Business credit line without personal guarantee – A business credit line without a personal guarantee offers a unique opportunity for entrepreneurs and business owners. It allows you to access funds for operational expenses, inventory, or expansion without putting your personal assets at risk. This type of financing can be a game-changer, providing flexibility and peace of mind.

Understanding the intricacies of business credit lines without personal guarantees requires careful consideration of eligibility criteria, credit score impact, and responsible management strategies. This comprehensive guide explores these aspects in detail, offering valuable insights for informed decision-making.

Understanding Business Credit Lines

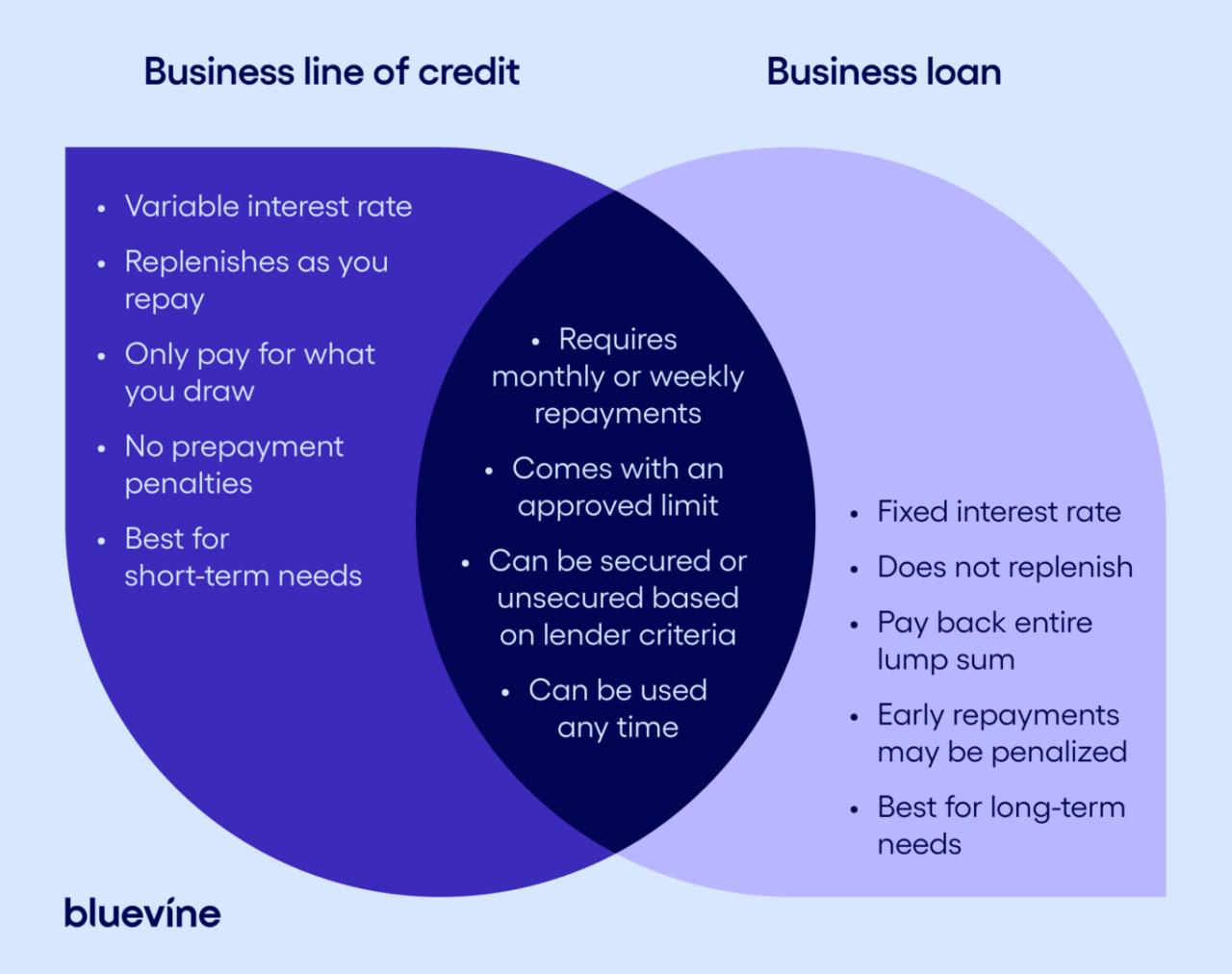

A business credit line is a type of revolving credit that allows businesses to borrow money up to a certain limit, and then repay it over time. It’s similar to a credit card for businesses, providing flexibility and access to funds when needed.

