Update Equifax Business Credit Report: Your business credit report is a crucial document that reflects your financial health and trustworthiness. It’s a snapshot of your company’s borrowing and repayment history, influencing your access to loans, credit lines, and even vendor relationships. Just like your personal credit score, maintaining a positive business credit score is essential for securing favorable financing terms and fostering a strong financial reputation.

Equifax is one of the three major credit reporting agencies in the United States, and its business credit reports are widely used by lenders, suppliers, and other businesses to assess your creditworthiness. Understanding how to access, update, and manage your Equifax business credit report is critical for any business owner looking to secure financing, negotiate favorable terms, and build a strong financial foundation.

Understanding Business Credit Reports

A business credit report is a comprehensive document that Artikels a company’s financial history and creditworthiness. It serves as a vital tool for lenders, investors, and suppliers to assess a business’s risk profile and make informed decisions regarding credit extensions, investments, or business partnerships.

The Significance of Business Credit Reports

Business credit reports play a crucial role in the financial health of a company. They provide lenders and investors with valuable insights into a company’s financial stability, repayment history, and overall creditworthiness. A strong credit report can lead to:

* Access to favorable financing options: Lenders are more likely to offer competitive interest rates and favorable loan terms to businesses with a good credit history.

* Improved business relationships: Suppliers and vendors may be more willing to offer extended payment terms or discounts to businesses with a strong credit rating.

* Enhanced reputation: A good credit score can enhance a business’s reputation and attract potential investors, partners, and customers.

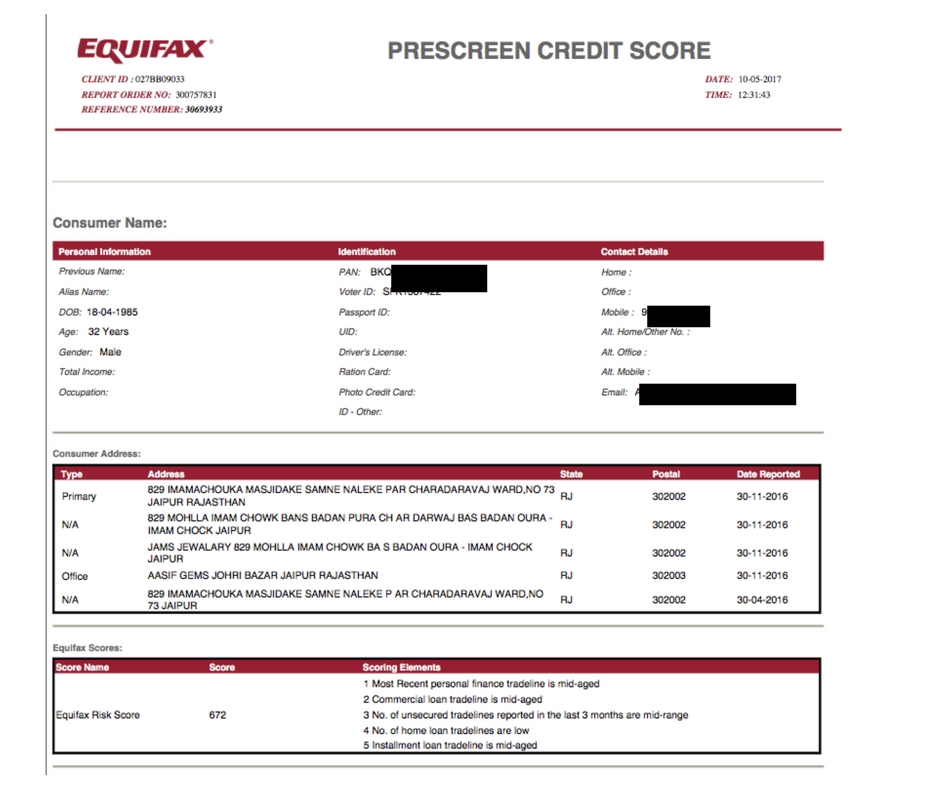

Key Elements of an Equifax Business Credit Report

An Equifax business credit report typically includes the following key elements:

* Business information: This section provides basic details about the company, including its legal name, address, phone number, and industry.

