Where to apply for business credit is a crucial question for any entrepreneur. Establishing business credit is like building a financial foundation for your company, paving the way for future growth and success. A strong credit score unlocks access to valuable resources, such as loans, lines of credit, and even better interest rates. It’s a powerful tool that can help your business thrive.

This guide will explore the different types of business credit available, the factors to consider when choosing a provider, and the steps involved in applying for business credit. We’ll also provide practical tips for increasing your chances of approval and managing your business credit responsibly.

Understanding Business Credit

Establishing and maintaining good business credit is crucial for your company’s financial health and success. It’s like a credit score for your business, reflecting your ability to repay debts and manage finances responsibly.

Importance of Establishing Business Credit

A strong business credit score opens doors to various opportunities, including:

- Securing loans and lines of credit at favorable interest rates, allowing you to finance business growth and expansion.

- Gaining access to better terms and discounts from suppliers and vendors, reducing operational costs.

- Attracting investors and securing funding for your business, demonstrating financial stability and trustworthiness.

- Improving your business’s reputation and credibility, enhancing its standing in the marketplace.

Benefits of Good Business Credit

Having good business credit offers numerous advantages, including:

- Lower interest rates: Lenders consider businesses with good credit scores less risky, leading to lower interest rates on loans and lines of credit. This translates to significant savings over time.

- Improved access to financing: Good credit increases your chances of securing loans, lines of credit, and other forms of financing, allowing you to pursue growth opportunities and manage cash flow effectively.

- Better supplier relationships: Suppliers are more likely to offer favorable terms, such as extended payment periods and discounts, to businesses with strong credit histories. This can significantly reduce operational costs.

- Enhanced reputation: A good business credit score reflects financial responsibility and trustworthiness, enhancing your company’s reputation and credibility in the market. This can attract customers, partners, and investors.

Factors Influencing Business Credit Scores

Several factors contribute to your business credit score. These include:

- Payment history: Consistent and timely payments on all business obligations, such as loans, credit cards, and utility bills, are crucial. Late or missed payments negatively impact your credit score.

- Credit utilization: This refers to the amount of credit you’re using compared to your available credit limit. Keeping credit utilization low, ideally below 30%, helps improve your credit score.

- Credit mix: A diverse mix of credit accounts, such as loans, lines of credit, and credit cards, demonstrates responsible credit management. This can positively impact your credit score.

- Length of credit history: A longer credit history, with a track record of responsible credit use, generally results in a better credit score. It indicates financial stability and experience.

- New credit inquiries: Each time you apply for credit, a hard inquiry is placed on your credit report. Too many inquiries can negatively impact your score.

Types of Business Credit

You’ve learned about business credit, now let’s explore the various types of credit available to businesses. Understanding these types will help you determine which ones best suit your business needs and goals.

Types of Business Credit

There are various types of business credit, each with its own features and eligibility requirements.

- Trade Credit: This is a common form of business credit offered by suppliers to their customers. It allows businesses to purchase goods or services on credit and pay later, typically within a set timeframe. Trade credit is often offered with a discount for early payment, encouraging prompt settlements.

- Commercial Loans: These are loans provided by banks and other financial institutions to businesses for various purposes, including operating expenses, equipment purchases, and real estate acquisition. Commercial loans can be secured or unsecured, with interest rates and repayment terms varying based on factors like the borrower’s creditworthiness and the loan’s purpose.

- Lines of Credit: A line of credit is a revolving credit facility that allows businesses to borrow money up to a predetermined limit. It provides flexibility for short-term financing needs, enabling businesses to draw funds as needed and repay them over time.

- Credit Cards: Business credit cards offer businesses a convenient way to make purchases and track expenses. They typically come with rewards programs, such as cash back or travel points, and may provide access to travel and other perks.

- Invoice Financing: This financing option helps businesses improve cash flow by allowing them to receive immediate payment for their invoices. Invoice financing companies purchase a business’s invoices at a discount and then collect the full amount from the customers.

- Equipment Financing: Businesses can lease or finance equipment through specialized lenders. This option allows businesses to acquire necessary equipment without a large upfront investment, with payments spread over time.

- Small Business Administration (SBA) Loans: The SBA offers various loan programs to small businesses, providing access to affordable financing options. These loans often have more favorable terms compared to traditional commercial loans, making them attractive to small businesses with limited credit history.

Eligibility Requirements for Business Credit, Where to apply for business credit

Eligibility requirements for different types of business credit vary. However, some common factors considered by lenders include:

- Credit History: Lenders assess a business’s credit history, including payment history, credit utilization, and any outstanding debts. A strong credit history is crucial for securing favorable credit terms.

- Financial Performance: Lenders examine a business’s financial statements, including income statements, balance sheets, and cash flow statements, to evaluate its financial health and ability to repay the debt.

- Business Plan: A well-written business plan demonstrates a business’s future plans and growth potential, providing lenders with insights into its viability and ability to generate revenue.

- Collateral: Secured loans often require collateral, such as real estate or equipment, to mitigate the lender’s risk.

