Equifax credit report for business is a comprehensive document that provides a detailed snapshot of your business’s financial health. It is a critical tool for lenders, investors, and even potential business partners to assess your creditworthiness and make informed decisions. Understanding the intricacies of your business credit report is essential for securing loans, obtaining financing, and ultimately, driving your business’s growth.

Equifax, one of the three major credit bureaus in the United States, plays a pivotal role in compiling and disseminating business credit reports. These reports offer a comprehensive view of your company’s financial history, including payment patterns, credit utilization, and any outstanding debts. Understanding the nuances of these reports can empower you to make strategic decisions that enhance your business’s credit standing and open doors to valuable financial opportunities.

Understanding Equifax Business Credit Reports: Equifax Credit Report For Business

Equifax business credit reports are crucial for lenders, investors, and suppliers to assess the financial health and creditworthiness of businesses. These reports provide a comprehensive overview of a company’s credit history, payment patterns, and overall financial performance.

Components of an Equifax Business Credit Report

An Equifax business credit report comprises several key components that offer insights into a company’s creditworthiness.

- Business Information: This section includes basic details about the business, such as its legal name, address, phone number, and industry.

- Trade Lines: This section lists the company’s credit accounts, including suppliers, lenders, and other creditors. It includes details such as account type, credit limit, outstanding balance, and payment history.

- Public Records: This section includes information about any legal actions or bankruptcies filed against the business.

- Inquiries: This section lists the companies that have accessed the business’s credit report in the past.

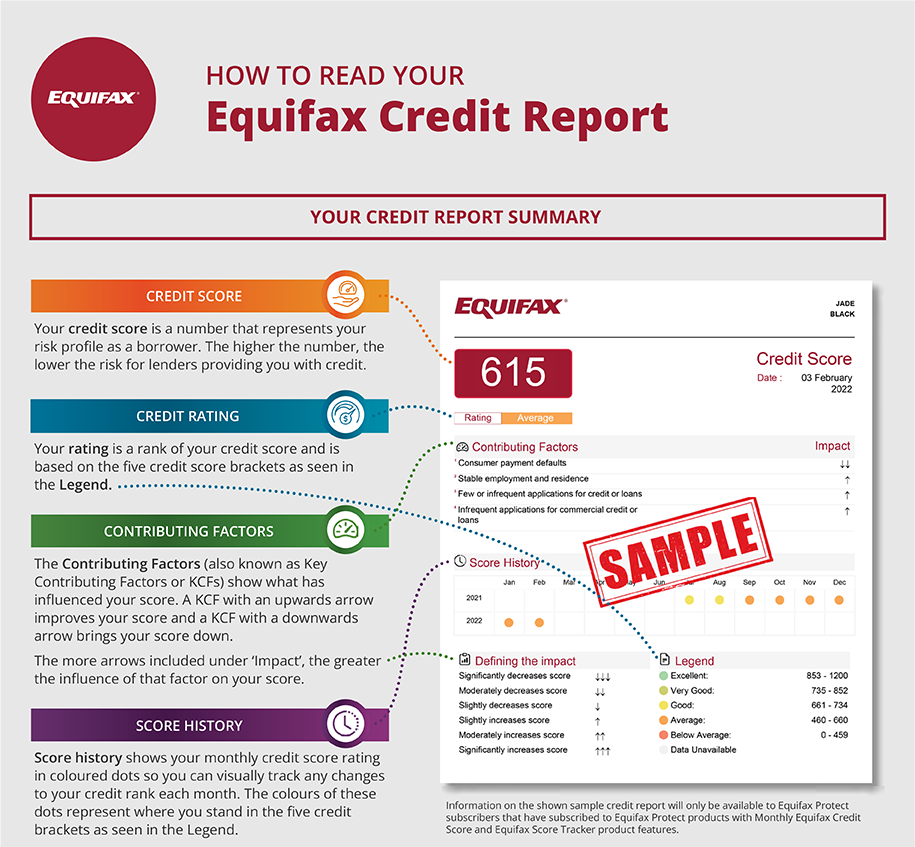

- Credit Score: This is a numerical representation of the company’s overall creditworthiness, based on its credit history and payment behavior.

