Unsecured business line of credit rates – Unsecured business lines of credit rates are a crucial factor for businesses seeking flexible financing options. These lines of credit, unlike secured loans, don’t require collateral, offering a convenient way to access funds. However, the absence of collateral often translates to higher interest rates, making it essential for businesses to understand the factors influencing these rates.

This article explores the complexities of unsecured business line of credit rates, delving into the key factors that determine the cost of borrowing. From credit score and revenue to industry type and business history, we’ll examine the elements that impact interest rates. Additionally, we’ll provide insights into typical rates, alternative financing options, and tips for obtaining competitive terms.

Understanding Unsecured Business Lines of Credit

An unsecured business line of credit is a flexible financing option that provides businesses with access to a predetermined amount of funds they can draw upon as needed. Unlike secured lines of credit, which require collateral, unsecured lines are based on the borrower’s creditworthiness and financial history.

This type of financing offers businesses the flexibility to manage their cash flow, cover unexpected expenses, or invest in growth opportunities without having to secure a traditional loan.

Key Characteristics of Unsecured Business Lines of Credit

Unsecured business lines of credit are characterized by several key features that distinguish them from other financing options. These characteristics are important for businesses to understand before applying for this type of financing.

- No Collateral Requirement: Unsecured lines of credit do not require businesses to pledge any assets as collateral, making them an attractive option for companies with limited assets or those seeking to avoid tying up valuable resources.

- Flexible Access to Funds: Businesses can draw upon the available credit line as needed, making it a convenient way to manage short-term cash flow fluctuations. This flexibility allows businesses to react quickly to changing market conditions or unexpected expenses.

- Revolving Credit: As businesses repay their outstanding balance, the credit line is replenished, allowing for repeated use as long as the credit limit is not exceeded. This revolving feature provides ongoing access to funds without needing to apply for new loans repeatedly.

- Interest Rates: Unsecured lines of credit typically carry higher interest rates than secured loans due to the increased risk for lenders. The interest rate is usually variable, meaning it can fluctuate based on market conditions and the borrower’s creditworthiness.

- Credit Limit: Each line of credit has a predetermined credit limit, which represents the maximum amount of funds available to the business. The credit limit is based on the borrower’s financial history and creditworthiness.

Examples of Business Uses for Unsecured Lines of Credit

Unsecured business lines of credit are versatile financing tools that can be used for various business purposes. Understanding the common uses can help businesses determine if this financing option is right for their needs.

- Working Capital Management: Businesses often use unsecured lines of credit to manage their working capital, covering expenses such as inventory purchases, payroll, and operating costs. This helps businesses maintain a healthy cash flow and avoid financial strain.

- Seasonal Business Fluctuations: Businesses with seasonal sales cycles can utilize unsecured lines of credit to bridge cash flow gaps during slow periods. This allows them to continue operations and meet financial obligations while waiting for sales to pick up.

- Unexpected Expenses: Unsecured lines of credit can be used to cover unexpected expenses, such as emergency repairs, legal fees, or marketing campaigns. This provides businesses with a safety net to handle unforeseen situations without disrupting their operations.

- Growth Opportunities: Businesses can use unsecured lines of credit to fund growth opportunities, such as expanding operations, launching new products, or acquiring new equipment. This flexibility allows businesses to seize opportunities without waiting for traditional loans to be approved.

Factors Influencing Unsecured Business Line of Credit Rates

The interest rate you’ll pay on an unsecured business line of credit is determined by a combination of factors, including your creditworthiness, the lender’s risk assessment, and prevailing market conditions. Understanding these factors can help you negotiate a better rate and secure financing for your business.

Credit Score, Unsecured business line of credit rates

Your credit score is a numerical representation of your creditworthiness, based on your past borrowing and repayment history. A higher credit score indicates a lower risk to lenders, resulting in more favorable interest rates. Lenders use a variety of credit scoring models, but generally, a score above 700 is considered good, while a score below 620 may indicate a higher risk.

Business Revenue

Lenders consider your business’s revenue to assess its ability to repay the loan. A strong revenue history, with consistent and increasing earnings, suggests a lower risk to lenders and may result in a lower interest rate. Conversely, businesses with volatile or declining revenue may face higher rates due to perceived risk.

Debt-to-Equity Ratio

The debt-to-equity ratio measures the amount of debt a business has relative to its equity. A higher ratio indicates a greater reliance on debt financing, which may increase the risk for lenders. Businesses with a lower debt-to-equity ratio generally qualify for lower interest rates.

Industry Type

The industry in which your business operates can also influence interest rates. Some industries, like technology or healthcare, are perceived as having higher growth potential and may attract lower rates. Other industries, such as retail or manufacturing, may be considered riskier due to factors like competition or economic cycles.

