Tomo Credit Card for Business sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This card, designed specifically for entrepreneurs and small business owners, presents a compelling proposition with its unique blend of rewards, benefits, and security features. Tomo Credit Card for Business is not just another credit card; it is a tool designed to empower businesses and help them thrive.

The Tomo Credit Card for Business offers a comprehensive package tailored to the needs of modern businesses. It boasts a generous rewards program, including points that can be redeemed for travel, merchandise, or cash back. Additionally, it provides valuable benefits such as travel insurance, purchase protection, and extended warranty, ensuring peace of mind for business owners. The card’s security features, including fraud protection and a robust dispute resolution process, are designed to safeguard your business transactions. Tomo Credit Card for Business aims to simplify business finances and streamline operations by offering a user-friendly platform and excellent customer support.

Tomo Credit Card for Business Overview

The Tomo Credit Card for Business is a powerful financial tool designed specifically for entrepreneurs and small business owners. It offers a unique blend of features and benefits that can help businesses grow and thrive.

Target Audience

The Tomo Credit Card for Business caters to a diverse range of entrepreneurs and small businesses, including:

- Sole proprietorships

- Partnerships

- Limited liability companies (LLCs)

- Small businesses with 1-50 employees

- Freelancers and independent contractors

Features and Benefits

The Tomo Credit Card for Business offers a comprehensive set of features and benefits designed to simplify business operations and maximize financial rewards:

- High credit limit: The card provides access to a generous credit limit, allowing businesses to make significant purchases and manage cash flow effectively.

- Reward points: Earn valuable reward points on every purchase, which can be redeemed for travel, merchandise, or cash back.

- Travel insurance: Enjoy peace of mind with comprehensive travel insurance coverage for business trips, including trip cancellation, medical expenses, and lost luggage.

- Purchase protection: Protect your business investments with purchase protection coverage that reimburses you for stolen or damaged goods.

- 0% introductory APR: Take advantage of an introductory period with 0% APR on purchases, allowing businesses to manage debt effectively and save on interest charges.

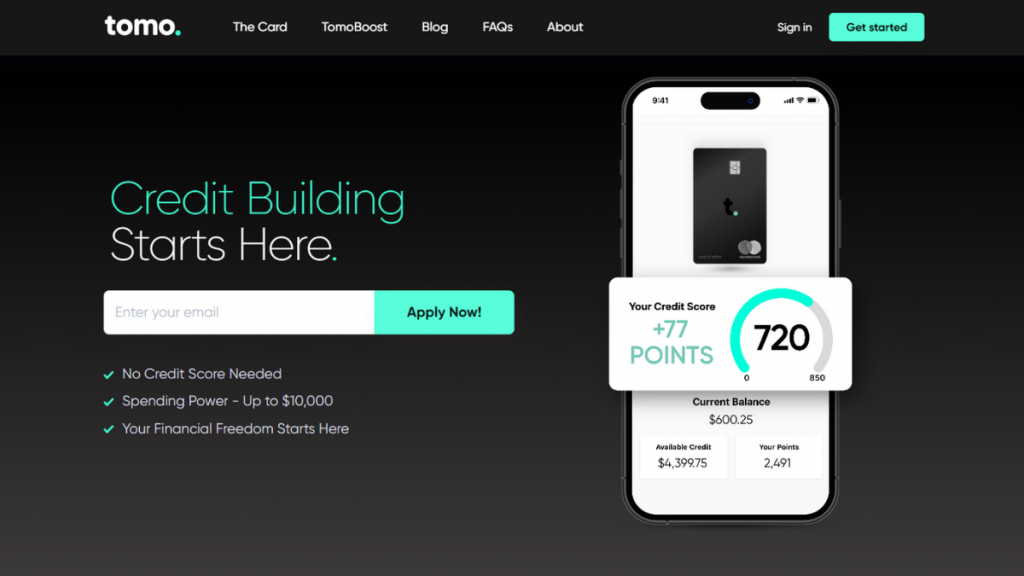

- Mobile app: Access your account anytime, anywhere with the user-friendly mobile app, enabling you to track spending, manage rewards, and make payments on the go.

