The PNC unsecured business line of credit stands as a valuable financing tool for businesses seeking flexible and readily available capital. This credit line, unlike traditional loans, provides a revolving source of funds that businesses can access as needed, offering a convenient way to manage short-term cash flow fluctuations and fund operational expenses.

A PNC unsecured business line of credit offers a number of benefits, including quick approval and access to funds, competitive interest rates, and flexible repayment options. However, it’s important to carefully consider the eligibility criteria, interest rates, and fees associated with this financing option before applying.

PNC Unsecured Business Line of Credit Overview

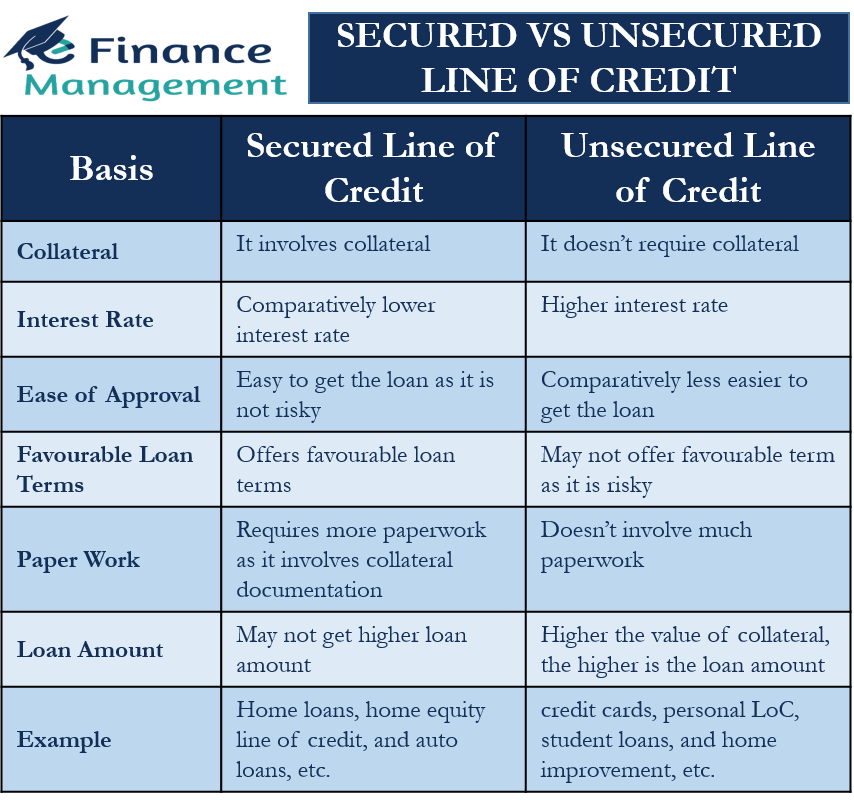

A PNC unsecured business line of credit is a revolving credit facility that provides businesses with access to funds as needed, without requiring collateral. It offers flexibility and convenience for managing short-term cash flow needs.

Eligibility Criteria

To be eligible for a PNC unsecured business line of credit, businesses typically need to meet certain criteria. These criteria are designed to assess the creditworthiness and financial stability of the applicant.

- Strong Credit History: A good credit score and a history of responsible borrowing are essential for approval. This indicates the business’s ability to manage debt effectively.

- Established Business: PNC generally prefers businesses that have been operating for a minimum period, typically two years or more. This demonstrates the business’s longevity and stability.

- Revenue and Profitability: The business should have a track record of consistent revenue and profitability. This demonstrates the business’s ability to generate income and repay the line of credit.

- Adequate Cash Flow: PNC will assess the business’s cash flow to ensure that it has sufficient funds to cover its operating expenses and debt obligations.

Benefits of an Unsecured Business Line of Credit

PNC unsecured business lines of credit offer several advantages to businesses, providing flexibility and financial support for various needs.

- Flexible Access to Funds: Businesses can draw funds as needed, up to the approved credit limit, without requiring pre-approval for each withdrawal.

- Convenient Funding: The line of credit can be accessed quickly and easily, often through online banking platforms, allowing businesses to meet urgent financial needs.

- Interest Only Payments: Businesses only pay interest on the amount they use, making it a cost-effective option for short-term financing needs.

- Potential for Building Credit: Responsible use of a business line of credit can help improve the business’s credit score, making it easier to secure financing in the future.

Drawbacks of an Unsecured Business Line of Credit

While offering benefits, unsecured business lines of credit also have certain drawbacks that businesses should consider.

- Higher Interest Rates: Unsecured lines of credit typically carry higher interest rates compared to secured loans, reflecting the higher risk associated with the lack of collateral.

