The small business credit application form is your gateway to securing funding for your entrepreneurial endeavors. It’s a crucial document that allows lenders to assess your financial health and determine your creditworthiness. This form serves as a roadmap for your business’s financial future, providing insights into the types of credit products available, the application process, and the factors that influence your chances of approval.

Navigating the world of small business credit can feel overwhelming, but understanding the application process is essential for success. This guide will demystify the process, providing valuable insights into the key information required, the evaluation criteria used by lenders, and tips for maximizing your chances of securing the funding you need.

Understanding Small Business Credit Applications

A small business credit application form is a crucial document that helps lenders assess your business’s financial health and determine if you qualify for credit. This form serves as a gateway to obtaining essential funding for your business operations, growth, and expansion.

Key Information Requested on Credit Applications

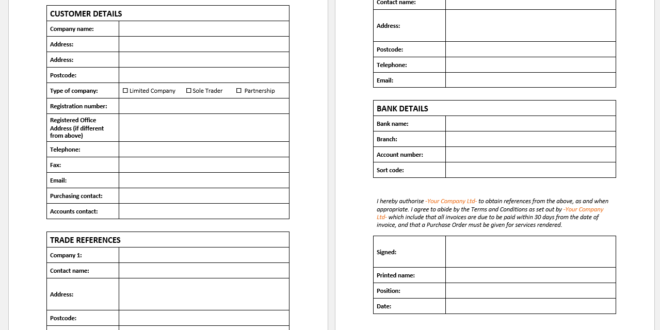

Credit application forms are designed to gather comprehensive information about your business, allowing lenders to make informed decisions about your creditworthiness. Here’s a breakdown of the key information typically requested:

- Business Information: This includes your business name, legal structure (sole proprietorship, partnership, LLC, etc.), date of establishment, industry, and primary business address. This information provides a foundational understanding of your business entity.

- Financial Information: Lenders require details about your business’s financial performance, including revenue, expenses, assets, liabilities, and cash flow. This data helps assess your business’s financial stability and ability to repay loans.

- Personal Information: Some credit applications request personal information about the business owner(s), such as Social Security numbers, credit history, and income. This information provides insight into the owner’s financial background and creditworthiness.

- Business Plan: This section often requires a detailed description of your business model, products or services, target market, marketing strategy, and growth projections. A well-structured business plan demonstrates your vision and ability to succeed.

- Collateral: Lenders may require collateral, such as real estate or equipment, to secure loans. This collateral provides a safety net for the lender in case of default.