- Concierge service: Get personalized assistance with travel arrangements, event planning, and other business needs through the dedicated concierge service.

- Business expense tracking: Streamline expense management with detailed transaction history and categorization features, simplifying accounting and tax preparation.

Key Selling Points

The Tomo Credit Card for Business stands out from other business credit cards with its unique blend of features and benefits:

- Focus on rewards: Tomo offers a competitive rewards program that provides tangible value for businesses, helping them maximize their spending power.

- Comprehensive insurance coverage: The card’s robust travel and purchase protection insurance provides peace of mind and financial security for businesses.

- User-friendly mobile app: The intuitive mobile app simplifies account management, allowing businesses to stay organized and on top of their finances.

- Dedicated customer support: Tomo provides responsive and personalized customer support, ensuring businesses have access to assistance when they need it.

Tomo Credit Card for Business Eligibility Requirements

To be eligible for the Tomo Credit Card for Business, you must meet certain criteria. These requirements are designed to ensure that Tomo can provide you with the best possible service and that you are able to manage your business credit responsibly.

Credit Score Requirements

Tomo considers your personal credit score and your business credit score when evaluating your eligibility for the Tomo Credit Card for Business. A strong credit history demonstrates your ability to manage finances responsibly, which is an important factor in determining your creditworthiness.

Tomo may have specific credit score requirements for eligibility, so it’s essential to check their website or contact them directly for the most up-to-date information.

Business History Considerations

Tomo evaluates your business history to assess your financial stability and track record. They may consider factors such as:

- Years in business: Tomo may require a minimum number of years in operation to demonstrate business stability.

- Revenue: Tomo may have minimum revenue requirements to ensure your business can handle the credit line responsibly.

- Business structure: Tomo may have specific requirements for business structures, such as sole proprietorships, partnerships, or corporations.

- Industry: Tomo may have specific requirements for certain industries, depending on their risk assessment.

Application Process

The application process for the Tomo Credit Card for Business is generally straightforward. You will need to provide the following documentation:

- Personal information: Your name, address, Social Security number, and date of birth.

- Business information: Your business name, address, tax ID number, and business structure.

- Financial information: Information about your business revenue, expenses, and debt.

- Credit history: Your personal and business credit scores may be reviewed.

It’s recommended to review the Tomo Credit Card for Business website for detailed information about the application process and required documentation.

Tomo Credit Card for Business Fees and Charges

Tomo Credit Card for Business, like other business credit cards, has fees associated with its use. Understanding these fees is crucial for making informed decisions about your business finances. This section provides a comprehensive overview of Tomo Credit Card for Business fees, comparing them with other popular business credit card options.

Tomo Credit Card for Business Fees

Tomo Credit Card for Business charges fees for various services, including annual fees, transaction fees, and late payment fees. The table below provides a detailed breakdown of these fees:

| Fee Type | Fee Amount | Description |

|---|---|---|

| Annual Fee | $0 | Tomo Credit Card for Business does not charge an annual fee, making it a more attractive option compared to some competitors that charge annual fees of up to $95. |

| Foreign Transaction Fee | 2.5% | This fee applies to all transactions made in foreign currencies. While it’s a standard fee for many credit cards, some competitors offer cards with no foreign transaction fees. |

| Cash Advance Fee | 3% of the amount advanced, minimum $10 | Tomo Credit Card for Business charges a fee for cash advances, which can be a valuable option for businesses in emergencies. However, the fee is relatively high compared to some competitors who offer lower cash advance fees. |

| Late Payment Fee | $39 | This fee is applied if you miss a payment due date. It’s crucial to pay your bills on time to avoid these fees. |

Comparison with Other Business Credit Cards

Comparing Tomo Credit Card for Business fees with other popular business credit card options reveals that Tomo Credit Card for Business offers a competitive fee structure. While some competitors may offer lower foreign transaction fees or cash advance fees, Tomo Credit Card for Business stands out with its no annual fee policy, which can significantly reduce the overall cost of using the card.

