Business line of credit applications are a valuable financing option for businesses seeking flexible access to capital. They offer a revolving credit line that can be drawn upon as needed, providing a safety net for unexpected expenses or opportunities for growth. Unlike traditional loans, which require a fixed amount and repayment schedule, business lines of credit offer a more adaptable approach, allowing businesses to borrow only what they require and pay interest only on the amount used.

Understanding the intricacies of business line of credit applications is crucial for businesses seeking to leverage this financial tool effectively. This guide explores the various aspects of business line of credit applications, from eligibility requirements and application processes to factors influencing interest rates and credit limits. It also delves into the effective management of these lines of credit, highlighting strategies for minimizing interest charges and maximizing credit utilization.

What is a Business Line of Credit?

A business line of credit is a revolving credit facility that allows businesses to borrow money as needed, up to a pre-approved credit limit. It’s similar to a credit card for businesses, offering flexibility and convenience.

Purpose of a Business Line of Credit

A business line of credit serves a variety of purposes, including:

- Working capital: Covering day-to-day operating expenses, such as payroll, rent, and inventory.

- Seasonal fluctuations: Managing cash flow during periods of high demand or low sales.

- Unexpected expenses: Addressing unforeseen costs, such as repairs or emergencies.

- Investment opportunities: Funding expansion, new equipment, or marketing initiatives.

Differences from Other Business Loans

A business line of credit differs from other types of business loans in several key ways:

- Revolving credit: Unlike a traditional loan, which provides a lump sum upfront, a business line of credit allows you to borrow and repay funds as needed, within your credit limit.

- Interest charged only on borrowed amount: You only pay interest on the amount you actually borrow, not on the entire credit limit.

- Flexibility: A business line of credit offers greater flexibility than a term loan, allowing you to access funds quickly when needed.

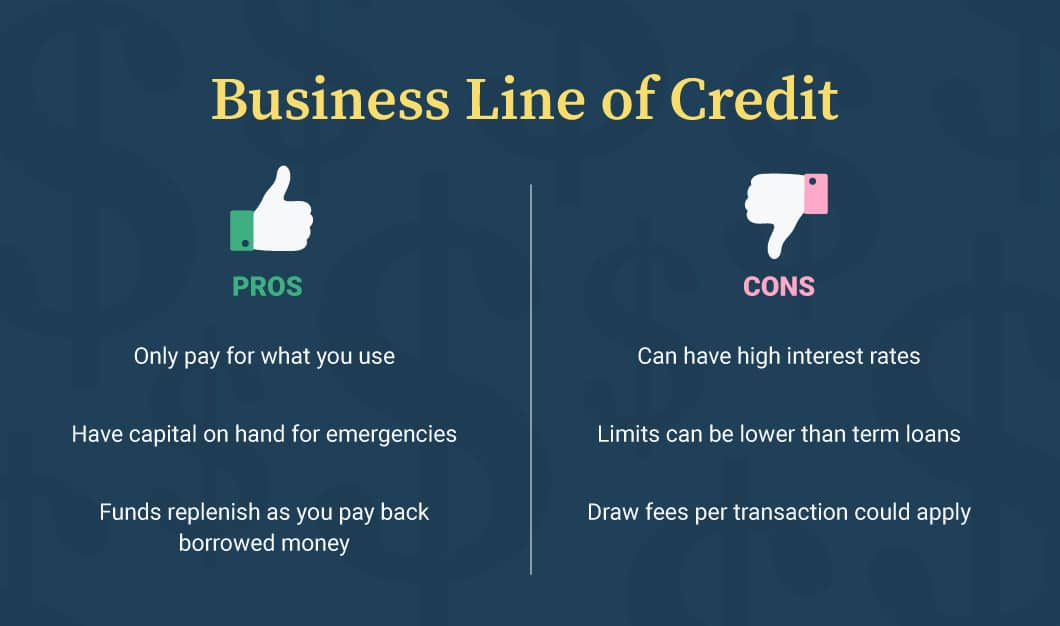

Advantages of Using a Business Line of Credit

A business line of credit offers several advantages:

- Flexibility: You can borrow only what you need, when you need it.

- Convenience: Accessing funds is often faster and easier than obtaining a traditional loan.

- Lower interest costs: You only pay interest on the amount you borrow, not on the entire credit limit.

- Improved credit score: Responsible use of a business line of credit can improve your business’s credit score.

Disadvantages of Using a Business Line of Credit

While a business line of credit offers many benefits, it also has some drawbacks:

- Interest rates: Interest rates on business lines of credit can be higher than those on traditional loans.

