Credit card to start a business – it’s a concept that sparks both excitement and caution. The idea of tapping into a readily available source of capital for your new venture is enticing, but it’s crucial to approach it with a balanced understanding. This guide delves into the advantages and disadvantages of using credit cards for business funding, helping you navigate the complexities and make informed decisions for your startup’s financial journey.

From understanding the different types of business credit cards to managing expenses effectively, this exploration provides insights on responsible credit card utilization. We’ll explore how to choose the right card for your specific needs, leverage rewards programs, and minimize the risk of accumulating debt.

The Appeal of Credit Cards for Business Startups

Credit cards can be a valuable tool for business startups, offering a quick and accessible way to finance initial operations and bridge the gap between funding rounds. While they may seem like a simple solution, understanding the nuances of credit card financing is crucial for making informed decisions.

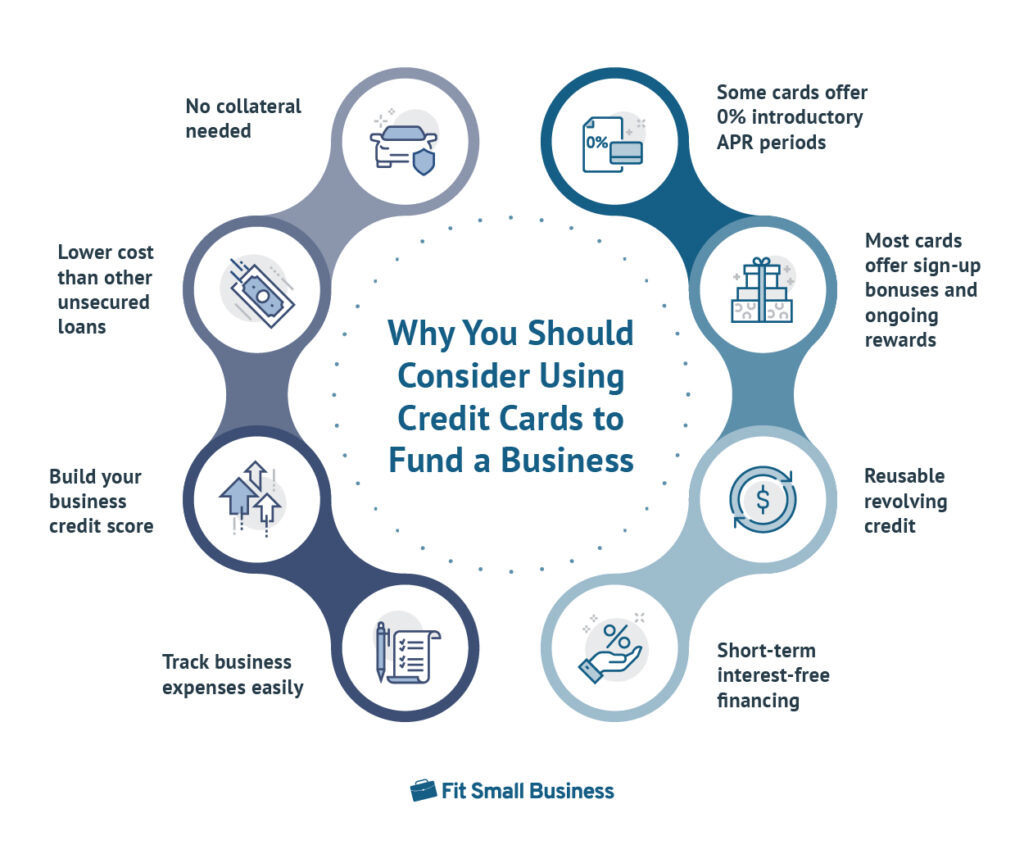

Advantages of Credit Card Financing

Credit cards offer several advantages for startups seeking funding, particularly in the early stages:

- Immediate Access to Capital: Credit cards provide instant access to funds, which can be crucial for covering immediate expenses, such as inventory, marketing, or rent. This allows startups to quickly seize opportunities and get their business up and running without waiting for traditional loan approvals.

- Flexible Repayment Options: Credit cards offer flexible repayment terms, allowing startups to make minimum payments or pay down the balance faster, depending on their cash flow. This flexibility can be helpful for startups with unpredictable revenue streams.

- Building Business Credit: Responsible use of credit cards can help startups establish business credit, which is essential for securing loans and other forms of financing in the future. By making timely payments and keeping utilization low, startups can build a positive credit history.

Potential Disadvantages of Credit Card Financing

While credit cards offer advantages, they also come with potential drawbacks:

- High-Interest Rates: Credit cards typically have high-interest rates compared to other forms of financing, such as bank loans. If not managed carefully, interest charges can quickly accumulate, putting a strain on cash flow and potentially hindering growth.

- Potential for Debt Accumulation: Easy access to credit can lead to overspending, especially for startups with limited experience managing finances. This can result in significant debt accumulation, which can be difficult to manage, especially during periods of slow growth.

- Impact on Personal Credit Scores: Using a personal credit card for business expenses can negatively impact personal credit scores if not managed properly. This is because business expenses may not be considered “good debt” by credit bureaus, and late payments or high utilization can hurt scores.

