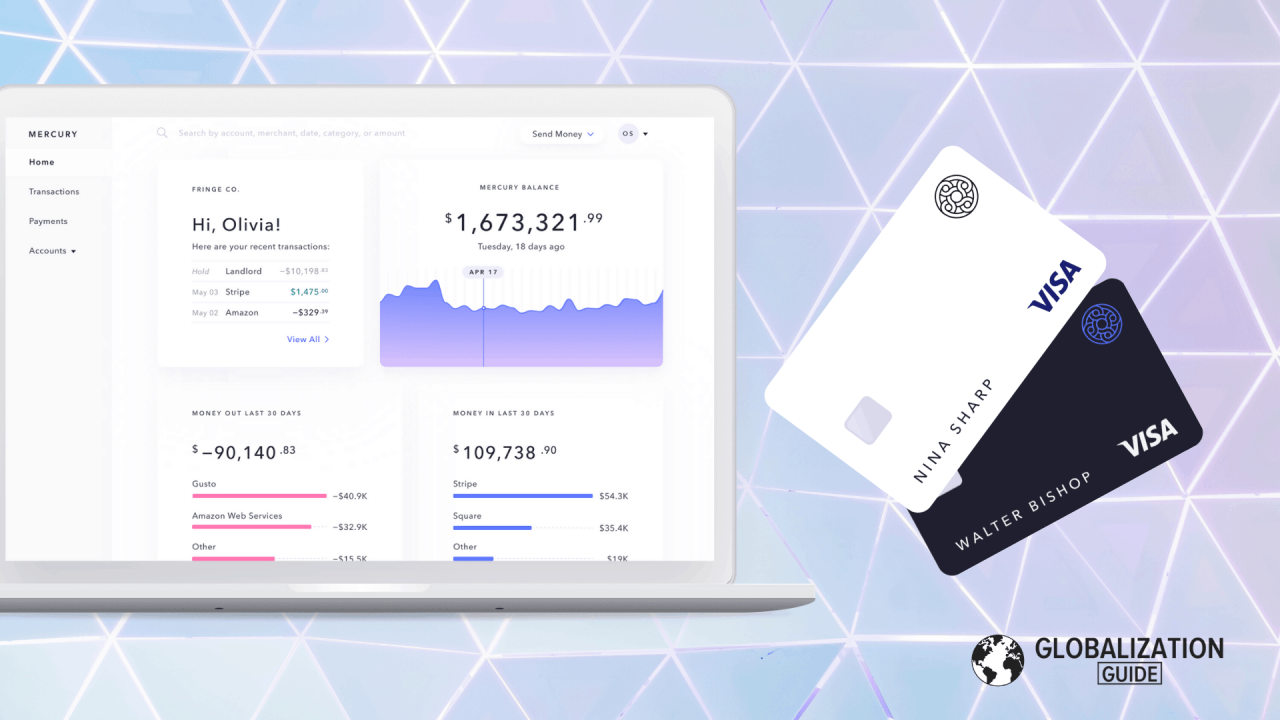

The Mercury Bank Business Credit Card sets the stage for this comprehensive guide, offering readers a detailed exploration of its features, benefits, and considerations. This credit card is designed to cater to the needs of small business owners and entrepreneurs, providing them with a range of tools and resources to manage their finances effectively. From rewards programs and travel insurance to interest rates and application processes, this guide covers all aspects of the Mercury Bank Business Credit Card, providing a thorough understanding of its potential value for your business.

The Mercury Bank Business Credit Card stands out for its user-friendly interface, robust security measures, and commitment to customer satisfaction. Whether you’re a seasoned entrepreneur or just starting your business journey, this credit card offers a compelling option to streamline your financial management and unlock valuable rewards.

Mercury Bank Business Credit Card Overview

The Mercury Bank Business Credit Card is designed to meet the financial needs of small business owners and entrepreneurs. This card offers a range of features and benefits that can help businesses manage their expenses, build credit, and earn rewards.

Target Audience

The Mercury Bank Business Credit Card is primarily targeted towards small business owners, entrepreneurs, and freelancers who require a credit card specifically tailored for their business needs. This card caters to individuals who are looking to consolidate business expenses, earn rewards on business purchases, and build their business credit.

