Short term business credit – Short-term business credit plays a crucial role in helping businesses navigate periods of growth and unexpected expenses. From lines of credit to invoice financing, various options exist, each tailored to specific needs. Understanding the intricacies of these financial tools can empower entrepreneurs to make informed decisions that fuel their ventures forward.

This guide delves into the fundamentals of short-term business credit, exploring its purpose, types, eligibility requirements, and effective management strategies. By providing a comprehensive overview, we aim to equip readers with the knowledge necessary to leverage these financial solutions effectively.

Understanding Short-Term Business Credit

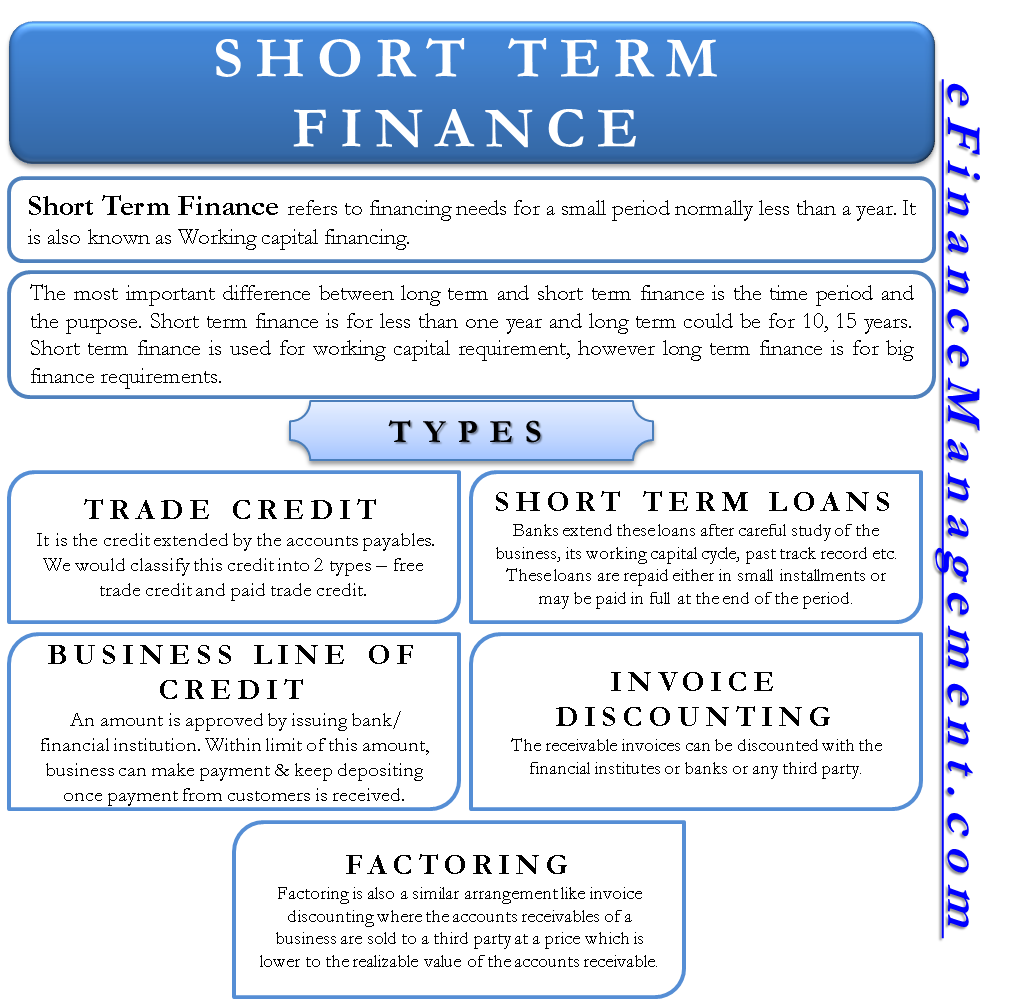

Short-term business credit is a valuable tool for businesses that need access to funds for a short period of time. It can be used to cover expenses, finance inventory, or bridge a cash flow gap. Short-term business credit is typically repaid within a year, and interest rates are often higher than those for long-term loans.

Types of Short-Term Business Credit

Short-term business credit is available in several forms, each with its own advantages and disadvantages. Understanding these differences can help you choose the right type of credit for your business needs.

