Low APR business credit cards can be a game-changer for businesses seeking to manage cash flow and minimize interest charges. These cards offer lower interest rates compared to traditional business credit cards, allowing you to stretch your budget and potentially save on financing costs. But with so many options available, choosing the right card can feel overwhelming.

This guide delves into the world of low APR business credit cards, covering everything from eligibility requirements and choosing the right card to using it strategically and avoiding potential risks. Whether you’re a seasoned entrepreneur or just starting out, understanding the ins and outs of these cards can be invaluable for your financial success.

Understanding Low APR Business Credit Cards

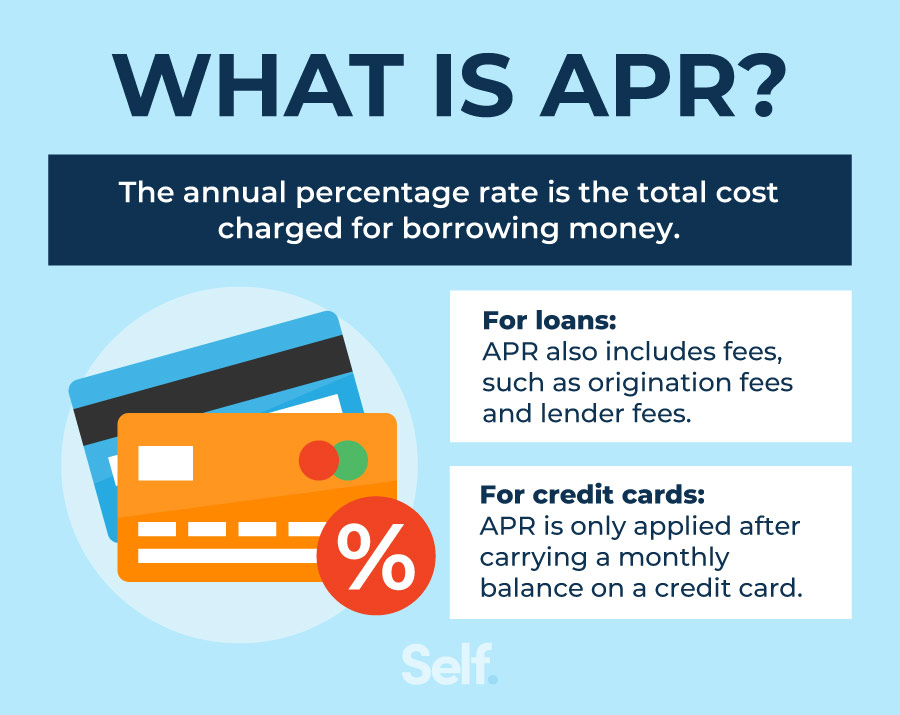

A low APR business credit card can be a valuable tool for businesses that need to manage their finances effectively. APR stands for Annual Percentage Rate, which is the annual interest rate charged on outstanding balances. Understanding APR and its implications for your business is crucial for making informed financial decisions.

Low APR Business Credit Cards vs. Other Types

Low APR business credit cards differ from other types of business credit cards in their primary focus. While other cards may emphasize rewards, cash back, or travel perks, low APR cards prioritize minimizing interest charges. This makes them particularly advantageous for businesses that carry balances or anticipate needing extended payment terms.

- Low APR cards: Designed to help businesses save money on interest charges by offering a lower APR compared to other types of cards.

- Rewards cards: Focus on offering rewards like cash back, points, or travel miles for purchases made with the card.

- Cash back cards: Offer a percentage of cash back on purchases made with the card.

- Travel cards: Provide travel-related benefits, such as airline miles, hotel points, or airport lounge access.

Benefits of Low APR Business Credit Cards

Low APR business credit cards offer several benefits for businesses, particularly those seeking to manage their finances effectively. The primary advantage is the lower interest rate, which can translate to significant savings over time, especially for businesses carrying balances.

- Lower interest charges: The primary benefit of low APR cards is the reduced interest charged on outstanding balances. This can significantly impact a business’s bottom line, especially if carrying a balance for an extended period.

- Predictable monthly payments: A fixed APR provides businesses with predictable monthly payments, allowing for better budgeting and financial planning.

- Flexible payment options: Low APR cards often offer flexible payment options, allowing businesses to choose a payment schedule that aligns with their cash flow needs.

