Reloadable credit cards for business are revolutionizing the way companies manage their finances. These cards offer a flexible and secure way to make payments, control spending, and track expenses. Imagine a scenario where your team needs to purchase materials for an upcoming project. Instead of using a traditional credit card with a potentially high limit, you can issue reloadable cards to each team member, pre-loaded with a specific amount. This not only ensures responsible spending but also simplifies expense tracking and reconciliation.

Reloadable business credit cards come in various forms, including prepaid cards, virtual cards, and mobile wallets. Each type caters to specific needs, offering features like customizable spending limits, real-time transaction monitoring, and enhanced security measures. Businesses can choose the option that best aligns with their budget, payment preferences, and operational requirements.

Introduction to Reloadable Credit Cards for Business

Reloadable credit cards specifically designed for business use offer a convenient and secure way for companies to manage their expenses and streamline financial operations. These cards provide a centralized platform for tracking and controlling spending, enabling businesses to optimize cash flow and enhance financial transparency.

Reloadable business credit cards serve as a valuable tool for businesses of all sizes, offering a range of benefits that contribute to efficient operations and improved financial management.

Advantages of Using Reloadable Business Credit Cards, Reloadable credit cards for business

Reloadable business credit cards offer several advantages that can significantly benefit businesses in various aspects of their operations.

- Enhanced Expense Control: Businesses can set spending limits and control the amount of funds available on the card, preventing unauthorized purchases and overspending.

- Improved Cash Flow Management: Reloadable cards allow businesses to manage their cash flow effectively by loading funds as needed, reducing the risk of overdraft fees or negative balances.

- Increased Security: Reloadable cards provide an extra layer of security, as businesses can choose to load specific amounts and restrict transactions to authorized merchants and categories.

- Simplified Accounting and Reconciliation: Businesses can easily track expenses and reconcile transactions, making it easier to manage financial records and prepare financial statements.

- Convenient Payment Options: Reloadable cards offer a convenient way to make purchases both online and in-person, eliminating the need for multiple payment methods.

Example of Using a Reloadable Business Credit Card

Imagine a small business owner who frequently travels for work. By using a reloadable business credit card, they can pre-load funds for travel expenses, such as flights, accommodation, and meals. This approach eliminates the need to carry large amounts of cash and simplifies expense tracking, ensuring a more efficient and organized travel experience.

Key Features and Benefits

Reloadable business credit cards offer a range of features designed to streamline financial management and enhance security for businesses. These cards provide a flexible and controlled way to manage business expenses, offering advantages over traditional business credit cards.

Improved Spending Control

Reloadable business credit cards empower businesses to manage their spending effectively by setting limits and controlling the amount of funds available on the card. This feature allows businesses to allocate specific funds for specific purposes, preventing overspending and ensuring that expenses remain within budget. For example, a business owner can load a card with a specific amount for travel expenses, ensuring that expenditures are confined to the allocated budget.

Enhanced Security

These cards prioritize security by offering features like fraud protection and secure online access. Businesses can track transactions and monitor card activity in real-time, identifying any suspicious activity and taking prompt action to prevent fraudulent use. This level of security minimizes the risk of unauthorized transactions and protects sensitive financial data.

Simplified Expense Tracking

Reloadable business credit cards provide businesses with detailed transaction records, simplifying expense tracking and reconciliation. This feature streamlines the process of categorizing and analyzing expenses, making it easier to identify spending patterns and make informed financial decisions. Businesses can easily access transaction history, categorize expenses, and generate reports, facilitating efficient accounting and financial reporting.

Types of Reloadable Business Credit Cards

Reloadable business credit cards come in various forms, each designed to cater to specific business needs and preferences. Understanding the different types is crucial for choosing the card that best aligns with your business operations and financial goals.

