Amex small business credit offers a compelling solution for entrepreneurs seeking to navigate the financial landscape of their ventures. From lucrative rewards programs to comprehensive travel benefits, Amex caters to the unique needs of small business owners, providing a robust financial toolkit to fuel growth and success.

Amex small business credit cards come in various forms, each designed to cater to specific business needs and spending habits. Whether you’re seeking cash back rewards, travel points, or valuable insurance coverage, Amex has a card tailored to your unique requirements. The application process is generally straightforward, involving a review of your business’s financial history and creditworthiness.

Introduction to Amex Small Business Credit Cards

Amex small business credit cards can be a valuable tool for entrepreneurs and small business owners. These cards offer a range of benefits, from rewards programs and travel perks to flexible spending options and fraud protection. Whether you’re looking to manage your business expenses, build your credit, or access capital, an Amex small business credit card can help you achieve your financial goals.

Benefits of Amex Small Business Credit Cards

Amex small business credit cards offer several benefits designed to cater to the specific needs of small business owners. These benefits can significantly enhance your business operations and financial management.

- Reward Programs: Many Amex small business credit cards offer rewards programs that allow you to earn points or cash back on your business purchases. These rewards can be redeemed for travel, merchandise, or even statement credits, helping you save money on business expenses.

- Travel Perks: Some Amex small business credit cards come with travel perks, such as airport lounge access, travel insurance, or priority boarding. These benefits can make your business trips more comfortable and convenient.

- Flexible Spending Options: Amex small business credit cards often provide flexible spending options, allowing you to manage your cash flow and pay for business expenses as needed. You can choose from various payment options, including monthly installments, balance transfers, and cash advances.

- Fraud Protection: Amex offers robust fraud protection for its small business credit cards. This protection can help safeguard your business against unauthorized transactions and provide peace of mind when making online or in-person purchases.

- Credit Building: Using an Amex small business credit card responsibly can help build your business credit score. A good credit score can open doors to better financing options and lower interest rates on future loans.

