Sunbelt business credit is a vital engine driving the economic boom in the Southern United States. This region, known for its warm climate, diverse population, and growing industries, attracts entrepreneurs and businesses seeking opportunities for expansion. From booming tech hubs in Texas to thriving tourism destinations in Florida, the Sunbelt offers a dynamic environment for businesses to flourish. Understanding the intricacies of business credit in this region is essential for navigating the competitive landscape and securing the financial resources needed for success.

As businesses in the Sunbelt strive for growth, access to reliable credit becomes paramount. This guide delves into the unique aspects of business credit in the Sunbelt, exploring the resources available, the challenges businesses face, and the strategies for building a strong credit profile. By understanding the factors that influence business credit in the Sunbelt, entrepreneurs can gain a competitive edge and position themselves for sustained success.

The Sunbelt: A Hub for Business Growth

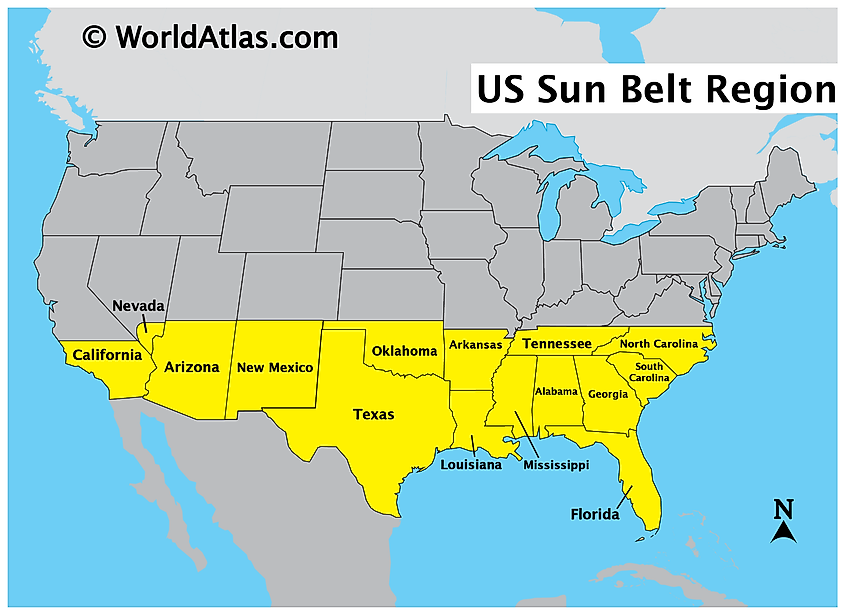

The Sunbelt region of the United States, stretching from the Southeast to the Southwest, has experienced remarkable economic growth in recent decades. This growth is fueled by a combination of factors, including a favorable business climate, a growing population, and a diverse economy.

Economic and Demographic Factors Driving Growth

The Sunbelt is experiencing a population boom, driven by factors such as a warmer climate, lower cost of living, and a growing number of job opportunities. This population growth is fueling demand for housing, retail, and other services, creating a positive feedback loop for economic development. The region also benefits from a favorable business climate, with low taxes, less stringent regulations, and a skilled workforce. These factors attract businesses and investment, further contributing to economic growth.

Key Industries and Sectors Flourishing in the Sunbelt

The Sunbelt is home to a diverse range of industries, including:

- Technology: The region is a hub for tech companies, with major centers in Austin, Texas; Raleigh, North Carolina; and Atlanta, Georgia. The growth of the tech sector is driven by factors such as access to talent, a supportive ecosystem of venture capital, and a growing demand for technology-driven solutions.

- Healthcare: The Sunbelt is experiencing a growing healthcare sector, driven by an aging population and an increasing demand for medical services. The region is home to major hospitals, medical research centers, and pharmaceutical companies.

- Energy: The Sunbelt is a major producer of oil, gas, and renewable energy, with significant investments in solar and wind power. The region is also home to major energy companies, including ExxonMobil, Chevron, and ConocoPhillips.

- Tourism: The Sunbelt’s warm climate and diverse attractions make it a popular destination for tourists. The region is home to major tourist destinations such as Orlando, Florida; Las Vegas, Nevada; and San Diego, California.

- Manufacturing: The Sunbelt is experiencing a resurgence in manufacturing, driven by factors such as lower labor costs, proximity to raw materials, and a growing demand for manufactured goods. The region is home to major manufacturing centers in Houston, Texas; Phoenix, Arizona; and Charlotte, North Carolina.

Examples of Successful Businesses in the Sunbelt

- Tesla: The electric car manufacturer has established a major manufacturing facility in Austin, Texas, taking advantage of the region’s business-friendly environment and skilled workforce.

- Amazon: The e-commerce giant has a significant presence in the Sunbelt, with major fulfillment centers in Phoenix, Arizona; Atlanta, Georgia; and Dallas, Texas. The company has also invested heavily in renewable energy projects in the region.

- Apple: The tech giant has a major campus in Austin, Texas, employing thousands of workers in software development, engineering, and other fields.