- Credit limit: Your credit limit may be lower than the amount you need, limiting your borrowing capacity.

- Fees: Some lenders charge annual fees or other fees associated with a business line of credit.

- Potential for overspending: Easy access to funds can lead to overspending and financial problems.

Eligibility Requirements for Business Line of Credit Applications

Securing a business line of credit requires meeting specific eligibility criteria. Lenders carefully assess various factors to determine if a business is a suitable candidate for this type of financing. The primary factors considered include the business’s credit score, history, and revenue.

Credit Score

A business’s credit score is a crucial indicator of its financial health and trustworthiness. Lenders use this score to assess the likelihood of a business repaying its debts. A strong credit score demonstrates responsible financial management, making a business more attractive to lenders.

Business History

Lenders carefully evaluate the business’s track record to gauge its stability and profitability. A history of consistent revenue generation, responsible financial practices, and successful business operations strengthens a business’s application.

Revenue

Consistent revenue generation is a critical factor in determining eligibility for a business line of credit. Lenders look for businesses with a stable revenue stream that demonstrates the ability to repay the loan. Businesses with a history of steady revenue growth and profitability are more likely to be approved.

The Business Line of Credit Application Process: Business Line Of Credit Applications

Applying for a business line of credit involves a series of steps, each designed to assess your business’s financial health and creditworthiness. The process can vary slightly depending on the lender, but generally involves gathering documentation, completing an application, and undergoing a credit review.

Documentation Required for the Application Process

To assess your business’s financial health and creditworthiness, lenders require various documents. These documents provide a comprehensive picture of your business’s operations, financial performance, and credit history.

- Business Plan: This document Artikels your business’s goals, strategies, and financial projections. It demonstrates your understanding of the market, your competitive advantage, and your ability to generate revenue and manage expenses.

- Financial Statements: These include your balance sheet, income statement, and cash flow statement. They provide a snapshot of your business’s financial position, profitability, and cash flow.

- Tax Returns: Recent tax returns (typically the past two to three years) provide evidence of your business’s income and expenses. They are crucial for verifying your financial performance and assessing your tax compliance.

- Personal Credit Report: Lenders may request your personal credit report, especially if you are applying for a small business line of credit. This is because your personal credit score can reflect your financial responsibility and ability to repay debt.

- Bank Statements: Bank statements show your business’s transaction history and cash flow patterns. They help lenders assess your cash flow management and liquidity.

- Collateral: Depending on the type of line of credit and the lender’s requirements, you may need to provide collateral. Collateral can include assets such as equipment, inventory, or real estate, which can be used to secure the loan.

Common Questions Asked During the Application Process

Lenders typically ask questions to gather information about your business, its financial performance, and your creditworthiness. These questions help them assess your ability to repay the line of credit and determine the appropriate credit limit and terms.

- What is your business’s purpose and industry? This question helps lenders understand your business’s nature and its operating environment.

- What is your business’s revenue and profit history? This question assesses your business’s financial performance and profitability.

- What is your business’s current debt load and credit history? This question helps lenders understand your existing financial obligations and your creditworthiness.

- What is your business’s cash flow and liquidity? This question assesses your business’s ability to generate cash and meet its financial obligations.

- What is your business’s growth strategy and future plans? This question helps lenders understand your business’s potential and its ability to repay the line of credit in the long term.

- What is your business’s management team and experience? This question assesses the expertise and experience of your management team, which can impact your business’s success and ability to repay the line of credit.

Factors Influencing Interest Rates and Credit Limits

Lenders carefully evaluate several factors when determining interest rates and credit limits for business lines of credit. These factors directly influence the cost of borrowing and the amount of available credit.

Creditworthiness

Lenders assess the creditworthiness of a business to determine the risk associated with lending money. This involves analyzing factors such as:

- Credit score: A numerical representation of a business’s credit history, reflecting its ability to repay debts. A higher credit score generally translates to lower interest rates and higher credit limits.

- Credit history: A review of past borrowing and repayment patterns, including the number of open accounts, payment history, and any defaults or delinquencies. A positive credit history indicates a lower risk for the lender.

- Financial statements: A detailed analysis of the business’s financial performance, including revenue, expenses, profitability, and cash flow. Strong financial statements demonstrate the business’s ability to generate sufficient income to cover debt obligations.

- Debt-to-equity ratio: A measure of the business’s leverage, indicating the proportion of debt financing relative to equity financing. A lower debt-to-equity ratio suggests a lower risk for the lender.

Industry

The industry in which a business operates can significantly influence interest rates and credit limits.