Advantages of a Business Credit Line Without a Personal Guarantee, Business credit line without personal guarantee

A business credit line without a personal guarantee offers several advantages for business owners. The primary benefit is that it separates the business’s finances from the owner’s personal finances. This means that if the business defaults on the loan, the owner’s personal assets are not at risk. This can be a significant advantage for entrepreneurs who want to protect their personal finances.

- Reduced Personal Liability: The most significant advantage is the reduced risk to the business owner’s personal assets. If the business defaults on the loan, the owner’s personal assets are protected.

- Improved Credit Score: Responsible use of a business credit line can help build a positive credit history for the business, which can improve its credit score and access to future financing.

- Greater Financial Flexibility: A business credit line provides a flexible source of funds for various business needs, such as covering seasonal fluctuations, unexpected expenses, or taking advantage of new opportunities.

Examples of Business Credit Line Usage

Businesses can utilize a business credit line for various purposes, including:

- Working Capital: To cover day-to-day expenses like inventory, payroll, and rent.

- Seasonal Fluctuations: To manage cash flow during peak seasons or periods of high demand.

- Unexpected Expenses: To address unforeseen costs, such as repairs, equipment breakdowns, or legal fees.

- Expansion or Growth Opportunities: To finance new projects, hire additional staff, or expand into new markets.

- Inventory Purchases: To acquire bulk inventory or seasonal items.

Eligibility and Requirements

Securing a business credit line without a personal guarantee requires meeting specific eligibility criteria and providing necessary documentation. Lenders carefully assess your business’s financial health, track record, and future prospects before approving your application.

Eligibility Criteria

Lenders consider several factors to determine your business’s eligibility for a credit line without a personal guarantee. These include:

- Time in Business: Lenders typically prefer businesses that have been operating for at least two years, demonstrating stability and a track record of generating revenue.

- Credit History: A strong credit history, reflected in your business’s credit score, is crucial. A good credit score indicates responsible financial management and a lower risk for lenders.

- Revenue and Profitability: Lenders evaluate your business’s revenue and profitability to assess its ability to repay the credit line. They may require financial statements, such as income statements and balance sheets, to verify your financial performance.

- Debt-to-Equity Ratio: Lenders examine your business’s debt-to-equity ratio, which indicates the proportion of debt financing compared to equity. A lower ratio suggests a more stable financial position.

- Industry and Market Conditions: Lenders consider the industry your business operates in and the overall market conditions. They may be more cautious about lending to businesses in volatile industries or during economic downturns.

Required Documents

To apply for a business credit line without a personal guarantee, you will generally need to provide the following documents:

- Business Plan: A well-written business plan outlining your business’s goals, strategies, and financial projections.

- Financial Statements: Recent income statements, balance sheets, and cash flow statements to demonstrate your business’s financial performance.

- Tax Returns: Copies of your business’s recent tax returns to verify your revenue and profitability.

- Personal Credit Report: Some lenders may request your personal credit report, even though they are not seeking a personal guarantee. This helps them assess your overall financial responsibility.

- Business Licenses and Permits: Proof of your business’s legal registration and compliance with relevant regulations.

- Bank Statements: Bank statements showing your business’s transaction history and cash flow.

- Collateral: Depending on the lender and the amount of credit you seek, you may need to provide collateral, such as real estate or equipment, to secure the loan.