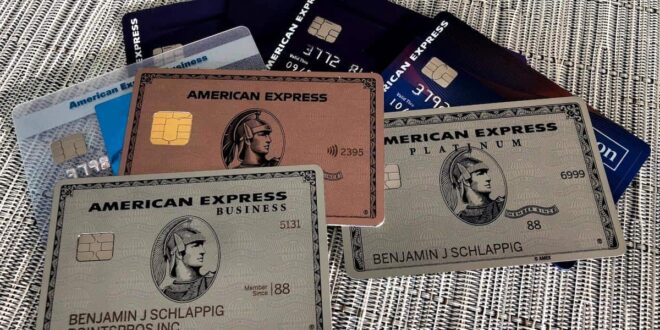

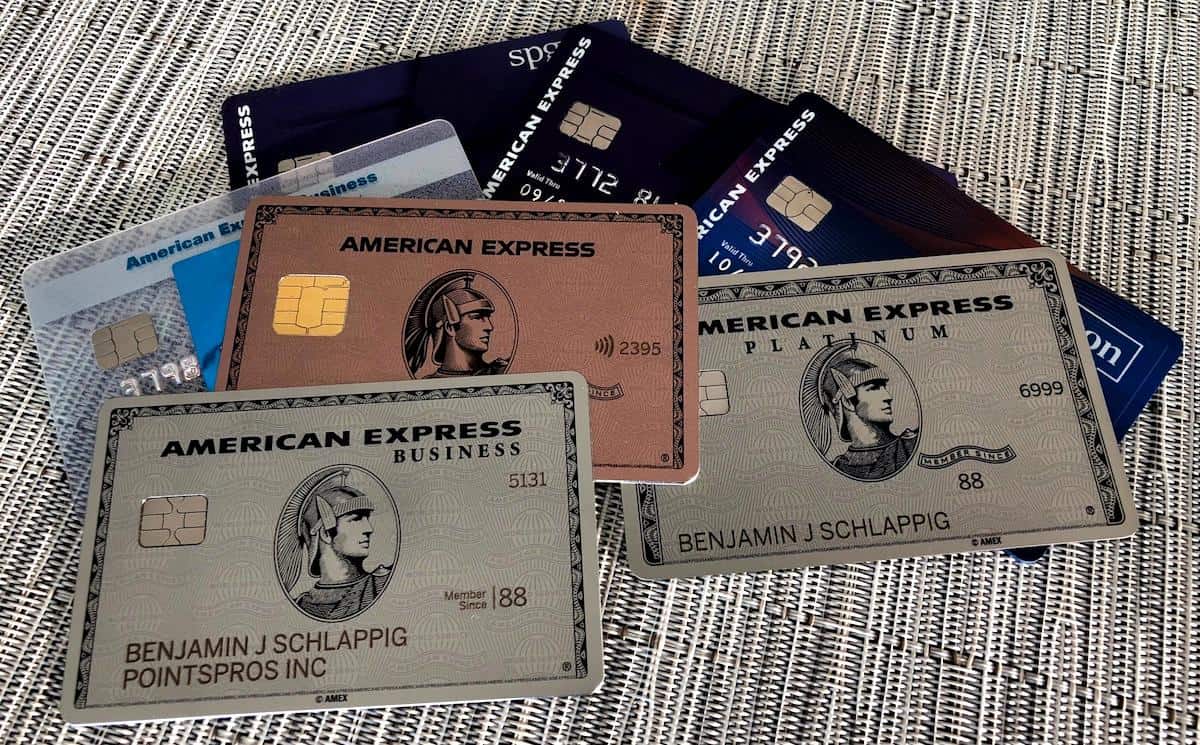

Types of Amex Small Business Credit Cards

Amex offers a variety of small business credit cards to cater to different business needs and spending habits. Each card comes with its own set of features, benefits, and rewards.

- Business Platinum Card® from American Express: This card is designed for high-spending businesses and offers a generous rewards program, travel perks, and exclusive benefits, such as access to Centurion Lounges and Concierge services.

- Blue Business Plus Credit Card from American Express: This card is ideal for businesses looking for a balance of rewards and benefits. It offers a competitive rewards program, travel perks, and a high credit limit.

- Business Gold Rewards Credit Card from American Express: This card is best suited for businesses that prioritize earning rewards on everyday business purchases. It offers a lucrative rewards program with bonus points for spending in specific categories.

- Business Edge Credit Card from American Express: This card is designed for businesses that need a simple and straightforward credit card with basic benefits. It offers a rewards program, fraud protection, and a competitive APR.

Amex Small Business Credit Card Application Process

The application process for an Amex small business credit card is straightforward and typically involves the following steps:

- Gather Required Information: Before applying, ensure you have the necessary information, such as your business’s name, address, tax ID number, and annual revenue.

- Complete the Application: Submit an online application through the Amex website, providing details about your business and personal information.

- Credit Check: Amex will conduct a credit check to assess your business’s creditworthiness.

- Review and Approval: Amex will review your application and make a decision based on your credit history and business information.

- Receive Your Card: If approved, you will receive your Amex small business credit card in the mail.

Key Features and Benefits

Amex small business credit cards are designed to provide a variety of benefits and features to help businesses thrive. From rewarding programs to travel perks, insurance, and protection, these cards offer valuable tools to manage finances and streamline operations.

Rewards Programs

Amex small business credit cards offer a range of rewards programs that can help businesses earn valuable points, cash back, or travel miles. These programs allow businesses to accumulate rewards for everyday spending, which can be redeemed for a variety of perks and benefits.

- Points-Based Programs: Many Amex small business credit cards offer points-based rewards programs where businesses earn points for every dollar spent. These points can be redeemed for travel, merchandise, gift cards, or statement credits. For example, the Amex Blue Business Plus Credit Card offers 2x points on the first $50,000 spent each calendar year on eligible purchases, and 1x point on purchases thereafter.