Credit Card Financing Compared to Other Options

Credit card financing should be considered alongside other funding options for startups:

- Loans: Bank loans typically offer lower interest rates than credit cards, but they require a more rigorous application process and may have stricter eligibility criteria. This can be a good option for startups with a strong track record and a clear business plan.

- Grants: Grants are non-repayable funds provided by government agencies or private foundations. They often have specific eligibility requirements and may be focused on supporting certain industries or initiatives. Grants can be a valuable source of funding, but they are often competitive and require careful research and application.

- Crowdfunding: Crowdfunding allows startups to raise funds from a large number of individuals through online platforms. This can be a good option for startups with a compelling story and a strong online presence. However, it can be time-consuming to build a successful crowdfunding campaign and there is no guarantee of reaching funding goals.

Choosing the Right Credit Card for Your Business

Selecting the right business credit card is crucial for maximizing your financial resources and ensuring your business operates smoothly. It’s not just about finding the lowest interest rates, but also about identifying features that align with your specific business needs and spending patterns.

Key Features to Consider

When choosing a business credit card, several key features should be carefully evaluated to ensure you secure the best card for your needs.

- Rewards Programs: Rewards programs are a significant factor for many businesses. They offer cashback, travel miles, or points that can be redeemed for various benefits. Analyze the rewards structure and determine if it aligns with your business’s spending habits. For instance, if you travel frequently for business, a travel rewards card might be beneficial. Conversely, if you primarily use the card for everyday expenses, a cashback card might be more suitable.

- Interest Rates: Interest rates are crucial, especially if you carry a balance. A lower interest rate can save you significant money in the long run. Compare interest rates across different cards and choose one that offers the lowest rate. Remember that interest rates can vary based on your credit score and other factors.

- Annual Fees: Annual fees are a recurring cost associated with credit cards. While some cards offer no annual fees, others may charge a fee. Consider the value proposition of the card and its features against the annual fee. If the benefits outweigh the fee, it may be worthwhile.

- Credit Limits: Credit limits determine the maximum amount you can charge on your card. A higher credit limit can provide flexibility for larger purchases, but it’s important to use credit responsibly and avoid maxing out your limit.

Types of Business Credit Cards

Business credit cards are categorized based on their specific features and benefits. Here’s a breakdown of some popular types:

- Cashback Cards: Cashback cards offer a percentage of your spending back as cash rewards. These cards are ideal for businesses with consistent spending and are looking for a straightforward rewards system. Examples include the Chase Ink Business Cash Credit Card and the Capital One Spark Cash for Business.

- Travel Rewards Cards: Travel rewards cards offer points or miles that can be redeemed for flights, hotels, or other travel expenses. These cards are advantageous for businesses that travel frequently, either for conferences or client meetings. Examples include the Chase Sapphire Preferred for Business and the Capital One Venture X Rewards Credit Card.

- Business-Specific Cards: These cards offer perks tailored to specific business needs, such as extended warranties or travel insurance. These cards can provide added value and protection for your business. Examples include the American Express Business Platinum Card and the U.S. Bank Business Cash Rewards Visa Signature Card.

Tips for Finding the Best Credit Card

Finding the right business credit card involves considering your unique needs and spending patterns. Here are some tips to guide your search:

- Analyze your spending: Identify the types of purchases your business makes most frequently. This will help you determine which rewards program or features are most beneficial.

- Compare cards: Use online comparison tools to compare different business credit cards based on interest rates, annual fees, rewards programs, and other features.

- Read the fine print: Carefully review the terms and conditions of each card before applying. Pay attention to things like interest rates, fees, and reward redemption rules.

- Consider your credit score: Your credit score will influence the interest rate and credit limit you qualify for. Check your credit score before applying for a card to get an idea of your eligibility.

Responsible Credit Card Use for Business Growth: Credit Card To Start A Business

A business credit card can be a powerful tool for growth, but responsible use is essential. Just like personal credit, it’s crucial to manage your business credit card effectively to avoid unnecessary debt and build a strong financial foundation for your business.

Developing a Plan for Managing Business Credit Card Expenses, Credit card to start a business

Effective management of business credit card expenses is vital for achieving financial stability and maximizing the benefits of credit. By implementing a well-structured plan, you can ensure responsible spending, track your progress, and maintain control over your finances.

- Setting Spending Limits: Establishing clear spending limits for your business credit card is crucial. This involves determining a budget for each category of expenses, such as supplies, marketing, or travel. Setting these limits in advance helps you avoid overspending and maintain financial discipline.

- Tracking Transactions: Regularly monitoring your business credit card transactions is essential for maintaining financial transparency and identifying potential issues. You can utilize online banking platforms, mobile apps, or spreadsheets to track your spending patterns, identify any unauthorized charges, and ensure that all transactions are accounted for.

- Making Timely Payments: Making timely payments on your business credit card is paramount for maintaining a good credit score and avoiding late fees. Establish a system for paying your balance in full each month or setting up automatic payments to ensure that your bills are paid on time.

