No income verification business line of credit presents a unique opportunity for businesses seeking funding without traditional income documentation. This financing option caters to companies that may not have traditional income statements or prefer to keep their financial details private. However, it’s essential to understand the nuances of this financing approach, including its advantages, disadvantages, and potential risks.

These lines of credit are often based on factors like business credit score, revenue history, and business age. While they offer a faster and more convenient way to access capital, they typically come with higher interest rates and shorter repayment terms compared to traditional business loans.

Understanding No Income Verification Business Lines of Credit

A no income verification business line of credit, also known as a “no doc” business loan, is a type of financing that doesn’t require borrowers to provide traditional documentation of their income, such as tax returns or bank statements. This makes it a more accessible option for businesses that may not have the documentation required for traditional loans, or those who prefer to keep their financial information private.

Target Audience

No income verification business lines of credit are typically targeted towards businesses with:

- Strong credit scores and a history of good financial management.

- Significant assets, such as real estate or equipment, that can be used as collateral.

- A need for short-term financing, such as for working capital or inventory.

Advantages

No income verification business lines of credit offer several advantages, including:

- Faster approval process: Since lenders don’t need to verify income, the approval process can be much faster than for traditional loans.

- More flexible terms: No income verification loans often have more flexible repayment terms, such as shorter terms or variable interest rates.

- Greater privacy: Borrowers don’t have to disclose their financial information to lenders, which can be beneficial for businesses that prefer to keep their finances private.

Disadvantages

While no income verification business lines of credit offer several advantages, they also come with some drawbacks:

- Higher interest rates: Since lenders are taking on more risk by not verifying income, they often charge higher interest rates on no income verification loans.

- Limited borrowing amounts: The borrowing amounts available with no income verification loans are typically lower than traditional loans.

- Less forgiving terms: If a business defaults on a no income verification loan, lenders may be less forgiving than with traditional loans.

Comparison with Traditional Business Loans

- Traditional business loans typically require borrowers to provide extensive documentation of their income and financial history. This can make the approval process longer and more complicated. However, traditional loans often have lower interest rates and higher borrowing amounts than no income verification loans.

- No income verification business lines of credit are a faster and more flexible option, but they come with higher interest rates and lower borrowing amounts. They are also more risky for borrowers, as lenders may be less forgiving if a business defaults on the loan.

Eligibility and Qualification Criteria

Securing a no income verification business line of credit requires meeting specific eligibility criteria. Lenders carefully evaluate various factors to assess your business’s creditworthiness and determine if you qualify for this type of financing.

Factors Considered for Eligibility

Lenders consider several factors when evaluating applications for no income verification business lines of credit. These factors help them assess the risk associated with lending to your business and determine your ability to repay the loan.

- Business Credit Score: Your business credit score is a crucial indicator of your creditworthiness. A higher score demonstrates responsible financial management and increases your chances of approval.

- Business Revenue: Lenders typically require a minimum level of business revenue to ensure you have sufficient cash flow to repay the loan. They may consider your revenue history and projections for future growth.

- Business Age: The age of your business is a factor that reflects its stability and track record. Newer businesses may face stricter eligibility requirements or higher interest rates.

- Business Plan: A well-structured business plan outlining your business goals, financial projections, and strategies for repayment is essential. It demonstrates your understanding of your business and your ability to manage it effectively.

- Financial History: Lenders review your business’s financial history, including bank statements, tax returns, and other relevant documents, to assess your financial performance and identify any potential red flags.

Importance of a Strong Business Plan and Financial History

A strong business plan is critical for obtaining a no income verification business line of credit. It provides lenders with a comprehensive overview of your business, including your goals, strategies, and financial projections. This information helps them understand your business model, assess its potential for success, and determine your ability to repay the loan.

Similarly, a solid financial history is crucial. Lenders examine your past financial performance to evaluate your creditworthiness and determine if you have a history of managing your finances responsibly. A consistent track record of profitability and timely debt repayment strengthens your application and increases your chances of approval.

Interest Rates and Fees

No income verification business lines of credit typically come with higher interest rates and fees compared to traditional business loans that require income verification. This is because lenders face a higher risk when they don’t have access to your income information.