* Credit history: This section Artikels the company’s payment history on its credit accounts, including loans, lines of credit, and trade credit.

* Financial information: This section includes information about the company’s financial performance, such as revenue, profit, and debt levels.

* Public records: This section may include information about any legal actions or bankruptcies filed against the company.

* Trade references: This section lists the company’s suppliers and vendors, along with their assessments of the company’s payment history.

* Inquiries: This section shows the number of times lenders or suppliers have requested the company’s credit report.

Business Credit Reports vs. Personal Credit Reports

While both business credit reports and personal credit reports provide information about an individual’s or company’s creditworthiness, there are key differences:

| Feature | Business Credit Report | Personal Credit Report |

|---|---|---|

| Reporting agency | Equifax, Experian, Dun & Bradstreet | Equifax, Experian, TransUnion |

| Information included | Business financial history, payment history, trade references | Personal financial history, payment history, credit card usage, loans |

| Impact on credit score | Affects business credit score | Affects personal credit score |

| Access | Accessible by lenders, investors, suppliers | Accessible by lenders, landlords, employers |

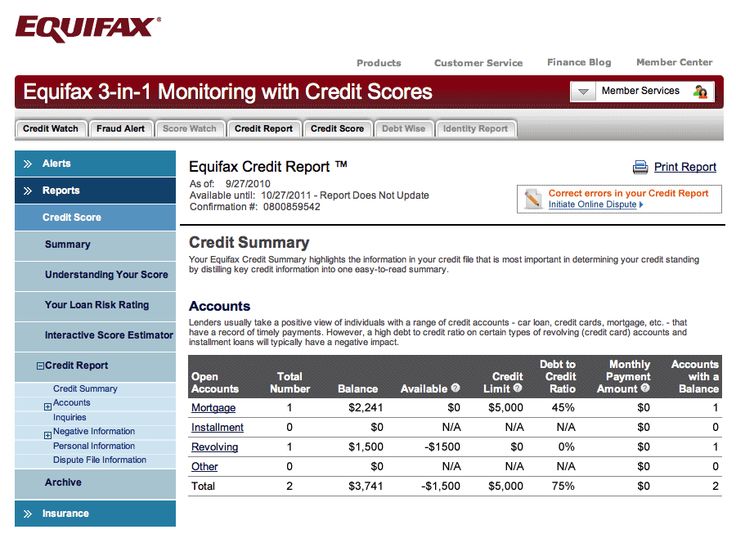

Accessing Your Equifax Business Credit Report

Knowing how to access your Equifax business credit report is crucial for managing your business’s financial health. It allows you to monitor your creditworthiness, identify any errors, and understand how lenders perceive your business.

Methods of Accessing Your Equifax Business Credit Report

There are a few different ways you can obtain your Equifax business credit report.

- Directly from Equifax: You can order your report directly from Equifax’s website or by phone. This is the most common method, as it allows you to access the report quickly and easily.

- Through a Business Credit Monitoring Service: Several companies offer business credit monitoring services that provide access to your Equifax business credit report, along with other valuable features like alerts for changes in your credit score or reports. These services can be a convenient option if you need regular access to your report.

- Through a Business Loan Application: When you apply for a business loan, the lender will typically pull your Equifax business credit report as part of the application process. You may receive a copy of the report as part of the loan application process.

Costs Associated with Accessing Your Equifax Business Credit Report

The cost of obtaining your Equifax business credit report can vary depending on the method you choose.

- Directly from Equifax: Equifax offers a variety of pricing options for obtaining your business credit report. For example, you may be able to access a basic report for a nominal fee, or you may have to pay a higher fee for a more comprehensive report.

- Through a Business Credit Monitoring Service: The cost of a business credit monitoring service can vary depending on the features offered. Some services may offer a free trial period, while others may require a monthly subscription fee.

- Through a Business Loan Application: Lenders may charge a fee for pulling your Equifax business credit report as part of a loan application. The fee is typically included in the overall loan application fee.

