PayPal Business Credit Account offers a convenient and potentially valuable financing option for businesses. It’s a revolving line of credit that can be used for various business expenses, allowing you to manage cash flow and potentially access funds when you need them. This guide will explore the features, benefits, and considerations associated with using a PayPal Business Credit Account.

The account is designed to provide businesses with flexible access to funds, often with a relatively straightforward application process. It’s a tool that can be particularly beneficial for entrepreneurs and small businesses seeking to streamline their finances and potentially enhance their purchasing power.

Overview of PayPal Business Credit Account

The PayPal Business Credit account is a revolving line of credit designed to help businesses manage their cash flow and cover short-term expenses. This account provides businesses with a dedicated credit limit that they can draw on as needed, offering flexibility and convenience for managing finances.

Eligibility Criteria

To be eligible for a PayPal Business Credit account, businesses must meet certain criteria. These include:

- Having a PayPal Business account in good standing.

- Meeting PayPal’s creditworthiness requirements, which may involve reviewing the business’s financial history and credit score.

- Operating a business that is eligible for a PayPal Business Credit account. Some industries or business models may be excluded.

Benefits of Using a PayPal Business Credit Account

A PayPal Business Credit account offers various benefits for businesses, including:

- Access to working capital: The account provides a revolving line of credit that businesses can draw on to cover expenses, purchase inventory, or invest in growth initiatives. This flexibility helps businesses manage cash flow and avoid potential financial shortfalls.

- Convenient access to funds: With a PayPal Business Credit account, businesses can access funds quickly and easily through their PayPal account. This can be particularly beneficial for businesses that need to make urgent payments or cover unexpected expenses.

- Simplified payment processing: Businesses can use their PayPal Business Credit account to make payments to suppliers and vendors through PayPal, streamlining the payment process and reducing administrative burdens.

- Potential for building credit: Responsible use of a PayPal Business Credit account can help businesses build their credit history, which can be beneficial when applying for other forms of financing in the future.

Credit Limit and Interest Rates

The PayPal Business Credit Account offers a revolving line of credit that can be used for various business expenses. The credit limit and interest rate are two key factors to consider when evaluating this credit option.

Credit Limit Determination

The credit limit assigned to your PayPal Business Credit Account is based on several factors. PayPal assesses your business’s financial health, including your revenue, credit history, and business age. It also considers your payment history with PayPal, the amount of money you have in your PayPal account, and your overall financial responsibility.

“The credit limit is dynamic and can increase as you use the account responsibly and build a positive payment history.”

Interest Rates Compared to Other Options, Paypal business credit account

The interest rate for PayPal Business Credit Accounts is variable and can fluctuate based on market conditions. Generally, the rates are competitive with other business credit cards and lines of credit.

- PayPal Business Credit Accounts: Interest rates typically range from 10% to 25% APR, depending on your creditworthiness.

- Business Credit Cards: Interest rates can vary widely, but they typically fall between 10% and 25% APR.

- Business Lines of Credit: Interest rates for business lines of credit are often lower than those for business credit cards, typically ranging from 5% to 15% APR.

Fees Associated with the Account

In addition to interest charges, PayPal Business Credit Accounts may also have fees associated with their use. These fees can include:

- Annual Fee: Some PayPal Business Credit Accounts may have an annual fee, which is charged for the privilege of having the account.

- Late Payment Fee: If you miss a payment on your account, you may be charged a late payment fee.

- Cash Advance Fee: If you take out a cash advance, you may be charged a cash advance fee.

- Foreign Transaction Fee: If you use your account to make purchases in foreign currencies, you may be charged a foreign transaction fee.

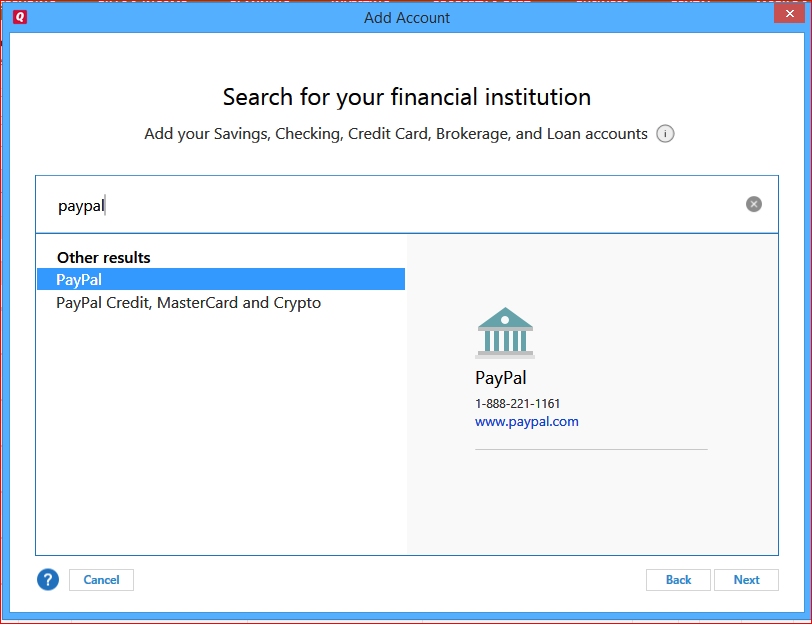

Applying for a PayPal Business Credit Account

Applying for a PayPal Business Credit Account is a straightforward process. You can apply directly through the PayPal website or mobile app. The application process usually takes a few minutes to complete, and PayPal will provide a decision within a few days.