Lender Requirements Comparison

Here’s a table comparing the specific requirements of different lenders for business credit lines without personal guarantees:

| Lender | Minimum Time in Business | Minimum Credit Score | Minimum Revenue | Collateral Required |

|---|---|---|---|---|

| Lender A | 2 years | 650 | $100,000 | Yes |

| Lender B | 1 year | 680 | $50,000 | No |

| Lender C | 3 years | 700 | $200,000 | Yes |

Credit Score and Business History

A strong business credit score is crucial for securing a business credit line without a personal guarantee. It reflects your business’s financial health and ability to repay borrowed funds. Lenders rely on this score to assess the risk associated with lending to your business.

A good business credit score is also essential for obtaining favorable loan terms, such as lower interest rates and longer repayment periods.

Impact of Business History

A business’s history plays a significant role in determining its creditworthiness. Lenders examine several factors, including:

* Payment history: Timely payments on existing loans and credit lines demonstrate financial responsibility and reliability.

* Credit utilization: This ratio indicates the amount of available credit used by your business. A lower utilization ratio generally suggests better financial management.

* Length of credit history: A longer credit history signifies stability and experience in managing credit.

* Public records: Any negative records, such as bankruptcies or judgments, can negatively impact your credit score.

- Positive history: A consistent record of on-time payments and responsible credit utilization can lead to better credit terms and potentially lower interest rates.

- Negative history: Conversely, a history of late payments, missed payments, or defaults can result in lower credit scores, making it harder to obtain a business credit line.

Strategies to Improve Business Credit Score

Here are some strategies to improve your business credit score:

| Strategy | Description |

|---|---|

| Pay bills on time | Establish a consistent record of timely payments. |

| Keep credit utilization low | Aim for a credit utilization ratio of 30% or less. |

| Monitor credit reports regularly | Check for any errors or inaccuracies and dispute them promptly. |

| Establish business credit accounts | Open business credit cards, lines of credit, or trade accounts to build a credit history. |

| Use business credit wisely | Avoid excessive borrowing and prioritize responsible credit management. |

Interest Rates and Fees

Understanding the interest rates and fees associated with a business credit line without a personal guarantee is crucial for making informed financial decisions. These costs can significantly impact your overall borrowing expenses, so it’s essential to compare different options and understand the factors that influence them.

Interest Rate Calculation

Interest rates for business credit lines without personal guarantees are typically variable and fluctuate based on market conditions. Lenders use a variety of factors to determine your specific interest rate, including your business’s creditworthiness, revenue, cash flow, and the overall risk associated with lending to your industry.

The interest rate is often calculated as a prime rate plus a margin, which is a percentage added to the prime rate.

For example, if the prime rate is 5% and your margin is 3%, your interest rate would be 8%.

Fee Structures

Various fees are associated with business credit lines, including:

- Annual Fee: This is a yearly fee charged for maintaining the credit line, regardless of usage.

- Origination Fee: A one-time fee charged when the credit line is established, typically a percentage of the credit limit.

- Draw Fee: A fee charged each time you borrow money from the credit line.

- Late Payment Fee: A penalty charged for missed or late payments.

- Overdraft Fee: A fee charged if you exceed your credit limit.

Fee Structure Comparison

| Fee Type | Description | Implications |

|---|---|---|

| Annual Fee | A fixed fee charged annually for maintaining the credit line. | Increases the overall cost of borrowing, especially if the credit line is not used frequently. |

| Origination Fee | A one-time fee charged at the start of the credit line. | Adds to the initial cost of obtaining the credit line, but may be offset by lower interest rates. |

| Draw Fee | A fee charged each time you borrow money from the credit line. | Increases the cost of borrowing, especially if you make frequent withdrawals. |

| Late Payment Fee | A penalty charged for missed or late payments. | Can significantly increase the cost of borrowing and damage your credit score. |

| Overdraft Fee | A fee charged if you exceed your credit limit. | Can add significant costs if you make unplanned purchases or experience unexpected expenses. |

Benefits and Drawbacks

A business credit line without a personal guarantee can be a valuable financial tool for businesses, offering a flexible source of funding without putting personal assets at risk. However, it’s essential to understand both the benefits and drawbacks before deciding if this type of financing is right for your company.