Interest Rates

Interest rates for no income verification business lines of credit can vary significantly depending on several factors, including your creditworthiness, the loan amount, and the repayment term.

- Creditworthiness: Lenders use your credit score and history to assess your creditworthiness. A higher credit score generally translates to a lower interest rate.

- Loan Amount: Larger loan amounts often come with higher interest rates. This is because lenders assume a greater risk with larger loans.

- Repayment Term: Longer repayment terms generally lead to higher interest rates, as you have more time to accrue interest.

Fees

No income verification business lines of credit can also have various fees, including:

- Origination Fee: This is a one-time fee charged by the lender for processing your loan application. It’s typically a percentage of the loan amount.

- Annual Fee: Some lenders charge an annual fee for maintaining your business line of credit. This fee can vary depending on the lender.

- Late Payment Fee: If you miss a payment, you may be charged a late payment fee. The amount of this fee can vary depending on the lender.

Comparison of Interest Rates and Fees

Here is a comparison of interest rates and fees for no income verification business lines of credit from different lenders:

| Lender | Interest Rate Range | Origination Fee | Annual Fee | Late Payment Fee |

|---|---|---|---|---|

| Lender A | 10-20% | 2-5% of loan amount | $100-$250 | $25-$50 |

| Lender B | 12-25% | 3-7% of loan amount | $150-$300 | $30-$75 |

| Lender C | 15-30% | 4-10% of loan amount | $200-$400 | $40-$100 |

Repayment Options and Terms: No Income Verification Business Line Of Credit

Understanding the repayment options and terms of a no income verification business line of credit is crucial for managing your finances effectively. These terms dictate how you’ll pay back the borrowed funds, including the interest rate, loan term, and minimum payment. This section will discuss the common repayment options and how to navigate the repayment process.

Repayment Options

No income verification business lines of credit typically offer two primary repayment options: fixed monthly payments and revolving credit.

- Fixed Monthly Payments: This option involves making equal, predetermined payments each month over a set period. This provides predictable budgeting and helps you track your progress towards repayment.

