The Southwest Business Credit Card offer presents a compelling opportunity for business owners seeking to maximize travel rewards and streamline expenses. This card, designed specifically for entrepreneurs, provides a gateway to the Southwest Rapid Rewards program, offering valuable perks for both business and personal travel.

From generous sign-up bonuses and earning potential to exclusive travel benefits and comprehensive account management tools, the Southwest Business Credit Card caters to the needs of busy professionals. This in-depth exploration delves into the card’s features, benefits, and application process, empowering you to make an informed decision about whether it aligns with your business objectives.

Southwest Business Credit Card Overview: Southwest Business Credit Card Offer

The Southwest Business Credit Card is a great option for small business owners who frequently fly Southwest Airlines. This card offers a variety of perks and rewards that can help you save money and earn valuable points for future travel.

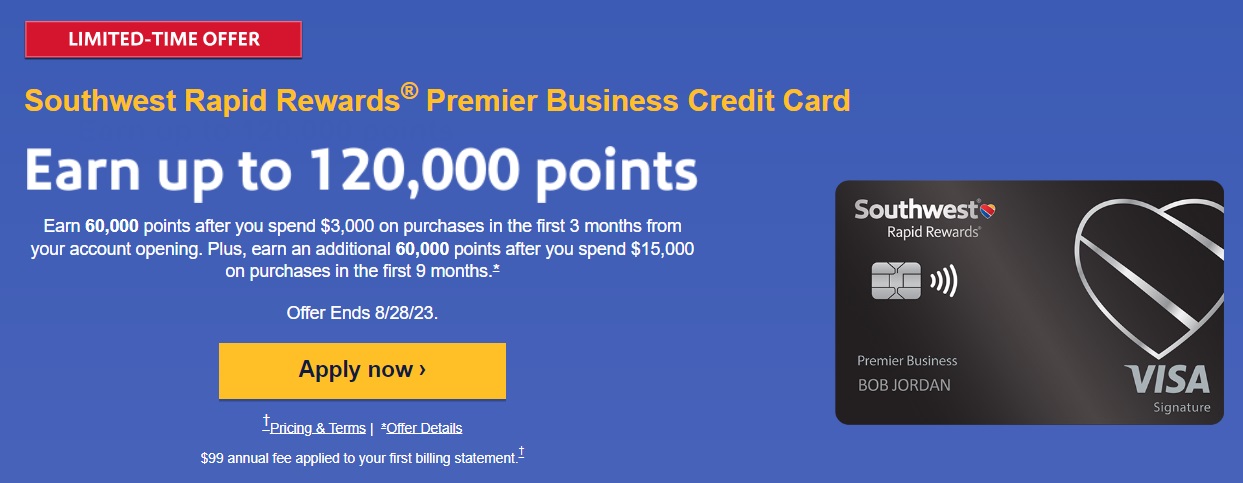

Sign-Up Bonus

The Southwest Business Credit Card offers a generous sign-up bonus for new cardholders. You can earn a substantial amount of Rapid Rewards points after spending a certain amount within the first few months of account opening. This bonus can significantly contribute to your travel goals, allowing you to redeem points for free flights, upgrades, or other travel-related expenses.

Annual Fee and Associated Fees

The Southwest Business Credit Card has an annual fee, but it’s offset by the potential rewards and benefits you can earn. Additionally, there may be other associated fees, such as foreign transaction fees, depending on the specific card terms and conditions. It’s crucial to review the fee structure carefully before applying to ensure it aligns with your budget and travel needs.

Rapid Rewards Earning Potential, Southwest business credit card offer

The Southwest Business Credit Card allows you to earn Rapid Rewards points on your eligible purchases. You’ll earn a specific number of points per dollar spent, making it easy to accumulate points for future travel. The earning potential is further enhanced by bonus categories, where you can earn more points for spending in certain categories, such as dining or office supplies. This makes it easier to reach your travel goals faster.

Rapid Rewards Redemption Options

Rapid Rewards points earned with the Southwest Business Credit Card can be redeemed for a variety of travel-related benefits. You can use your points for free flights, upgrades, in-flight purchases, and even travel-related expenses like hotel stays or car rentals. Southwest Airlines offers a wide range of redemption options, giving you flexibility in how you use your points.

Benefits for Business Owners

The Southwest Business Credit Card is designed to provide a range of benefits that can help your business thrive. From earning valuable rewards to enjoying travel perks and accessing financial tools, this card can streamline your business operations and boost your bottom line.

Benefits for Business Owners

This card offers a variety of benefits that can help your business grow and save money. Here are some of the key advantages:

| Benefit | Description | Example |

|---|---|---|

| Earn Southwest Rapid Rewards Points | Earn 2 points per dollar spent on eligible purchases. | You spend $1,000 on eligible purchases, you earn 2,000 Rapid Rewards points. |

| Companion Pass | Earn a Companion Pass after spending $14,000 in a calendar year, allowing you to bring a companion along for free on most Southwest flights. | You spend $14,000 on your card in 2024 and earn a Companion Pass, allowing you to bring a friend or family member with you on your next Southwest flight for free. |

| Travel Perks | Enjoy priority boarding, free checked bags, and other travel perks. | You can board your flight before other passengers, saving you time and stress. You can also check two bags for free, saving you money on luggage fees. |

| Financial Benefits | Access a range of financial tools, such as purchase protection and travel insurance. | Your purchase is damaged or stolen, you can file a claim for reimbursement. If you experience a travel delay or cancellation, you may be eligible for travel insurance coverage. |

Potential Cost Savings

The Southwest Business Credit Card can help you save money in several ways. For example, you can earn rewards on eligible purchases, which can be redeemed for travel or other expenses. You can also enjoy free checked bags and other travel perks, which can save you money on airfare and luggage fees. Additionally, the card offers purchase protection and travel insurance, which can help you avoid unexpected expenses.