Benefits

A business credit line without a personal guarantee offers several advantages, making it an attractive option for many businesses:

- Protection of Personal Assets: The most significant benefit is the protection of personal assets. If your business defaults on the loan, your personal assets, such as your home, car, or savings, are not at risk. This is a crucial advantage for business owners who want to separate their personal finances from their business finances.

- Improved Creditworthiness: Building a strong business credit history through responsible use of a business credit line can lead to better credit terms and lower interest rates in the future. It also demonstrates your business’s financial stability to potential investors and lenders.

- Flexibility and Convenience: Business credit lines offer flexible access to funds as needed. You can draw down funds as needed, and only pay interest on the amount you use. This flexibility can be valuable for managing seasonal fluctuations in cash flow or unexpected expenses.

- No Collateral Requirements: In some cases, a business credit line without a personal guarantee may not require collateral, allowing you to access funding without putting up valuable assets as security.

Drawbacks

While a business credit line without a personal guarantee offers several benefits, there are also potential drawbacks to consider:

- Higher Interest Rates: Because the lender assumes more risk without a personal guarantee, interest rates on these lines of credit may be higher compared to loans with personal guarantees.

- Stricter Eligibility Requirements: Lenders may have stricter eligibility requirements for business credit lines without personal guarantees. This can include higher revenue thresholds, a longer business history, and a strong credit score.

- Limited Availability: These credit lines may not be readily available to all businesses, especially startups or those with limited credit history.

- Potential for Debt Accumulation: The flexibility of a credit line can lead to overspending and debt accumulation if not managed carefully. It’s crucial to have a clear budget and repayment plan in place.

Situations Where a Business Credit Line Without a Personal Guarantee Might Be Suitable

A business credit line without a personal guarantee can be a good fit for businesses in these situations:

- Established Businesses with Strong Credit: Businesses with a proven track record of profitability and a good credit score are more likely to qualify for a business credit line without a personal guarantee. This type of financing can be a good option for managing seasonal fluctuations in cash flow or funding expansion plans.

- Businesses with Limited Personal Assets: If you’ve recently started a business or have limited personal assets to pledge as collateral, a business credit line without a personal guarantee can provide access to funding without jeopardizing your personal finances.

- Businesses Seeking Flexibility: The flexibility of a business credit line can be invaluable for businesses that experience unpredictable expenses or need to adjust their spending based on market conditions.

Situations Where a Business Credit Line Without a Personal Guarantee Might Be Unsuitable

A business credit line without a personal guarantee may not be the best option for businesses in these situations:

- Startups or Businesses with Limited Credit History: Startups and businesses with a limited credit history may find it difficult to qualify for a business credit line without a personal guarantee. Lenders may require a personal guarantee to mitigate their risk.

- Businesses with Poor Credit: If your business has a history of late payments or defaults, it may be challenging to obtain a business credit line without a personal guarantee. Lenders may be hesitant to extend credit without the assurance of personal assets.

- Businesses with High Debt Levels: Businesses with high debt levels may struggle to qualify for a business credit line without a personal guarantee, as lenders may be concerned about your ability to repay the loan.

Alternative Financing Options

Business credit lines without personal guarantees are a valuable financing option for many businesses. However, they are not the only option available. Understanding the advantages and disadvantages of alternative financing options can help you determine the best solution for your business.

Comparison with Other Financing Options

Alternative financing options offer distinct advantages and disadvantages compared to business credit lines without personal guarantees. This section explores some common alternatives, their key features, and their suitability in different scenarios.

- Term Loans: Term loans provide a fixed amount of funding for a specific period, with regular payments. They offer predictable repayment terms and are often used for major investments, such as equipment purchases or building renovations.

- Advantages: Predictable repayment terms, fixed interest rates, and longer repayment periods.

- Disadvantages: Less flexible than credit lines, may require collateral, and can be time-consuming to obtain.

- Suitable for: Businesses with a clear and specific financing need, such as equipment purchases or expansion.

- SBA Loans: The Small Business Administration (SBA) provides loan guarantees to lenders, making it easier for small businesses to secure financing. SBA loans often have lower interest rates and more flexible terms than traditional bank loans.