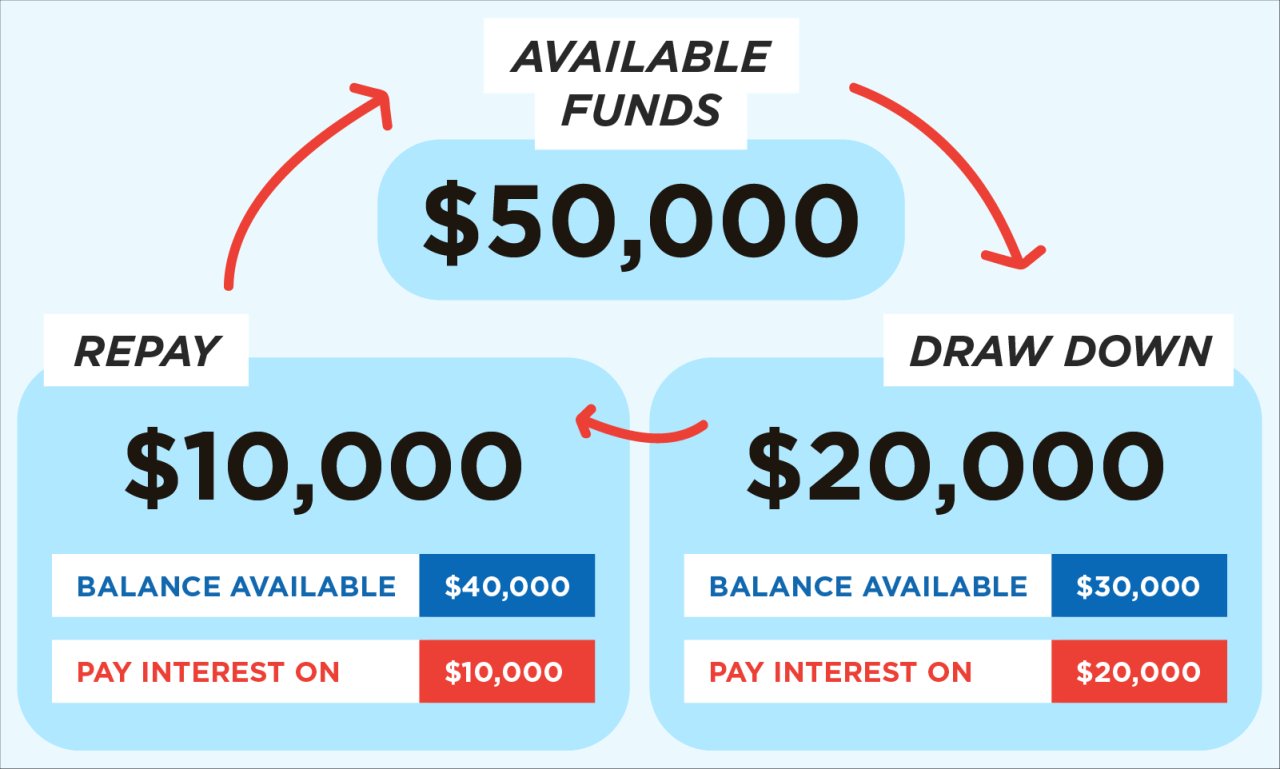

- Revolving Credit: This option allows you to borrow funds as needed, up to a pre-approved credit limit. You only make payments on the outstanding balance, which can fluctuate depending on your usage. This offers flexibility but can lead to higher interest costs if not managed carefully.

Repayment Terms

Repayment terms define the structure of your repayment obligation. It’s important to understand the following key components:

- Interest Rate: This is the cost of borrowing money, expressed as a percentage. A higher interest rate means you’ll pay more in interest charges over the life of the loan.

- Loan Term: This is the duration of the loan, typically expressed in months or years. A longer loan term generally means lower monthly payments but higher overall interest costs.

- Minimum Payment: This is the smallest amount you’re required to pay each month. Making only the minimum payment can significantly extend the repayment period and increase overall interest costs.

Managing Repayment

Effective repayment management helps you avoid late fees and penalties, minimize interest charges, and maintain a good credit score. Consider the following strategies:

- Set a Budget: Create a realistic budget that allocates funds for your line of credit repayment. This helps ensure you can make timely payments and avoid falling behind.

- Prioritize Repayment: Make paying down your line of credit a priority, especially if you have a high interest rate. This helps minimize overall interest charges and reduce your debt faster.

- Explore Early Repayment Options: If possible, consider making additional payments or lump sum payments to reduce your principal balance faster and save on interest.

Potential Risks and Considerations

While no income verification business lines of credit offer convenience and flexibility, it’s crucial to understand the potential risks associated with this type of financing. These lines of credit often come with higher interest rates, shorter repayment terms, and the potential for debt accumulation if not managed responsibly.

Higher Interest Rates

Lenders who don’t require income verification typically charge higher interest rates to compensate for the increased risk they take on. This is because they have less information about your ability to repay the loan. It’s important to compare interest rates from different lenders and choose the option that offers the most favorable terms.

Shorter Repayment Terms

No income verification business lines of credit often have shorter repayment terms than traditional loans. This means you’ll have to make larger monthly payments, which can put a strain on your cash flow. Consider your ability to manage these payments before accepting a line of credit.

Potential for Debt Accumulation, No income verification business line of credit

Without careful budgeting and financial planning, it’s easy to overspend and accumulate debt using a no income verification business line of credit. It’s crucial to set spending limits and track your expenses to avoid exceeding your credit limit and incurring additional interest charges.

Mitigating Risks and Ensuring Responsible Borrowing Practices

To mitigate the risks associated with no income verification business lines of credit, it’s essential to adopt responsible borrowing practices. This includes:

- Thorough Research: Compare interest rates and repayment terms from multiple lenders to find the most favorable option.

- Budgeting and Financial Planning: Create a detailed budget and track your expenses to ensure you can afford the monthly payments.

- Spending Limits: Set clear spending limits for yourself and stick to them to avoid overspending.

- Regular Monitoring: Track your balance and repayment progress regularly to stay on top of your obligations.

- Emergency Fund: Build an emergency fund to cover unexpected expenses and avoid relying on your line of credit.

