TD Business Line of Credit interest rate is a crucial factor for businesses seeking financing. It directly impacts borrowing costs and overall profitability. Understanding how TD determines interest rates, the factors influencing them, and strategies for managing them is essential for successful business operations.

This guide delves into the complexities of TD Business Line of Credit interest rates, exploring the various components that contribute to their calculation. We’ll analyze the role of creditworthiness, business revenue, and loan amount in shaping interest rates, providing insights into how businesses can optimize their financial strategies. Additionally, we’ll examine effective methods for managing interest rate fluctuations and negotiating favorable terms with TD.

TD Business Line of Credit Overview

A TD Business Line of Credit is a flexible financing option that can be a valuable tool for businesses looking to manage their cash flow, fund short-term projects, or take advantage of unexpected opportunities. It provides access to a pre-approved amount of funds that can be drawn upon as needed, offering convenience and flexibility.

Eligibility Requirements

To be eligible for a TD Business Line of Credit, businesses generally need to meet certain criteria. These requirements are designed to assess the creditworthiness and financial stability of the applicant.

- Established Business: The business should have a proven track record of operations, ideally with a minimum of one year in business.

- Strong Credit History: A good credit score and history are essential, demonstrating responsible financial management.

- Adequate Revenue: The business should generate sufficient revenue to support the repayment of the line of credit.

- Collateral: Depending on the loan amount and the borrower’s financial profile, collateral may be required to secure the line of credit.

Key Features and Terms

TD Business Line of Credit products typically offer a range of features and terms that can vary depending on the specific loan agreement.

- Variable Interest Rates: Interest rates are typically variable, meaning they can fluctuate based on market conditions.

- Revolving Credit: Businesses can draw funds as needed, up to the approved credit limit, and repay the outstanding balance over time.

- Flexible Repayment Options: TD may offer various repayment options, such as fixed monthly payments or interest-only payments, depending on the loan agreement.

- Annual Fees: Some TD Business Line of Credit products may have annual fees associated with maintaining the line of credit.

Interest Rate Calculation

The interest rate charged on a TD Business Line of Credit is typically a variable rate that is based on the prime rate. The prime rate is a benchmark interest rate set by major Canadian banks. The actual interest rate charged will be a percentage points above the prime rate, determined by TD based on the borrower’s creditworthiness and other factors.

Interest Rate = Prime Rate + Margin

The margin is the additional percentage points added to the prime rate to determine the final interest rate.

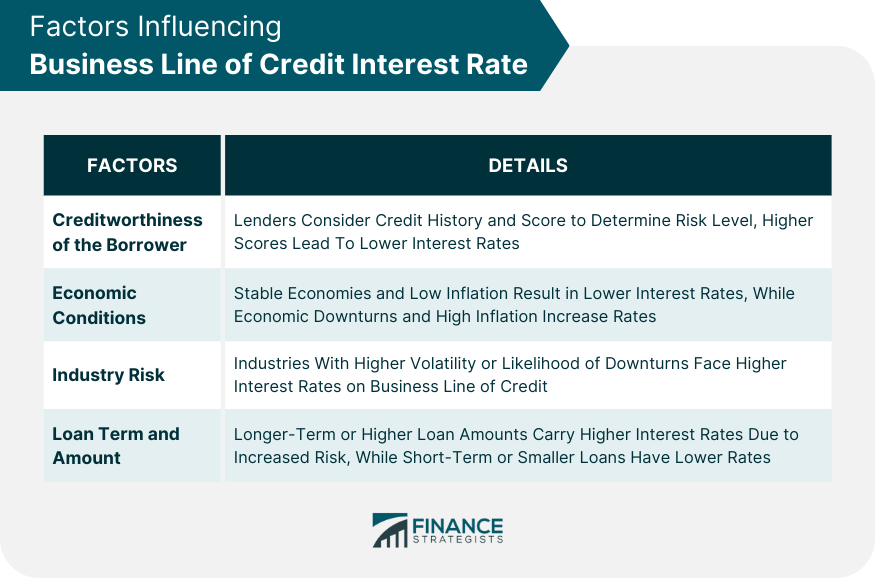

Interest Rate Factors

The interest rate on a TD Business Line of Credit is determined by a combination of factors, including your creditworthiness, the amount of the loan, and the current economic conditions.