- Advantages: Lower interest rates, longer repayment terms, and less stringent eligibility requirements.

- Disadvantages: Can be more time-consuming to obtain due to the SBA approval process.

- Suitable for: Small businesses that meet the SBA’s eligibility criteria, particularly those with limited credit history or access to traditional financing.

- Invoice Financing: Invoice financing allows businesses to access cash flow by selling their unpaid invoices to a financing company at a discount. This can be a valuable option for businesses with a steady stream of invoices but limited working capital.

- Advantages: Quick access to cash, no need for collateral, and can help improve cash flow.

- Disadvantages: Can be expensive due to the discount on invoices, and may not be suitable for businesses with fluctuating invoice volumes.

- Suitable for: Businesses with a reliable stream of invoices and a need for immediate cash flow.

- Equity Financing: Equity financing involves selling a portion of your business ownership to investors in exchange for capital. This can provide a significant influx of funds but also dilutes your ownership stake.

- Advantages: Large amounts of capital, no debt repayment obligations, and potential for long-term growth.

- Disadvantages: Loss of control over your business, potential for disagreements with investors, and dilution of ownership.

- Suitable for: Businesses seeking significant growth capital or looking to expand into new markets.

Responsible Credit Line Management: Business Credit Line Without Personal Guarantee

Managing a business credit line responsibly is crucial for maintaining a healthy financial standing and ensuring the long-term success of your business. Just like any other financial tool, a credit line needs careful planning and disciplined usage to avoid accumulating unnecessary debt and damaging your credit score.

Tracking and Monitoring Credit Line Usage

Keeping track of your credit line usage is essential for responsible management. This involves monitoring your balance, payment due dates, and interest charges regularly.

- Regularly check your account statements: Review your monthly statements to ensure accuracy and identify any discrepancies. Look for any unexpected charges or fees.

- Set up payment reminders: Utilize online banking features or third-party apps to receive timely reminders about upcoming payment due dates. Avoid late fees by making payments on time.

- Monitor your credit utilization ratio: This ratio represents the percentage of your available credit that you’re currently using. A lower utilization ratio generally indicates responsible credit management. Aim for a utilization ratio below 30% to maintain a good credit score.

Maintaining a Healthy Credit Line

Maintaining a healthy credit line involves taking proactive steps to ensure responsible usage and avoid unnecessary debt accumulation.

- Create a budget and stick to it: Establish a clear budget for your business and allocate funds for specific expenses. This will help you avoid overspending and prevent unnecessary credit line usage.

- Prioritize essential expenses: Use your credit line primarily for essential business expenses, such as inventory, equipment, or marketing. Avoid using it for personal expenses or unnecessary purchases.

- Pay down your balance regularly: Make regular payments on your credit line balance, ideally more than the minimum payment. This helps reduce interest charges and keep your utilization ratio low.

- Avoid using your credit line as a primary source of funding: While a credit line can be helpful for short-term cash flow needs, it shouldn’t be relied upon as a long-term funding solution. Explore alternative financing options for larger capital investments.

Outcome Summary

Securing a business credit line without a personal guarantee can empower your business with the financial resources it needs to thrive. By carefully evaluating your eligibility, building a strong business credit score, and managing your credit line responsibly, you can unlock this valuable financing option and propel your business towards success.

Answers to Common Questions

What are the typical interest rates for business credit lines without personal guarantees?

Interest rates for business credit lines without personal guarantees vary based on factors like your business credit score, revenue, and loan amount. They generally fall between 5% and 15% APR.

Can I use a business credit line for any purpose?

While you can typically use a business credit line for operational expenses, inventory, or expansion, some lenders may have restrictions on specific uses. Check with your lender for details.

How long does it take to get approved for a business credit line without a personal guarantee?

Approval times vary depending on the lender and the complexity of your application. It can take anywhere from a few days to several weeks.

What happens if my business defaults on a business credit line?

If your business defaults on a business credit line, the lender may take legal action to recover the outstanding debt. They may also report the default to credit bureaus, which can negatively impact your business credit score.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!