Equifax Business Credit Scoring System

Equifax uses a proprietary scoring system to evaluate the creditworthiness of businesses. The score ranges from 0 to 100, with higher scores indicating better creditworthiness.

- Payment History: This is the most important factor in the scoring system, accounting for 35% of the score. Equifax analyzes the company’s payment history on its trade lines, including the number of late payments, missed payments, and collections.

- Credit Utilization: This factor represents the amount of credit the business is using compared to its available credit limit. It accounts for 30% of the score. A lower credit utilization ratio generally indicates better financial management.

- Credit Mix: This factor assesses the diversity of the business’s credit accounts, such as revolving credit, installment loans, and trade lines. It accounts for 15% of the score. A balanced credit mix can reflect responsible credit management.

- Length of Credit History: This factor considers the age of the business’s credit accounts. It accounts for 10% of the score. Longer credit history generally indicates a more established business with a track record of responsible credit use.

- New Credit: This factor considers the number of recent credit applications made by the business. It accounts for 10% of the score. Excessive new credit applications can negatively impact the score as they may suggest financial instability or increased risk.

Accessing and Obtaining Your Business Credit Report

Obtaining your business credit report from Equifax is a straightforward process. You can access your report online, by phone, or by mail.

Accessing Your Report Online

Equifax offers a secure online platform for accessing your business credit report. This is the most convenient and efficient method. To access your report, you will need to create an account with Equifax Business. You will then be able to view your report, download it, and track changes over time.

Accessing Your Report by Phone

You can also request your business credit report by phone. Equifax provides a dedicated phone number for this purpose. When calling, you will need to provide your business information, including your business name, address, and tax identification number.

Accessing Your Report by Mail

Equifax also allows you to request your business credit report by mail. To do so, you will need to download and complete a request form from the Equifax Business website. You can then mail the completed form to the address provided on the form.

Costs Associated with Obtaining a Business Credit Report

Equifax charges a fee for accessing your business credit report. The cost varies depending on the type of report you request. For example, a basic business credit report may cost around $20, while a more comprehensive report may cost upwards of $50.

It is important to note that these fees are subject to change.

Interpreting and Analyzing Your Business Credit Report

Your business credit report is a comprehensive snapshot of your company’s financial health. It provides valuable insights into your creditworthiness and how potential lenders and investors view your business. Understanding the information presented on the report is crucial for making informed decisions about your business’s financial future.

Understanding the Report’s Sections

Equifax business credit reports typically consist of several key sections. These sections provide a detailed overview of your business’s credit history, payment patterns, and overall financial performance.

- Business Information: This section includes your business’s legal name, address, phone number, and other identifying details. It also lists the type of business entity (e.g., sole proprietorship, corporation) and the industry your business operates in.

- Trade Lines: This section lists your business’s credit accounts, including loans, credit cards, and lines of credit. Each trade line includes the account type, credit limit (if applicable), current balance, payment history, and any open or closed status.

- Public Records: This section displays any public records related to your business, such as liens, judgments, and bankruptcies. These records can negatively impact your business’s credit score and may indicate potential financial difficulties.

- Inquiries: This section lists recent inquiries from lenders and other businesses that have accessed your business credit report. Too many inquiries can negatively affect your credit score, as it suggests that your business may be actively seeking credit.

- Credit Score: Your business credit score is a numerical representation of your business’s creditworthiness. It is calculated based on the information in your credit report, with higher scores indicating better credit health.

Identifying Red Flags and Areas of Concern

While a positive credit report is essential, it’s equally important to identify potential red flags or areas of concern. These issues can indicate financial instability or credit risk, which may deter lenders or investors from extending credit to your business.

- Late Payments: A history of late payments is a significant red flag. It indicates that your business may struggle to meet its financial obligations.

- High Credit Utilization: If your business has a high credit utilization ratio (the percentage of available credit that is being used), it suggests that your business may be heavily reliant on debt. This can make it difficult to secure additional financing.