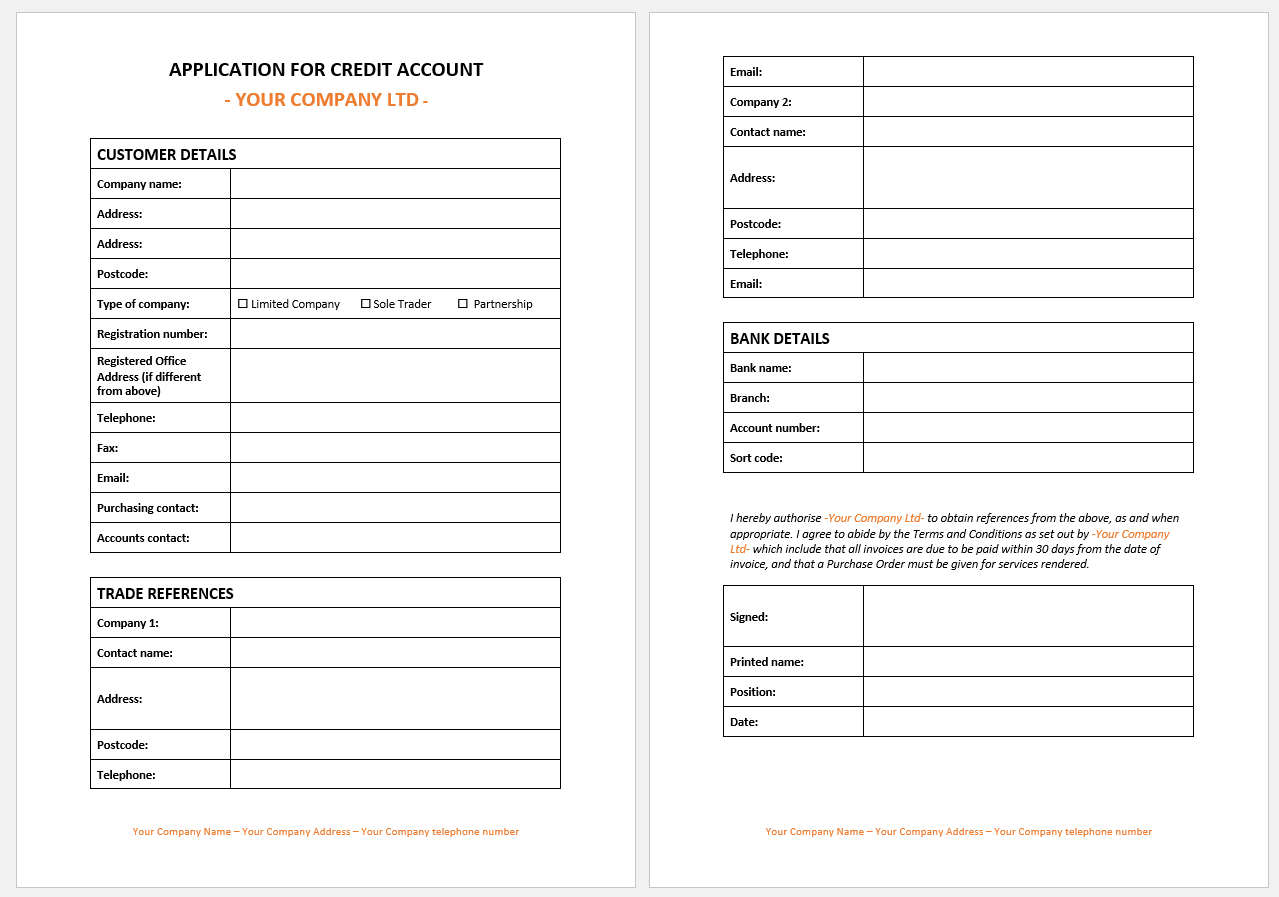

- References: Providing references from previous lenders or suppliers helps establish your business’s credibility and track record. These references can vouch for your reliability and responsible financial practices.

Types of Credit Products for Small Businesses

Small businesses have access to a variety of credit products designed to meet their specific needs and financial goals. These products can be categorized as follows:

- Business Loans: These are traditional loans that provide a lump sum of money with a fixed interest rate and repayment schedule. Business loans are versatile and can be used for various purposes, such as equipment purchases, working capital, or expansion.

- Lines of Credit: A line of credit provides a revolving credit facility, allowing businesses to borrow funds up to a pre-approved limit. This flexibility allows for quick access to funds when needed, making it suitable for managing cash flow fluctuations or covering unexpected expenses.

- Merchant Cash Advances: These advances provide immediate cash flow by offering a lump sum in exchange for a percentage of future sales. Merchant cash advances are typically used for short-term needs and are repaid through a daily or weekly deduction from credit card sales.

- Equipment Financing: This type of financing allows businesses to purchase equipment with monthly payments. Equipment financing is often used for acquiring vehicles, machinery, or technology that supports business operations.

- Invoice Factoring: Invoice factoring involves selling your invoices to a third-party company at a discounted rate, providing immediate cash flow. This option is particularly helpful for businesses with long payment terms from customers.

The Application Process

Applying for small business credit can seem daunting, but it’s a necessary step for many businesses to access the funding they need. The application process typically involves gathering information, completing forms, and providing documentation. Understanding the process can make it less stressful and help you ensure a successful application.