Eligibility Criteria

To be eligible for the Mercury Bank Business Credit Card, applicants must meet the following criteria:

- Be at least 18 years of age

- Have a valid Social Security number

- Have a good credit history

- Have a business bank account

- Provide business documentation, such as a business license or tax ID number

Rewards and Benefits

The Mercury Bank Business Credit Card offers a comprehensive rewards program and valuable benefits designed to help businesses grow and thrive. These perks provide tangible value, making the card a worthwhile investment for entrepreneurs and business owners.

Rewards Program

The Mercury Bank Business Credit Card rewards program is structured to cater to the spending patterns of businesses. Cardholders earn rewards points for every dollar spent on eligible purchases. These points can be redeemed for a variety of travel, merchandise, and cash back options, providing flexibility and value.

- Earn Points: Cardholders earn 1 point for every dollar spent on eligible purchases.

- Redemption Options: Points can be redeemed for travel, merchandise, or cash back.

- Travel Rewards: Redeem points for flights, hotel stays, car rentals, and other travel experiences.

- Merchandise Rewards: Points can be exchanged for a wide range of merchandise, including electronics, home goods, and gift cards.

- Cash Back Rewards: Points can be redeemed for cash back deposited directly into the cardholder’s account.

Benefits

The Mercury Bank Business Credit Card offers a suite of benefits designed to enhance the cardholder’s business experience and provide peace of mind.

- Travel Insurance: Enjoy comprehensive travel insurance coverage for unexpected events, such as trip cancellation, baggage delay, and medical emergencies.

- Purchase Protection: Protect your business purchases against damage, theft, or loss for a specified period.

- Extended Warranty: Extend the manufacturer’s warranty on eligible purchases, providing greater peace of mind and value.

- Zero Liability Fraud Protection: Rest assured that you are protected against unauthorized charges with zero liability fraud protection.

Comparison with Other Business Credit Cards

The Mercury Bank Business Credit Card stands out in the market by offering a competitive rewards program and a robust suite of benefits.

- Rewards: Compared to other business credit cards, the Mercury Bank Business Credit Card offers a generous earning rate and a wide range of redemption options.

- Benefits: The card’s benefits package, including travel insurance and purchase protection, is comprehensive and valuable for business owners.

- Overall Value: The combination of rewards and benefits makes the Mercury Bank Business Credit Card a compelling option for businesses seeking to maximize value and convenience.

Fees and Interest Rates

Understanding the fees and interest rates associated with the Mercury Bank Business Credit Card is crucial for maximizing its benefits and minimizing potential costs. This section will provide a detailed breakdown of these financial aspects, helping you make informed decisions about your business spending.

Annual Fee

The annual fee for the Mercury Bank Business Credit Card is a recurring charge that is billed annually. The specific amount of the annual fee can vary depending on the card’s tier or specific features. For example, a premium card with travel perks might have a higher annual fee than a basic business card.

Transaction Fees

Transaction fees are charged for specific activities related to your card usage. These fees can include:

- Foreign transaction fees: These fees apply when you make purchases in a currency other than the card’s primary currency.

- Cash advance fees: These fees are charged when you withdraw cash from an ATM or through a cash advance service.

- Balance transfer fees: These fees are charged when you transfer a balance from another credit card to your Mercury Bank Business Credit Card.

Late Payment Fees

Late payment fees are penalties imposed when you fail to make your minimum payment by the due date. The amount of the late payment fee can vary depending on the card’s terms and conditions.

Interest Rates

The interest rate, also known as the Annual Percentage Rate (APR), is the cost of borrowing money on your Mercury Bank Business Credit Card. The APR can vary depending on your creditworthiness and the card’s current promotional offers.

Impact of Fees and Interest Rates

The fees and interest rates associated with the Mercury Bank Business Credit Card can significantly impact the overall cost of using the card. It’s crucial to understand these costs and factor them into your financial planning. For example, if you frequently make foreign transactions, the foreign transaction fees could add up over time. Similarly, carrying a balance on your card can lead to significant interest charges, which can erode the value of your rewards.