Minimizing Interest Charges and Maximizing Rewards

By implementing effective strategies, you can minimize interest charges and maximize rewards, making your business credit card a valuable tool for financial growth.

- Paying Off Balances in Full Each Month: The most effective way to avoid interest charges is to pay off your entire balance each month. This ensures that you are only using your credit card for its convenience and not incurring debt.

- Utilizing Balance Transfer Offers: If you find yourself with a high balance on your business credit card, consider utilizing balance transfer offers. These offers allow you to transfer your balance to a new card with a lower interest rate, potentially saving you money on interest charges. However, be sure to compare the terms and fees associated with balance transfer offers before making a decision.

- Maximizing Rewards Programs: Many business credit cards offer rewards programs that can provide valuable benefits. These programs often offer cash back, travel miles, or points that can be redeemed for merchandise or services. To maximize your rewards, choose a card that aligns with your business’s spending patterns and utilize the card for eligible purchases.

Building a Strong Credit History for Your Business

A strong credit history is essential for securing future funding and improving your business’s financial standing.

A good credit score can make the difference between securing a loan at a favorable interest rate and being denied altogether.

- Consistent Payments: Making timely payments on your business credit card is the foundation of building a strong credit history. Consistent payments demonstrate your financial responsibility and help you establish a positive track record.

- Maintaining a Low Credit Utilization Ratio: Your credit utilization ratio is the percentage of your available credit that you are using. Keeping this ratio low, ideally below 30%, signals to lenders that you are managing your credit responsibly.

- Diversifying Your Credit Mix: Having a mix of different types of credit, such as business credit cards and loans, can demonstrate your ability to manage various financial obligations.

Credit Card Utilization for Specific Business Needs

Credit cards can be powerful tools for business owners, offering flexibility and financial control when managing various business expenses. By strategically utilizing credit cards, entrepreneurs can effectively manage cash flow, build business credit, and unlock opportunities for growth.

Credit Card Utilization for Different Business Types

Understanding how different business types can leverage credit cards for specific purposes is crucial for maximizing their benefits. The following table Artikels how various industries can utilize credit cards for inventory purchases, marketing campaigns, travel expenses, and equipment upgrades:

| Business Type | Inventory Purchases | Marketing Campaigns | Travel Expenses | Equipment Upgrades |

|---|---|---|---|---|

| E-commerce | Purchasing products from suppliers | Online advertising, social media campaigns | Attending industry conferences, trade shows | Investing in new website infrastructure, software |

| Retail | Stocking merchandise, seasonal inventory | Local advertising, promotional events | Business trips for sourcing, vendor meetings | Upgrading point-of-sale systems, display equipment |

| Service-Based | Purchasing supplies, materials for projects | Online marketing, content creation | Client meetings, professional development | Investing in new tools, software for service delivery |

| Food & Beverage | Purchasing ingredients, food supplies | Social media promotions, local advertising | Attending culinary events, industry conferences | Upgrading kitchen equipment, dining furniture |

Pros and Cons of Using Business Credit Cards for Specific Industries

While credit cards can be valuable tools, it’s essential to consider the potential challenges and best practices for specific industries:

| Industry | Pros | Cons | Best Practices |

|---|---|---|---|

| Technology Startups | Access to funding for rapid growth, building credit | High interest rates, potential for debt accumulation | Focus on short-term, high-impact expenses, prioritize repayment |

| Healthcare Businesses | Streamlining medical supply purchases, managing patient care expenses | Strict compliance regulations, potential for fraud | Utilize cards with robust security features, comply with HIPAA regulations |

| Construction Companies | Purchasing materials, equipment rentals, managing project expenses | Fluctuating project costs, potential for overspending | Track expenses meticulously, use cards with high credit limits |

Successful Startups Using Credit Cards for Growth

Numerous startups have effectively leveraged credit cards to fuel their growth and achieve their goals. For example,

“Airbnb, the global travel platform, initially used credit cards to cover operational expenses and marketing campaigns during its early stages, allowing them to scale rapidly.”

“Shopify, the e-commerce platform, utilized credit cards to purchase essential software and infrastructure, enabling them to build a robust online marketplace.”

These examples demonstrate how credit cards can provide the necessary financial flexibility for startups to navigate the initial growth phases and achieve their objectives.

Wrap-Up

Navigating the world of business credit cards requires a blend of strategic planning and responsible financial management. By carefully weighing the benefits and drawbacks, you can leverage credit cards as a valuable tool to fuel your business growth. Remember, building a strong credit history is essential for securing future funding and establishing a solid financial foundation for your startup’s success.

FAQ Resource

What are the minimum credit score requirements for a business credit card?

Credit score requirements vary depending on the issuer and the specific card. However, generally, a good credit score (above 670) is recommended for approval.

How do I build business credit?

Building business credit involves establishing a positive track record of responsible financial management. This includes paying bills on time, maintaining a healthy credit utilization ratio, and using business credit products like credit cards.

Can I use a personal credit card for business expenses?

While it’s possible, it’s generally not recommended. Using a personal credit card for business expenses can negatively impact your personal credit score and complicate tax reporting.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!