Lines of Credit

A line of credit is a revolving credit account that allows you to borrow money up to a certain limit. You can withdraw funds as needed and repay them over time, making it a flexible financing option.

- Advantages: Lines of credit offer flexibility, allowing you to borrow only what you need and pay interest only on the amount borrowed. They can also be a good option for businesses with fluctuating cash flow.

- Disadvantages: Lines of credit typically have higher interest rates than other forms of financing. They can also be subject to a credit limit, which may not be enough for your needs.

Invoice Financing

Invoice financing is a form of financing that allows you to get cash advances against your outstanding invoices. This can be a helpful option if you have customers who pay slowly or if you need cash flow to cover expenses before your invoices are paid.

- Advantages: Invoice financing can provide quick access to cash, allowing you to pay your bills and keep your business running smoothly. It can also help you improve your cash flow and manage your working capital.

- Disadvantages: Invoice financing typically involves a fee for each invoice financed, which can add to the overall cost of borrowing. You may also need to provide collateral to secure the loan.

Merchant Cash Advances

A merchant cash advance is a lump-sum payment that is provided in exchange for a percentage of your future credit card sales. This can be a quick and easy way to access cash, but it often comes with high interest rates and fees.

- Advantages: Merchant cash advances are typically easier to obtain than other forms of financing, and the approval process is often quick. They can also be a good option for businesses with seasonal cash flow fluctuations.

- Disadvantages: Merchant cash advances typically have very high interest rates and fees, which can make them an expensive form of financing. They can also be difficult to repay if your sales decline.

Eligibility and Requirements

Securing short-term business credit requires meeting specific eligibility criteria. Lenders carefully evaluate various factors to assess your business’s creditworthiness and determine the likelihood of repayment.

Creditworthiness Factors

Lenders assess several factors to determine your business’s creditworthiness. These include:

- Business Credit Score: This score reflects your business’s credit history and repayment performance. A higher score indicates a lower risk for lenders, often resulting in better loan terms.

- Business Revenue and Profitability: Lenders want to see a stable and growing business with sufficient revenue and profitability to cover loan repayments. They may review financial statements, such as income statements and balance sheets, to assess your business’s financial health.

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt financing compared to equity financing. A lower ratio suggests a healthier financial structure, as the business relies less on debt.

- Time in Business: Lenders often prefer businesses that have been operating for a certain period, demonstrating stability and experience. This can be particularly important for businesses seeking larger loan amounts.

- Industry and Market Conditions: The industry in which your business operates and the overall market conditions can influence a lender’s decision. Lenders may consider factors such as industry growth potential, competition, and regulatory environment.

- Personal Credit Score: For smaller businesses, lenders may also consider the personal credit score of the business owner(s). This can be particularly relevant for startups or businesses with limited credit history.

Impact of Business Credit Scores

Your business credit score plays a crucial role in securing short-term business credit. A higher score generally translates into:

- Increased Loan Approval Odds: Lenders are more likely to approve loan applications from businesses with strong credit scores, as they perceive them as lower risk.

- Lower Interest Rates: Businesses with excellent credit scores often qualify for lower interest rates, reducing the overall cost of borrowing.

- More Favorable Loan Terms: Lenders may offer more flexible repayment terms, such as longer repayment periods or lower down payments, to businesses with strong credit scores.

“A good business credit score can be your key to unlocking favorable loan terms and securing the funding you need to grow your business.”

Obtaining Short-Term Business Credit

Securing short-term business credit is crucial for businesses of all sizes, especially startups and small businesses that may not have access to traditional long-term financing options. Short-term credit provides the necessary funds to cover operational expenses, manage cash flow, and take advantage of growth opportunities.

Applying for Short-Term Business Credit

Applying for short-term business credit can be done through various channels, each with its own advantages and disadvantages.

- Online Applications: Many online lenders offer quick and convenient application processes, often requiring minimal documentation. These platforms utilize advanced algorithms to assess creditworthiness and make decisions quickly. However, they may have higher interest rates and shorter repayment terms compared to traditional lenders.

- Traditional Bank Loans: Banks offer a wide range of short-term loans, including lines of credit, business credit cards, and term loans. While they may have more stringent requirements, they often offer lower interest rates and longer repayment terms. However, the application process can be more time-consuming and involve more paperwork.