Application Process: Mercury Bank Business Credit Card

Applying for the Mercury Bank Business Credit Card is a straightforward process that can be completed online or by phone. The application requires basic information about your business and your personal credit history.

The application process typically involves several steps, including:

Required Documentation

The documentation required for a business credit card application can vary depending on the lender. However, some common documents include:

- Business Information: This includes your business name, address, phone number, website, and industry.

- Financial Statements: You may be required to provide your business’s balance sheet, income statement, and cash flow statement.

- Personal Information: This includes your name, address, Social Security number, and date of birth.

- Credit History: The lender may request a copy of your personal credit report and score.

Application Process

Here’s a breakdown of the typical application process:

- Gather Required Documentation: Before you begin the application, ensure you have all the necessary documents ready.

- Complete the Application: You can apply for the Mercury Bank Business Credit Card online or by phone. The online application process typically involves filling out a form with your business and personal information.

- Submit Your Application: Once you have completed the application, submit it to Mercury Bank.

- Review and Approval: Mercury Bank will review your application and documentation. The review process can take a few days to a few weeks, depending on the complexity of your application and the lender’s workload.

- Notification: Once a decision has been made, you will be notified via email or phone. If your application is approved, you will receive your credit card in the mail.

Processing Time

The average processing time for a business credit card application is typically 7 to 14 business days. However, several factors can affect processing speed, including:

- Completeness of Application: If your application is missing information or documentation, it may take longer to process.

- Credit History: If you have a strong credit history, your application may be processed faster.

- Business Type: Applications from certain business types may be subject to additional scrutiny, which could extend the processing time.

- Lender’s Workload: If the lender is experiencing a high volume of applications, it may take longer to process your application.

Improving Approval Chances

To improve your chances of being approved for the Mercury Bank Business Credit Card, consider the following:

- Maintain a Good Credit Score: A strong personal credit score can significantly increase your chances of approval.

- Provide Accurate and Complete Information: Ensure that all the information you provide in your application is accurate and complete. Inaccurate or incomplete information can delay the processing of your application or even lead to rejection.

- Demonstrate Strong Financial Performance: Provide evidence of your business’s financial stability, such as financial statements and tax returns. This will show the lender that you have a solid track record and can manage your credit responsibly.

- Meet the Minimum Requirements: Ensure you meet the minimum requirements for the Mercury Bank Business Credit Card, such as having a minimum credit score and being in business for a certain period.

Customer Service and Support

Navigating the world of business credit cards can sometimes feel like a maze, but with Mercury Bank’s commitment to customer service, you can rest assured that help is just a call, chat, or email away.

Mercury Bank understands that your time is valuable and strives to provide a seamless experience when you need assistance. Their dedicated customer service team is available to answer your questions, address your concerns, and provide guidance on all aspects of your Mercury Bank Business Credit Card.

Contacting Mercury Bank

- Phone Support: Mercury Bank offers a 24/7 phone support line, ensuring that you can reach a representative at any time, day or night. This ensures that you can get immediate assistance when you need it most. The phone number is prominently displayed on their website and your credit card statement.

- Online Chat: For quick and convenient assistance, Mercury Bank also provides a live chat feature on their website. This allows you to connect with a customer service representative directly through their website, without the need for a phone call.

- Email Support: If your inquiry requires a more detailed response or involves sensitive information, you can contact Mercury Bank via email. Their website provides a dedicated email address for customer service inquiries.

Customer Service Responsiveness

Mercury Bank’s customer service team is known for its responsiveness and helpfulness. They are dedicated to providing prompt and efficient service, ensuring that your inquiries are resolved quickly and effectively.

Overall Customer Experience, Mercury bank business credit card

Mercury Bank consistently receives positive feedback from its customers regarding their customer service. Online reviews and ratings often highlight the bank’s friendly, knowledgeable, and efficient customer support team. Customers appreciate the bank’s dedication to resolving issues quickly and effectively, as well as their willingness to go the extra mile to ensure customer satisfaction.

Pros and Cons

Making the right choice for your business credit card can be a challenge. To help you decide if the Mercury Bank Business Credit Card is right for you, here’s a breakdown of its pros and cons.