Completing the Application

The application process begins with gathering the necessary information. This includes basic business details, such as your business name, address, and contact information. You’ll also need to provide financial information, including your annual revenue, expenses, and debt obligations. It’s crucial to have all the information readily available before starting the application.

- Gather Essential Information: Begin by gathering key business information like your business name, address, contact details, and industry. This forms the foundation of your application.

- Complete the Application Form: Carefully review and complete all sections of the application form. Pay attention to instructions and ensure accuracy in all fields. If you are unsure about any section, seek clarification from the lender.

- Provide Financial Details: Include your annual revenue, expenses, and any outstanding debt. Accurate and complete financial data is essential for the lender to assess your business’s financial health.

- Review and Submit: Before submitting your application, carefully review all the information you’ve provided to ensure accuracy and completeness. Submitting a well-prepared application increases your chances of approval.

Required Documents

To verify the information you’ve provided, lenders typically require supporting documentation. These documents help them understand your business and its financial performance. The specific documents requested may vary depending on the lender and the type of credit you’re applying for.

- Business Plan: A well-written business plan Artikels your business’s goals, strategies, and financial projections. It provides lenders with a clear understanding of your business model and its potential for success.

- Tax Returns: Recent tax returns, such as your most recent Form 1040 (if you’re a sole proprietor) or Form 1120 (if you’re a corporation), demonstrate your business’s financial history and profitability.

- Financial Statements: Balance sheets, income statements, and cash flow statements provide a detailed picture of your business’s financial position. These documents should be up-to-date and accurate.

- Bank Statements: Bank statements for the past few months show your business’s cash flow and banking activity. They can help lenders assess your financial stability.

- Credit Reports: Your personal and business credit reports provide information about your credit history and repayment performance. A strong credit score can improve your chances of approval.

Accuracy and Completeness

Accuracy and completeness are paramount in a small business credit application.

Lenders rely on the information you provide to make informed decisions. Inaccurate or incomplete information can delay the application process or even lead to rejection.

- Double-Check Everything: Before submitting your application, thoroughly review all the information you’ve provided. Ensure all details are accurate and complete. Any errors or omissions could raise red flags for the lender.

- Be Honest and Transparent: Providing accurate information is crucial for building trust with lenders. Be upfront about any financial challenges your business may face. Honesty helps lenders understand your situation and potentially work with you to find a solution.

- Seek Clarification: If you’re unsure about any aspect of the application, don’t hesitate to contact the lender for clarification. It’s better to ask questions than to submit incomplete or inaccurate information.

Creditworthiness Evaluation

Lenders meticulously assess the creditworthiness of small businesses before approving loan applications. This evaluation process helps lenders determine the likelihood of a business repaying its debt obligations.

Factors Considered in Creditworthiness Evaluation

Lenders consider several key factors when evaluating a small business’s creditworthiness. These factors provide a comprehensive picture of the business’s financial health and ability to manage debt responsibly.

- Credit History: Lenders examine a business’s credit history to assess its track record of repaying debts. This includes reviewing credit reports from credit bureaus, which provide detailed information about past loans, credit lines, and payment history. A positive credit history, characterized by timely payments and responsible credit utilization, signals a lower risk to lenders.

- Financial Statements: Lenders carefully analyze a business’s financial statements, such as balance sheets, income statements, and cash flow statements. These documents reveal the business’s financial performance, assets, liabilities, and cash flow. Lenders assess key financial ratios, such as profitability, liquidity, and leverage, to gauge the business’s financial stability and ability to generate sufficient revenue to cover debt payments.

- Business Plan: A well-structured business plan provides lenders with a roadmap for the business’s future. It Artikels the business’s goals, strategies, market analysis, and financial projections. Lenders evaluate the feasibility and viability of the business plan, considering factors such as the market opportunity, competitive landscape, and management team’s experience. A strong business plan with realistic projections instills confidence in lenders about the business’s potential for success and repayment.