Business History

The length of time your business has been in operation and its track record of success can significantly impact interest rates. Businesses with a longer history and a proven track record of profitability are typically considered lower risk and may qualify for more favorable rates.

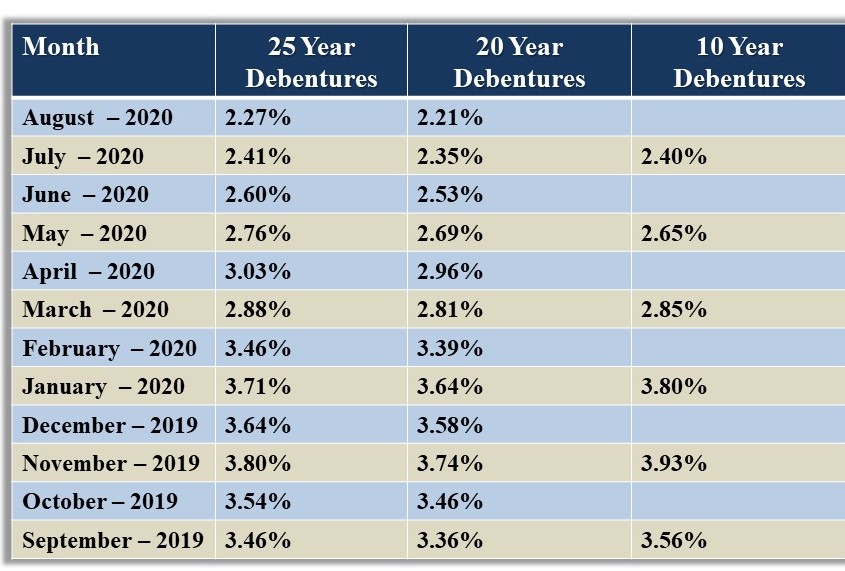

Typical Unsecured Business Line of Credit Rates

Unsecured business lines of credit, while offering flexibility, often come with higher interest rates compared to secured options. The rates are influenced by various factors, including the borrower’s creditworthiness, the prevailing economic conditions, and the lender’s risk appetite.

Interest Rate Range

Interest rates on unsecured business lines of credit can vary significantly depending on the borrower’s creditworthiness. Here’s a general overview of the typical rate range:

| Credit Score | Interest Rate Range |

|---|---|

| Excellent (740+) | 5.00% – 10.00% |

| Good (670-739) | 7.00% – 12.00% |

| Fair (620-669) | 9.00% – 15.00% |

| Poor (580-619) | 12.00% – 20.00% |

| Very Poor (Below 580) | 15.00% – 30.00% or higher |

It’s important to note that these are just general ranges, and actual rates may vary based on specific lender policies and the individual borrower’s circumstances.

Impact of Economic Conditions

Interest rates on unsecured business lines of credit are also influenced by prevailing economic conditions. During periods of economic growth, lenders may offer lower rates as they compete for borrowers. However, during periods of economic uncertainty or recession, rates tend to rise as lenders become more risk-averse.

For example, during the 2008 financial crisis, interest rates on unsecured business lines of credit significantly increased as lenders tightened their lending standards and sought to minimize risk. Conversely, in recent years, with a strong economy and low interest rates, lenders have been more willing to offer competitive rates on unsecured business lines of credit.

Alternatives to Unsecured Business Lines of Credit

Unsecured business lines of credit are a popular choice for small businesses, but they are not always the best option. Depending on your specific circumstances, there may be other financing options that are more suitable. This section will explore some of the most common alternatives to unsecured business lines of credit, comparing their advantages and disadvantages.

Secured Business Lines of Credit

Secured business lines of credit are similar to unsecured lines of credit, but they require you to pledge collateral, such as real estate or equipment, to secure the loan.

- Advantages:

- Secured lines of credit typically offer lower interest rates than unsecured lines of credit because lenders perceive less risk.

- They often come with higher credit limits because the collateral provides a safety net for the lender.

- Secured lines of credit can be easier to qualify for, especially if you have a limited credit history or a lower credit score.

- Disadvantages:

- If you default on a secured line of credit, the lender can seize your collateral to recover their losses.

- You may need to pay additional fees for the appraisal and insurance of your collateral.

- Secured lines of credit can be less flexible than unsecured lines of credit because the collateral can limit your borrowing capacity.

Term Loans

Term loans are a type of business financing that provides a fixed amount of money for a set period of time. They typically have a fixed interest rate and a regular payment schedule.

- Advantages:

- Term loans can provide a predictable payment schedule, making budgeting easier.

- They offer a fixed interest rate, which can help protect you from rising interest rates.

- Term loans can be used for a variety of purposes, such as purchasing equipment, expanding your business, or refinancing debt.

- Disadvantages:

- Term loans may have higher interest rates than unsecured lines of credit.

