Typical business line of credit interest rates are a crucial factor for businesses seeking financing. These rates can significantly impact the overall cost of borrowing and influence a company’s financial health. Understanding how these rates are determined, the factors that affect them, and strategies for managing them is essential for any business owner.

This guide delves into the intricacies of business line of credit interest rates, exploring key concepts, influencing factors, and practical strategies for optimizing your borrowing experience. From the basics of interest rate calculations to navigating the complexities of variable and fixed rates, we’ll provide a comprehensive overview to empower you with the knowledge you need to make informed financial decisions.

Understanding Business Line of Credit Interest Rates

A business line of credit is a flexible financing option that allows businesses to borrow money as needed, up to a pre-approved credit limit. Understanding the interest rates associated with these lines of credit is crucial for businesses to make informed financial decisions.

Business Line of Credit Interest Rates Explained

Business line of credit interest rates are the cost of borrowing money from a lender. They are expressed as an annual percentage rate (APR), which represents the total cost of borrowing over a year, including interest and any fees.

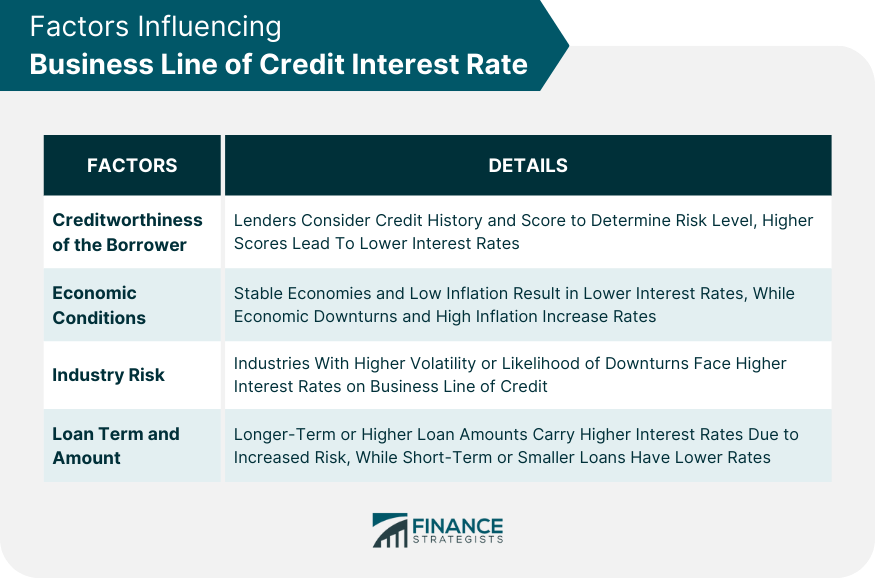

Factors Influencing Business Line of Credit Interest Rates

Several factors influence the interest rate on a business line of credit. These include:

- Credit Score: Businesses with higher credit scores generally qualify for lower interest rates. Lenders consider a business’s credit history, payment history, and debt-to-income ratio to assess its creditworthiness.

- Business Revenue and Profitability: Lenders evaluate a business’s financial performance, including revenue, profit margins, and cash flow, to assess its ability to repay the loan. Businesses with strong financial performance are more likely to secure lower interest rates.

- Industry and Competition: The industry a business operates in and the level of competition can influence interest rates. Certain industries may be considered riskier than others, potentially leading to higher interest rates.

- Loan Amount and Term: The amount of money borrowed and the loan term can also affect interest rates. Larger loan amounts and longer terms may result in higher interest rates.

- Collateral: Lenders may offer lower interest rates if a business provides collateral, such as real estate or equipment, to secure the loan. Collateral reduces the lender’s risk, making them more willing to offer favorable terms.

- Current Market Conditions: Interest rates fluctuate based on overall market conditions, including inflation, economic growth, and central bank policies. When interest rates rise in the broader market, lenders typically adjust their rates accordingly.

Relationship Between Business Line of Credit Interest Rates and Market Conditions

Business line of credit interest rates are closely tied to overall market conditions. When interest rates rise in the broader economy, lenders typically increase their rates on business lines of credit. This is because lenders need to adjust their rates to reflect the higher cost of borrowing money. Conversely, when interest rates fall, lenders may offer lower rates on business lines of credit to attract borrowers.