Comparison to Other Business Credit Cards

Compared to other business credit cards, the Southwest Business Credit Card offers a unique combination of travel perks, rewards, and financial benefits. While some other cards may offer higher earning rates or more extensive travel insurance coverage, the Southwest Business Credit Card stands out for its focus on Southwest Airlines travel and its Companion Pass benefit, which can provide significant value for frequent travelers.

Eligibility and Application Process

Applying for the Southwest Business Credit Card is a straightforward process, and you can learn more about the eligibility criteria, application process, and required documentation here.

Eligibility Criteria

To be eligible for the Southwest Business Credit Card, you must meet the following criteria:

- Be at least 18 years old.

- Have a valid Social Security number.

- Be a U.S. citizen or permanent resident.

- Have a good credit history.

- Be the owner or authorized representative of a business.

Application Process

The application process for the Southwest Business Credit Card is simple and can be completed online, over the phone, or through a Chase branch.

- Gather your information. You will need your business information, including your business name, address, and tax ID number, as well as your personal information, including your name, address, Social Security number, and date of birth.

- Complete the application. You can apply online at the Chase website or by calling Chase customer service. If you are applying in person, you can complete an application at a Chase branch.

- Submit your application. Once you have completed the application, you will need to submit it to Chase for review. You can submit your application online, by phone, or in person.

- Wait for a decision. Chase will review your application and make a decision within a few business days. You will be notified of the decision by email or phone.

Required Documentation

To complete your application, you will need to provide Chase with the following documentation:

- Business information. This includes your business name, address, tax ID number, and business structure (e.g., sole proprietorship, partnership, corporation).

- Personal information. This includes your name, address, Social Security number, and date of birth.

- Financial information. This includes your business revenue and expenses, as well as your personal income and credit history.

Creditworthiness Requirements

Chase will review your credit history to determine your creditworthiness. This includes your credit score, payment history, and amount of debt. You will need a good credit score to be approved for the Southwest Business Credit Card.

Limitations and Restrictions

There are some limitations and restrictions on applications for the Southwest Business Credit Card. For example, you may not be approved for the card if you have a history of late payments or if you have too much debt. Additionally, Chase may limit the amount of credit you are approved for based on your creditworthiness.

Southwest Rapid Rewards Program

The Southwest Rapid Rewards program is a valuable perk for Southwest Business Credit Card holders. It allows you to earn points on your everyday spending and redeem them for flights, upgrades, and other travel benefits.

Rapid Rewards Program Tiers and Benefits

The Rapid Rewards program has four tiers, each offering unique benefits.

| Tier | Requirements | Benefits |

|---|---|---|

| A-List | Earn 25,000 qualifying points in a calendar year | Priority check-in, priority boarding, free checked bags, early access to Companion Pass, and more. |

| A-List Preferred | Earn 50,000 qualifying points in a calendar year | All A-List benefits, plus upgraded boarding positions, more Rapid Rewards points on flights, and priority security screening. |

| Companion Pass | Earn 110,000 qualifying points in a calendar year, or 125,000 points in a calendar year if you’re not an A-List Preferred member. | Fly a companion for free on any Southwest flight. |

| Rapid Rewards Member | No requirements | Basic Rapid Rewards program benefits, including the ability to earn points on flights and other purchases. |

The Value of Rapid Rewards Points for Business Travel

Rapid Rewards points can be incredibly valuable for business travel. They can be redeemed for flights, upgrades, and other travel expenses, which can help you save money on your business trips. For example, you can use your points to book flights for your employees, clients, or yourself, or to upgrade to a more comfortable seat on a flight.

Earning Rapid Rewards Points

You can earn Rapid Rewards points in several ways:

- Flying with Southwest: Earn points for every dollar spent on Southwest flights.

- Using the Southwest Business Credit Card: Earn points on all your business purchases.

- Partnering with other companies: Earn points through partnerships with hotels, car rental companies, and other businesses.

- Participating in promotions: Take advantage of limited-time promotions and offers to earn bonus points.

Redeeming Rapid Rewards Points

Redeeming your Rapid Rewards points is easy. You can use them to book flights, upgrade to a better seat, or pay for other travel expenses.

- Book flights: Redeem your points for flights on Southwest Airlines, with the number of points required varying based on the route, date, and time of travel.

- Upgrade your seat: Use your points to upgrade to a more comfortable seat on a Southwest flight.

- Pay for other travel expenses: Redeem your points for rental cars, hotels, and other travel expenses through Southwest’s travel partners.

Ultimate Conclusion

Ultimately, the Southwest Business Credit Card offer presents a unique opportunity for business owners to leverage their spending for travel rewards and valuable benefits. By understanding the card’s features, eligibility criteria, and rewards program, you can determine if it aligns with your business travel needs and financial goals. Whether you’re a seasoned entrepreneur or just starting out, this card offers a compelling path to maximize your travel experiences and streamline your business expenses.

Clarifying Questions

What is the annual fee for the Southwest Business Credit Card?

The annual fee for the Southwest Business Credit Card is [insert fee amount] but can be waived for the first year.

Can I use the Southwest Business Credit Card for personal travel?

Yes, you can use the card for both business and personal travel. However, you can only earn Rapid Rewards points on purchases that are eligible for business expenses.

What are the creditworthiness requirements for the Southwest Business Credit Card?

The creditworthiness requirements for the Southwest Business Credit Card vary based on individual credit history. Generally, a good credit score is recommended for approval.

How can I contact customer support for the Southwest Business Credit Card?

You can contact customer support for the Southwest Business Credit Card by phone, email, or through their website. The contact information is available on their website.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!