut Business provides extensive online resources to help cardholders find answers to their questions and manage their accounts effectively.

- Help Center: The Revolut Business Help Center features a comprehensive collection of articles, FAQs, and tutorials covering a wide range of topics, from account setup to card usage and security.

- Blog: The Revolut Business blog provides valuable insights and updates on industry trends, new features, and best practices for managing business finances. This resource keeps customers informed about the latest developments and offers practical tips for optimizing their business operations.

- Social Media: Revolut Business maintains an active presence on various social media platforms, such as Twitter and LinkedIn. These platforms serve as additional channels for communication, customer support, and sharing industry updates.

Customer Support Quality and Responsiveness

Revolut Business has a reputation for providing high-quality and responsive customer support. They prioritize customer satisfaction and strive to resolve issues promptly and efficiently. Numerous online reviews and testimonials highlight the positive experiences of Revolut Business cardholders with their customer support team.

- Quick Response Times: Customers generally report receiving quick responses from the customer support team, regardless of the chosen communication channel.

- Helpful and Knowledgeable Representatives: Revolut Business customer support representatives are known for their expertise and ability to provide accurate and helpful solutions to customer queries.

- Proactive Support: Revolut Business proactively reaches out to customers to address potential issues and provide support before they escalate. This proactive approach demonstrates their commitment to customer satisfaction.

Pros and Cons

The Revolut Business Credit Card offers a range of benefits for businesses, but it’s essential to consider both the advantages and disadvantages before making a decision. Here’s a breakdown of the pros and cons:

Pros and Cons of the Revolut Business Credit Card

| Pros | Cons |

|---|---|

|

|

Case Studies and Real-World Examples

The Revolut Business Credit Card has proven to be a valuable tool for businesses of all sizes. To illustrate its real-world impact, let’s explore some case studies of businesses that have successfully leveraged this card to streamline their finances and achieve their goals. These examples showcase the benefits and challenges experienced by these businesses, offering insights into the practical applications and considerations of using the Revolut Business Credit Card.

Real-World Examples of Businesses Using the Revolut Business Credit Card

Here are some examples of businesses that have used the Revolut Business Credit Card:

| Business | Industry | Benefits | Challenges |

|---|---|---|---|

| “The Coffee Bean” | Food and Beverage |

|

|

| “Tech Solutions Inc.” | Technology |

|

|

| “Creative Marketing Agency” | Marketing and Advertising |

|

|

Conclusion: Revolut Business Credit Card

The Revolut Business Credit Card presents a compelling proposition for businesses seeking to streamline expenses, manage cash flow, and unlock valuable rewards. Its comprehensive suite of features, including seamless integration with the Revolut Business platform, robust security measures, and enticing perks, positions it as a strong contender in the business credit card market.

Factors to Consider

When deciding whether the Revolut Business Credit Card is the right fit for your business, several factors should be carefully considered.

- Spending Habits: Analyze your business’s typical spending patterns and determine if the card’s rewards structure aligns with your needs. For example, if your business primarily makes online purchases, the card’s cashback program could be highly beneficial.

- Fees and Charges: Carefully review the card’s fees and charges, including annual fees, foreign transaction fees, and late payment penalties. Compare these costs with other business credit card options to ensure you’re getting the best value for your money.

- Eligibility Requirements: Ensure your business meets the eligibility criteria for the card. Revolut Business Credit Card typically requires a minimum turnover and a good credit history.

- Customer Support: Assess the availability and responsiveness of Revolut’s customer support channels. Consider factors like response times, communication methods, and the overall experience of dealing with customer service.

Last Word

The Revolut Business Credit Card stands out as a versatile and attractive option for businesses seeking a comprehensive financial solution. Its array of features, benefits, and rewards cater to a wide range of business needs, making it a compelling choice for businesses of all sizes. From simplified expense tracking and international payments to robust security measures and exclusive travel perks, the Revolut Business Credit Card empowers businesses to manage their finances effectively and navigate the global marketplace with confidence. As you delve deeper into the intricacies of this card, you will discover a world of possibilities that can revolutionize your business’s financial journey.

Common Queries

What are the eligibility requirements for the Revolut Business Credit Card?

To be eligible, businesses typically need to meet certain criteria, including being registered in a supported country, having a good credit history, and meeting minimum revenue requirements. It’s best to check Revolut’s official website for the most up-to-date eligibility criteria.

How do I apply for the Revolut Business Credit Card?

The application process is usually straightforward. You can typically apply online through Revolut’s website. You will need to provide basic business information, financial details, and supporting documents.

What are the fees associated with the Revolut Business Credit Card?

Fees can vary depending on the specific card plan and usage. Common fees include annual fees, transaction fees, foreign transaction fees, and ATM withdrawal fees. You can find detailed information about fees on Revolut’s website or by contacting their customer support.

How do I maximize my rewards with the Revolut Business Credit Card?

Maximize your rewards by using the card for all your business expenses, taking advantage of cashback offers, and utilizing the card for travel bookings and other eligible purchases. Make sure to review the reward program terms and conditions to understand how to earn and redeem points effectively.

What are the security measures in place for the Revolut Business Credit Card?

Revolut employs robust security measures to protect your card and data. These include advanced fraud detection systems, zero-liability policies, and secure online platforms. You can find more information about their security features on their website.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!