SBA business credit lines offer a flexible and accessible funding option for businesses looking to expand, manage cash flow, or navigate seasonal fluctuations. These lines of credit, backed by the Small Business Administration, provide a lifeline for entrepreneurs seeking to overcome financial hurdles and achieve their business goals.

With a variety of programs and lenders to choose from, businesses can tailor an SBA credit line to meet their specific needs. Whether it’s investing in new equipment, expanding inventory, or covering unexpected expenses, an SBA credit line can provide the financial flexibility needed to thrive in today’s competitive market.

SBA Business Credit Line Overview

An SBA business credit line is a revolving line of credit that provides small businesses with access to working capital. It is a flexible financing option that allows businesses to draw funds as needed and repay them over time. This can be a valuable tool for managing cash flow, covering seasonal expenses, or funding short-term growth opportunities.

Benefits of an SBA Business Credit Line

An SBA business credit line offers several advantages to small businesses, making it a popular choice for funding needs.

- Lower Interest Rates: SBA loans generally have lower interest rates compared to traditional commercial loans, which can save businesses significant money on financing costs.

- Longer Repayment Terms: SBA loans often come with longer repayment terms than traditional loans, providing businesses with more time to repay their debt.

- Flexible Draw Options: SBA business credit lines allow businesses to draw funds as needed, providing flexibility to meet changing financial requirements.

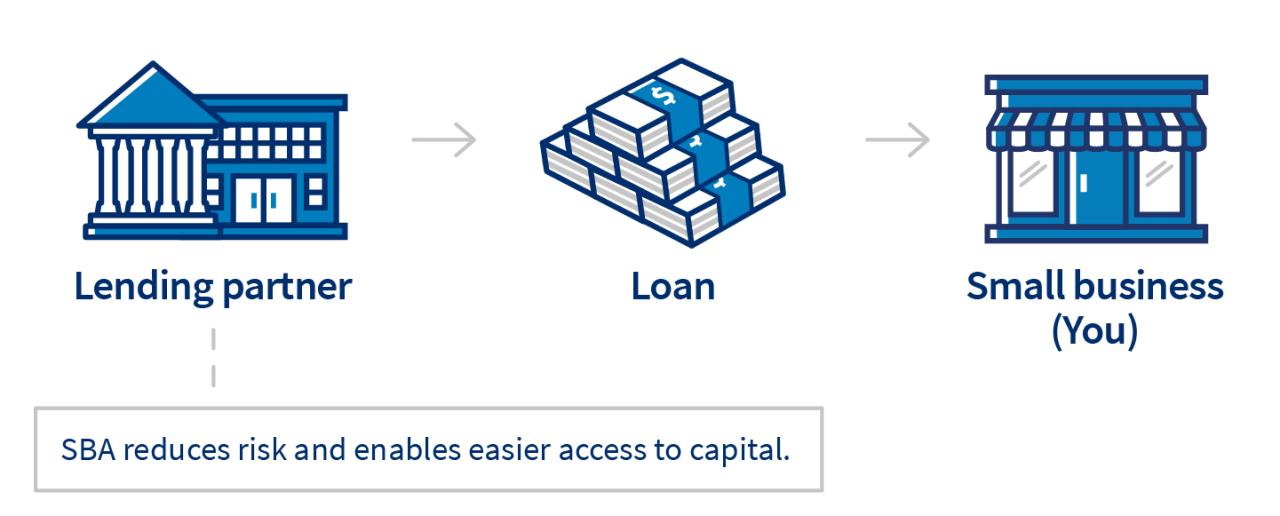

- Government Guarantee: The SBA provides a guarantee to lenders, reducing their risk and making it easier for businesses to qualify for loans.

Types of SBA Business Credit Lines

There are various types of SBA business credit lines available, each designed to cater to specific needs and circumstances.

- 7(a) Loan Program: This is the most common SBA loan program, offering a wide range of loan options, including lines of credit. 7(a) loans can be used for various purposes, such as working capital, equipment purchases, and real estate.