- Industry risk: Certain industries are inherently more risky than others, due to factors such as economic cycles, competition, and regulatory changes. Industries with higher risk profiles may face higher interest rates and lower credit limits.

- Industry growth: Industries experiencing strong growth may attract more favorable lending terms, as lenders perceive them as having higher potential for repayment. Conversely, industries facing decline may face higher interest rates and lower credit limits.

Loan Terms

The terms of the business line of credit, including the loan amount, repayment period, and interest rate structure, can also impact interest rates and credit limits.

- Loan amount: Larger loan amounts may come with higher interest rates, as lenders perceive greater risk associated with larger loans. Conversely, smaller loan amounts may attract lower interest rates.

- Repayment period: Longer repayment periods generally result in higher interest rates, as lenders compensate for the extended time value of money. Conversely, shorter repayment periods may attract lower interest rates.

- Interest rate structure: Lenders offer various interest rate structures, such as fixed rates, variable rates, and prime-based rates. Each structure carries different risks and benefits for both the borrower and the lender. For example, fixed rates offer predictability, while variable rates can fluctuate based on market conditions.

Using a Business Line of Credit Effectively

A business line of credit can be a valuable financial tool, but it’s crucial to use it responsibly to avoid accumulating unnecessary debt and jeopardizing your business’s financial health. Here’s a guide to maximizing its benefits while mitigating risks.

Managing a Business Line of Credit Responsibly

Managing a business line of credit responsibly involves a combination of proactive planning, disciplined spending, and regular monitoring.

- Set a Budget and Stick to It: Establish a clear budget for your business operations and track your expenses diligently. This helps prevent overspending and ensures you use the line of credit only for necessary business purposes.

- Use It for Short-Term Needs: Business lines of credit are designed for short-term financing, such as covering seasonal fluctuations in cash flow, purchasing inventory, or funding unexpected expenses. Avoid using it for long-term investments or projects.

- Pay Down the Balance Regularly: Aim to pay down the outstanding balance as quickly as possible, ideally within the grace period or before interest charges start accumulating. Regular repayments help reduce interest expenses and maintain a healthy credit utilization ratio.

- Monitor Your Credit Utilization: Keep a close eye on your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A high utilization ratio can negatively impact your credit score, making it more difficult to secure future financing.

Minimizing Interest Charges and Maximizing Credit Utilization, Business line of credit applications

Strategies for minimizing interest charges and maximizing credit utilization focus on optimizing your borrowing and repayment practices.

- Negotiate a Favorable Interest Rate: Shop around for the best interest rates and negotiate with lenders to secure a competitive deal. Consider factors like your business’s creditworthiness, the amount you’re borrowing, and the repayment terms.

- Maximize Your Credit Limit: A higher credit limit allows for greater flexibility and can help lower your credit utilization ratio, potentially leading to better interest rates in the future. However, remember to use this additional credit responsibly.

- Avoid Carrying a Balance: Ideally, aim to pay off the outstanding balance in full each month to avoid accumulating interest charges. If you can’t pay the full balance, try to make the largest possible payment to minimize interest accrual.

- Explore Repayment Options: Some lenders offer different repayment options, such as fixed monthly payments or interest-only payments. Choose the option that best aligns with your cash flow and repayment goals.

Regular Monitoring and Repayment of Outstanding Balances

Regular monitoring and timely repayment are crucial for maintaining a healthy financial standing and ensuring you can access credit when needed.

- Track Your Balance and Payments: Keep detailed records of your outstanding balance, interest charges, and payment history. This helps you stay informed about your borrowing and repayment obligations.

- Set Up Payment Reminders: Use calendar reminders or automated payment systems to ensure you make your payments on time. Late payments can damage your credit score and incur penalties.

- Review Your Line of Credit Regularly: Periodically review your line of credit terms, including the interest rate, credit limit, and any fees associated with the account. This helps identify any potential areas for improvement or negotiation.

- Consider a Revolving Line of Credit: A revolving line of credit allows you to draw on funds as needed and repay them over time, offering greater flexibility compared to a term loan. This option can be beneficial for businesses with fluctuating cash flow needs.

Alternatives to Business Lines of Credit

A business line of credit is a valuable financing tool, but it may not be the best fit for every business or situation. Exploring alternative financing options is crucial to finding the most suitable solution for your specific needs.

Comparison of Business Lines of Credit with Other Financing Options

Understanding the differences between business lines of credit and other financing options is essential for making informed decisions.

- Business Lines of Credit: These offer flexible access to funds, allowing businesses to draw money as needed and repay it over time. However, they typically come with higher interest rates than other forms of financing, and the available credit limit can fluctuate based on your business’s financial performance.