Tomo Credit Card for Business provides a valuable alternative for businesses seeking a credit card with minimal fees.

Tomo Credit Card for Business Rewards and Benefits

The Tomo Credit Card for Business offers a rewarding program designed to help businesses maximize their spending and earn valuable benefits. By using your card for everyday business expenses, you can accumulate points that can be redeemed for a variety of rewards, including travel, merchandise, and cash back.

Rewards Program Structure

The Tomo Credit Card for Business rewards program is structured around earning points for every dollar spent on eligible purchases. You earn 1 point for every $1 spent on all purchases, regardless of the category. The more you use your card for business expenses, the more points you accumulate, allowing you to unlock a wider range of redemption options.

Redemption Options

Tomo Credit Card for Business offers a diverse range of redemption options, catering to various business needs and preferences. You can redeem your accumulated points for:

- Travel: Redeem your points for flights, hotels, car rentals, and other travel experiences.

- Merchandise: Exchange your points for a wide selection of popular merchandise, including electronics, appliances, and gift cards.

- Cash Back: Opt to receive cash back directly into your business account, providing a simple and convenient way to utilize your earned rewards.

Benefits

In addition to the rewards program, the Tomo Credit Card for Business offers a range of benefits designed to support your business operations and provide peace of mind:

- Travel Insurance: Enjoy coverage for unexpected events while traveling for business, including trip cancellation, baggage delay, and medical emergencies.

- Purchase Protection: Get protection against damage or theft of eligible purchases made with your card for a limited period.

- Extended Warranty: Extend the manufacturer’s warranty on eligible purchases, providing added value and peace of mind.

Tomo Credit Card for Business Security and Protection

Tomo Credit Card for Business prioritizes the security of your data and transactions. We employ robust measures to safeguard your sensitive information and protect you from potential fraud.

Fraud Protection Features

Tomo Credit Card for Business offers a comprehensive suite of fraud protection features to help you manage risk and protect your business.

- Zero Liability Protection: You are not responsible for unauthorized charges made on your Tomo Credit Card for Business. We will cover any fraudulent charges, giving you peace of mind.

- Real-Time Fraud Monitoring: Our advanced systems continuously monitor your transactions for suspicious activity. We will alert you immediately if we detect any unusual spending patterns.

- Secure Online Portal: Access and manage your account securely through our online portal. You can view transaction history, set spending limits, and report fraud easily.

Dispute Resolution Process

If you suspect fraudulent activity on your Tomo Credit Card for Business, our dispute resolution process is designed to be quick and efficient.

- Report the Fraud: Contact our customer support team immediately to report the suspected fraud.

- Provide Information: We will ask you for details about the fraudulent transaction, including the date, amount, and merchant.

- Investigation: We will investigate the claim and work with you to resolve the issue promptly.

Customer Support

Tomo Credit Card for Business offers various customer support options to assist you with any questions or concerns.

- 24/7 Phone Support: Reach our dedicated customer support team anytime, day or night.

- Online Chat: Connect with a customer service representative through our online chat portal for immediate assistance.

- Email Support: Send us an email with your questions or concerns, and we will respond promptly.

Tomo Credit Card for Business Use Cases

The Tomo Credit Card for Business can be a valuable tool for a wide range of businesses, offering flexibility and benefits that can streamline operations and enhance profitability. Here are some examples of how different types of businesses can leverage the card’s features and benefits.