For example, during periods of economic uncertainty or high inflation, lenders may charge higher interest rates on business lines of credit to compensate for increased risk. Conversely, during periods of economic stability and low inflation, lenders may offer lower rates to encourage borrowing and stimulate economic growth.

Factors Affecting Business Line of Credit Interest Rates

Several factors play a crucial role in determining the interest rate you’ll receive on a business line of credit. These factors can significantly impact the overall cost of borrowing.

Credit Score

Your business’s credit score is a primary factor influencing the interest rate you’ll be offered. Lenders use this score to assess your creditworthiness, reflecting your history of repaying debts. A higher credit score indicates a lower risk for the lender, resulting in a lower interest rate. Conversely, a lower credit score signifies a higher risk, leading to a higher interest rate.

A higher credit score generally translates to a lower interest rate, while a lower credit score typically results in a higher interest rate.

Loan Amount and Repayment Terms

The amount you borrow and the repayment terms you choose also influence the interest rate. Generally, larger loan amounts tend to come with higher interest rates. This is because lenders perceive larger loans as carrying greater risk. Similarly, longer repayment terms can lead to higher interest rates, as the lender faces a longer exposure to potential default.

Borrowing larger amounts or opting for longer repayment terms might result in higher interest rates due to the increased risk for the lender.

Other Factors Affecting Interest Rates

| Factor | Description | Impact on Interest Rates |

|---|---|---|

| Industry | The industry your business operates in can impact interest rates. Some industries are considered riskier than others, leading to higher rates. | Higher risk industries may face higher interest rates. |

| Business Age and History | Businesses with a longer operating history and a proven track record of success often receive lower interest rates. | Established businesses with a strong track record may qualify for lower interest rates. |

| Collateral | Offering collateral, such as real estate or equipment, can help secure a lower interest rate. Collateral provides the lender with an asset to recover if you default on the loan. | Providing collateral can potentially lead to lower interest rates due to reduced risk for the lender. |

| Debt-to-Equity Ratio | A high debt-to-equity ratio indicates that your business relies heavily on debt financing, which can increase your risk profile. | A higher debt-to-equity ratio might result in higher interest rates. |

| Current Economic Conditions | Interest rates can fluctuate based on broader economic conditions, such as inflation and monetary policy. | Economic factors can influence interest rates across the board, affecting business line of credit rates as well. |

| Competition Among Lenders | A competitive lending market can drive down interest rates, while a limited number of lenders might lead to higher rates. | A more competitive market may offer lower interest rates, while a limited number of lenders might lead to higher rates. |

Evaluating Business Line of Credit Interest Rates

Evaluating business line of credit interest rates is crucial for making informed financial decisions. Understanding the factors that influence these rates and how to compare them from different lenders can save you money in the long run.

Comparing Rates from Multiple Lenders

It is essential to compare rates from multiple lenders to secure the best possible deal. Each lender has its own criteria for determining interest rates, which can vary significantly. By obtaining quotes from several lenders, you can identify the most competitive options and potentially negotiate a lower rate.

Assessing the Overall Cost of a Business Line of Credit

The interest rate is just one aspect of the overall cost of a business line of credit. Other fees, such as annual fees, origination fees, and monthly maintenance fees, can also add up. It’s crucial to consider all associated costs when evaluating a line of credit offer.

Checklist for Evaluating Business Line of Credit Interest Rates

Here’s a checklist to help you evaluate business line of credit interest rates:

- Variable vs. Fixed Interest Rates: Understand the difference between variable and fixed interest rates and how they might impact your monthly payments.

- APR (Annual Percentage Rate): Compare the APRs from different lenders, as this reflects the total cost of borrowing, including interest and fees.

- Fees: Inquire about all applicable fees, such as annual fees, origination fees, and monthly maintenance fees.

- Credit Score: Your credit score plays a significant role in determining your interest rate. Aim for a good credit score to qualify for lower rates.

- Loan Term: The length of the loan term can impact your monthly payments and the total interest you pay over the life of the loan.

- Repayment Options: Explore different repayment options offered by lenders, such as fixed monthly payments or interest-only payments.

Tip: When comparing rates, be sure to consider the overall cost of the loan, including interest, fees, and other expenses.

Strategies for Managing Business Line of Credit Interest Rates

Managing business line of credit interest rates effectively is crucial for optimizing your business’s financial health. By implementing smart strategies, you can minimize interest rate costs, improve cash flow, and enhance your overall financial performance.