- Personal Guarantees: Lenders may require business owners to provide personal guarantees, making them personally liable for the debt if the business fails to repay.

Choosing the Right Credit Provider: Where To Apply For Business Credit

Finding the right business credit provider is crucial for securing the financial resources your business needs. This involves understanding your business needs, comparing different providers, and evaluating their offerings to make an informed decision.

Factors to Consider When Selecting a Provider

Choosing the right business credit provider involves considering various factors that align with your business needs and financial goals.

- Credit History and Score: Your business credit history and score play a significant role in determining your eligibility for credit and the interest rates you qualify for. A strong credit history can lead to more favorable terms and lower interest rates.

- Interest Rates and Fees: Compare interest rates, annual percentage rates (APRs), and fees associated with different credit products. Look for providers offering competitive rates and transparent fee structures.

- Loan Terms and Conditions: Evaluate the loan terms, including the repayment period, loan amount, and any prepayment penalties. Choose terms that align with your business’s cash flow and financial planning.

- Customer Service and Support: Consider the provider’s reputation for customer service, responsiveness, and ease of communication. A reliable provider offers accessible and helpful support when needed.

- Flexibility and Customization: Explore whether the provider offers flexible credit options, such as lines of credit, term loans, or equipment financing. Look for providers that can tailor their products to your specific business needs.

Reputable Business Credit Providers

Several reputable business credit providers offer a range of products and services to support businesses of all sizes.

- Banks: Traditional banks often offer business loans, lines of credit, and credit cards. They typically have a more established presence and offer competitive rates, but their approval process can be more stringent.

- Credit Unions: Credit unions often offer lower interest rates and more personalized service compared to banks. However, their loan limits might be smaller.

- Online Lenders: Online lenders provide quick and convenient loan options, often with less stringent requirements. They may offer higher interest rates than traditional lenders but can be a good option for businesses with limited credit history.

- Small Business Administration (SBA): The SBA offers loan programs specifically designed for small businesses. These programs often have lower interest rates and longer repayment terms, making them attractive options for businesses with limited credit.

- Alternative Lenders: Alternative lenders, such as fintech companies, offer innovative credit products, including invoice financing and merchant cash advances. They may be more flexible with credit requirements but often charge higher interest rates.

Comparing Key Features of Business Credit Providers

Here’s a table comparing key features of different business credit providers:

| Provider Type | Interest Rates | Fees | Loan Terms | Credit Requirements |

|---|---|---|---|---|

| Banks | Competitive | Moderate | Variable | Strict |

| Credit Unions | Lower | Lower | Variable | Moderate |

| Online Lenders | Higher | Variable | Variable | Less Strict |

| SBA | Lower | Moderate | Longer | Moderate |

| Alternative Lenders | Higher | Variable | Short | Flexible |

Note: Interest rates, fees, and loan terms can vary significantly based on individual factors, such as your credit score, loan amount, and industry.