- Alternative Lenders: Alternative lenders, such as peer-to-peer lending platforms and merchant cash advance providers, offer alternative financing solutions for businesses that may not qualify for traditional loans. These options may have higher interest rates and fees but can be more accessible to businesses with limited credit history or recent financial challenges.

Increasing Approval Chances

To increase the chances of approval for short-term business credit, it is essential to have a well-prepared business plan and strong financial statements. These documents demonstrate the viability of your business, its financial health, and your ability to repay the loan.

- Business Plan: A well-written business plan Artikels your business’s goals, strategies, market analysis, and financial projections. It provides lenders with a clear understanding of your business model, its potential for success, and your ability to generate revenue.

- Financial Statements: Accurate and up-to-date financial statements, including income statements, balance sheets, and cash flow statements, showcase your business’s financial performance and its ability to manage finances. These documents help lenders assess your creditworthiness and risk profile.

- Credit History: A good credit history is essential for securing favorable loan terms. Regularly monitoring and improving your personal and business credit scores can significantly enhance your chances of approval.

- Strong Collateral: Offering collateral, such as equipment or inventory, can increase your chances of approval, especially for larger loans. Collateral provides lenders with an additional layer of security in case of default.

- Strong Relationships: Building relationships with lenders can improve your chances of approval. Maintaining good communication and a positive track record with lenders can make them more likely to consider your application favorably.

Managing Short-Term Business Credit

Effectively managing short-term business credit is crucial for maintaining financial stability and achieving long-term success. It involves a strategic approach to budgeting, repayment, and monitoring credit utilization.

Budgeting for Short-Term Business Credit

A well-structured budget is the cornerstone of managing short-term business credit. It helps you understand your income and expenses, allowing you to allocate funds for repayments and avoid overextending your credit.

- Track Income and Expenses: Regularly monitor your business income and expenses to get a clear picture of your financial health. This information will help you determine how much credit you can responsibly utilize.

- Create a Repayment Plan: Develop a detailed repayment plan that Artikels the amount you will pay towards each short-term loan or line of credit, and when. This plan will ensure timely payments and help you avoid late fees and negative impacts on your credit score.

- Allocate Funds: Set aside specific funds for short-term credit repayments. This will prevent you from using these funds for other purposes and ensure that you have the necessary resources to meet your financial obligations.

Repayment Strategies for Short-Term Business Credit

There are various repayment strategies you can employ to manage your short-term business credit effectively.

- Pay More Than the Minimum: Paying more than the minimum payment each month will help you reduce your debt faster and minimize interest charges. This can significantly improve your financial standing and free up cash flow for other business needs.

- Make Lump-Sum Payments: If possible, consider making lump-sum payments whenever you have extra funds. This can dramatically shorten the repayment period and save you on interest charges.

- Negotiate Payment Terms: Communicate with your lenders if you anticipate difficulty meeting your repayment obligations. They may be willing to work with you to adjust payment terms, such as extending the repayment period or reducing the interest rate.

Monitoring Credit Utilization, Short term business credit

Regularly monitoring your credit utilization is essential for maintaining a healthy credit score and avoiding over-indebtedness.

- Check Your Credit Reports: Obtain copies of your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) regularly. Review them carefully for any errors or inconsistencies.

- Track Credit Limits: Keep track of your credit limits for each short-term loan or line of credit. This will help you understand your available credit and avoid exceeding your limits.

- Calculate Credit Utilization Ratio: Your credit utilization ratio is the percentage of your available credit that you are currently using. Aim to keep this ratio below 30% to maintain a good credit score.

Building a Strong Credit History

A strong credit history is crucial for obtaining favorable loan terms and interest rates.

- Pay Bills on Time: Make all payments on time, including credit card bills, loan payments, and utility bills. This demonstrates your financial responsibility and helps build a positive credit history.

- Avoid Late Payments: Late payments can significantly damage your credit score. Set reminders for due dates and make payments well in advance to avoid late fees and negative impacts on your credit.

- Use Credit Wisely: Avoid overusing your credit and keep your credit utilization ratio low. This shows lenders that you are responsible with credit and can manage your finances effectively.

Real-World Examples

Short-term business credit can be a valuable tool for businesses of all sizes. It can help businesses bridge cash flow gaps, fund seasonal inventory needs, and take advantage of growth opportunities.