- Collateral: Lenders often require collateral, such as property or equipment, as security for a loan. Collateral serves as a backup for the lender in case the borrower defaults on the loan. The value of the collateral and its relevance to the business’s operations are considered when assessing the loan application.

- Industry and Market Conditions: Lenders evaluate the overall industry and market conditions in which the business operates. Factors such as industry growth, competition, and economic trends are considered. A strong industry outlook and favorable market conditions indicate a better chance of the business succeeding and repaying its debt.

- Management Team: Lenders assess the experience, expertise, and track record of the business’s management team. A strong and experienced management team is crucial for effective business operations and financial management.

Credit Scoring Models

Lenders often utilize credit scoring models to assess the creditworthiness of small businesses. These models use statistical algorithms to analyze various financial and business data points and assign a credit score. The score reflects the business’s overall credit risk, with higher scores indicating a lower risk of default.

- FICO Small Business Scoring Service (SBSS): FICO, a leading credit bureau, offers the SBSS model, which assesses the creditworthiness of small businesses based on factors such as payment history, credit utilization, and public records. The model provides a score ranging from 0 to 300, with higher scores indicating better creditworthiness.

- Experian Small Business Credit Report: Experian, another major credit bureau, provides small business credit reports that include a credit score based on factors such as payment history, trade lines, and public records. The score helps lenders assess the business’s credit risk.

- Equifax Small Business Credit Report: Equifax, a third major credit bureau, offers small business credit reports that include a credit score based on factors such as payment history, financial statements, and business operations.

Credit Application Tips

Submitting a strong credit application is crucial for securing the financing your small business needs. By presenting a well-prepared application, you demonstrate your financial responsibility and increase your chances of approval. Here are some key tips to help you create a compelling application.

Improving Your Credit Score

A good credit score is essential for obtaining favorable loan terms. Here are some strategies to improve your credit score:

- Pay Bills on Time: Late payments significantly impact your credit score. Set up reminders or automate payments to ensure timely payments.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This ratio represents the amount of credit you’re using compared to your total available credit.

- Monitor Your Credit Report: Regularly review your credit report for any errors. You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

- Consider a Secured Credit Card: If you have limited credit history, a secured credit card can help you build credit. You deposit a security deposit that acts as collateral, allowing you to use the card responsibly and establish a positive credit history.

Building a Positive Credit History

A strong credit history demonstrates your ability to manage debt responsibly. Here’s how to build a positive credit history:

- Establish Business Credit: Apply for a business credit card or line of credit. This helps you build a separate credit history for your business.

- Pay Business Expenses on Time: Timely payment of business expenses, such as rent, utilities, and supplier invoices, contributes to a positive credit history.

- Report Business Income and Expenses: Ensure that your business income and expenses are accurately reported to credit bureaus. This helps them assess your creditworthiness.

Maintaining Good Financial Records

Accurate and well-organized financial records are essential for a strong credit application. They provide lenders with a clear picture of your business’s financial health.

- Keep Detailed Records: Track all income, expenses, assets, and liabilities. Use accounting software or spreadsheets to maintain organized records.

- Prepare Financial Statements: Generate regular financial statements, including balance sheets, income statements, and cash flow statements. These statements provide a comprehensive overview of your business’s financial performance.

- Reconcile Bank Accounts: Regularly reconcile your bank accounts to ensure accuracy and identify any discrepancies. This helps maintain a clear picture of your cash flow.

Managing Cash Flow

Effective cash flow management is crucial for the success of any business. It ensures you have enough funds to cover your expenses and meet your financial obligations.

- Create a Budget: Develop a detailed budget that Artikels your anticipated income and expenses. This helps you plan for future cash flow needs.

- Track Your Expenses: Monitor your expenses closely to identify areas for potential savings. Utilize budgeting tools or accounting software to streamline this process.

- Offer Payment Terms: Consider offering flexible payment terms to customers to improve cash flow. This can help you manage receivables and ensure timely payments.