Updating Your Equifax Business Credit Report: Update Equifax Business Credit Report

It’s essential to ensure the accuracy of your Equifax business credit report. Inaccuracies can negatively impact your business’s ability to secure financing, obtain favorable terms from suppliers, and even damage your reputation. This section will guide you through the process of identifying and disputing inaccuracies on your report, as well as provide tips for maintaining accurate information.

Identifying Common Inaccuracies, Update equifax business credit report

It’s crucial to regularly review your Equifax business credit report for any inaccuracies. Some common errors include:

- Incorrect personal or business information: This can include misspellings, outdated addresses, or incorrect business names.

- Mistaken identity: Your business’s credit information might be mixed up with another company’s, leading to incorrect credit history.

- Unpaid or disputed accounts: If you’ve paid off a debt or disputed an account, it may not be reflected accurately on your report.

- Fraudulent accounts: You may find accounts on your report that you never opened.

- Late payments or missed payments: If you made a payment on time but it was marked late, this could affect your credit score.

Disputing Inaccurate Information

If you discover inaccuracies on your Equifax business credit report, you can dispute them directly with Equifax. The process typically involves:

- Gather evidence: Collect any documentation that supports your claim, such as payment receipts, invoices, or correspondence with creditors.

- Submit a dispute: Equifax provides a dispute form that you can submit online or by mail.

- Wait for a response: Equifax will investigate your dispute and respond within a specified timeframe.

- Follow up: If you don’t receive a response within the allotted time, or if you disagree with their decision, you can follow up with Equifax to clarify the situation.

Maintaining Accurate Business Credit Information

Here are some tips to maintain accurate and up-to-date business credit information:

- Review your report regularly: Check your report at least once a year for any inaccuracies.

- Pay bills on time: Make all payments promptly to avoid late payment marks on your report.

- Monitor your credit activity: Be aware of any new accounts or inquiries that appear on your report.

- Correct errors promptly: If you discover an error, dispute it immediately to prevent further damage to your credit score.

- Keep your contact information updated: Ensure that Equifax has your current address and phone number to receive important notices.

The Impact of Business Credit Reports

Business credit reports play a crucial role in the financial health of your business. They provide a comprehensive overview of your company’s creditworthiness, influencing the decisions of lenders, suppliers, and even potential business partners.

The Role of Business Credit Reports in Lending Decisions

Lenders heavily rely on business credit reports to assess the risk associated with extending credit to your business. A positive credit history demonstrates your company’s financial responsibility, making it more likely for lenders to approve loans with favorable terms. Conversely, a poor credit history can result in loan denials, higher interest rates, and stricter loan conditions.

How Business Credit Scores Influence Interest Rates and Loan Terms

Business credit scores, calculated based on the information in your credit report, directly impact the interest rates and loan terms you receive. A higher credit score indicates a lower risk for lenders, leading to lower interest rates and more favorable loan terms. Conversely, a lower credit score signals a higher risk, potentially resulting in higher interest rates, shorter loan terms, or even loan denial.

A business with a good credit score might qualify for a loan with a 5% interest rate and a 10-year term, while a business with a poor credit score might receive a loan with a 10% interest rate and a 5-year term.

The Importance of Maintaining a Positive Business Credit History

Maintaining a positive business credit history is crucial for securing favorable financing options, attracting investors, and fostering strong business relationships. A good credit history can:

- Secure Lower Interest Rates: Lower interest rates translate into lower monthly payments, allowing you to allocate more capital towards business growth and expansion.

- Access More Favorable Loan Terms: Lenders may offer longer loan terms, providing you with more time to repay your debt and manage cash flow effectively.

- Improve Your Business’s Reputation: A strong credit history builds trust and credibility among lenders, suppliers, and potential business partners, enhancing your company’s overall reputation.

- Attract Investors: Investors are more likely to invest in companies with a solid credit history, as it indicates financial stability and responsible management.