- Google: The search engine giant has a major data center in Council Bluffs, Iowa, and is expanding its presence in other parts of the Sunbelt.

- SpaceX: The private space exploration company has a launch facility in Boca Chica, Texas, and is expanding its operations in the region.

Accessing Business Credit in the Sunbelt

The Sunbelt, known for its vibrant economy and burgeoning business landscape, offers numerous opportunities for entrepreneurs and businesses. Accessing business credit is crucial for funding growth, expansion, and operational needs. Understanding the available resources, navigating the credit landscape, and establishing strong creditworthiness are essential for success in this dynamic region.

Key Resources and Institutions

The Sunbelt is home to a diverse array of financial institutions, government programs, and private lenders that cater to the specific needs of businesses.

- Small Business Administration (SBA): The SBA provides loan guarantees and other support to small businesses across the country, including those in the Sunbelt. Programs like the 7(a) Loan Program and the 504 Loan Program offer attractive terms and flexible options for businesses seeking funding.

- Community Development Financial Institutions (CDFIs): CDFIs are mission-driven financial institutions that provide loans, investments, and other financial services to underserved communities. They play a vital role in supporting small businesses and entrepreneurs in the Sunbelt, often offering tailored solutions and flexible credit terms.

- Regional Banks and Credit Unions: Many regional banks and credit unions have established a strong presence in the Sunbelt, offering a range of business credit products, including lines of credit, term loans, and equipment financing. These institutions often have a deep understanding of the local market and can provide personalized support to businesses.

- Online Lenders: The rise of online lending platforms has provided businesses in the Sunbelt with access to alternative financing options. These platforms often offer faster approval times and more flexible requirements than traditional lenders, but it’s crucial to carefully compare interest rates and terms.

Challenges in Securing Business Credit

While the Sunbelt offers a wealth of credit resources, businesses may face challenges in securing funding.

- Limited Credit History: Startups and young businesses may struggle to secure credit due to a lack of established credit history. Lenders often require a track record of financial stability and responsible credit management.

- Strict Credit Requirements: Lenders often have stringent credit score requirements and may prioritize businesses with strong financial performance and low debt-to-equity ratios. This can pose a barrier for businesses with limited financial resources or a history of financial difficulties.

- Competition for Funding: The Sunbelt’s dynamic economy attracts numerous businesses seeking funding, creating a competitive landscape for securing credit. Lenders may be more selective in their lending decisions, prioritizing businesses with strong growth potential and a clear business plan.

Best Practices for Building and Maintaining Business Credit

Building and maintaining strong business credit is essential for attracting investors, securing loans, and fostering long-term financial stability.

- Establish a Business Credit Profile: Obtain a separate credit card for your business and use it regularly to build a credit history. Pay your bills on time and keep your credit utilization low to demonstrate responsible financial management.

- Monitor Your Credit Reports: Regularly check your business credit reports for errors and discrepancies. You can obtain free reports from the three major credit bureaus: Experian, Equifax, and TransUnion.

- Pay Bills Promptly: Late payments can negatively impact your business credit score. Set up automatic payments or reminders to ensure timely bill payments.

- Develop a Strong Business Plan: A well-crafted business plan outlining your company’s goals, strategies, and financial projections can demonstrate your business’s viability and attract lenders.

The Impact of Business Credit on Sunbelt Businesses: Sunbelt Business Credit

The Sunbelt region, encompassing states like Texas, Florida, Arizona, and Georgia, has become a hub for business growth. Strong business credit is crucial for Sunbelt businesses to thrive in this dynamic environment. Access to credit allows businesses to secure financing, expand operations, and navigate economic fluctuations.

Benefits of Strong Business Credit

Strong business credit is a valuable asset that unlocks numerous opportunities for Sunbelt businesses.

- Access to Funding: A good credit score makes it easier for businesses to obtain loans, lines of credit, and other forms of financing. This access to capital allows for investments in growth, expansion, and innovation.

- Lower Interest Rates: Businesses with excellent credit scores often qualify for lower interest rates on loans, reducing financing costs and increasing profitability.

- Improved Supplier Relationships: Suppliers are more likely to extend favorable terms, such as extended payment periods or discounts, to businesses with a solid credit history.

- Enhanced Business Reputation: A strong credit score reflects responsible financial management and builds trust among stakeholders, including customers, investors, and lenders.

Consequences of Poor Business Credit

Conversely, poor business credit can hinder growth and even lead to financial instability.

- Limited Access to Funding: Lenders may be reluctant to extend credit to businesses with poor credit scores, limiting access to vital capital.

- Higher Interest Rates: Businesses with poor credit may face significantly higher interest rates on loans, increasing financing costs and reducing profitability.

- Restricted Supplier Relationships: Suppliers may demand stricter payment terms or refuse to extend credit to businesses with a history of late payments.

- Negative Business Reputation: A poor credit score can damage a business’s reputation, making it difficult to attract customers, investors, and talented employees.