- 504 Loan Program: This program is specifically designed for fixed assets, such as land, buildings, and equipment. It offers long-term financing with low interest rates, making it suitable for businesses investing in major capital projects.

- Microloans: Microloans are small loans, typically up to $50,000, designed to help microenterprises and startups with their initial funding needs. They often come with flexible repayment terms and low interest rates.

Eligibility Requirements for SBA Business Credit Lines

To be eligible for an SBA business credit line, businesses must meet certain criteria.

- For-Profit Business: The business must be a for-profit entity operating in the United States.

- Good Credit History: Businesses must have a good credit history, demonstrating responsible financial management.

- Demonstrated Need: Businesses must demonstrate a clear need for the loan, outlining how the funds will be used to benefit the business.

- Ability to Repay: Businesses must have the ability to repay the loan, showcasing a strong financial track record and a viable business plan.

How SBA Business Credit Lines Work

SBA business credit lines provide flexible funding options for small businesses. They offer a revolving line of credit that businesses can access as needed, up to a pre-approved limit. This allows businesses to manage cash flow effectively and meet unexpected expenses or capitalize on growth opportunities.

Application Process

The application process for an SBA business credit line involves several steps, including gathering necessary documentation, submitting the application, and undergoing a credit review. The process typically involves:

- Gathering Required Documents: Businesses need to provide documentation such as their business plan, tax returns, financial statements, and personal credit history. This information helps lenders assess the business’s financial health and creditworthiness.

- Submitting the Application: Once the documentation is prepared, businesses submit the application to an SBA-approved lender. The lender reviews the application and makes a credit decision based on the business’s financial profile.

- Credit Review and Approval: The SBA guarantees a portion of the loan, reducing the risk for lenders and making it easier for businesses to secure financing. The SBA reviews the lender’s credit decision and may provide its guarantee if the business meets the eligibility criteria.

Terms and Conditions

SBA business credit lines come with specific terms and conditions that businesses need to understand before applying. These conditions may include:

- Credit Limit: The maximum amount of money that a business can borrow from the credit line.

- Interest Rate: The percentage charged on the borrowed funds. SBA business credit lines typically have lower interest rates compared to conventional loans.

- Repayment Period: The timeframe within which the business needs to repay the borrowed funds. This period can vary depending on the lender and the credit line amount.

- Fees: Lenders may charge fees for origination, closing, and annual maintenance of the credit line.

- Collateral: Some lenders may require collateral as security for the loan, which can be in the form of real estate, equipment, or inventory.

Interest Rates and Fees

The interest rates and fees associated with SBA business credit lines can vary depending on several factors, including:

- Creditworthiness of the Business: Businesses with strong credit histories and financial performance may qualify for lower interest rates.

- Loan Amount: Larger loan amounts may have higher interest rates.

- Lender’s Policies: Different lenders may have varying interest rate structures and fees.

- Market Conditions: Interest rates can fluctuate based on prevailing market conditions.

SBA business credit lines offer competitive interest rates compared to conventional loans, making them an attractive financing option for small businesses.

Advantages and Disadvantages of SBA Business Credit Lines

SBA business credit lines offer several advantages over traditional business loans, making them an attractive financing option for many small businesses. However, it is essential to consider the potential disadvantages before making a decision. This section will explore the pros and cons of SBA business credit lines to help you determine if this type of financing is right for your business.

Advantages of SBA Business Credit Lines

SBA business credit lines offer several advantages over traditional business loans, making them an attractive financing option for many small businesses. These advantages include:

- Lower Interest Rates: SBA business credit lines typically have lower interest rates than traditional business loans. This is because the SBA guarantees a portion of the loan, reducing the risk for lenders.

- Longer Repayment Terms: SBA business credit lines often have longer repayment terms than traditional business loans. This can make it easier to manage your monthly payments and free up cash flow for other business needs.