Importance of Budgeting and Financial Planning

Budgeting and financial planning are crucial when utilizing a no income verification business line of credit. By creating a detailed budget, you can track your income and expenses, identify areas where you can cut back, and allocate funds for debt repayment. This helps you stay on top of your finances, avoid overspending, and minimize the risk of debt accumulation.

Alternative Financing Options

While no income verification business lines of credit offer a quick and convenient way to access funds, they’re not the only financing option available for businesses. Understanding the alternatives can help you choose the best fit for your specific needs and circumstances.

Traditional Business Loans

Traditional business loans are a common financing option for businesses. They are typically offered by banks and other financial institutions and are often secured by collateral, such as real estate or equipment. Traditional business loans usually require a more extensive application process and often involve income verification.

Traditional Business Loan Eligibility and Qualification Criteria

Traditional business loans typically require a strong credit score, a history of profitability, and a solid business plan. The specific eligibility criteria vary depending on the lender, but they generally include:

- Good Credit Score: A credit score of at least 680 is usually required for a traditional business loan.

- Financial History: Lenders want to see a history of profitability, with consistent revenue and positive cash flow.

- Business Plan: A detailed business plan outlining your business’s goals, strategies, and financial projections is crucial.

- Collateral: Lenders often require collateral to secure the loan, which can include real estate, equipment, or inventory.

Traditional Business Loan Interest Rates and Repayment Terms

Interest rates for traditional business loans can vary depending on factors such as the borrower’s credit score, the loan amount, and the loan term. Repayment terms typically range from 5 to 10 years, with monthly payments.

Advantages and Disadvantages of Traditional Business Loans

Advantages

- Lower Interest Rates: Traditional business loans often have lower interest rates compared to other financing options.

- Longer Repayment Terms: Longer repayment terms can make monthly payments more manageable.

- Larger Loan Amounts: Traditional business loans can provide larger amounts of funding than other options.

Disadvantages

- Rigorous Application Process: The application process for traditional business loans can be lengthy and complex.

- Income Verification: Lenders typically require income verification, which can be time-consuming and may not be suitable for all businesses.

- Collateral Requirements: Collateral requirements can be a barrier for some businesses.

SBA Loans

SBA loans are government-backed loans that are designed to help small businesses access financing. They are offered through banks and other lenders, but the Small Business Administration (SBA) guarantees a portion of the loan, making them less risky for lenders. SBA loans often have more flexible eligibility requirements than traditional business loans and may offer lower interest rates.

SBA Loan Eligibility and Qualification Criteria

SBA loans are generally available to businesses that are located in the United States and meet the SBA’s size standards. The specific eligibility criteria vary depending on the type of SBA loan, but they generally include:

- Good Credit Score: A good credit score is typically required, but it may be lower than for traditional business loans.

- Business Plan: A comprehensive business plan outlining your business’s goals, strategies, and financial projections is necessary.

- Financial History: Lenders will review your financial history, including revenue, expenses, and cash flow.

- Collateral: Collateral may be required, depending on the type of loan and the lender’s requirements.

SBA Loan Interest Rates and Repayment Terms

Interest rates for SBA loans are typically lower than for traditional business loans, but they can vary depending on the loan amount, the loan term, and the borrower’s credit score. Repayment terms can range from 5 to 25 years, with monthly payments.

Advantages and Disadvantages of SBA Loans

Advantages

- Lower Interest Rates: SBA loans often have lower interest rates compared to traditional business loans.

- Longer Repayment Terms: Longer repayment terms can make monthly payments more manageable.

- Flexible Eligibility Requirements: SBA loans have more flexible eligibility requirements than traditional business loans, making them more accessible to a wider range of businesses.

Disadvantages

- Complex Application Process: The application process for SBA loans can be more complex than for traditional business loans.

- Longer Processing Times: SBA loans typically have longer processing times than traditional business loans.

- Limited Loan Amounts: SBA loans have maximum loan amounts, which may not be sufficient for all businesses.

Crowdfunding

Crowdfunding is a method of raising funds from a large number of individuals, typically through online platforms. There are several different types of crowdfunding, including equity crowdfunding, rewards-based crowdfunding, and donation-based crowdfunding.