- Term Loans: These provide a fixed amount of money for a specific period, with a predetermined repayment schedule. Term loans often have lower interest rates than lines of credit, but they lack the flexibility of drawing funds as needed.

- Equipment Financing: This option allows businesses to purchase equipment with specific loan terms tailored to the asset being financed. The loan repayment is tied to the asset’s value, and it often comes with lower interest rates than other financing options.

- Invoice Financing: This financing method provides immediate cash flow by offering short-term loans based on outstanding invoices. It’s a good option for businesses with a steady stream of invoices and a need for quick access to funds.

- Merchant Cash Advances: These provide upfront capital in exchange for a percentage of future sales. Merchant cash advances are typically characterized by high interest rates and shorter repayment terms, making them suitable for businesses with a consistent revenue stream.

Suitability of Alternative Financing Methods for Different Business Needs

The best financing option for your business depends on your specific needs, including the amount of capital required, the repayment timeframe, and your business’s financial health.

- Short-term Needs: For immediate cash flow needs, invoice financing or merchant cash advances can be suitable options. These offer quick access to funds, but come with higher interest rates and shorter repayment terms.

- Long-term Investments: For long-term projects or investments, term loans or equipment financing may be more appropriate. These provide fixed amounts of capital with lower interest rates and longer repayment terms.

- Variable Funding Requirements: Businesses with fluctuating cash flow needs may benefit from a business line of credit. This provides flexibility in drawing funds as needed and repaying them over time.

Pros and Cons of Alternative Financing Options

Each financing option has its advantages and disadvantages. Carefully consider the pros and cons before making a decision.

- Term Loans

- Pros: Lower interest rates, fixed repayment schedule, predictable monthly payments.

- Cons: Less flexible than lines of credit, may not be suitable for businesses with fluctuating cash flow needs.

- Equipment Financing

- Pros: Lower interest rates, tailored repayment terms, potential tax benefits.

- Cons: Limited to financing specific equipment, may not be suitable for other business needs.

- Invoice Financing

- Pros: Quick access to funds, based on outstanding invoices, can improve cash flow.

- Cons: High interest rates, short repayment terms, may not be suitable for businesses with inconsistent revenue.

- Merchant Cash Advances

- Pros: Quick access to funds, no collateral required, suitable for businesses with consistent sales.

- Cons: High interest rates, short repayment terms, can be expensive in the long run.

Real-World Examples of Business Line of Credit Applications

Business lines of credit can be valuable tools for businesses of all sizes. They provide flexible financing options that can be used for a variety of purposes, such as managing cash flow, funding seasonal inventory needs, or making unexpected investments.

Examples of Business Line of Credit Applications

The following table illustrates how businesses use lines of credit, along with typical interest rates and credit limits:

| Business Type | Line of Credit Use | Interest Rate | Credit Limit |

|---|---|---|---|

| Retail Store | Purchasing holiday inventory | 7.5% | $50,000 |

| Construction Company | Bridging financing for a large project | 9.0% | $200,000 |

| Software Startup | Funding marketing and development efforts | 10.5% | $100,000 |

| Restaurant | Covering seasonal fluctuations in demand | 8.0% | $75,000 |

| E-commerce Business | Expanding online advertising campaigns | 6.5% | $25,000 |

The interest rates and credit limits are based on several factors, including the borrower’s credit score, the business’s financial history, and the amount of collateral offered.

For example, a retail store with a strong credit history and substantial collateral may qualify for a lower interest rate and a higher credit limit than a software startup with a shorter operating history and limited assets.

Closure

In conclusion, business lines of credit can be a powerful financial tool for businesses seeking flexible access to capital. By understanding the eligibility requirements, application processes, and factors influencing interest rates and credit limits, businesses can make informed decisions regarding the use of these lines of credit. Remember to utilize these lines of credit responsibly, ensuring regular monitoring and repayment of outstanding balances to maintain a healthy financial standing.

Answers to Common Questions

What is the typical credit limit offered for a business line of credit?

Credit limits vary based on factors like your creditworthiness, business history, and industry. They can range from a few thousand dollars to hundreds of thousands or even millions.

What are the common interest rates for business lines of credit?

Interest rates fluctuate based on market conditions and your credit profile. They are typically higher than personal loans but lower than short-term loans.

How long does it take to get approved for a business line of credit?

The approval process can take anywhere from a few days to several weeks, depending on the lender and the complexity of your application.

Can I use a business line of credit for personal expenses?

Generally, business lines of credit are intended for business purposes only. Using them for personal expenses could violate the terms of your agreement and potentially result in penalties.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!