Required Documentation and Information

Before you begin the application process, ensure you have the following information and documentation ready:

- Your business name and legal structure (e.g., sole proprietorship, partnership, LLC)

- Your business address and phone number

- Your Social Security number or Employer Identification Number (EIN)

- Your bank account information (for direct deposit of funds)

- Your business website (if applicable)

- Your business revenue and expenses for the past year

- Your credit history (PayPal may perform a soft credit check)

Application Processing Time

The time it takes for PayPal to process your application can vary depending on several factors, such as the complexity of your application and the availability of your credit history. In general, PayPal aims to provide a decision within a few days. However, it can sometimes take up to a week or longer for the application to be processed.

Advantages and Disadvantages

A PayPal Business Credit Account can be a valuable tool for businesses, but it’s essential to weigh the advantages and disadvantages before deciding if it’s the right fit for your needs.

This section will explore the potential benefits and drawbacks of using a PayPal Business Credit Account. We’ll also discuss potential risks associated with using this account and compare it to other business credit options.

Potential Advantages

The following points Artikel the benefits of using a PayPal Business Credit Account:

- Easy Application Process: Applying for a PayPal Business Credit Account is generally straightforward, with a quick online application process. This can be advantageous for businesses looking for a fast and hassle-free credit option.

- Flexible Funding: PayPal Business Credit Accounts offer flexible funding options, allowing businesses to access funds when they need them. This can be helpful for managing cash flow and covering unexpected expenses.

- Simple Integration with PayPal Ecosystem: Businesses already using PayPal for transactions can seamlessly integrate the credit account into their existing workflow, simplifying payments and account management.

- Potential for Building Business Credit: Using a PayPal Business Credit Account responsibly and making timely payments can contribute to building your business credit score, which can benefit you when applying for other credit products.

Potential Disadvantages

While there are advantages, there are also some drawbacks to consider:

- Limited Credit Limit: PayPal Business Credit Accounts often have lower credit limits compared to traditional business loans. This may not be sufficient for larger expenses or substantial business needs.

- Higher Interest Rates: Compared to traditional business loans, PayPal Business Credit Accounts typically have higher interest rates. This can make borrowing more expensive over time.

- Limited Access to Funds: While PayPal Business Credit Accounts provide access to funds, the amount available may be restricted, limiting your ability to use them for significant investments or expansions.

- Potential for Debt Accumulation: Using a PayPal Business Credit Account without careful planning can lead to debt accumulation, impacting your financial health. It’s crucial to use credit responsibly and manage payments effectively.

Potential Risks

It’s important to consider the potential risks associated with using a PayPal Business Credit Account:

- Credit Score Impact: Late payments or defaulting on your PayPal Business Credit Account can negatively affect your business credit score, making it harder to secure future financing.

- Fees and Charges: PayPal Business Credit Accounts may have various fees and charges, such as annual fees, late payment fees, and interest charges. Carefully review the terms and conditions to understand the associated costs.

- Security Concerns: Like any online financial service, there are potential security risks associated with using a PayPal Business Credit Account. Ensure you take necessary precautions to protect your account information.

Alternative Business Credit Options

Here are some alternative business credit options to consider:

- Traditional Business Loans: Traditional business loans from banks or credit unions often offer larger credit limits and lower interest rates than PayPal Business Credit Accounts. However, the application process can be more complex and time-consuming.

- Business Credit Cards: Business credit cards can provide flexible financing options and rewards programs. However, it’s crucial to manage spending and payments carefully to avoid accruing debt.

- Small Business Administration (SBA) Loans: SBA loans are government-backed loans designed to support small businesses. They typically offer favorable terms, including lower interest rates and longer repayment periods.

Final Summary: Paypal Business Credit Account

A PayPal Business Credit Account can be a useful tool for businesses looking to manage their finances and potentially access additional funding. However, it’s crucial to carefully evaluate your needs, compare interest rates and fees, and make sure you can manage repayments responsibly. Understanding the advantages and disadvantages of this account can help you determine if it’s the right fit for your business needs.

Top FAQs

What is the minimum credit score required to qualify for a PayPal Business Credit Account?

PayPal doesn’t publicly disclose a specific minimum credit score requirement. However, having a good credit history and a strong business profile generally increases your chances of approval.

How can I track my credit limit and balance on my PayPal Business Credit Account?

You can easily monitor your account activity and balance through your PayPal Business account dashboard. You can access your account statements, view recent transactions, and track your available credit limit.

Can I use my PayPal Business Credit Account for international transactions?

Yes, you can typically use your PayPal Business Credit Account for international transactions. However, it’s important to be aware of potential foreign transaction fees and exchange rates that may apply.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!