An open line of credit for business sets the stage for a more flexible and convenient approach to business financing. It’s a powerful tool that empowers businesses to manage cash flow, seize opportunities, and navigate unexpected challenges. Unlike traditional loans, a line of credit provides a revolving pool of funds that can be accessed as needed, offering businesses a lifeline when they require extra capital.

This guide will delve into the intricacies of open lines of credit for businesses, exploring their benefits, application process, responsible use, and alternatives. By understanding the ins and outs of this financing option, businesses can make informed decisions about how to access the capital they need to thrive.

What is an Open Line of Credit for Business?

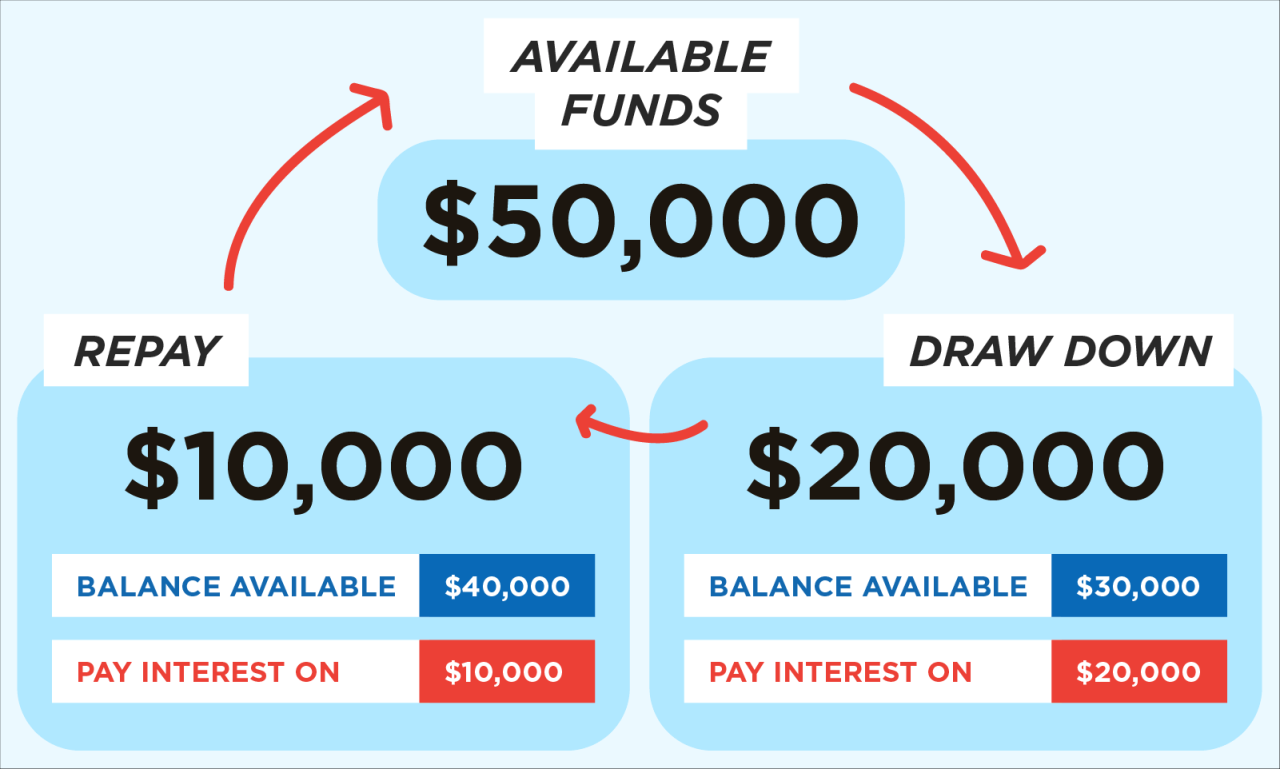

An open line of credit is a revolving credit facility that businesses can use to access funds as needed. It’s similar to a credit card, but typically with higher credit limits and lower interest rates. Businesses can borrow up to their credit limit, make payments, and then borrow again, as long as they stay within their approved credit limit.