Credit Score

Your credit score is a major factor in determining your interest rate. A higher credit score generally indicates a lower risk to the lender, which can lead to a lower interest rate.

A credit score above 700 is considered excellent and can qualify you for the lowest interest rates.

A lower credit score may result in a higher interest rate, as the lender perceives you as a higher risk.

Business Revenue

Your business’s revenue is another factor that can influence your interest rate. A business with a strong revenue history and consistent profitability is generally considered a lower risk, which can lead to a lower interest rate.

A business with a history of consistent revenue growth and profitability is likely to receive a lower interest rate.

A business with a fluctuating revenue history or a history of losses may be considered a higher risk and may be offered a higher interest rate.

Loan Amount

The amount of the loan you request can also affect your interest rate. Larger loan amounts may be subject to higher interest rates, as the lender is assuming a greater risk.

Smaller loan amounts may be subject to lower interest rates, as the lender perceives them as less risky.

However, TD Bank may offer competitive interest rates for both small and large loan amounts, depending on the overall risk assessment.

Comparison with Other Banks

TD Bank’s interest rates are generally competitive with other major banks. However, it’s important to compare rates from multiple lenders before making a decision.

It’s recommended to shop around and compare interest rates from at least three different lenders.

Factors such as your credit score, business revenue, and the amount of the loan will affect the interest rates offered by different lenders.

Interest Rate Calculation and Structure

TD Bank uses a comprehensive approach to determine the interest rate for your Business Line of Credit. This rate is influenced by several factors, including your creditworthiness, the loan amount, and prevailing market conditions. Understanding how the interest rate is calculated and structured can help you make informed decisions about your financing needs.

Interest Rate Calculation

The interest rate on a TD Business Line of Credit is calculated based on a combination of factors, including:

- Prime Rate: The prime rate is a benchmark interest rate set by major Canadian banks. It serves as a foundation for calculating interest rates on various loans and credit products, including business lines of credit.

- Creditworthiness: Your creditworthiness is a key determinant of the interest rate you’ll receive. This includes your credit score, debt-to-income ratio, and overall financial history. A strong credit history typically translates into a lower interest rate.

- Loan Amount: The amount you borrow can also influence the interest rate. Generally, larger loan amounts may come with slightly higher interest rates.

- Market Conditions: Fluctuations in the overall economic environment, such as interest rate trends and inflation, can impact the interest rate on your business line of credit.

TD Bank uses a proprietary algorithm to assess these factors and determine the final interest rate. The algorithm considers various data points and assigns weights to each factor based on their relative importance.

Interest Rate Structure

TD Business Line of Credit interest rates can be structured as either fixed or variable:

- Fixed Interest Rate: A fixed interest rate remains constant throughout the term of the loan, providing predictable monthly payments. This option is suitable for businesses seeking stability and certainty in their financing costs.

- Variable Interest Rate: A variable interest rate fluctuates based on changes in the prime rate. This option can potentially offer lower initial interest rates but carries the risk of increased payments if the prime rate rises.

Interest Rate Tiers

TD Bank typically categorizes its Business Line of Credit interest rates into tiers based on creditworthiness:

| Creditworthiness Tier | Interest Rate Structure | Approximate Interest Rate Range |

|---|---|---|

| Excellent | Prime + 0.50% – 1.50% | Prime + 0.50% to Prime + 1.50% |

| Good | Prime + 1.50% – 2.50% | Prime + 1.50% to Prime + 2.50% |

| Fair | Prime + 2.50% – 3.50% | Prime + 2.50% to Prime + 3.50% |

> Note: These are approximate ranges, and the actual interest rate you receive may vary depending on the specific factors discussed above.