Best Practices for Managing Business Credit

Managing business credit effectively is crucial for your company’s financial health. A strong credit score can unlock access to favorable financing terms, lower interest rates, and better business opportunities. Conversely, poor credit can lead to higher borrowing costs, limited access to funding, and even damage to your business reputation. This section will explore best practices for managing your business credit, monitoring your reports, and building a strong credit score.

Developing a Checklist for Managing Business Credit

A comprehensive checklist can help you stay organized and ensure you’re taking the necessary steps to manage your business credit effectively. Here’s a list of key practices:

- Monitor your credit reports regularly. This allows you to identify any errors or discrepancies and take action to correct them promptly.

- Pay your bills on time. Late payments negatively impact your credit score, so make timely payments a top priority.

- Keep credit utilization low. Aim to use no more than 30% of your available credit, as high utilization can hurt your score.

- Avoid opening too many new accounts. Each new account inquiry can slightly lower your score, so only apply for credit when necessary.

- Maintain a healthy mix of credit. A diverse credit portfolio, including business loans, credit cards, and lines of credit, can demonstrate responsible credit management.

- Review your credit agreements carefully. Understand the terms and conditions of your credit accounts to avoid unexpected fees or penalties.

- Dispute any errors on your credit report. If you find inaccuracies, contact the credit bureau and follow their dispute process.

- Establish business credit. Building a strong credit history takes time, so start early by opening business credit accounts and using them responsibly.

- Consider a business credit monitoring service. These services can alert you to changes in your credit report and help you identify potential problems early on.

Monitoring Your Business Credit Reports

Regularly monitoring your business credit reports is essential for identifying errors, tracking your progress, and proactively managing your credit health.

- Obtain your credit reports annually. You’re entitled to a free annual credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion). You can request these reports through AnnualCreditReport.com.

- Set up credit monitoring alerts. Many credit bureaus and monitoring services offer alerts that notify you of changes to your credit report, such as new accounts or inquiries.

- Review your reports carefully. Pay close attention to the details, including account information, payment history, and inquiries.

- Dispute any errors promptly. If you find inaccuracies, contact the credit bureau and follow their dispute process.

Building and Maintaining a Strong Business Credit Score

A strong business credit score is crucial for accessing favorable financing terms, securing business loans, and building a positive reputation in the marketplace.

- Pay your bills on time. Timely payments are the most significant factor influencing your credit score. Aim to pay all your bills before the due date to avoid late fees and negative marks on your report.

- Keep credit utilization low. High credit utilization (the amount of credit you’re using compared to your available credit limit) can negatively impact your score. Aim to keep your utilization below 30%.

- Establish a mix of credit. A diverse credit portfolio, including business loans, credit cards, and lines of credit, demonstrates responsible credit management and can improve your score.

- Avoid opening too many new accounts. Each new credit inquiry can slightly lower your score, so only apply for credit when necessary.

- Maintain a long credit history. The longer your credit history, the better your score. Pay your bills on time and avoid closing old accounts to maintain a positive track record.

- Become an authorized user on a business credit account. If you’re starting a new business, you can build credit by becoming an authorized user on an existing business credit account.

- Consider a business credit card. Using a business credit card responsibly can help you build credit and earn rewards.

- Monitor your credit score regularly. Regularly checking your credit score can help you identify any potential problems and take action to improve your score.

Epilogue

Maintaining a positive business credit history is an ongoing process that requires diligence and attention to detail. By understanding the importance of your Equifax business credit report, accessing it regularly, and addressing any inaccuracies promptly, you can ensure that your business’s financial standing is accurately reflected and that you have access to the resources you need to grow and thrive. Remember, a strong business credit score can unlock opportunities for your business, while a poor one can hinder its progress. Take the time to learn about your business credit report, understand how it works, and take steps to maintain a positive record. It’s an investment in your business’s future.

Common Queries

How often should I check my Equifax business credit report?

It’s recommended to review your business credit report at least once a year, or even more frequently if you’ve recently made significant financial changes.

What if I find errors on my Equifax business credit report?

If you discover any inaccuracies, you should file a dispute with Equifax immediately. You’ll need to provide supporting documentation to prove the error.

How can I improve my business credit score?

To improve your business credit score, pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!