Understanding the Concept of an Open Line of Credit

An open line of credit is a flexible financing option that provides businesses with ongoing access to funds, allowing them to manage cash flow, meet short-term needs, and take advantage of opportunities.

Comparison with Other Forms of Business Financing, Open line of credit for business

An open line of credit differs from other forms of business financing in several ways:

Loans

- Loans are a one-time disbursement of funds with a fixed repayment schedule.

- Open lines of credit provide ongoing access to funds, allowing businesses to borrow and repay as needed.

Grants

- Grants are non-repayable funds provided for specific purposes.

- Open lines of credit are a form of debt financing that requires repayment with interest.

Equity Financing

- Equity financing involves selling ownership shares in the business to investors.

- Open lines of credit do not involve giving up ownership of the business.

Examples of Business Uses for an Open Line of Credit

Businesses can use an open line of credit for various purposes, including:

Working Capital

- Covering day-to-day expenses, such as payroll, rent, and utilities.

- Managing seasonal fluctuations in cash flow.

Inventory Management

- Purchasing raw materials and finished goods.

- Managing inventory levels to meet demand.

Seasonal Fluctuations

- Funding increased production or marketing efforts during peak seasons.

- Bridging cash flow gaps during slow periods.

Benefits of an Open Line of Credit for Business

An open line of credit for your business offers a variety of advantages that can contribute to your financial stability and growth. It provides a flexible and convenient source of funding that can be accessed quickly when needed.

Flexibility and Convenience

A business line of credit offers flexibility by allowing you to borrow only the amount you need, when you need it. Unlike a traditional loan, you’re not obligated to take out the entire amount approved. This makes it an ideal solution for managing unexpected expenses or taking advantage of time-sensitive opportunities.

Improved Cash Flow Management

Having an open line of credit available can help you manage your cash flow more effectively. By having access to funds when you need them, you can avoid late payments or other financial penalties. This can also help you take advantage of discounts for early payments or bulk purchases.

Managing Unexpected Expenses

Unexpected expenses, such as equipment repairs, legal fees, or sudden inventory shortages, can disrupt your business operations. An open line of credit provides a safety net to cover these unforeseen costs without jeopardizing your existing cash flow.

Seizing Time-Sensitive Opportunities

Opportunities don’t always present themselves with ample time to plan. An open line of credit allows you to act quickly on time-sensitive opportunities, such as purchasing inventory at a discount or bidding on a new project.

Building a Strong Credit History

Responsible use of a business line of credit can help you build a strong credit history for your business. By making timely payments and keeping your credit utilization low, you demonstrate financial responsibility to lenders, which can lead to better loan terms and interest rates in the future.

Applying for an Open Line of Credit

Securing an open line of credit for your business involves a thorough application process that assesses your financial health and business viability. Lenders meticulously evaluate your creditworthiness to determine if you’re a suitable candidate for this financial tool.

Requirements and Application Process

To apply for an open line of credit, businesses typically need to provide a comprehensive set of documents. This ensures that lenders have a clear understanding of your financial situation and business operations. The application process typically involves the following steps:

- Gather necessary documents: This includes financial statements, tax returns, business plans, and personal credit reports. These documents provide a detailed picture of your financial history, current performance, and future projections.

- Complete the application: The application form will request information about your business, including its legal structure, industry, revenue, expenses, and debt obligations.

- Provide supporting documentation: Lenders will often require additional documentation, such as bank statements, invoices, and contracts, to verify the information provided in the application.

- Credit check and review: Lenders will conduct a thorough credit check to assess your business’s creditworthiness and financial history. They will also review your application and supporting documentation to evaluate your business’s viability and potential for repayment.

- Negotiate terms: Once your application is approved, you will need to negotiate the terms of the open line of credit, including the credit limit, interest rate, and repayment terms.

- Sign the agreement: After the terms are finalized, you will need to sign the loan agreement, which Artikels the terms and conditions of the open line of credit.

Factors Considered in Creditworthiness

Lenders evaluate several factors to determine your business’s creditworthiness, including:

- Credit history: Lenders will examine your business’s credit history, including past loan repayments, payment patterns, and any outstanding debts.