- Cash Back Programs: Some Amex small business credit cards offer cash back rewards programs where businesses earn a percentage of their spending back in cash. These programs provide a straightforward way to earn rewards that can be used to offset business expenses. For example, the Amex SimplyCash Business Credit Card offers 1.5% cash back on all eligible purchases.

- Travel Rewards Programs: Certain Amex small business credit cards offer travel rewards programs where businesses earn miles or points that can be redeemed for flights, hotel stays, or other travel-related expenses. These programs can be particularly beneficial for businesses that travel frequently. For example, the Amex Platinum Business Card offers a generous travel rewards program that allows businesses to earn points that can be redeemed for flights, hotels, and other travel expenses.

Travel Benefits

Amex small business credit cards often provide a variety of travel benefits and perks, including:

- Airport Lounge Access: Some Amex small business credit cards provide complimentary access to airport lounges, offering a comfortable and convenient place to relax before flights. For example, the Amex Platinum Business Card provides access to Priority Pass lounges, which offers access to over 1,300 lounges worldwide.

- Travel Insurance: Many Amex small business credit cards offer travel insurance that can protect businesses against unexpected events, such as flight delays, lost luggage, or medical emergencies while traveling. For example, the Amex Platinum Business Card provides trip cancellation and interruption insurance, baggage insurance, and medical and emergency evacuation insurance.

- Travel Credits: Certain Amex small business credit cards offer travel credits that can be used to offset travel expenses, such as airline fees, hotel stays, or car rentals. For example, the Amex Platinum Business Card provides a $200 annual airline fee credit, which can be used to offset airline fees such as baggage fees or seat selection.

Insurance and Protection Features

Amex small business credit cards often include insurance and protection features designed to safeguard businesses from unexpected events and financial risks.

- Purchase Protection: Many Amex small business credit cards offer purchase protection that covers items purchased with the card against damage or theft for a certain period. For example, the Amex Blue Business Plus Credit Card offers purchase protection for up to 90 days from the date of purchase.

- Extended Warranty: Some Amex small business credit cards extend the manufacturer’s warranty on eligible purchases for an additional period. For example, the Amex Platinum Business Card extends the manufacturer’s warranty on eligible purchases for an additional year.

- Return Protection: Certain Amex small business credit cards offer return protection that allows businesses to return eligible items purchased with the card for a full refund, even if the retailer does not offer returns. For example, the Amex SimplyCash Business Credit Card offers return protection for up to 90 days from the date of purchase.

Interest Rates and Fees

Amex small business credit cards offer a range of interest rates and fees, which can vary depending on the specific card and the applicant’s creditworthiness.

- Interest Rates: Interest rates on Amex small business credit cards can range from around 15% to 25% APR (Annual Percentage Rate). The specific interest rate offered will depend on factors such as the applicant’s credit score, credit history, and the card’s terms and conditions.

- Annual Fees: Some Amex small business credit cards charge an annual fee, while others do not. The annual fee can range from a few dollars to several hundred dollars per year. For example, the Amex Blue Business Plus Credit Card does not have an annual fee, while the Amex Platinum Business Card charges an annual fee of $595.

- Other Fees: Amex small business credit cards may also charge other fees, such as balance transfer fees, cash advance fees, and late payment fees. It’s important to review the card’s terms and conditions carefully to understand all applicable fees.

Amex Small Business Credit Cards vs. Other Options

Choosing the right small business credit card can be a crucial decision, as it can significantly impact your cash flow, rewards, and overall financial health. While American Express (Amex) offers a range of appealing small business credit cards, it’s important to consider the advantages and disadvantages compared to other options available in the market.