- Public Records: The presence of public records, such as liens or judgments, indicates that your business has faced legal or financial challenges. These records can significantly damage your business’s credit score and make it difficult to obtain credit.

- Multiple Inquiries: A large number of inquiries on your business credit report can signal that your business is actively seeking credit, which may be perceived as a sign of financial instability.

- Negative Trade Lines: Trade lines with negative information, such as collections or charge-offs, can negatively impact your business’s credit score.

Analyzing Your Business Credit Report for Strengths and Weaknesses, Equifax credit report for business

Analyzing your business credit report is a crucial step in understanding your company’s financial health. By identifying both strengths and weaknesses, you can develop strategies to improve your creditworthiness and access more favorable financing options.

- Positive Payment History: A consistent history of on-time payments demonstrates your business’s financial responsibility and can improve your credit score.

- Low Credit Utilization: Maintaining a low credit utilization ratio suggests that your business is not heavily reliant on debt and has strong financial management practices.

- Limited Public Records: The absence of public records, such as liens or judgments, indicates that your business has a clean financial history and is not facing any significant legal or financial challenges.

- Positive Trade Lines: Trade lines with positive information, such as long-standing credit accounts with good payment histories, can enhance your business’s creditworthiness.

- Limited Inquiries: A limited number of inquiries on your business credit report suggests that your business is not actively seeking credit, which can be seen as a sign of financial stability.

Improving Your Business Credit Score

A strong business credit score is essential for securing loans, obtaining favorable terms from suppliers, and attracting investors. A higher credit score indicates a lower risk to lenders and suppliers, leading to better interest rates, lower fees, and more favorable payment terms. By taking proactive steps to improve your business credit score, you can unlock significant financial benefits and enhance your company’s overall financial health.

Positive Payment History

A consistent track record of timely payments is the most crucial factor influencing your business credit score. Paying your bills on time demonstrates your financial responsibility and reliability to lenders. Equifax and other credit bureaus track your payment history and assign a score based on your timely payment performance. A single late payment can negatively impact your score, while a history of on-time payments can significantly boost your score.

- Set reminders: Utilize calendar reminders or online payment tools to ensure timely payments.

- Automate payments: Set up automatic payments for recurring bills to avoid missed deadlines.

- Pay early: Paying bills early can positively impact your credit score, especially if you have a history of late payments.

- Monitor your credit reports: Regularly review your credit reports for any errors or discrepancies.

Credit Utilization

Credit utilization refers to the amount of credit you’re currently using compared to your total available credit. Lenders look at this ratio to assess your financial risk. A high credit utilization ratio (close to 100%) indicates that you’re heavily reliant on credit and may be struggling to manage your finances. A lower credit utilization ratio (ideally below 30%) suggests that you’re responsible with credit and have ample financial flexibility.

- Keep credit utilization low: Aim to keep your credit utilization ratio below 30%.

- Pay down balances: Reduce your outstanding balances on credit cards and loans to lower your utilization ratio.

- Increase credit limits: Request credit limit increases on existing accounts to lower your utilization ratio without increasing your debt.

The Role of Business Credit Reports in Lending and Financing

Business credit reports are crucial tools for lenders and financial institutions when evaluating loan applications and determining creditworthiness. These reports provide a comprehensive overview of a business’s financial history, including payment patterns, credit lines, and outstanding debt.

The Use of Business Credit Reports by Lenders

Lenders use business credit reports to assess the risk associated with lending to a particular business. By analyzing the information contained within the report, they can determine the likelihood of a business repaying its debts on time. This information is essential for making informed lending decisions and mitigating potential losses.

- Credit History: Lenders examine a business’s payment history to assess its reliability and track record. This includes information on past loans, credit lines, and other financial obligations.

- Credit Utilization: Lenders analyze how much credit a business is using compared to its available credit limit. A high credit utilization ratio can indicate financial strain or poor management practices.

- Public Records: Lenders review public records, such as lawsuits, liens, or bankruptcies, to identify any potential financial issues that could affect the business’s ability to repay its debts.