- Financial statements: Your financial statements, such as income statements, balance sheets, and cash flow statements, provide a comprehensive view of your business’s financial performance and health.

- Business plan: A well-structured business plan Artikels your business’s objectives, strategies, and financial projections. It demonstrates your understanding of the market, your competitive advantage, and your ability to generate revenue and profits.

- Debt-to-equity ratio: This ratio measures the proportion of your business’s assets financed by debt compared to equity. A higher debt-to-equity ratio can indicate a higher risk for lenders.

- Cash flow: Lenders will assess your business’s ability to generate sufficient cash flow to cover your debt obligations. They will look at your operating cash flow, which reflects your ability to generate cash from your core business operations.

- Industry and market conditions: Lenders will consider the overall health of your industry and the competitive landscape in your market. They will assess the growth potential and stability of your industry and your business’s position within it.

- Management team: Lenders will evaluate the experience, expertise, and track record of your management team. They will assess their ability to manage the business effectively and make sound financial decisions.

Documentation Requirements

To support your application for an open line of credit, businesses typically need to provide the following documentation:

- Financial statements: These include income statements, balance sheets, and cash flow statements, which provide a detailed picture of your business’s financial performance and health.

- Tax returns: Tax returns demonstrate your business’s revenue, expenses, and profitability.

- Business plan: A well-structured business plan Artikels your business’s objectives, strategies, and financial projections. It demonstrates your understanding of the market, your competitive advantage, and your ability to generate revenue and profits.

- Personal credit reports: Lenders may also request personal credit reports to assess your creditworthiness and financial history.

- Bank statements: Bank statements provide evidence of your business’s cash flow and transaction history.

- Invoices and contracts: Invoices and contracts demonstrate your business’s revenue stream and customer base.

- Collateral: If you are seeking a secured open line of credit, you may need to provide collateral, such as real estate or equipment, to secure the loan.

Using an Open Line of Credit Responsibly

An open line of credit can be a valuable tool for businesses, but it’s crucial to use it responsibly to avoid excessive debt and financial strain. Just like any other financial instrument, responsible usage involves planning, tracking, and discipline.

Best Practices for Responsible Management

Responsible management of an open line of credit is essential for maximizing its benefits while minimizing potential risks. Here are some best practices to follow:

- Set Spending Limits: Establish a clear budget and spending limit for your open line of credit. This will help you avoid overspending and ensure that you can comfortably make repayments.

- Track Usage Regularly: Monitor your account balance, outstanding debt, and interest charges regularly. This will help you stay on top of your spending and identify any potential issues early on.

- Make Timely Payments: Make your minimum payments on time to avoid late fees and penalties. Aim to pay more than the minimum whenever possible to reduce your outstanding debt and interest charges.

- Review Your Credit Limit: Periodically review your credit limit to ensure it aligns with your business needs. If your business has grown, you may need to request a credit limit increase.

- Consider a Payment Schedule: Develop a repayment schedule that fits your cash flow and allows you to manage your debt effectively. This can involve setting aside a specific amount each month to pay down your balance.

Tips for Avoiding Excessive Debt

It’s essential to avoid excessive debt accumulation, which can put a strain on your business finances. Here are some tips:

- Use the Open Line of Credit Strategically: Avoid using your open line of credit for everyday expenses or non-essential purchases. Reserve it for strategic investments or short-term cash flow needs.

- Prioritize Debt Repayment: Make paying down your open line of credit a priority, especially if you have other outstanding debts. Consider consolidating your debts into a lower-interest loan if possible.

- Explore Alternative Funding Options: If you find yourself consistently relying on your open line of credit, explore alternative funding options such as business loans or equity financing. These options may offer more favorable terms or longer repayment periods.

Questions to Ask Before Using an Open Line of Credit

Before utilizing your open line of credit, it’s essential to ask yourself some crucial questions to ensure it’s the right decision for your business:

- What is the specific purpose of the credit line? Clearly define the reason for accessing the open line of credit. Is it for short-term cash flow needs, inventory purchases, or a specific project?