- Credit Limit Restrictions: The approved credit limit may be lower than what businesses require, limiting their access to funds.

- Potential for Debt Accumulation: If not used responsibly, a business line of credit can lead to debt accumulation, impacting the business’s financial health.

Interest Rates and Fees

PNC’s unsecured business lines of credit come with competitive interest rates and fees, but it’s essential to understand how these costs are determined and what they encompass.

Interest Rates, Pnc unsecured business line of credit

PNC’s interest rates for unsecured business lines of credit are variable and are based on several factors, including your creditworthiness, the amount you borrow, and the overall market conditions.

- Credit Score: A higher credit score generally translates to a lower interest rate, as lenders perceive you as a lower risk borrower.

- Borrowing Amount: Larger loan amounts might come with slightly higher interest rates, as they represent a greater financial commitment for the lender.

- Market Conditions: The overall economic environment and prevailing interest rates can influence the rates offered by PNC.

Fees

PNC charges various fees associated with its unsecured business lines of credit. These fees are designed to cover the administrative and operational costs of managing the credit facility.

- Annual Fee: Some unsecured business lines of credit may come with an annual fee, which is a fixed amount charged yearly for maintaining the account.

- Transaction Fees: PNC might charge fees for certain transactions, such as cash advances or wire transfers. These fees are typically disclosed in the loan agreement.

- Late Payment Penalties: If you fail to make your minimum payment by the due date, you might incur a late payment penalty, which can add to your overall borrowing cost.

Comparison with Other Unsecured Business Lines of Credit

PNC’s interest rates and fees are generally competitive compared to other unsecured business lines of credit offered by major banks and credit unions. However, it’s crucial to shop around and compare offers from multiple lenders to ensure you’re getting the best terms for your specific needs.

Case Studies and Examples

PNC’s unsecured business line of credit has been a valuable tool for numerous businesses across various industries. This financing option provides flexibility and access to capital when needed, enabling businesses to seize opportunities, manage cash flow, and achieve their goals.

Examples of Successful Implementations

Here are some examples of how businesses have leveraged PNC’s unsecured business line of credit to their advantage:

- A small retail store owner secured a PNC unsecured business line of credit to purchase seasonal inventory. This line of credit provided the necessary funds to stock up on popular items during peak shopping seasons, allowing the owner to meet increased customer demand and boost sales.

- A technology startup utilized a PNC unsecured business line of credit to cover operating expenses during its initial growth phase. The flexible access to capital allowed the startup to hire new talent, invest in marketing, and develop its product, ultimately leading to a successful launch and rapid expansion.

- A restaurant owner secured a PNC unsecured business line of credit to renovate and expand their dining space. The financing allowed the owner to create a more inviting atmosphere, increase seating capacity, and attract new customers, resulting in increased revenue and profitability.

Key Aspects of Case Studies

The following table summarizes the key aspects of these case studies, highlighting the diverse applications of PNC’s unsecured business line of credit:

| Business Type | Financing Amount | Positive Outcomes |

|---|---|---|

| Retail Store | $25,000 | Increased inventory, boosted sales during peak seasons |

| Technology Startup | $50,000 | Hiring new talent, marketing investments, successful product launch |

| Restaurant | $100,000 | Renovation and expansion, increased seating capacity, higher revenue |

Wrap-Up: Pnc Unsecured Business Line Of Credit

Ultimately, a PNC unsecured business line of credit can be a valuable tool for businesses looking to manage their finances effectively and achieve their growth objectives. By understanding the terms, conditions, and eligibility requirements, businesses can make informed decisions about whether this financing option is the right fit for their needs.

FAQ Guide

How much can I borrow with a PNC unsecured business line of credit?

The borrowing limit for a PNC unsecured business line of credit varies depending on factors such as your business’s financial history, credit score, and revenue. It’s best to contact PNC directly to discuss your specific borrowing needs.

What are the typical repayment terms for a PNC unsecured business line of credit?

Repayment terms for PNC unsecured business lines of credit can vary. You’ll usually have a set repayment period, such as 12 or 24 months, with a minimum monthly payment due. However, you can pay down the balance faster or make larger payments to reduce interest costs.

What happens if I don’t make my payments on time?

Late payments on a PNC unsecured business line of credit can result in late fees and potentially damage your credit score. It’s crucial to make payments on time to maintain a good financial standing.

Can I use a PNC unsecured business line of credit for any purpose?

While PNC unsecured business lines of credit are generally flexible, there may be restrictions on certain uses. It’s essential to review the terms and conditions carefully to understand any limitations.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!