Retail Businesses

Retail businesses can use the Tomo Credit Card for Business to manage inventory, purchase supplies, and cover operational expenses. The card’s rewards program can provide valuable cashback on everyday purchases, helping to offset business costs. For example, a clothing boutique can use the card to purchase new inventory from wholesalers, earning rewards that can be used to purchase additional merchandise or cover other expenses.

Service Businesses, Tomo credit card for business

Service businesses can benefit from the Tomo Credit Card for Business’s flexible spending options and robust security features. The card can be used to pay for marketing services, professional development, and other business-related expenses. Its fraud protection features provide peace of mind, ensuring that sensitive financial data is secure. For example, a consulting firm can use the card to pay for online advertising, marketing materials, and travel expenses, while knowing that their transactions are protected.

E-commerce Businesses

E-commerce businesses can utilize the Tomo Credit Card for Business to manage online payments, purchase marketing services, and cover website development costs. The card’s online transaction security features ensure that customer data is safe, while the rewards program can help offset the costs of running an online store. For example, an online retailer can use the card to process customer payments, purchase advertising on social media platforms, and pay for website maintenance, earning rewards that can be used to reinvest in the business.

Freelancers and Small Businesses

Freelancers and small businesses can use the Tomo Credit Card for Business to manage their income and expenses. The card’s features can help with tracking spending, making payments, and managing cash flow. For example, a freelance graphic designer can use the card to pay for software subscriptions, purchase design resources, and manage their client invoices, while benefiting from the card’s rewards program and expense tracking tools.

Tomo Credit Card for Business Comparison

Choosing the right business credit card can be a crucial decision for any entrepreneur or small business owner. Tomo Credit Card for Business is a relatively new player in the market, offering a range of features and benefits. To understand how it stacks up against established players, it’s essential to compare it with other leading business credit card options.

Comparison with Other Business Credit Cards

A comprehensive comparison helps identify the best card for your specific needs. The following table highlights key features, fees, rewards, and benefits of Tomo Credit Card for Business alongside other popular options:

| Feature | Tomo Credit Card for Business | Card 1 | Card 2 | Card 3 |

|---|---|---|---|---|

| Annual Fee | $0 | $95 | $0 | $0 |

| Rewards Program | 1.5% Cash Back on all purchases | 2x points on travel and dining, 1 point on other purchases | 1.5% cash back on all purchases | 1 point per $1 spent, redeemable for travel, merchandise, and gift cards |

| Sign-Up Bonus | $100 statement credit after spending $500 in the first 3 months | 50,000 bonus points after spending $3,000 in the first 3 months | $200 statement credit after spending $1,000 in the first 3 months | 10,000 bonus points after spending $1,000 in the first 3 months |

| Travel Benefits | Trip cancellation and interruption insurance, travel accident insurance | Priority Pass membership, airport lounge access | Trip delay and baggage delay insurance | Travel accident insurance |

| Purchase Protection | Extended warranty protection, purchase protection | Purchase protection, return protection | Extended warranty protection, price protection | Purchase protection |

| Other Benefits | Early payment discount, fraud protection | Employee card program, mobile wallet access | Mobile app with expense tracking features | Concierge services, roadside assistance |

Pros and Cons of Each Card

Understanding the pros and cons of each card is essential to making an informed decision.

Tomo Credit Card for Business

Pros:

- No annual fee

- Simple and straightforward rewards program with 1.5% cash back on all purchases

- Generous sign-up bonus

- Comprehensive travel and purchase protection benefits

Cons:

- Limited travel benefits compared to some other cards

- No bonus categories for specific spending, such as travel or dining

Card 1

Pros:

- Generous rewards program with bonus points for travel and dining

- Valuable travel benefits, including Priority Pass membership and airport lounge access

- Employee card program for managing business expenses

Cons:

- High annual fee

- Limited cash back rewards on non-bonus categories

Card 2

Pros:

- No annual fee

- Straightforward 1.5% cash back on all purchases

- Good sign-up bonus

- Trip delay and baggage delay insurance

Cons:

- Limited travel benefits compared to some other cards

- No bonus categories for specific spending

Card 3

Pros:

- No annual fee

- Rewards can be redeemed for travel, merchandise, and gift cards

- Concierge services and roadside assistance

Cons:

- Lower rewards rate compared to some other cards

- Limited travel benefits

Tomo Credit Card for Business Customer Reviews and Testimonials

Tomo Credit Card for Business has garnered a significant amount of positive feedback from its users. The card has received praise for its user-friendly interface, generous rewards program, and exceptional customer service.