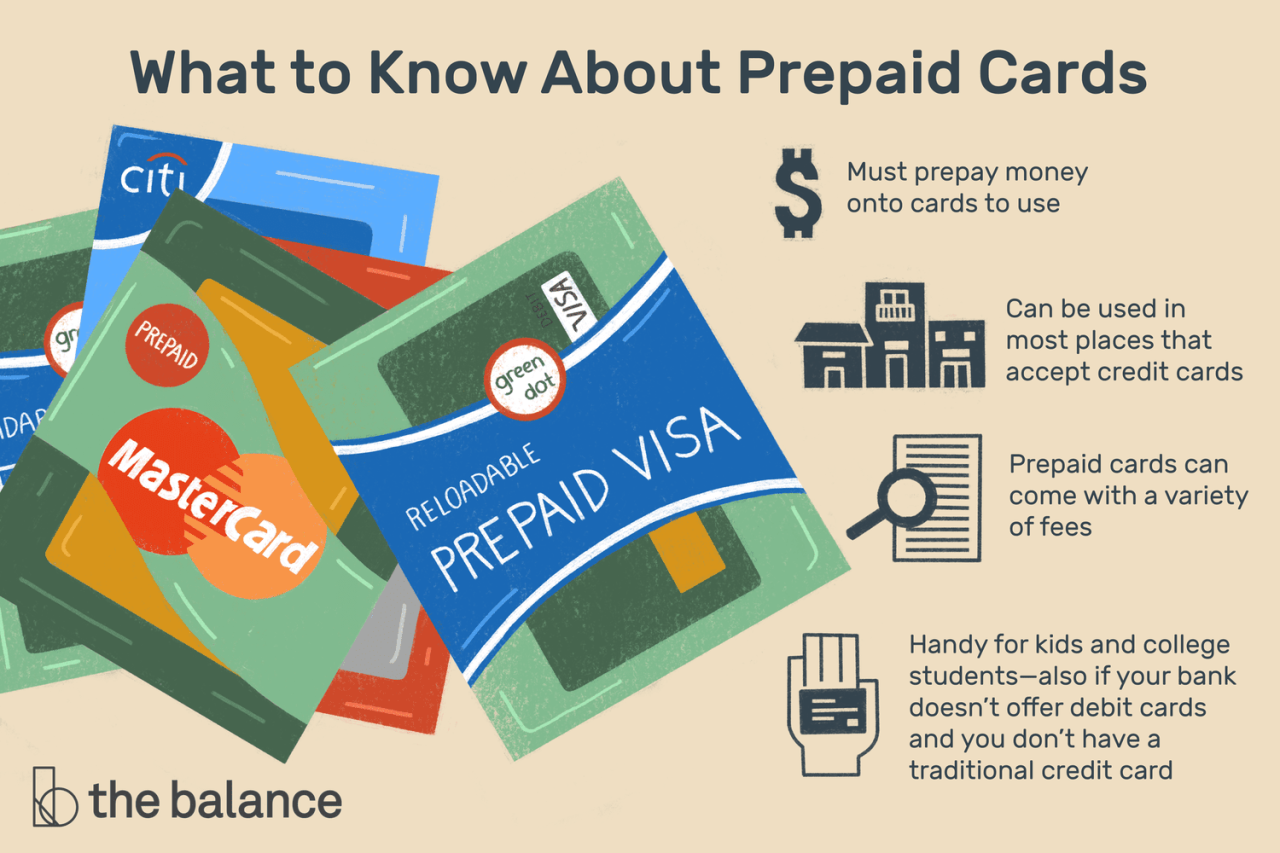

Prepaid Cards

Prepaid business credit cards function similarly to traditional prepaid cards. They require an initial deposit of funds before they can be used for purchases.

- Prepaid cards offer a secure way to manage business expenses and track spending.

- They are particularly suitable for businesses with fluctuating expenses or those seeking to limit spending.

- Prepaid cards are also an effective tool for controlling employee spending and ensuring that they adhere to pre-set budget limits.

Virtual Cards

Virtual cards are digital versions of credit cards, typically generated online and used for specific transactions.

- Virtual cards provide a high level of security and control over online payments.

- Each virtual card is assigned a unique number and expiration date, making it ideal for one-time purchases or recurring subscriptions.

- They can be easily created and deactivated, reducing the risk of fraud and unauthorized transactions.

Mobile Wallets

Mobile wallets are digital payment platforms stored on smartphones or other mobile devices.

- Mobile wallets offer convenience and flexibility for making payments on the go.

- They typically allow users to store multiple payment methods, including reloadable business credit cards, debit cards, and loyalty programs.

- Mobile wallets can be used for contactless payments, online purchases, and peer-to-peer transfers, streamlining business transactions and reducing reliance on physical cards.

Choosing the Right Reloadable Business Credit Card

Selecting the right reloadable business credit card can significantly impact your business finances. By carefully evaluating various factors, you can choose a card that aligns with your business needs and optimizes your spending and cash flow management.

Factors to Consider When Choosing a Reloadable Business Credit Card

It’s crucial to assess several factors before committing to a reloadable business credit card. These factors can help you make an informed decision and ensure the card meets your business requirements.

- Fees: Reloadable business credit cards often come with various fees, including annual fees, reload fees, transaction fees, and inactivity fees. It’s essential to compare these fees across different card providers to find the most cost-effective option.

- Spending Limits: Consider your business’s average monthly spending and ensure the card offers a spending limit that accommodates your needs. A higher spending limit can be beneficial for larger businesses, while smaller businesses may opt for a lower limit.

- Rewards Programs: Many reloadable business credit cards offer rewards programs, such as cash back, points, or travel miles. Evaluate the rewards structure and determine if it aligns with your business’s spending patterns and priorities. For example, if your business primarily makes online purchases, a card that offers bonus points for online spending might be advantageous.