- Improved credit score: Responsible use of a low APR card, including timely payments, can help improve a business’s credit score, which can be beneficial for future financing needs.

Drawbacks of Low APR Business Credit Cards

While low APR cards offer several benefits, it’s essential to consider their potential drawbacks.

- Limited rewards or perks: Low APR cards often prioritize low interest rates over rewards programs or other perks, so businesses may not receive cash back, points, or travel benefits.

- Higher annual fees: Some low APR cards may have higher annual fees compared to other types of cards, offsetting some of the interest savings.

- Introductory APR periods: Many low APR cards offer introductory rates for a limited period, after which the APR may revert to a higher standard rate.

- Strict eligibility requirements: Low APR cards may have stricter eligibility requirements compared to other cards, making it challenging for some businesses to qualify.

Eligibility and Requirements for Low APR Business Credit Cards

Securing a low APR business credit card often requires meeting specific eligibility criteria. Issuers carefully assess applicants to ensure they pose minimal risk.

Factors Affecting Eligibility for Low APR Business Credit Cards

Creditworthiness plays a significant role in determining eligibility for low APR business credit cards. This involves your personal credit score and your business’s financial health. Issuers typically consider the following factors:

- Personal Credit Score: Your personal credit score is a crucial indicator of your financial responsibility. A higher score, generally above 700, is more likely to result in approval for a low APR card.

- Business Credit Score: A strong business credit score, often measured by a Dun & Bradstreet (D&B) score, is essential for demonstrating your business’s financial stability. A higher score indicates a lower risk for the issuer.

- Business Revenue: Issuers may consider your business’s revenue to assess its financial viability. A steady and consistent revenue stream can enhance your chances of approval.

- Time in Business: Establishing a business takes time, and lenders often prefer applicants with a proven track record. Being in business for a longer period, typically at least a year, can improve your eligibility.

- Debt-to-Income Ratio: Your debt-to-income ratio (DTI) reflects the proportion of your income used to pay off existing debts. A lower DTI suggests you have more financial flexibility, making you a more attractive applicant.

- Industry: Certain industries may be considered higher risk than others. Issuers might have specific requirements for businesses in these industries.

Improving Your Chances of Approval

Taking steps to enhance your creditworthiness can significantly increase your chances of securing a low APR business credit card. Here are some tips:

- Build a Strong Personal Credit History: Pay bills on time, keep credit utilization low, and avoid opening too many new credit accounts.

- Establish Business Credit: Obtain a business credit card, pay your suppliers on time, and report your business information to credit bureaus.

- Increase Business Revenue: Focus on strategies to grow your business and generate a consistent revenue stream.

- Reduce Debt: Pay down existing debt to improve your debt-to-income ratio and demonstrate financial responsibility.

Choosing the Right Low APR Business Credit Card

Finding the right low APR business credit card requires careful consideration of your specific needs and financial situation. It’s important to compare different cards based on their APR, annual fees, rewards programs, and other features to make an informed decision.

Comparing Low APR Business Credit Cards

Here’s a table comparing some popular low APR business credit cards:

| Card | APR | Annual Fee | Rewards Program | Other Features |

|---|---|---|---|---|

| Chase Ink Business Cash® Credit Card | 14.99% – 22.99% Variable APR | $0 | 5% cash back on the first $25,000 spent each quarter in select categories, 1% cash back on all other purchases | 0% intro APR for 12 months on purchases and balance transfers, no foreign transaction fees |

| Capital One Spark Cash for Business | 14.99% – 22.99% Variable APR | $0 | 2% cash back on all purchases | Unlimited 2% cash back, no foreign transaction fees |

| U.S. Bank Business Leverage Visa Signature Card | 14.99% – 22.99% Variable APR | $0 | 2 points per $1 spent on purchases, 1 point per $1 spent on travel and dining | Redeem points for travel, merchandise, and gift cards, no foreign transaction fees |

Using a Low APR Business Credit Card Strategically

A low APR business credit card can be a valuable tool for managing cash flow and minimizing interest charges. By using it strategically, you can maximize its benefits and keep your business finances healthy.

Creating a Plan for Effective Utilization

To use a low APR business credit card strategically, it’s essential to create a plan that Artikels how you’ll use it and how you’ll manage your payments. This plan should consider your business’s spending patterns and cash flow cycles.