- Trade Lines: Lenders assess the business’s relationships with suppliers and other vendors to gauge its financial stability and payment practices. This information is often reflected in the business’s trade lines, which show its payment history with various creditors.

The Relationship Between a Good Credit Score and Loan Approval

A good business credit score significantly increases the likelihood of loan approval and secures favorable loan terms. Lenders generally view businesses with strong credit scores as lower-risk borrowers, leading to:

- Higher Approval Rates: Businesses with excellent credit scores are more likely to be approved for loans, as lenders perceive them as reliable and financially responsible.

- Lower Interest Rates: Lenders offer lower interest rates to businesses with strong credit scores, as they are less likely to default on their loans. This can save the business substantial interest payments over the loan’s life.

- More Favorable Loan Terms: Businesses with good credit scores often receive more favorable loan terms, such as longer repayment periods or lower down payments. This can provide more flexibility and financial breathing room.

- Access to Larger Loan Amounts: Lenders may be willing to provide larger loan amounts to businesses with excellent credit scores, as they are confident in their ability to repay the debt.

Potential Benefits of Having a Strong Business Credit Score

Maintaining a strong business credit score offers numerous benefits beyond loan approvals:

- Improved Business Reputation: A good credit score reflects a business’s financial health and responsible management practices, enhancing its reputation among suppliers, customers, and investors.

- Easier Access to Trade Credit: Suppliers and vendors are more likely to offer trade credit to businesses with strong credit scores, allowing them to purchase goods and services on credit and improve cash flow.

- Lower Insurance Premiums: Some insurance companies may offer lower premiums to businesses with good credit scores, as they are perceived as less risky policyholders.

- Attracting Investors: Investors are more likely to consider investing in businesses with strong credit scores, as it indicates financial stability and a lower risk of investment losses.

Equifax Business Credit Report vs. Personal Credit Report

Understanding the differences between your personal and business credit reports is crucial for managing your financial health effectively. While both reports track your credit history, they serve distinct purposes and are evaluated differently.

Impact of Personal Credit History on Business Credit Scores

Your personal credit history can significantly influence your business credit score, especially when starting a new business or seeking funding. Lenders often use your personal credit history to assess your overall creditworthiness, particularly if your business lacks a long credit history.

- Initial Credit Assessment: When applying for business credit, lenders may initially rely on your personal credit score to determine your risk profile. This is especially true for new businesses with limited credit history.

- Guarantees and Personal Liability: If you personally guarantee business loans or debts, your personal credit score will be directly impacted. Any missed payments or defaults on business obligations can negatively affect your personal credit score.

- Limited Business Credit: Businesses with a short credit history or limited credit activity may find that their personal credit score is a significant factor in determining loan terms and interest rates.

Importance of Maintaining Separate Business and Personal Credit

Keeping your business and personal credit separate is essential for several reasons.

- Credit Score Protection: Maintaining separate credit accounts helps safeguard your personal credit score from potential business-related risks. If your business experiences financial difficulties, your personal credit score is less likely to be affected.

- Improved Business Credit: Establishing a strong business credit history can lead to better loan terms and interest rates, even if your personal credit score is less than ideal.

- Financial Management: Separating your business and personal finances allows for clearer financial planning and budgeting, helping you track expenses and manage cash flow effectively.

Epilogue

Navigating the world of business credit reports can seem daunting, but understanding the fundamentals is essential for any business owner. By proactively monitoring your business credit report, taking steps to improve your score, and utilizing this information to your advantage, you can establish a strong financial foundation that paves the way for sustained success.

Common Queries

How often should I check my business credit report?

It’s recommended to review your business credit report at least annually, and more frequently if you’re actively seeking financing or making significant financial decisions.

What are the main factors that impact my business credit score?

Your business credit score is primarily influenced by payment history, credit utilization, length of credit history, and the number of inquiries on your report.

Can I dispute errors on my business credit report?

Yes, you can dispute inaccurate information on your business credit report. Contact Equifax directly to initiate the dispute process.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!