- Security Features: Security is paramount for any business credit card. Look for cards that offer robust security features, such as fraud protection, EMV chip technology, and two-factor authentication.

- Customer Service: Choose a card provider with a reputation for excellent customer service. This is crucial for resolving issues, obtaining support, and ensuring a smooth user experience.

Evaluating Fees

Fees are a significant consideration when choosing a reloadable business credit card. Carefully assess the fee structure to determine the overall cost of using the card.

- Annual Fee: Some cards have an annual fee, while others do not. Compare the annual fees across different card providers and consider the potential benefits of a card with a fee versus one without a fee.

- Reload Fees: These fees are charged when you add funds to your card. Check the reload fee structure, as some cards may have a flat fee per reload, while others may charge a percentage of the reload amount.

- Transaction Fees: Some cards charge transaction fees for purchases, balance transfers, or cash advances. Be aware of these fees and compare them across different card providers.

- Inactivity Fees: These fees may be charged if you don’t use the card for a certain period. Check the card’s terms and conditions to understand the inactivity fee policy.

Comparing Spending Limits

The spending limit determines the maximum amount you can spend on your card. It’s essential to choose a card with a spending limit that aligns with your business’s needs.

- Average Monthly Spending: Consider your business’s average monthly spending to determine the appropriate spending limit. A higher limit may be beneficial for businesses with significant monthly expenses, while smaller businesses may need a lower limit.

- Credit History: Your business’s credit history can influence the spending limit offered by card providers. A strong credit history may result in a higher limit, while a limited credit history may lead to a lower limit.

- Credit Limit Increases: Some card providers allow you to request credit limit increases after demonstrating responsible use of the card. This can be helpful if your business’s spending needs increase over time.

Understanding Rewards Programs

Rewards programs can offer valuable benefits to businesses. Evaluate the rewards structure and determine if it aligns with your business’s spending patterns and priorities.

- Cash Back: Some cards offer cash back rewards for every dollar spent. The cash back percentage may vary depending on the card and the type of purchase.

- Points: Other cards offer points for every dollar spent, which can be redeemed for travel, merchandise, or gift cards. The value of points can vary depending on the card provider and redemption options.

- Travel Miles: Some cards offer travel miles for every dollar spent, which can be redeemed for flights, hotel stays, or other travel expenses.

Assessing Security Features

Security is a top priority for any business credit card. Look for cards that offer robust security features to protect your business from fraud and unauthorized transactions.

- Fraud Protection: Most reloadable business credit cards offer fraud protection, which helps protect you from unauthorized charges. This feature typically includes zero liability for fraudulent transactions.

- EMV Chip Technology: EMV chip technology is a more secure way to process transactions, reducing the risk of counterfeit cards and skimming. Look for cards that have EMV chips embedded in them.

- Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring you to enter a code sent to your mobile device in addition to your password. This helps prevent unauthorized access to your account.

Researching and Comparing Reloadable Business Credit Card Options

Once you understand the key factors to consider, you can begin researching and comparing different reloadable business credit card options.

- Online Comparison Websites: Several websites specialize in comparing credit cards, including reloadable business credit cards. These websites can provide detailed information about fees, rewards programs, and other features. Use these websites to narrow down your options and identify the most promising candidates.

- Card Provider Websites: Visit the websites of card providers to get more detailed information about their reloadable business credit cards. Read the terms and conditions carefully to understand the fees, spending limits, rewards programs, and other features. Look for customer reviews and testimonials to get insights into the card provider’s reputation and customer service.

- Contact Card Providers: If you have questions or need clarification, don’t hesitate to contact card providers directly. You can call their customer service lines, send emails, or use their online chat features.

Ultimate Conclusion

By embracing reloadable credit cards, businesses can streamline their financial processes, gain greater control over spending, and enhance security. The flexibility, convenience, and enhanced security offered by these cards make them an invaluable tool for modern businesses. As technology continues to evolve, we can expect to see even more innovative features and functionalities integrated into reloadable business credit cards, further simplifying financial management and empowering businesses to achieve their goals.

FAQ

What are the fees associated with reloadable business credit cards?

Fees can vary depending on the card issuer and the type of card. Common fees include activation fees, monthly maintenance fees, reload fees, and transaction fees. It’s essential to carefully review the fee structure before choosing a card.

How do I reload a reloadable business credit card?

Reload methods typically include bank transfers, debit card transfers, or direct deposits. Some issuers may offer additional options like cash reload at specific locations.

Are there any rewards programs associated with reloadable business credit cards?

While not as common as with traditional credit cards, some reloadable business credit cards may offer rewards programs, such as cash back, points, or travel miles. Check the card issuer’s website for details.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!