Customer Service

Customer service is a crucial aspect of any credit card experience. Tomo Credit Card for Business has consistently received high marks for its responsiveness, helpfulness, and professionalism. Customers have praised the company’s dedication to resolving issues promptly and efficiently.

“I had a question about my statement and was able to get in touch with a customer service representative quickly. They were very helpful and resolved my issue within minutes.” – John S.

Rewards Program

The Tomo Credit Card for Business rewards program is another area where the card has earned positive reviews. Customers appreciate the card’s generous cashback rewards, which can be redeemed for a variety of travel, dining, and shopping experiences.

“I love the cashback rewards program. I’ve already earned enough points to redeem for a free flight!” – Sarah M.

Security and Protection

Tomo Credit Card for Business offers a comprehensive suite of security features to protect its users from fraud and identity theft. These features include zero-liability fraud protection, chip technology, and advanced fraud detection systems.

“I feel confident using my Tomo Credit Card for Business knowing that my account is protected by their advanced security features.” – David B.

Tomo Credit Card for Business Conclusion

The Tomo Credit Card for Business presents a compelling option for entrepreneurs and small business owners seeking a user-friendly and rewarding credit card experience. With its streamlined application process, competitive rewards program, and robust security features, the Tomo Credit Card for Business empowers businesses to manage their finances effectively and achieve their goals.

Key Takeaways

The Tomo Credit Card for Business offers a comprehensive suite of benefits, including:

- A straightforward application process that emphasizes speed and convenience.

- A generous rewards program that allows businesses to earn cash back on eligible purchases.

- Robust security features that protect businesses from fraudulent activity.

- A dedicated customer support team that provides personalized assistance and guidance.

Recommendations

Based on the information presented, the Tomo Credit Card for Business is recommended for:

- Entrepreneurs and small business owners seeking a user-friendly and rewarding credit card experience.

- Businesses that prioritize earning cash back on eligible purchases.

- Businesses that value robust security features to protect their financial data.

- Businesses that require personalized customer support and guidance.

Last Recap

Tomo Credit Card for Business emerges as a compelling option for businesses seeking a reliable and rewarding financial partner. Its tailored features, robust security measures, and comprehensive benefits cater to the unique needs of entrepreneurs and small business owners. Whether you are looking to optimize business expenses, earn valuable rewards, or enhance your business’s financial security, the Tomo Credit Card for Business presents a compelling solution. With its focus on customer satisfaction and commitment to innovation, Tomo Credit Card for Business is poised to become a leading force in the business credit card market.

FAQ Explained

What is the minimum credit score required for the Tomo Credit Card for Business?

The minimum credit score requirement for the Tomo Credit Card for Business is typically 670. However, this can vary depending on your individual credit history and other factors.

What are the annual fees associated with the Tomo Credit Card for Business?

The annual fee for the Tomo Credit Card for Business is $99. However, there may be introductory offers or waivers available for new cardholders.

What are the interest rates for the Tomo Credit Card for Business?

The interest rates for the Tomo Credit Card for Business vary depending on your creditworthiness. It is best to check the Tomo Credit Card website for the most up-to-date information.

Does the Tomo Credit Card for Business offer any travel insurance?

Yes, the Tomo Credit Card for Business offers travel insurance, which can provide coverage for trip cancellation, baggage loss, and other travel-related incidents.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!