Interest Rate Management Strategies

Managing interest rate fluctuations on your TD Business Line of Credit is crucial for maintaining financial stability and maximizing profitability. By implementing proactive strategies, you can mitigate the impact of rising rates and potentially even secure more favorable terms.

Locking in a Fixed Interest Rate, Td business line of credit interest rate

Locking in a fixed interest rate can provide a predictable and stable cost of borrowing, shielding your business from potential rate hikes. This approach is particularly advantageous in periods of economic uncertainty or when interest rates are expected to rise.

A fixed interest rate offers a known and consistent cost for the duration of your loan term, eliminating the risk of unexpected rate increases.

However, it’s important to consider that fixed rates may be higher than variable rates, especially in periods of low interest rates.

Negotiating Favorable Interest Rates

You can leverage your business’s financial health and track record to negotiate favorable interest rates with TD.

Here are some key strategies:

- Strong Credit History: Maintaining a positive credit history demonstrates your business’s reliability and creditworthiness, making you a more attractive borrower.

- Consistent Revenue and Profitability: Demonstrating a consistent track record of revenue generation and profitability strengthens your bargaining position. Provide financial statements and projections to highlight your business’s financial stability.

- Collateral: Offering collateral, such as real estate or equipment, can reduce TD’s risk and potentially lead to a lower interest rate.

- Relationship Building: Cultivating a strong relationship with your TD representative can be beneficial. Building rapport and demonstrating your commitment to TD can positively influence negotiations.

- Comparison Shopping: Research interest rates offered by other financial institutions to have a benchmark for comparison. This can provide leverage during negotiations with TD.

Impact of Interest Rates on Business Operations

Interest rates play a crucial role in shaping a business’s financial health and operational efficiency. Understanding their influence on cash flow, profitability, and borrowing costs is vital for informed decision-making.

Impact on Cash Flow and Profitability

Changes in interest rates directly impact a business’s cash flow and profitability. When interest rates rise, the cost of borrowing increases, leading to higher debt repayment obligations. This can strain cash flow, leaving less money available for investments, expansion, or operational expenses. Conversely, falling interest rates reduce borrowing costs, freeing up cash flow for growth initiatives.

Impact on Borrowing Costs and Debt Repayment Schedules

Interest rates influence the cost of borrowing, impacting a business’s debt repayment schedule. Higher interest rates increase borrowing costs, leading to larger monthly payments. This can make it challenging to meet financial obligations and potentially hinder growth plans. Conversely, lower interest rates reduce borrowing costs, easing debt repayment burdens and freeing up cash flow for other purposes.

Importance of Monitoring Interest Rates and Making Adjustments

Monitoring interest rate trends is essential for businesses to adapt their financial strategies proactively. Regular monitoring allows for early identification of potential risks and opportunities.

- Businesses can explore refinancing options to secure lower interest rates during periods of declining rates, reducing borrowing costs and enhancing cash flow.

- During periods of rising rates, businesses may need to adjust their spending habits, prioritizing essential expenses and delaying non-critical investments to manage cash flow effectively.

- Businesses can consider alternative financing options, such as equity financing or vendor financing, to mitigate the impact of high interest rates.

Wrap-Up: Td Business Line Of Credit Interest Rate

By understanding the intricacies of TD Business Line of Credit interest rates, businesses can make informed decisions about their financing needs. By actively managing their creditworthiness, leveraging negotiation strategies, and staying informed about market trends, businesses can secure favorable terms and minimize the impact of interest rate fluctuations on their financial performance.

FAQ Resource

What is the average TD Business Line of Credit interest rate?

The average interest rate for a TD Business Line of Credit varies depending on factors like creditworthiness, loan amount, and current market conditions. It’s best to contact TD directly for a personalized rate quote.

How can I improve my chances of getting a lower interest rate on a TD Business Line of Credit?

Maintaining a strong credit score, demonstrating consistent business revenue, and providing a solid business plan can help secure a lower interest rate. Additionally, exploring options like fixed-rate loans or negotiating with TD can also lead to favorable terms.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!