The Southwest Business Credit Card promotion sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This promotion provides a compelling opportunity for business owners to leverage their travel expenses and earn valuable rewards. The Southwest Airlines Business Credit Card offers a comprehensive package of benefits designed to streamline business travel and maximize value. This promotion offers a unique blend of travel perks and financial advantages, making it a compelling choice for businesses seeking to optimize their travel strategy and enhance their rewards earning potential.

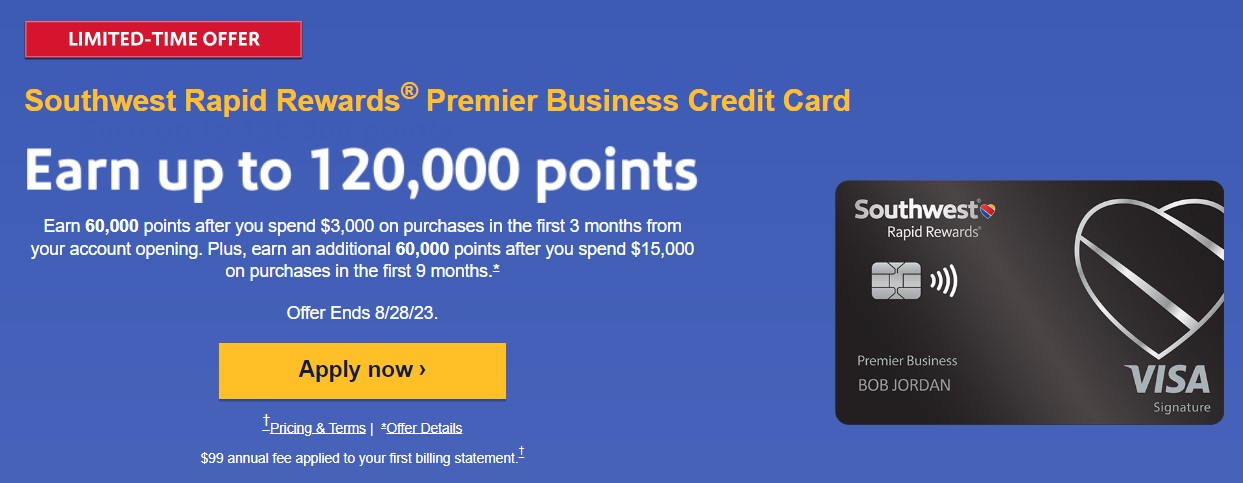

The Southwest Business Credit Card promotion provides a compelling opportunity for business owners to leverage their travel expenses and earn valuable rewards. This promotion offers a unique blend of travel perks and financial advantages, making it a compelling choice for businesses seeking to optimize their travel strategy and enhance their rewards earning potential. The promotion typically includes bonus points for new cardholders, making it an attractive option for businesses looking to maximize their rewards. The promotion offers a unique blend of travel perks and financial advantages, making it a compelling choice for businesses seeking to optimize their travel strategy and enhance their rewards earning potential.

Southwest Airlines Business Credit Card Overview

The Southwest Airlines Business Credit Card is a rewarding option for business owners who frequently fly Southwest Airlines. It offers a range of benefits designed to streamline travel expenses and maximize rewards.

Southwest Rapid Rewards Points Accumulation

The Southwest Airlines Business Credit Card earns Rapid Rewards points, which can be redeemed for flights, upgrades, and other travel perks.

- Earn 2 points per $1 spent on Southwest Airlines purchases. This includes flights, baggage fees, in-flight purchases, and Southwest Rapid Rewards points.

- Earn 1 point per $1 spent on all other purchases. This includes everyday expenses like groceries, gas, and dining.

- Earn a Companion Pass after spending $50,000 in a calendar year. This allows you to bring a companion along on any Southwest Airlines flight for just the cost of taxes and fees.

Southwest Rapid Rewards Points Redemption

Rapid Rewards points can be redeemed for a variety of travel-related expenses.

- Flights: Redeem points for flights on Southwest Airlines, with no blackout dates or restrictions.

- Upgrades: Use points to upgrade to a more comfortable seat on your flight.

- Bags: Avoid baggage fees by using points to pay for checked bags.

- Other Travel Perks: Points can also be used to redeem for in-flight snacks and drinks, rental cars, and hotels.

Comparison with Other Business Credit Cards

The Southwest Airlines Business Credit Card stands out from other business credit cards in the market due to its focus on Southwest Airlines travel. Here’s a comparison with some popular options:

| Feature | Southwest Airlines Business Credit Card | Chase Ink Business Preferred Card | American Express Business Platinum Card |

|---|---|---|---|

| Welcome Bonus | 60,000 bonus points after spending $3,000 in the first 3 months | 80,000 bonus points after spending $5,000 in the first 3 months | 100,000 bonus points after spending $15,000 in the first 3 months |

| Rewards Earning | 2 points per $1 on Southwest Airlines purchases, 1 point per $1 on all other purchases | 3 points per $1 on the first $150,000 spent in travel and select business categories, 1 point per $1 on all other purchases | 5 points per $1 on flights booked directly with airlines or on amextravel.com, 1 point per $1 on all other purchases |

| Transfer Partners | N/A | Yes, transfer points to multiple airline and hotel loyalty programs | Yes, transfer points to multiple airline and hotel loyalty programs |

| Travel Benefits | Companion Pass, Priority Boarding, Free checked bags | Travel insurance, airport lounge access | Global Entry/TSA Precheck credit, travel insurance, airport lounge access |

Eligibility and Application Process

Applying for the Southwest Airlines Business Credit Card requires meeting specific criteria and following a straightforward application process. This section Artikels the eligibility requirements, application steps, and documentation needed. It also provides an estimate of the typical approval timeframe.