Business Credit Options in the Sunbelt

The Sunbelt offers various business credit options to cater to diverse needs and circumstances.

| Option | Advantages | Disadvantages |

|---|---|---|

| Small Business Administration (SBA) Loans | Lower interest rates, longer repayment terms, and flexible eligibility requirements. | Complex application process and potentially longer approval times. |

| Bank Loans | Competitive interest rates and personalized service. | May require a strong credit history and collateral. |

| Alternative Lenders | Faster approval times and more flexible eligibility criteria. | Higher interest rates and potentially shorter repayment terms. |

| Business Credit Cards | Convenient financing and rewards programs. | High interest rates and potential for overspending. |

| Invoice Financing | Access to immediate cash flow by selling invoices to a lender. | May involve high fees and require a strong customer base. |

The Future of Business Credit in the Sunbelt

The Sunbelt, with its dynamic economic growth and burgeoning entrepreneurial spirit, is poised for continued expansion. The region’s business credit landscape is undergoing a significant transformation, driven by technological advancements, evolving regulatory frameworks, and shifting market dynamics. Understanding these trends and challenges is crucial for businesses to thrive in the future.

Predicting Trends and Challenges

The future of business credit in the Sunbelt is characterized by several key trends and challenges that will shape the industry. These include:

- Increased Access to Alternative Credit Sources: Fintech companies and online lending platforms are expanding their reach, providing businesses with more diverse and accessible credit options beyond traditional banks. This trend is particularly beneficial for startups and small businesses that may face challenges securing traditional financing.

- Data-Driven Credit Scoring: The use of data analytics and alternative data sources, such as social media activity and online reviews, is becoming increasingly prevalent in credit scoring models. This shift enables lenders to assess creditworthiness more comprehensively, potentially unlocking credit opportunities for businesses with limited credit history.

- Growing Importance of Business Credit Monitoring: As the complexity of business credit increases, businesses are increasingly prioritizing credit monitoring to proactively manage their financial health. This includes tracking credit utilization, monitoring credit scores, and identifying potential risks early on.

- Regulatory Changes: The regulatory landscape for business credit is constantly evolving. New regulations, such as those related to data privacy and cybersecurity, can impact how businesses access and manage credit. Staying informed about these changes is crucial for compliance and risk mitigation.

- Competition and Consolidation: The business credit market is becoming increasingly competitive, with new players entering the field and existing players consolidating their operations. Businesses need to be aware of these market dynamics to secure the best credit terms and access the most suitable financing options.

Developing a Strategy for Navigating the Evolving Landscape, Sunbelt business credit

To thrive in the evolving business credit landscape of the Sunbelt, businesses should adopt a proactive and strategic approach. Key elements of this strategy include:

- Building a Strong Credit Foundation: Establishing a solid credit history is paramount for accessing favorable credit terms. This involves paying bills on time, maintaining a low credit utilization ratio, and monitoring credit reports regularly.

- Exploring Alternative Credit Options: Businesses should consider exploring alternative credit sources, such as online lenders and fintech platforms, to diversify their financing options and access competitive rates.

- Leveraging Data and Technology: Embracing data-driven approaches to credit management can provide valuable insights into credit utilization, risk factors, and potential opportunities for improvement.

- Staying Informed about Regulations: Businesses should actively monitor regulatory changes and ensure compliance with applicable laws and regulations to avoid potential penalties and maintain a strong credit standing.

- Building Relationships with Lenders: Establishing strong relationships with lenders, including traditional banks and alternative credit providers, can provide access to personalized advice, customized financing solutions, and preferential terms.

Securing and Managing Business Credit: A Flowchart

The following flowchart illustrates the key steps involved in securing and managing business credit in the Sunbelt:

Step 1: Establish a Business Credit Profile

– Obtain an Employer Identification Number (EIN)

– Open a business bank account

– Secure a business credit card

Step 2: Monitor and Manage Credit Utilization

– Track credit utilization ratio

– Pay bills on time

– Review credit reports regularly

Step 3: Explore Financing Options

– Research traditional and alternative lenders

– Compare interest rates and loan terms

– Choose the most suitable financing option

Step 4: Secure and Manage Credit

– Negotiate favorable credit terms

– Maintain a strong payment history

– Monitor credit reports for any discrepancies

Concluding Remarks

The Sunbelt’s economic landscape is characterized by rapid growth and innovation, making business credit a critical component of success. By understanding the intricacies of securing and managing business credit in this region, entrepreneurs can unlock opportunities for expansion, attract investors, and contribute to the vibrant economic ecosystem of the Sunbelt. As the region continues to evolve, the importance of a solid business credit foundation will only grow, empowering businesses to navigate the challenges and capitalize on the immense potential of the Sunbelt.

FAQ Compilation

What are the common types of business credit available in the Sunbelt?

Common types of business credit in the Sunbelt include lines of credit, business credit cards, equipment financing, and SBA loans.

What are some resources for businesses seeking business credit in the Sunbelt?

Businesses can access business credit through local banks, credit unions, online lenders, and government programs like the Small Business Administration (SBA).

How can businesses build and maintain strong business credit in the Sunbelt?

Building strong business credit involves establishing a good payment history, managing debt responsibly, and maintaining a positive credit score.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!