- Do I have a clear repayment plan? Artikel a realistic and achievable repayment plan, considering your cash flow and financial projections.

- What are the interest rates and fees associated with the credit line? Understand the terms and conditions of the open line of credit, including interest rates, fees, and any other charges.

- Can I afford the monthly payments? Assess your cash flow and ability to make the minimum monthly payments without compromising your financial stability.

- Are there alternative funding options available? Explore other funding options, such as business loans or equity financing, to compare terms and interest rates.

Alternatives to an Open Line of Credit: Open Line Of Credit For Business

An open line of credit isn’t the only financing option for businesses. Several alternatives offer unique benefits and drawbacks. Let’s explore some popular choices and see how they stack up against an open line of credit.

Merchant Cash Advances

Merchant cash advances (MCAs) provide businesses with upfront capital in exchange for a percentage of future credit card sales. This option is often favored by businesses with consistent credit card sales, as the repayment is tied directly to their revenue stream.

- Pros:

- Quick and easy access to funds, often within a few days.

- No collateral requirements, making it accessible for businesses with limited assets.

- Flexible repayment structure based on sales volume.

- Cons:

- High interest rates and fees, which can significantly impact profitability.

- Repayment can be burdensome if sales fluctuate.

- Can be difficult to qualify for if you have a low credit score.

Example: A restaurant experiencing seasonal sales fluctuations might find an MCA more suitable than a traditional open line of credit, as the repayment is tied to their revenue stream, allowing them to pay more when business is good and less when it’s slow.

Invoice Financing

Invoice financing, also known as accounts receivable financing, provides businesses with immediate cash flow by offering short-term loans secured against outstanding invoices. This option is particularly beneficial for businesses with a stable customer base and a predictable invoice cycle.

- Pros:

- Fast access to funds, often within 24 hours.

- Repayment is linked to the invoice collection process, reducing financial risk.

- Can improve cash flow and working capital management.

- Cons:

- Higher interest rates compared to traditional loans.

- May require a minimum invoice volume to qualify.

- Limited access to funds compared to open lines of credit.

Example: A manufacturing company with a consistent stream of large orders might find invoice financing ideal, as it can access funds quickly based on their invoices, ensuring a smooth cash flow cycle.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect businesses with individual investors willing to lend money. This alternative financing option offers an alternative to traditional banks and can be particularly attractive for businesses with good credit scores and strong business plans.

- Pros:

- Potentially lower interest rates than traditional loans.

- Greater flexibility in terms of loan amounts and repayment periods.

- Direct access to investors, fostering a sense of partnership.

- Cons:

- Can be time-consuming to secure funding, as it involves finding suitable investors.

- May require a higher credit score to qualify compared to traditional loans.

- Limited access to funds compared to open lines of credit.

Example: A tech startup with a strong track record and a promising business plan might find P2P lending an attractive option, as it can access funding from individual investors who believe in their vision.

Last Point

Navigating the world of business financing can be complex, but understanding open lines of credit is a crucial step toward financial success. By carefully considering the benefits, application process, and responsible use of this financing option, businesses can unlock a valuable resource that empowers them to grow and prosper. Whether it’s managing working capital, seizing opportunities, or weathering unexpected challenges, an open line of credit can provide the financial flexibility and security that businesses need to navigate the ever-changing landscape of the modern economy.

FAQ Overview

What is the difference between an open line of credit and a loan?

An open line of credit is a revolving credit facility that allows you to borrow money as needed up to a predetermined limit, while a loan is a fixed sum of money that you borrow with a specific repayment schedule.

How does an open line of credit affect my business credit score?

Responsible use of an open line of credit, including making timely payments and keeping your utilization rate low, can positively impact your business credit score. However, excessive borrowing and late payments can negatively affect your creditworthiness.

What are the typical interest rates for an open line of credit?

Interest rates for open lines of credit vary depending on factors such as your business credit score, the amount of credit you request, and the lender’s policies. It’s essential to compare rates from different lenders to find the most competitive option.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!