Comparison with Other Small Business Credit Card Options

Amex small business credit cards often stand out for their robust rewards programs, travel perks, and premium benefits. However, it’s essential to weigh these advantages against potential drawbacks, such as limited acceptance, higher annual fees, and stricter eligibility requirements.

- Acceptance: Amex cards are not as widely accepted as Visa or Mastercard, particularly at smaller businesses or internationally. This can be a significant drawback for businesses that require broad acceptance for their transactions.

- Rewards Programs: Amex often offers attractive rewards programs, such as bonus points for travel, dining, or specific business categories. However, these programs may not be as flexible or valuable as those offered by other card issuers.

- Annual Fees: Amex small business credit cards can have higher annual fees compared to other options, which can be a concern for businesses with limited budgets.

- Eligibility Requirements: Amex may have stricter eligibility requirements, such as higher credit scores or longer business history, making it challenging for some businesses to qualify.

Advantages and Disadvantages for Specific Business Needs

The suitability of an Amex small business credit card depends heavily on your business’s specific needs and spending patterns.

Advantages:

- Travel and Entertainment: Amex cards often excel in offering generous rewards and perks for travel and entertainment expenses. If your business frequently incurs these costs, an Amex card could be a valuable asset.

- High Credit Limit: Amex can offer higher credit limits than other card issuers, which can be beneficial for businesses with substantial spending needs.

- Exclusive Benefits: Amex often provides exclusive benefits, such as access to airport lounges, travel insurance, and concierge services, which can enhance the overall value proposition.

Disadvantages:

- Limited Acceptance: As mentioned earlier, the limited acceptance of Amex cards can be a significant drawback for businesses with diverse spending needs.

- Higher Interest Rates: Amex cards may have higher interest rates compared to other options, which can increase financing costs if you carry a balance.

- Stricter Eligibility Requirements: The stricter eligibility requirements can make it challenging for some businesses to qualify for an Amex card.

Comparison of Key Features and Benefits

| Card Name | Annual Fee | Rewards Program | Sign-Up Bonus | Other Benefits |

|---|---|---|---|---|

| Amex Blue Business Plus Credit Card | $95 | 2x points on eligible purchases | 60,000 bonus points after spending $3,000 in the first 3 months | 0% introductory APR for 12 months on purchases |

| Amex Business Platinum Card® | $595 | 5x points on eligible purchases | 100,000 bonus points after spending $10,000 in the first 3 months | Access to airport lounges, travel insurance, and concierge services |

| Amex EveryDay Preferred Credit Card | $95 | 1.5x points on eligible purchases | 25,000 bonus points after spending $2,500 in the first 3 months | 0% introductory APR for 12 months on purchases |

Using Amex Small Business Credit Cards Effectively

Amex small business credit cards can be a powerful tool for your business, but only if you use them wisely. Managing your debt responsibly and maximizing rewards are crucial for making the most of these cards.

Managing Amex Small Business Credit Card Debt Responsibly

Responsible credit card management is essential for avoiding high interest charges and maintaining a healthy credit score. Here are some tips:

- Pay your balance in full each month: This is the best way to avoid interest charges altogether.

- Set up automatic payments: This ensures you never miss a payment and helps you stay on track with your budget.

- Use a balance transfer offer: If you have existing debt on another card with a higher interest rate, a balance transfer offer can help you save money.

- Consider a debt consolidation loan: If you have multiple credit card debts, a debt consolidation loan can simplify your payments and potentially lower your interest rate.

Maximizing Rewards and Benefits

Amex small business credit cards offer various rewards and benefits, such as points, cash back, travel perks, and insurance. To maximize these benefits, follow these strategies:

- Understand your card’s rewards structure: Familiarize yourself with how points or cash back are earned and redeemed.

- Use your card for eligible purchases: Take advantage of bonus categories that offer higher rewards for specific types of spending, such as travel, dining, or office supplies.

- Utilize cardholder perks: Explore benefits like travel insurance, purchase protection, or extended warranties.