Pros and Cons of the Mercury Bank Business Credit Card

The Mercury Bank Business Credit Card offers several benefits for businesses, but it also has some limitations. Here’s a breakdown of the pros and cons to help you make an informed decision.

| Pros | Cons |

|---|---|

|

|

Alternatives

Finding the right business credit card can be a challenge, especially with the plethora of options available. While the Mercury Bank Business Credit Card offers competitive features, it’s essential to explore other options that might better suit your specific business needs and preferences.

Comparison with Other Business Credit Cards

The following table compares the Mercury Bank Business Credit Card with several popular alternatives, highlighting key features, benefits, and drawbacks:

| Feature | Mercury Bank Business Credit Card | Chase Ink Business Preferred® Credit Card | American Express Blue Business Plus Credit Card | Capital One Spark Miles for Business |

|---|---|---|---|---|

| Annual Fee | $0 | $95 | $0 | $0 |

| Welcome Bonus | 50,000 bonus points after spending $3,000 in the first 3 months | 80,000 bonus points after spending $5,000 in the first 3 months | 50,000 bonus points after spending $3,000 in the first 3 months | 50,000 bonus miles after spending $5,000 in the first 3 months |

| Rewards Program | 1 point per $1 spent | 3 points per $1 spent on travel, dining, and shipping; 1 point per $1 spent on all other purchases | 2 points per $1 spent on eligible purchases; 1 point per $1 spent on all other purchases | 2 miles per $1 spent on all purchases |

| Redemption Options | Points can be redeemed for cash back, travel, gift cards, and merchandise | Points can be redeemed for travel, merchandise, and gift cards | Points can be redeemed for travel, merchandise, and gift cards | Miles can be redeemed for travel, merchandise, and gift cards |

| Other Benefits | 0% intro APR on purchases for 12 months | Purchase protection, extended warranty, travel insurance | Purchase protection, extended warranty, travel insurance | Purchase protection, extended warranty, travel insurance |

| Drawbacks | Limited rewards earning potential compared to other cards | High annual fee | Limited bonus categories | Limited redemption options |

Alternatives for Specific Business Needs

- For businesses with high travel expenses: The Chase Ink Business Preferred® Credit Card offers 3 points per $1 spent on travel, dining, and shipping, making it a valuable option for businesses that frequently travel. This card’s high annual fee may be offset by its generous rewards program.

- For businesses with a focus on maximizing rewards: The American Express Blue Business Plus Credit Card offers 2 points per $1 spent on eligible purchases, which includes a wide range of categories like online advertising, shipping, and office supplies. This card’s limited bonus categories may be a drawback for businesses that primarily spend in other categories.

- For businesses that prioritize simplicity: The Capital One Spark Miles for Business offers 2 miles per $1 spent on all purchases, providing a consistent rewards rate without complex bonus categories. This card’s limited redemption options may be a drawback for businesses seeking flexibility in redeeming their rewards.

Outcome Summary

In conclusion, the Mercury Bank Business Credit Card presents a compelling option for business owners seeking a comprehensive and rewarding financial solution. Its attractive rewards program, valuable benefits, and user-friendly platform make it a competitive choice in the market. However, careful consideration of fees, interest rates, and eligibility criteria is essential to ensure that this card aligns with your specific business needs and financial goals. By thoroughly evaluating the pros and cons and comparing it with alternative options, you can make an informed decision about whether the Mercury Bank Business Credit Card is the right fit for your business.

Clarifying Questions

What are the eligibility requirements for the Mercury Bank Business Credit Card?

Eligibility criteria typically include a good credit score, a valid business license, and a minimum annual revenue for your business. It’s recommended to review the specific requirements on the Mercury Bank website.

What are the annual fees associated with the Mercury Bank Business Credit Card?

The annual fee for the Mercury Bank Business Credit Card is typically disclosed during the application process. It’s crucial to consider this fee as part of your overall cost analysis when comparing different credit card options.

How do I redeem the rewards earned with the Mercury Bank Business Credit Card?

Rewards redemption methods vary depending on the specific program. Common options include cash back, travel points, gift cards, or merchandise. Details on redemption options are typically Artikeld in the cardholder agreement.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!