- Track Your Spending: Monitor your business expenses closely to understand your spending habits and identify areas where you can potentially use your credit card. This will help you make informed decisions about when and how to use your card.

- Set Spending Limits: Establish a clear spending limit for your business credit card. This will help you avoid overspending and accumulating excessive debt.

- Pay Your Balance in Full: If possible, pay your balance in full each month to avoid accruing interest charges. This is the most effective way to take advantage of a low APR and keep your credit utilization low.

- Use the Card for Recurring Expenses: Consider using your low APR business credit card for recurring expenses like utilities, rent, or subscriptions. This can help you manage cash flow and potentially earn rewards.

- Consider a Balance Transfer: If you have existing high-interest debt, you may want to consider transferring it to your low APR business credit card. However, be aware of any balance transfer fees and ensure that the new APR is significantly lower than your existing rate.

The Importance of Timely Payments

Promptly paying your balance is crucial to avoid late fees and negative impacts on your credit score. Late payments can lead to:

- Increased Interest Charges: Late payments can trigger penalty APRs, significantly increasing your interest charges.

- Damaged Credit Score: Late payments are reported to credit bureaus and can negatively impact your credit score, making it harder to obtain financing in the future.

- Account Closure: Repeated late payments can result in your credit card issuer closing your account, limiting your access to credit.

Maximizing Rewards Programs and Benefits

Many low APR business credit cards offer rewards programs and other benefits. Taking advantage of these can help you save money and improve your business operations.

- Cash Back Rewards: Some cards offer cash back rewards on purchases, which can be redeemed for cash or used to offset business expenses.

- Travel Rewards: Cards may offer points or miles that can be redeemed for travel expenses, including flights, hotels, and car rentals.

- Purchase Protection: Certain cards provide purchase protection against damage or theft, giving you peace of mind for your business purchases.

- Extended Warranties: Some cards extend the manufacturer’s warranty on eligible purchases, offering additional protection for your business assets.

- Travel Insurance: Some cards include travel insurance benefits, such as trip cancellation or baggage delay coverage.

Potential Risks and Considerations

While low APR business credit cards offer significant financial advantages, it’s crucial to understand the potential risks associated with credit card debt and the importance of responsible borrowing practices. Failure to manage credit card debt effectively can lead to serious financial consequences, impacting your business’s growth and stability.

Understanding the Risks of High Credit Card Debt

High credit card debt can significantly strain your business’s finances. Interest charges on outstanding balances can quickly accumulate, eating into your profits and making it difficult to manage other business expenses. Here are some key risks:

- High Interest Charges: Credit cards often come with high APRs, which can quickly escalate your debt burden. If you’re unable to pay your balance in full each month, you’ll accrue interest charges, potentially leading to a snowball effect where your debt grows rapidly.

- Negative Impact on Credit Score: Late payments or exceeding your credit limit can negatively impact your business credit score, making it harder to obtain loans or secure favorable terms in the future.

- Limited Cash Flow: Significant credit card debt can tie up your cash flow, making it difficult to invest in business growth or manage unexpected expenses.

- Potential for Legal Action: If you fail to make payments, your creditors may take legal action, such as wage garnishment or asset seizure, to recover their funds.

Epilogue

By understanding the benefits and potential drawbacks of low APR business credit cards, businesses can make informed decisions that align with their financial goals. Remember, responsible borrowing and budgeting are crucial for maintaining a healthy financial standing. Whether you’re seeking to consolidate debt, fund business expansion, or simply manage everyday expenses, a low APR business credit card can be a valuable tool when used strategically.

FAQ Guide

What is the difference between a low APR business credit card and a traditional business credit card?

A low APR business credit card typically offers a lower interest rate compared to a traditional business credit card. This means you’ll pay less in interest charges over time, making it a more cost-effective option for managing debt.

How can I improve my chances of getting approved for a low APR business credit card?

Building a strong credit history, maintaining good business revenue, and demonstrating a responsible financial track record are key factors in securing approval. Consider paying bills on time, keeping credit utilization low, and minimizing unnecessary credit applications.

What are some common benefits of using a low APR business credit card?

Common benefits include lower interest charges, potential rewards programs, cash back offers, travel points, and the ability to build business credit.

What are some potential risks associated with using a low APR business credit card?

Potential risks include accumulating high debt if not used responsibly, incurring late fees if payments are missed, and the potential for hidden fees or annual fees.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!