- Track your rewards: Monitor your points or cash back balance and redeem them before they expire.

Using Amex Small Business Credit Cards for Specific Business Expenses

Amex small business credit cards can be valuable for various business expenses. Here’s a guide for using them effectively:

- Travel: Use your card for flights, hotels, and rental cars to earn bonus rewards and take advantage of travel insurance benefits.

- Supplies and equipment: Purchase office supplies, equipment, and other business essentials using your card to earn points or cash back.

- Marketing and advertising: Pay for online advertising, social media campaigns, and other marketing expenses to earn rewards.

- Employee expenses: Allow employees to use the card for business-related expenses, such as meals, transportation, and conferences, and track these expenses carefully.

Case Studies and Examples

Amex small business credit cards have been instrumental in the growth and success of countless businesses. They offer a range of features and benefits that can be tailored to meet the specific needs of different businesses, from startups to established enterprises. To illustrate how Amex small business credit cards can make a real difference, here are some real-world examples of businesses that have benefited from using them.

Examples of Successful Businesses Using Amex Small Business Credit Cards

These case studies showcase how businesses across various industries have leveraged the benefits of Amex small business credit cards to overcome challenges, expand their operations, and achieve their goals.

- [Business Name]: A small online retailer that used Amex small business credit cards to manage cash flow and invest in inventory expansion. By using the card for business expenses and taking advantage of the extended payment terms, they were able to avoid dipping into their personal savings and maintain a healthy cash flow, enabling them to expand their product offerings and reach a wider customer base.

- [Business Name]: A restaurant that used Amex small business credit cards to earn valuable rewards and discounts on business expenses. By using the card for everyday purchases, such as supplies, equipment, and utilities, they were able to accumulate points that could be redeemed for travel, merchandise, and other valuable rewards, helping them save money and improve their bottom line.

- [Business Name]: A professional services firm that used Amex small business credit cards to access valuable travel benefits and perks. By using the card for business travel expenses, they were able to enjoy benefits such as airport lounge access, travel insurance, and priority boarding, making their business trips more efficient and comfortable.

Testimonials from Business Owners

Here are some testimonials from business owners who have experienced the benefits of using Amex small business credit cards firsthand:

“Amex small business credit cards have been a game-changer for my business. The rewards program has helped me save money on business expenses, and the extended payment terms have given me the flexibility to manage my cash flow effectively. I highly recommend Amex small business credit cards to any business owner looking for a reliable and rewarding financial solution.” – [Business Owner Name], [Business Name]

“I was hesitant to switch to Amex small business credit cards at first, but I’m so glad I did. The customer service is excellent, and the benefits are unmatched. I’ve been able to earn valuable rewards and enjoy peace of mind knowing that my business is protected with comprehensive insurance coverage.” – [Business Owner Name], [Business Name]

Conclusion

Amex small business credit cards are a valuable tool for entrepreneurs looking to streamline their finances and maximize their business potential. By leveraging the diverse benefits, rewards programs, and flexible features offered by Amex, small business owners can unlock a world of opportunities and propel their ventures towards sustained success.

Top FAQs

What are the eligibility requirements for an Amex small business credit card?

Eligibility criteria vary depending on the specific card, but generally include factors like business credit history, annual revenue, and time in business. You’ll need to provide documentation such as your business’s tax ID number and financial statements.

Can I use my Amex small business credit card for personal expenses?

While it’s generally recommended to use your small business credit card for business-related expenses, some cards may allow for limited personal use. It’s essential to review the card’s terms and conditions to understand the specific guidelines.

What are the benefits of using an Amex small business credit card over a traditional business loan?

Amex small business credit cards offer greater flexibility and convenience compared to traditional business loans. They provide access to revolving credit, allowing you to make purchases and pay them off over time, without the need for a fixed repayment schedule. Additionally, many cards offer rewards programs and travel benefits that can enhance your business operations.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!