- They can be more difficult to qualify for, especially if you have a limited credit history or a lower credit score.

- Term loans may require a down payment or a personal guarantee.

Merchant Cash Advances

Merchant cash advances (MCAs) are a type of financing that provides businesses with a lump sum of cash in exchange for a percentage of their future sales.

- Advantages:

- MCAs are typically easier to qualify for than traditional loans.

- They can provide funding quickly, often within a few days.

- MCAs do not require collateral.

- Disadvantages:

- MCAs can have very high interest rates.

- They can be difficult to repay if your sales are slow.

- MCAs may have hidden fees and penalties.

Examples of When Alternative Financing Options Might Be Preferable

- If you need a large amount of financing, a term loan may be a better option than an unsecured line of credit.

- If you have a limited credit history or a lower credit score, a secured line of credit or an MCA may be more accessible.

- If you need funding quickly, an MCA may be a good choice.

- If you have a stable business with predictable revenue, a term loan may be a more cost-effective option than an unsecured line of credit.

Tips for Obtaining Competitive Rates

Securing a competitive rate on an unsecured business line of credit requires a strategic approach. By focusing on improving your credit score and business financials, you can present yourself as a low-risk borrower and increase your chances of securing favorable terms. Additionally, understanding negotiation tactics can help you leverage your position and achieve a better rate.

Improving Credit Score and Business Financials

A strong credit score and healthy business financials are crucial for obtaining competitive rates. Here are some key strategies to improve these aspects:

- Pay Bills on Time: Timely payment of all financial obligations, including business loans, credit cards, and utilities, demonstrates financial responsibility and positively impacts your credit score.

- Reduce Credit Utilization Ratio: Keeping your credit utilization ratio (the amount of credit used compared to your total credit limit) low, ideally below 30%, signals responsible credit management and improves your credit score.

- Monitor Credit Reports: Regularly review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors and inconsistencies. Correcting inaccuracies can significantly improve your score.

- Build Business Credit: Establish a strong business credit history by obtaining business credit cards and paying bills on time. This demonstrates your business’s financial stability and creditworthiness.

- Increase Revenue and Profitability: Boosting your business’s revenue and profitability showcases its financial strength and makes it more attractive to lenders.

- Maintain Adequate Liquidity: Ensure your business has sufficient cash flow to cover its operating expenses and debt obligations. This demonstrates financial stability and reduces risk for lenders.

Negotiating Interest Rates

Negotiating interest rates with lenders can be an effective strategy to secure favorable terms. Here are some tips:

- Shop Around: Compare offers from multiple lenders to identify the most competitive rates and terms.

- Highlight Your Strengths: Emphasize your strong credit score, healthy business financials, and positive track record of timely payments.

- Negotiate Based on Industry Benchmarks: Research average interest rates for unsecured business lines of credit in your industry to use as a reference point during negotiations.

- Consider Collateral: If you’re willing to offer collateral, such as equipment or real estate, you may be able to secure a lower interest rate.

- Explore Alternative Financing Options: If you can’t secure a competitive rate through traditional lenders, explore alternative financing options like online lenders or peer-to-peer lending platforms.

Resources for Finding Competitive Rates

Several resources can help you find competitive rates for unsecured business lines of credit.

- Online Lenders: Many online lenders offer competitive rates and streamlined application processes.

- Business Credit Bureaus: Business credit bureaus, such as Dun & Bradstreet and Experian, provide credit reports and scores that can be used to compare rates from different lenders.

- Financial Advisors: Financial advisors can provide guidance on securing competitive rates and offer insights into different lending options.

- Industry Associations: Industry associations often offer resources and connections to lenders specializing in your industry.

Conclusion: Unsecured Business Line Of Credit Rates

Understanding unsecured business line of credit rates is essential for any business owner seeking to utilize this flexible financing option. By carefully considering the factors influencing rates, exploring alternative financing options, and implementing strategies to improve creditworthiness, businesses can secure competitive terms and optimize their financial well-being. Remember, thorough research and proactive planning are key to navigating the world of unsecured business lines of credit and making informed financial decisions.

Answers to Common Questions

What is the average unsecured business line of credit rate?

Average unsecured business line of credit rates vary depending on factors like creditworthiness and market conditions. However, rates typically range from 7% to 15%.

How can I improve my chances of getting a lower rate?

Improving your credit score, increasing your revenue, and reducing your debt-to-equity ratio can help you secure lower rates.

What are the risks associated with unsecured business lines of credit?

The primary risk is that you could be charged high interest rates if you have a poor credit score or if the lender perceives your business as high-risk.

Are there any other types of business lines of credit?

Yes, there are secured business lines of credit, which require collateral, and revolving lines of credit, which allow you to borrow and repay multiple times within a set period.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!