- Flexible Use of Funds: SBA business credit lines can be used for a wide range of business purposes, including working capital, inventory, equipment, and even real estate. This flexibility can be beneficial for businesses that need to fund multiple projects or address unexpected expenses.

- Easier Qualification: SBA business credit lines often have less stringent qualification requirements than traditional business loans. This can make it easier for businesses with limited credit history or lower revenue to obtain financing.

- Access to Counseling and Support: The SBA provides counseling and support services to small businesses, including assistance with developing a business plan, managing finances, and accessing other resources.

Disadvantages of SBA Business Credit Lines

While SBA business credit lines offer several advantages, it is important to consider the potential disadvantages:

- Longer Application Process: SBA business credit lines typically have a longer application process than traditional business loans. This is because the SBA must review and approve each loan application.

- More Documentation Required: SBA business credit lines often require more documentation than traditional business loans. This can include financial statements, tax returns, and business plans.

- Limited Loan Amounts: SBA business credit lines typically have lower loan limits than traditional business loans. This may not be sufficient for larger businesses or projects.

- Potential for Higher Fees: SBA business credit lines may have higher fees than traditional business loans. These fees can include origination fees, closing costs, and annual fees.

Comparison of SBA Business Credit Lines to Other Financing Options

Here is a table comparing SBA business credit lines to other financing options:

| Financing Option | Advantages | Disadvantages |

|---|---|---|

| SBA Business Credit Lines | Lower interest rates, longer repayment terms, flexible use of funds, easier qualification, access to counseling and support | Longer application process, more documentation required, limited loan amounts, potential for higher fees |

| Traditional Business Loans | Faster application process, less documentation required, higher loan amounts, lower fees | Higher interest rates, shorter repayment terms, less flexible use of funds, more stringent qualification requirements |

| Lines of Credit | Flexible use of funds, no fixed repayment schedule, lower interest rates than credit cards | Higher interest rates than traditional loans, potential for higher fees, may be difficult to qualify for |

| Credit Cards | Easy to obtain, convenient for small purchases, reward programs | High interest rates, limited credit limits, potential for high fees |

| Invoice Financing | Access to cash flow before invoices are paid, no debt taken on | Limited to businesses with a steady stream of invoices, potential for high fees |

Using an SBA Business Credit Line for Business Growth

An SBA business credit line can be a powerful tool for businesses seeking to expand their operations, improve cash flow, and navigate seasonal fluctuations. By providing access to flexible and readily available funds, an SBA business credit line can empower entrepreneurs to pursue growth opportunities and manage their finances effectively.

Using an SBA Business Credit Line for Business Expansion

An SBA business credit line can be a valuable resource for businesses looking to expand their operations. It can provide the necessary capital to invest in new equipment, hire additional staff, or expand into new markets. For example, a small bakery looking to open a second location could use an SBA business credit line to finance the costs of rent, equipment, and inventory for the new store.

Using an SBA Business Credit Line to Improve Cash Flow

An SBA business credit line can be a valuable tool for improving cash flow by providing access to funds when needed. Businesses can use an SBA business credit line to cover unexpected expenses, bridge gaps in revenue, or invest in working capital.

Here are some examples of how an SBA business credit line can be used to improve cash flow:

- Covering unexpected expenses: If a business experiences a sudden repair or faces an unexpected bill, an SBA business credit line can provide the necessary funds to cover the expense without disrupting normal operations.

- Bridging gaps in revenue: If a business experiences a seasonal dip in revenue, an SBA business credit line can provide the necessary funds to cover operating expenses until revenue picks up again.

- Investing in working capital: An SBA business credit line can provide the necessary funds to purchase inventory, pay suppliers, or cover other working capital needs.

Using an SBA Business Credit Line to Manage Seasonal Business Fluctuations

Businesses with seasonal sales cycles can utilize an SBA business credit line to manage fluctuations in cash flow. By drawing on the credit line during slow periods and repaying it during peak seasons, businesses can maintain a consistent cash flow and avoid financial strain.