Scenarios Where Short-Term Business Credit is Beneficial

Here are some real-world examples of how short-term business credit can be beneficial:

| Business Scenario | Type of Credit | Benefits |

|---|---|---|

| A small bakery needs to purchase a new oven to meet increased demand during the holiday season. | Equipment financing | The bakery can acquire the new oven without depleting its cash reserves, allowing it to meet the increased demand and generate additional revenue. |

| A seasonal retailer needs to purchase inventory for the upcoming summer season. | Inventory financing | The retailer can purchase the inventory without having to pay upfront, giving it more time to generate sales and repay the loan. |

| A startup company needs to fund its marketing campaign to launch a new product. | Line of credit | The startup can access funds as needed, allowing it to launch its marketing campaign effectively and reach its target audience. |

| A small business owner needs to cover payroll expenses during a slow month. | Invoice financing | The business owner can receive immediate cash flow by selling its invoices to a financing company, ensuring that its employees are paid on time. |

| A construction company needs to purchase materials for a large project. | Purchase order financing | The construction company can secure funding based on its purchase orders, allowing it to purchase materials and complete the project on time. |

Risks and Considerations

While short-term business credit can be a valuable tool for managing cash flow and funding growth, it’s crucial to understand the potential risks involved. Using short-term credit unwisely can lead to financial strain and even jeopardize your business’s long-term stability.

High Interest Rates

Short-term business loans often come with higher interest rates compared to traditional long-term loans. This is because lenders consider short-term loans riskier due to their shorter repayment periods. High interest rates can significantly increase the cost of borrowing, impacting your profitability and cash flow.

Debt Accumulation

Continuously relying on short-term credit to cover operational expenses can lead to a dangerous cycle of debt accumulation. As you take on more loans, the interest payments become a heavier burden, making it difficult to repay the principal and potentially putting your business at risk of default.

Potential Damage to Credit Scores

Failing to make timely payments on your short-term business loans can negatively impact your credit score. A poor credit score can make it challenging to secure future financing, including loans, lines of credit, and even business credit cards.

Planning and Responsible Borrowing

To mitigate the risks associated with short-term business credit, it’s essential to plan carefully and practice responsible borrowing habits.

Strategies for Mitigating Risks

- Develop a Comprehensive Budget: Create a detailed budget that accurately reflects your income and expenses. This will help you determine how much you can afford to borrow without putting your business at risk.

- Shop Around for the Best Rates: Compare interest rates and terms from multiple lenders to secure the most favorable deal. Consider factors like loan fees, repayment periods, and prepayment penalties.

- Use Short-Term Credit Strategically: Reserve short-term credit for specific, short-term needs, such as seasonal inventory purchases or covering unexpected expenses. Avoid using it for long-term investments or ongoing operational expenses.

- Prioritize Repayment: Make timely payments on all your short-term loans to avoid late fees and potential damage to your credit score. Consider setting up automatic payments to ensure you never miss a deadline.

- Explore Alternative Financing Options: Consider exploring alternative financing options like invoice financing or merchant cash advances, which may offer lower interest rates or more flexible repayment terms. However, thoroughly research these options and their potential drawbacks before committing.

Last Word

As you embark on your journey with short-term business credit, remember that responsible borrowing practices are essential for long-term success. Thorough planning, careful budgeting, and diligent repayment strategies will ensure that you harness the power of these financial tools to fuel sustainable growth without compromising your financial stability. Armed with knowledge and a strategic approach, you can confidently navigate the world of short-term business credit and unlock new avenues for your business to thrive.

FAQ Insights: Short Term Business Credit

What are the common interest rates for short-term business credit?

Interest rates for short-term business credit vary widely depending on factors like your credit score, the type of credit, and the lender. Rates can range from 10% to 50% or higher, so it’s crucial to shop around and compare offers before making a decision.

How can I improve my chances of getting approved for short-term business credit?

Building a strong credit history, maintaining a good credit score, and having a well-prepared business plan and financial statements can significantly increase your chances of approval. Additionally, working with a reputable lender and demonstrating a clear understanding of your financial needs can further enhance your application.

What are the risks associated with using short-term business credit?

While short-term business credit can be beneficial, it’s important to be aware of the potential risks. High interest rates can lead to significant debt accumulation, and failing to make timely repayments can damage your credit score and limit your future borrowing options. It’s crucial to use short-term business credit responsibly and only for essential business needs.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!