The line of credit loan business provides a flexible and accessible financing option for individuals and businesses. Unlike traditional loans, lines of credit offer a revolving credit facility, allowing borrowers to access funds as needed, up to a pre-approved limit. This unique feature makes lines of credit a popular choice for managing unexpected expenses, funding short-term projects, or consolidating existing debt.

This comprehensive guide delves into the intricacies of the line of credit loan business, exploring its various facets, including eligibility criteria, interest rates, credit management, and the evolving industry landscape. We will examine the advantages and drawbacks of utilizing a line of credit, providing insights to help readers make informed financial decisions.

Line of Credit Loan Basics

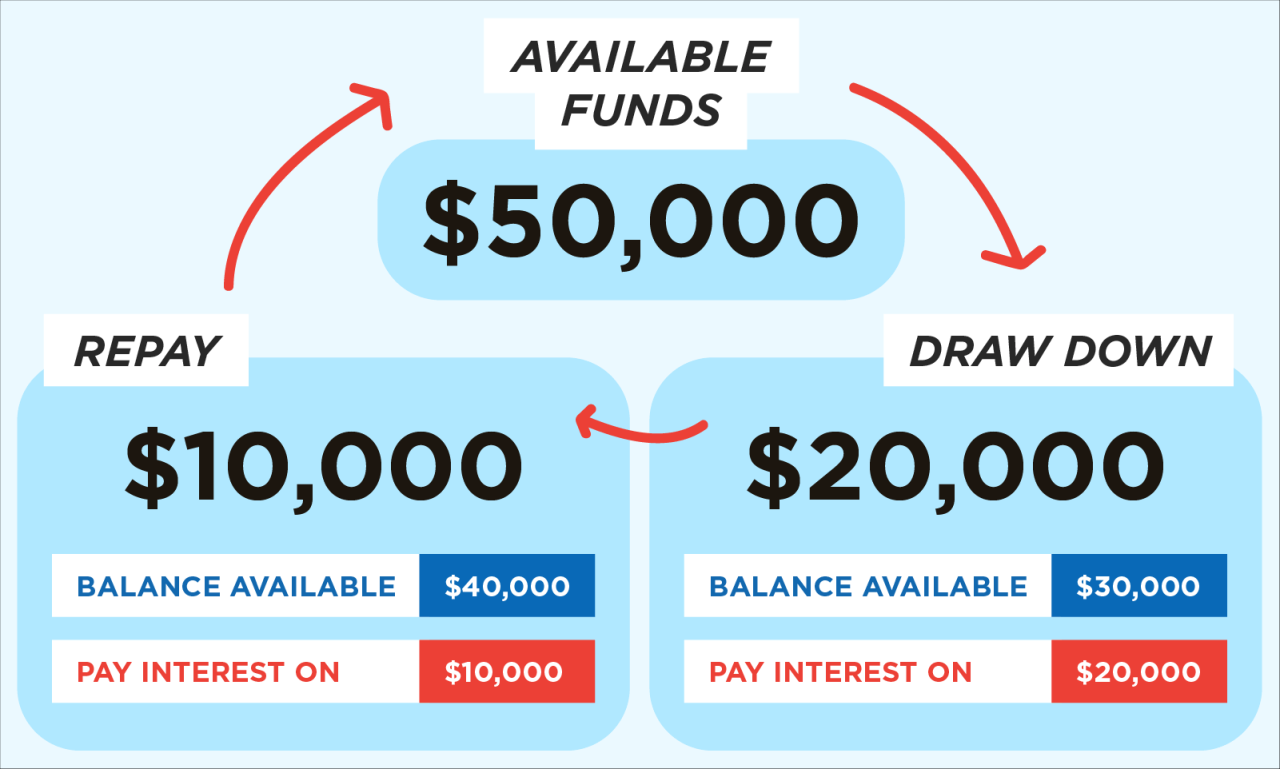

A line of credit loan is a flexible financing option that provides borrowers with a pre-approved amount of money they can access as needed. It functions like a revolving credit account, allowing you to borrow, repay, and borrow again within your credit limit. This contrasts with traditional loans, where you receive a lump sum upfront and repay it in fixed installments.

Understanding the Difference

Lines of credit and traditional loans differ in several key ways:

- Repayment Flexibility: With a line of credit, you only pay interest on the amount you borrow, and you can repay it at your own pace. Traditional loans require fixed monthly payments regardless of how much you’ve used.

- Access to Funds: A line of credit provides ongoing access to funds, allowing you to draw on it whenever you need money within your credit limit. Traditional loans provide a lump sum upfront, and you can’t access additional funds unless you apply for a new loan.

- Interest Rates: Interest rates on lines of credit are typically variable, meaning they can fluctuate based on market conditions. Traditional loans usually have fixed interest rates, which remain constant throughout the loan term.

Typical Uses of a Line of Credit

Lines of credit can be used for various purposes, including:

- Home Improvements: A line of credit can be a convenient way to finance home renovations or repairs, allowing you to pay for projects gradually as needed.

- Business Expenses: Businesses often use lines of credit to cover short-term operating expenses, such as inventory purchases or payroll.

- Debt Consolidation: Combining multiple high-interest debts into a single line of credit with a lower interest rate can help you save money on interest charges.

- Emergency Funds: Having a line of credit available can provide a safety net for unexpected expenses, such as medical bills or car repairs.

Eligibility and Application Process

Securing a line of credit requires meeting specific eligibility criteria and navigating a straightforward application process. Lenders evaluate applicants based on factors that demonstrate their creditworthiness and ability to repay the loan. The application process typically involves gathering essential documents, completing a credit check, and receiving a credit decision.