Minimizing Interest Rate Costs, Typical business line of credit interest rates

Minimizing interest rate costs involves adopting practices that reduce the overall amount of interest you pay on your business line of credit.

- Maintain a High Credit Score: A strong credit score demonstrates financial responsibility and reliability, making you a more attractive borrower to lenders. This often translates into lower interest rates. Aim for a credit score above 700, which is considered excellent.

- Negotiate Interest Rates: Don’t hesitate to negotiate with your lender for a lower interest rate, especially if you have a good credit history and a strong relationship with the bank. Be prepared to present your financial position and demonstrate your ability to repay the loan.

- Consider Alternative Lending Options: Explore alternative lending options like online lenders or credit unions, which may offer more competitive interest rates. However, thoroughly research each lender’s terms and conditions before making a decision.

- Pay Down Your Line of Credit Regularly: Aim to make more than the minimum payment on your line of credit to reduce your outstanding balance. This lowers the amount of interest you accrue over time.

- Shop Around for Rates: Regularly compare interest rates from different lenders to ensure you’re getting the best deal. Don’t be afraid to switch lenders if you find a more favorable offer.

Negotiating Lower Interest Rates

Negotiating lower interest rates requires preparation and confidence.

- Build a Strong Relationship with Your Lender: Cultivate a positive relationship with your lender by demonstrating your commitment to repayment and by being a reliable customer. This can improve your negotiating position.

- Present a Strong Financial Case: Be prepared to present your financial position, including your credit score, revenue, and cash flow, to demonstrate your ability to repay the loan. This strengthens your negotiating power.

- Research Competitor Rates: Gather information on interest rates offered by other lenders. This provides valuable leverage when negotiating with your current lender.

- Offer Incentives: Consider offering incentives to your lender, such as increasing your loan amount or extending the loan term, to sweeten the deal and secure a lower interest rate.

- Be Prepared to Walk Away: If you’re unable to negotiate a satisfactory interest rate, be prepared to walk away and explore other lending options. This demonstrates your confidence and can encourage your lender to make a more competitive offer.

Maintaining a Good Credit Score

A good credit score is essential for securing favorable interest rates on your business line of credit.

- Pay Bills on Time: Timely payment of all your bills, including credit card payments, utility bills, and loan payments, is crucial for maintaining a good credit score. Set reminders and automate payments to ensure consistency.

- Keep Credit Utilization Low: Credit utilization refers to the amount of credit you’re using compared to your total available credit. Aim to keep your credit utilization below 30% to improve your credit score.

- Avoid Opening Too Many New Accounts: Opening too many new credit accounts can negatively impact your credit score. Only apply for credit when necessary and avoid opening accounts you don’t need.

- Monitor Your Credit Report Regularly: Review your credit report regularly for any errors or inaccuracies. Dispute any errors with the credit reporting agencies to ensure your credit score reflects your true financial standing.

- Consider a Secured Credit Card: If you have limited credit history, consider a secured credit card. These cards require a security deposit, which reduces the lender’s risk and can help you build credit over time.

Summary: Typical Business Line Of Credit Interest Rates

In conclusion, navigating the world of business line of credit interest rates requires a thoughtful approach. By understanding the factors that influence these rates, comparing offers from multiple lenders, and implementing effective interest rate management strategies, businesses can minimize borrowing costs and optimize their financial performance. Remember, knowledge is power, and armed with the right information, you can confidently secure the financing your business needs while ensuring financial stability.

Essential Questionnaire

What is a business line of credit?

A business line of credit is a revolving credit facility that allows businesses to borrow money as needed up to a pre-approved credit limit. It provides flexibility for managing cash flow and covering short-term expenses.

How are business line of credit interest rates calculated?

Interest rates for business lines of credit are typically calculated based on a prime rate or a base rate plus a margin. The specific calculation method and factors used can vary depending on the lender.

What is the difference between variable and fixed interest rates?

Variable interest rates fluctuate based on market conditions, while fixed interest rates remain constant for the duration of the loan term. Variable rates offer potential for lower initial costs but carry the risk of increasing rates, while fixed rates provide stability but may have higher initial rates.

How can I improve my credit score to qualify for lower interest rates?

To improve your credit score, make timely payments on all debts, keep credit utilization low, and avoid opening too many new credit accounts. Building a strong credit history over time is crucial for securing favorable interest rates.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!