Eligibility Criteria

To be eligible for the Southwest Airlines Business Credit Card, applicants must meet the following criteria:

- Be at least 18 years old.

- Have a valid Social Security number.

- Have a U.S. residential address.

- Be a U.S. citizen or permanent resident.

- Have a good credit history.

- Own or operate a business.

Application Process

The application process for the Southwest Airlines Business Credit Card is simple and can be completed online or by phone. Here are the steps involved:

- Visit the Southwest Airlines website or call the Chase customer service line.

- Click on the “Apply Now” button or request an application form.

- Provide your personal and business information, including your name, address, phone number, Social Security number, business name, and business tax ID number.

- Review the terms and conditions and submit your application.

Documentation Required, Southwest business credit card promotion

To complete the application process, you may be asked to provide the following documentation:

- Proof of identity (e.g., driver’s license, passport)

- Proof of residency (e.g., utility bill, bank statement)

- Proof of business ownership (e.g., business license, articles of incorporation)

- Recent business tax returns

- Financial statements (e.g., balance sheet, income statement)

Approval Timeframe

The approval timeframe for the Southwest Airlines Business Credit Card typically ranges from a few days to a few weeks. The actual time may vary depending on the individual applicant’s creditworthiness and the completeness of the application. Once approved, you will receive a welcome packet with your credit card and instructions on how to activate it.

Benefits for Business Owners

The Southwest Airlines Business Credit Card offers a range of benefits designed to simplify business travel and expense management for entrepreneurs and business owners. These benefits are tailored to address the unique needs of businesses, helping them optimize their travel spending and earn valuable rewards.

Streamlined Travel Booking and Management

The card provides seamless access to Southwest Airlines’ extensive network, allowing business owners to easily book flights for their employees or themselves. With the ability to earn Rapid Rewards points on every purchase, including flights, business owners can accumulate points quickly and redeem them for future travel, maximizing their travel budget.

Simplified Expense Tracking and Reporting

The Southwest Airlines Business Credit Card offers a comprehensive online portal for tracking and managing expenses. This online platform provides detailed transaction records, allowing business owners to easily track their spending and generate reports for accounting purposes. The card’s expense tracking capabilities help streamline the expense management process, simplifying reconciliation and saving time for business owners.

Enhanced Travel Perks and Privileges

The Southwest Airlines Business Credit Card offers a variety of travel perks and privileges designed to enhance the travel experience for business owners. These benefits include priority boarding, free checked bags, and access to the Southwest Airlines Rapid Rewards program, which provides numerous benefits such as early bird check-in and exclusive deals.

Business Travel Rewards and Savings

The card provides a range of rewards and savings opportunities for business owners, including bonus points for business spending and travel purchases. By utilizing the card’s rewards program, business owners can earn points that can be redeemed for flights, upgrades, and other travel-related expenses, further enhancing their travel experience and saving money on business trips.

Exclusive Business Cardholder Benefits

The Southwest Airlines Business Credit Card offers a variety of exclusive benefits for business owners, such as access to airport lounges, travel insurance, and complimentary car rental upgrades. These benefits provide added value and convenience for business travelers, making their journeys more comfortable and enjoyable.

Final Review

In conclusion, the Southwest Business Credit Card promotion presents a compelling opportunity for businesses to enhance their travel experience and maximize their rewards earning potential. The promotion offers a unique blend of travel perks and financial advantages, making it a compelling choice for businesses seeking to optimize their travel strategy and enhance their rewards earning potential. The promotion typically includes bonus points for new cardholders, making it an attractive option for businesses looking to maximize their rewards. The promotion offers a unique blend of travel perks and financial advantages, making it a compelling choice for businesses seeking to optimize their travel strategy and enhance their rewards earning potential.

FAQ Insights: Southwest Business Credit Card Promotion

What is the current bonus offer for the Southwest Business Credit Card?

The current bonus offer varies, so it’s best to check the Southwest Airlines website or contact them directly for the most up-to-date information. It’s important to keep in mind that bonus offers can change at any time.

How long does it take to receive my bonus points after meeting the spending requirement?

The bonus points are typically awarded within 6-8 weeks of meeting the spending requirement. It’s important to note that this timeframe can vary depending on the specific promotion and your individual circumstances.

Can I use my Southwest Business Credit Card for personal expenses?

Yes, you can use the Southwest Business Credit Card for both business and personal expenses. However, it’s important to keep track of your expenses and ensure that you are maximizing the benefits of the card for your business.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!