For example, a landscaping company may experience a surge in business during the spring and summer months, but have a slower winter season. An SBA business credit line can provide the company with the necessary funds to cover operating expenses during the winter months, ensuring that they can continue to operate and be ready for the busy spring season.

Finding the Right SBA Business Credit Line

Navigating the world of SBA business credit lines can feel overwhelming, but with the right approach, you can find a financing option that aligns with your business needs. This section will guide you through the process of finding the best SBA business credit line for your company.

SBA Lender Resources

SBA business credit lines are offered through SBA-approved lenders, not directly by the SBA. Finding the right lender is crucial, and there are several resources available to help you locate them.

- SBA Lender Match: This free online tool connects you with SBA lenders based on your business profile and financing needs. Simply fill out a brief form with information about your business, the loan amount you need, and your industry, and the SBA will provide you with a list of potential lenders.

- SBA Website: The SBA’s website offers a comprehensive directory of SBA-approved lenders across the country. You can search by state, city, or lender type.

- Local Small Business Development Centers (SBDCs): SBDCs are non-profit organizations that provide free business counseling and training to small businesses. They can also help you identify potential SBA lenders in your area.

- SCORE: SCORE is a non-profit organization that provides free mentoring and business advice to small businesses. SCORE volunteers, many of whom are experienced business owners, can offer guidance on finding SBA lenders and navigating the loan process.

Choosing the Best SBA Business Credit Line

Once you have a list of potential SBA lenders, it’s time to start comparing their offers. To find the best SBA business credit line for your specific needs, consider these factors:

- Interest Rates: Interest rates on SBA business credit lines can vary significantly, so it’s essential to compare rates from multiple lenders.

- Fees: SBA lenders may charge various fees, such as application fees, origination fees, and annual fees. Make sure to inquire about these fees upfront.

- Loan Terms: Consider the loan term, which is the length of time you have to repay the loan. SBA business credit lines typically have terms ranging from one to ten years.

- Repayment Options: SBA business credit lines may offer different repayment options, such as fixed monthly payments or interest-only payments. Choose an option that aligns with your cash flow and financial goals.

- Credit Requirements: SBA business credit lines typically have more lenient credit requirements than traditional business loans. However, you’ll still need to have a good credit score and a solid business plan.

- Collateral: SBA business credit lines may require collateral, which is an asset that the lender can seize if you default on the loan. The type of collateral required will vary depending on the lender and the loan amount.

- Customer Service: Choose a lender that provides excellent customer service and is responsive to your questions and concerns.

Comparing SBA Business Credit Line Offers

Comparing SBA business credit line offers is crucial to finding the best deal for your business. Consider these tips:

- Get Multiple Quotes: Don’t settle for the first offer you receive. Get quotes from at least three different SBA lenders.

- Read the Fine Print: Carefully review the loan terms and conditions before signing any documents. Make sure you understand all the fees, interest rates, and repayment options.

- Ask Questions: Don’t hesitate to ask questions if you’re unsure about anything. The lender should be happy to explain the terms of the loan in detail.

Last Word

Navigating the world of SBA business credit lines requires careful research and consideration. By understanding the eligibility requirements, terms, and advantages, businesses can make informed decisions about whether this financing option is right for them. With a solid understanding of the process and a clear business plan, entrepreneurs can leverage the power of SBA credit lines to unlock growth opportunities and propel their businesses forward.

Expert Answers

What are the interest rates on SBA business credit lines?

Interest rates for SBA business credit lines vary depending on factors like the lender, creditworthiness, and loan amount. It’s essential to compare rates from multiple lenders to find the most competitive option.

How long does it take to get approved for an SBA business credit line?

The approval process for an SBA business credit line can take several weeks, as it involves a more thorough review than traditional loans. It’s crucial to start the application process early and gather all necessary documentation.

Are there any fees associated with SBA business credit lines?

Yes, SBA business credit lines typically involve fees such as application fees, closing costs, and annual maintenance fees. It’s important to understand these fees upfront and factor them into your overall borrowing costs.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!