Eligibility Criteria

Lenders typically assess several factors to determine an applicant’s eligibility for a line of credit. These factors aim to gauge the applicant’s financial stability and ability to repay the loan responsibly.

- Credit Score: A good credit score is usually a prerequisite for obtaining a line of credit. Lenders typically prefer applicants with a credit score of at least 670, as it indicates a responsible credit history. A higher credit score often translates to lower interest rates and more favorable loan terms.

- Income: Lenders assess your income to ensure you can afford the monthly payments. They may require documentation of your income, such as pay stubs or tax returns. A stable income stream is crucial for demonstrating your ability to repay the loan.

- Debt-to-Income Ratio: This ratio measures your existing debt obligations relative to your income. Lenders prefer a lower debt-to-income ratio, indicating a greater capacity to handle additional debt.

- Credit History: Lenders review your credit history to assess your past borrowing behavior. A positive credit history with a history of timely payments is essential for securing a line of credit.

- Employment History: A stable employment history demonstrates your financial reliability and ability to make consistent payments. Lenders may require proof of employment, such as a recent pay stub or employment verification.

- Assets: While not always a primary factor, having significant assets can strengthen your application. Assets, such as savings accounts or investments, can provide lenders with assurance of your financial stability.

Application Process

The application process for a line of credit typically involves the following steps:

- Choose a Lender: Start by researching and selecting a lender that offers a line of credit that aligns with your needs and financial circumstances. Consider factors like interest rates, fees, and repayment terms.

- Gather Required Documents: Lenders will require certain documents to verify your identity, income, and creditworthiness.

- Complete the Application: Submit the completed application form with all necessary documentation to the lender.

- Credit Check: The lender will conduct a credit check to review your credit history and score.

- Review and Approval: The lender will review your application and make a credit decision. If approved, you will receive a credit limit and terms of the line of credit.

Required Documents, Line of credit loan business

Here is a table outlining the essential documents typically required for a line of credit application:

| Document | Purpose |

|---|---|

| Photo Identification (Driver’s License, Passport) | Verify your identity |

| Social Security Number | Verify your identity and credit history |

| Proof of Income (Pay Stubs, Tax Returns) | Demonstrate your ability to repay the loan |

| Bank Statements | Provide insight into your financial activity |

| Credit Report | Show your credit history and score |

| Employment Verification | Confirm your employment status and income |

Interest Rates and Fees

Understanding the interest rates and fees associated with a line of credit is crucial for making informed financial decisions. These factors directly impact the overall cost of borrowing and can vary significantly depending on the lender and the type of line of credit you choose.

Interest Rate Structures

Interest rates on line of credit loans are typically variable, meaning they fluctuate based on market conditions. This is in contrast to fixed-rate loans, where the interest rate remains the same for the duration of the loan term.

- Variable Interest Rates: These rates are tied to a benchmark, such as the prime rate or LIBOR (London Interbank Offered Rate), and are adjusted periodically. This means your interest rate can go up or down, depending on market fluctuations.

- Fixed Interest Rates: Some line of credit options offer fixed interest rates, providing stability and predictability in your monthly payments. However, fixed-rate lines of credit are less common and may come with higher interest rates.

Common Fees Associated with Line of Credit Loans

In addition to interest rates, line of credit loans may come with various fees, which can add to the overall cost of borrowing.

- Annual Fee: Some lenders charge an annual fee for maintaining the line of credit.

- Origination Fee: This fee is charged at the time the line of credit is established. It is typically a percentage of the credit limit.

- Draw Fee: Some lenders charge a fee each time you draw money from your line of credit.

- Interest Calculation Fee: This fee is typically charged on a monthly basis and covers the administrative costs associated with calculating interest charges.

Interest Rate and Fee Calculation

Understanding how interest rates and fees are calculated is essential for comparing different line of credit options.

- Interest Rate Calculation: Interest rates are typically calculated based on a daily interest rate, which is determined by dividing the annual interest rate by 365 days. The daily interest rate is then multiplied by the outstanding balance of the line of credit to determine the daily interest charge.

- Fee Calculation: Fees are typically charged as a flat fee or a percentage of the credit limit or the amount borrowed. The specific calculation method will vary depending on the lender and the type of fee.

Example: A line of credit with a $10,000 credit limit and a 5% annual interest rate would have a daily interest rate of 0.0137% (5% / 365 days). If you borrow $5,000 from the line of credit, the daily interest charge would be $0.685 (0.0137% * $5,000).

Final Summary

Navigating the line of credit loan business requires a thorough understanding of its mechanics and associated risks. By carefully evaluating eligibility criteria, interest rates, and credit management strategies, borrowers can leverage the flexibility and accessibility of lines of credit to achieve their financial goals. As the industry continues to evolve, staying informed about emerging trends and regulatory changes is crucial for making responsible and advantageous financial decisions.

Key Questions Answered: Line Of Credit Loan Business

What is the difference between a line of credit and a personal loan?

A line of credit is a revolving credit facility, allowing you to borrow money as needed, up to a pre-approved limit. A personal loan is a fixed sum of money that you borrow at once, with a fixed repayment schedule.

How does credit utilization affect my credit score?

Credit utilization is the percentage of your available credit that you are using. A high credit utilization ratio can negatively impact your credit score. Aim to keep your utilization below 30% for optimal credit health.

What are some common fees associated with a line of credit?

Common fees include annual fees, interest charges, late payment fees, and overdraft fees. Carefully review the terms and conditions of your line of credit agreement to understand all associated fees.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!