Common Credit Application Mistakes

Applying for credit can be a daunting task, especially for small business owners. While the process might seem straightforward, a few common mistakes can jeopardize your chances of securing the necessary funding. Understanding these errors and how to avoid them can significantly improve your application’s success.

Inaccurate or Incomplete Information

Providing accurate and complete information is crucial for a successful credit application. Inaccurate or missing data can raise red flags and lead to delays or outright rejection.

- Incorrect Business Information: Double-check your business name, address, phone number, and contact information for any errors. Ensure all details are consistent across your application and other official documents.

- Misleading Financial Data: Providing inaccurate financial statements, income projections, or debt information can result in serious consequences, including denial of credit or even legal action. Always present honest and up-to-date financial figures.

- Missing Documentation: Failure to provide required documentation, such as tax returns, bank statements, or business licenses, can delay the application process and make it harder for lenders to assess your creditworthiness.

Lack of Financial Planning

A well-defined financial plan is essential for any business, but it’s particularly important when applying for credit. Without a clear plan, lenders may question your ability to manage debt and repay the loan.

- Unrealistic Projections: Overestimating income or underestimating expenses can create a false sense of financial security and lead to missed payments. Be realistic and conservative in your financial projections.

- Inadequate Budgeting: Failing to create a detailed budget that accounts for all expenses, including debt payments, can make it challenging to track cash flow and ensure timely repayments.

- Insufficient Collateral: Lenders often require collateral to secure loans, especially for larger amounts. Failing to provide adequate collateral can weaken your application and make it harder to obtain the desired financing.

Poor Credit History

Your personal and business credit history plays a significant role in the credit application process. A poor credit history can make it difficult to secure loans or obtain favorable interest rates.

- Missed Payments: Late or missed payments on previous loans or credit cards can negatively impact your credit score. Make every effort to pay your bills on time and avoid accumulating debt.

- High Debt-to-Income Ratio: A high debt-to-income ratio (DTI) indicates that a significant portion of your income is already committed to debt repayment. Lenders may view this as a risk factor and be less likely to approve your application.

- Negative Credit Reports: Errors or inaccuracies in your credit report can damage your credit score. Regularly review your credit report and dispute any errors with the credit reporting agencies.

Misunderstanding Credit Terms

Failing to fully understand the terms and conditions of a credit application can lead to unexpected financial obligations and challenges.

- Interest Rates: Carefully review the interest rate on the loan, as this can significantly impact the overall cost of borrowing. Consider comparing interest rates from multiple lenders to find the best deal.

- Fees: Be aware of any fees associated with the loan, such as origination fees, closing costs, or annual fees. These fees can add up and increase the total cost of borrowing.

- Loan Term: Understand the loan term and the monthly payment obligations. Choosing a longer loan term may result in lower monthly payments but could lead to higher overall interest payments.

Lack of Preparation

Rushing through the credit application process without adequate preparation can lead to mistakes and jeopardize your chances of success.

- Incomplete Application: Ensure that you have all the necessary information and documentation before submitting your application. A complete and accurate application demonstrates your seriousness and professionalism.

- Lack of Research: Take the time to research different lenders and compare their loan terms, interest rates, and fees. Choose a lender that best meets your business needs and financial goals.

- Poor Communication: Maintain clear and open communication with the lender throughout the application process. Address any questions or concerns promptly and be proactive in providing requested information.

Alternative Credit Options: Small Business Credit Application Form

Building a strong credit history takes time, and many small businesses, especially startups, may find themselves with limited credit history. This can pose a challenge when seeking traditional loans from banks and other financial institutions. Fortunately, alternative financing options are available to bridge the gap and provide access to capital for small businesses.

Microloans

Microloans are small, short-term loans designed specifically for entrepreneurs and small businesses with limited credit history. They are typically offered by non-profit organizations and community development financial institutions (CDFIs).

- Lower Interest Rates: Microloans often have lower interest rates compared to traditional loans, making them more affordable for businesses with limited credit.