Crowdfunding Eligibility and Qualification Criteria

The eligibility criteria for crowdfunding vary depending on the platform and the type of crowdfunding. Generally, businesses must meet certain requirements, such as having a compelling business idea, a strong online presence, and a well-developed marketing strategy.

Crowdfunding Interest Rates and Repayment Terms

Crowdfunding typically doesn’t involve interest rates or repayment terms in the traditional sense. Instead, investors receive equity in the company, rewards, or tax deductions, depending on the type of crowdfunding.

Advantages and Disadvantages of Crowdfunding

Advantages

- Access to a Wider Range of Investors: Crowdfunding can connect businesses with a wider range of investors, including individuals, angel investors, and venture capitalists.

- No Collateral Requirements: Crowdfunding typically doesn’t require collateral.

- Potential for Increased Brand Awareness: A successful crowdfunding campaign can help to increase brand awareness and generate excitement for your business.

Disadvantages

- Uncertainty of Funding: There is no guarantee that you will raise the desired amount of funding through crowdfunding.

- Time-Consuming: Crowdfunding campaigns can be time-consuming to plan and execute.

- Dilution of Equity: Equity crowdfunding can lead to a dilution of ownership in your company.

Resources and Information

Navigating the world of no income verification business lines of credit can be overwhelming, especially for first-time borrowers. Fortunately, numerous resources are available to guide businesses through the process and ensure they make informed decisions.

Reputable Resources for Businesses

| Resource Name | Website URL | Contact Information |

|---|---|---|

| Small Business Administration (SBA) | https://www.sba.gov/ | 1-800-827-5722 |

| National Federation of Independent Business (NFIB) | https://www.nfib.com/ | 1-800-343-5742 |

| SCORE | https://www.score.org/ | 1-800-634-0245 |

| U.S. Chamber of Commerce | https://www.uschamber.com/ | 1-800-638-6111 |

Industry Associations and Government Agencies

These organizations offer valuable insights, guidance, and support for businesses seeking financing options.

- Small Business Administration (SBA): The SBA provides resources and guidance for small businesses, including information on financing options, including no income verification lines of credit. Their website offers a wealth of information, including loan programs, workshops, and counseling services.

- National Federation of Independent Business (NFIB): The NFIB is a powerful advocacy group for small businesses. They offer resources and advice on a wide range of topics, including financing options, government regulations, and legal issues.

- SCORE: SCORE is a non-profit organization that provides free mentoring and counseling services to small businesses. They offer guidance on a wide range of topics, including business planning, financing, and marketing.

- U.S. Chamber of Commerce: The U.S. Chamber of Commerce is a powerful advocacy group for businesses of all sizes. They offer resources and information on a wide range of topics, including government regulations, tax policy, and financing options.

Financial Institutions

- Banks: While traditional banks may not always offer no income verification lines of credit, it’s still worth exploring options. Some banks may have alternative financing programs or be willing to work with businesses on a case-by-case basis.

- Credit Unions: Credit unions are often more flexible than banks and may be more likely to offer no income verification lines of credit. They often have lower interest rates and fees than banks.

- Online Lenders: Online lenders are becoming increasingly popular, offering quick and easy access to financing. They often have less stringent requirements than traditional lenders, making them a good option for businesses that may not qualify for traditional loans.

- Alternative Lenders: Alternative lenders specialize in providing financing to businesses that may not qualify for traditional loans. They often offer flexible terms and faster approval times.

Epilogue

Ultimately, no income verification business lines of credit can be a valuable tool for businesses that meet the eligibility requirements and understand the associated risks. By carefully considering their financing needs, exploring alternative options, and adhering to responsible borrowing practices, businesses can leverage this financing method to fuel their growth and achieve their goals.

FAQ Compilation

What is the typical interest rate for a no income verification business line of credit?

Interest rates vary significantly based on factors like creditworthiness, loan amount, and repayment term. Generally, expect higher interest rates compared to traditional business loans.

How long does it take to get approved for a no income verification business line of credit?

The approval process can be faster than traditional loans, but it still depends on the lender and the complexity of your application. Some lenders may offer same-day or next-day approval.

Are there any specific industries that benefit most from no income verification business lines of credit?

While not exclusive to any industry, businesses with fluctuating income, newer businesses, or those with limited documentation may find this financing option particularly helpful.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!