- Flexible Repayment Terms: Microloan providers often offer flexible repayment terms, allowing businesses to tailor their repayment schedule to their cash flow.

- Technical Assistance: Many microloan providers offer technical assistance and business mentorship in addition to funding, helping entrepreneurs develop their business skills and navigate the challenges of starting and growing a business.

Microloans are a valuable resource for entrepreneurs with limited credit history, providing access to capital and support for their business ventures.

Crowdfunding

Crowdfunding is a popular alternative financing method that allows businesses to raise funds from a large number of individuals, typically through online platforms.

- Equity Crowdfunding: In equity crowdfunding, businesses offer investors a stake in their company in exchange for funding. This option can be attractive for businesses with high growth potential, as it allows them to raise significant capital without giving up control of their company.

- Debt Crowdfunding: Debt crowdfunding involves businesses issuing loans to individual investors. This option is similar to traditional loans, but it allows businesses to access capital from a wider pool of investors.

- Reward Crowdfunding: In reward crowdfunding, businesses offer investors tangible rewards, such as products or services, in exchange for their funding. This option is often used by businesses launching new products or services, as it allows them to pre-sell their offerings and generate early revenue.

Crowdfunding can be a powerful tool for businesses to raise capital, build brand awareness, and engage with their target audience.

Non-Traditional Lenders

Non-traditional lenders, such as online lenders and alternative finance companies, offer a range of financing options for businesses with limited credit history. These lenders often use alternative data, such as business revenue and cash flow, to assess creditworthiness.

- Faster Approval Times: Non-traditional lenders often have faster approval times compared to traditional banks, allowing businesses to access capital more quickly.

- More Flexible Loan Terms: Non-traditional lenders often offer more flexible loan terms, such as shorter repayment periods and lower minimum loan amounts, making them more accessible to businesses with limited credit.

- Higher Interest Rates: Non-traditional lenders often charge higher interest rates than traditional banks, reflecting the higher risk associated with lending to businesses with limited credit.

Non-traditional lenders can be a viable option for businesses that need access to capital quickly, but it’s important to carefully compare loan terms and interest rates before making a decision.

Other Alternative Financing Options, Small business credit application form

- Factoring: Factoring involves selling your accounts receivable to a factoring company in exchange for immediate cash. This option can be beneficial for businesses with a steady stream of invoices, as it provides a quick way to access working capital.

- Merchant Cash Advance: A merchant cash advance is a lump-sum payment that businesses can receive in exchange for a percentage of their future credit card sales. This option can be a quick and convenient way to access capital, but it can be expensive.

- Government Grants: Government grants are free funds that businesses can receive to support their operations or specific projects. These grants are often awarded to businesses that meet specific criteria, such as those operating in underserved industries or those with a social mission.

These alternative financing options provide businesses with limited credit history with access to capital and support, enabling them to grow and thrive.

Epilogue

Completing a small business credit application form is a significant step in your journey toward financial stability. By understanding the process, preparing thoroughly, and presenting a compelling case for your business, you can increase your chances of securing the credit you need to achieve your entrepreneurial goals. Remember, careful planning, accurate documentation, and a strong financial foundation are crucial for a successful application. Embrace the opportunity to showcase your business’s potential and pave the way for a prosperous future.

FAQ Overview

What is a credit score, and why is it important?

A credit score is a numerical representation of your creditworthiness, based on your past borrowing and repayment history. Lenders use credit scores to assess your risk as a borrower. A higher credit score generally indicates a lower risk and may lead to more favorable loan terms.

What if my business doesn’t have a credit history?

If your business is new and lacks a credit history, you can build one by obtaining trade credit from suppliers, paying your bills on time, and applying for a secured loan. Consider alternative financing options like microloans or crowdfunding.

How can I improve my business’s credit score?

Pay your bills on time, keep credit utilization low, avoid opening too many new accounts, and monitor your credit reports regularly for errors. Building a positive credit history takes time and consistent responsible financial management.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!