Application Process

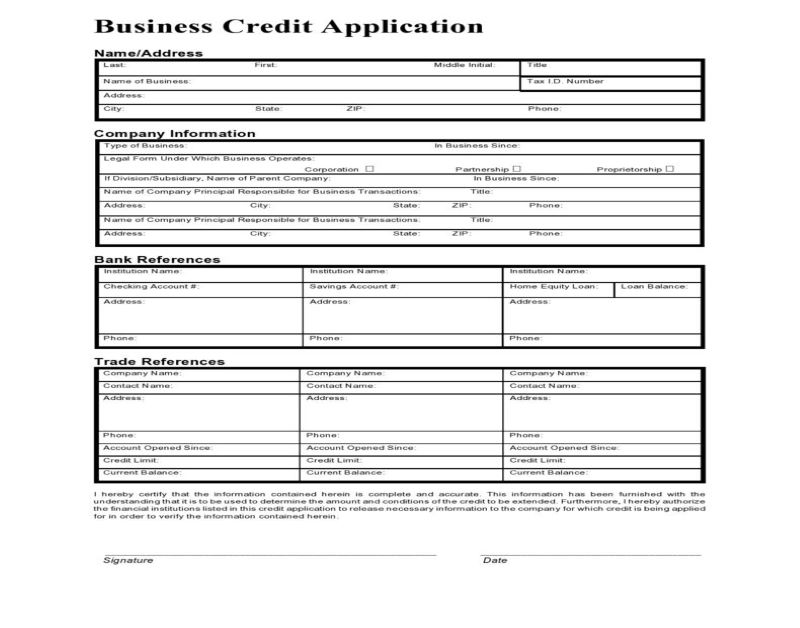

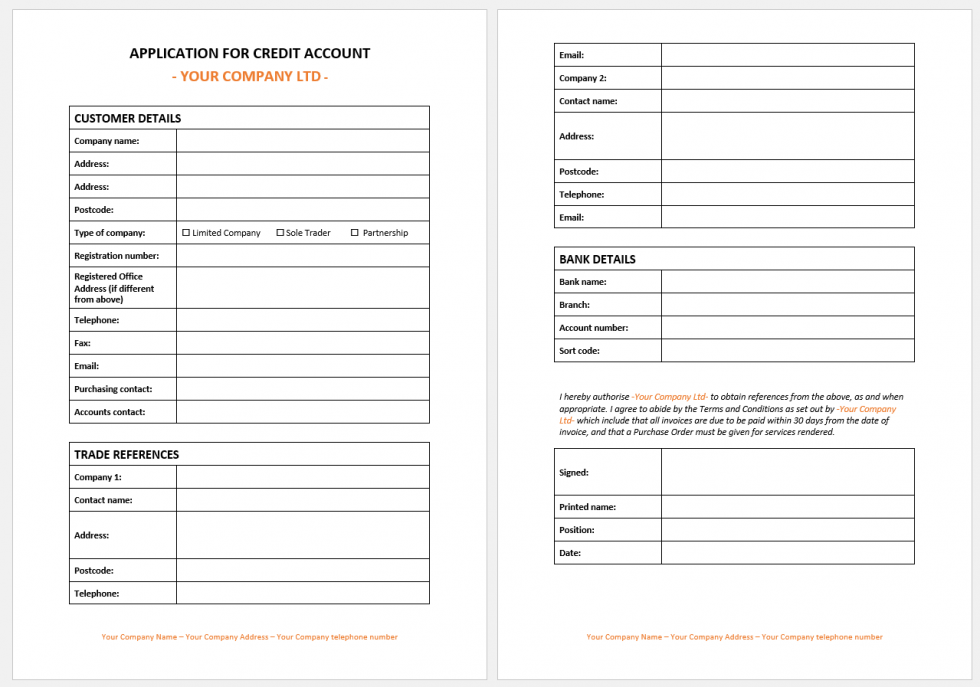

Applying for business credit involves several steps and requires specific documentation depending on the type of credit you seek. Understanding these steps and preparing the necessary documentation can significantly streamline the application process.

Documentation Required for Business Credit Applications

The documentation required for business credit applications varies depending on the type of credit being sought. However, common documents include:

- Business Plan: A detailed document outlining your business goals, target market, financial projections, and operational strategy. This document helps lenders assess your business’s viability and potential for success.

- Financial Statements: These include your balance sheet, income statement, and cash flow statement. They provide lenders with a snapshot of your business’s financial health and performance.

- Tax Returns: Recent tax returns (both federal and state) demonstrate your business’s revenue and profitability. This information helps lenders evaluate your financial history and assess your ability to repay debt.

- Personal Credit Report: In some cases, lenders may require your personal credit report, especially for small businesses or start-ups. This helps lenders assess your personal financial history and risk profile.

- Proof of Identity: This typically includes your driver’s license, passport, or other government-issued identification. It verifies your identity and confirms you are the legitimate owner of the business.

- Proof of Business Ownership: This can include your business license, articles of incorporation, or other legal documentation that proves your ownership of the business. It helps lenders confirm the legitimacy of your business and your authority to apply for credit.

Application Process Flow Chart

The application process for business credit can be visualized as a flow chart:

- Choose a Credit Provider: Select a credit provider based on your business needs and credit history. Consider factors like interest rates, terms, and the type of credit offered.

- Gather Required Documentation: Prepare the necessary documentation, including a business plan, financial statements, tax returns, and proof of identity and business ownership. Ensure all documents are accurate and up-to-date.

- Submit Application: Complete the credit application form online, by mail, or in person. Provide accurate information and ensure all required fields are filled out correctly.

- Credit Check and Review: The lender will review your application and conduct a credit check to assess your creditworthiness. This process may involve checking your business credit score and reviewing your financial statements.

- Decision and Approval: The lender will make a decision based on your creditworthiness and the terms of the credit you’re seeking. If approved, you will receive a credit agreement outlining the terms and conditions of your credit line.

- Credit Line Establishment: Once approved, your credit line will be established, and you can start using your business credit to make purchases or access funds.

Tips for Success

Securing business credit can be a significant step in your company’s journey. While there’s no guarantee of approval, there are strategies you can implement to improve your chances. By understanding the factors that lenders consider and taking proactive steps, you can build a strong foundation for your business’s financial future.

Increasing Approval Chances

- Establish a Solid Business Foundation: Before applying, ensure your business is legally established and has a track record of operations. This includes having a business plan, a clear understanding of your target market, and a reliable financial management system.

- Build a Positive Personal Credit Score: Your personal credit history can play a role in your business creditworthiness, especially when you’re first starting out. Maintaining a good personal credit score demonstrates financial responsibility and can make you a more attractive borrower.

- Demonstrate Financial Stability: Lenders want to see that your business can handle its financial obligations. Provide them with accurate and detailed financial statements, including profit and loss statements, balance sheets, and cash flow statements. Having a positive cash flow history is particularly important.

- Offer Collateral: If possible, offering collateral, such as equipment or real estate, can strengthen your application. Collateral provides lenders with an asset they can seize if you default on your loan, reducing their risk.

- Research and Choose the Right Lender: Not all lenders are created equal. Consider the specific needs of your business and compare different lenders’ terms, interest rates, and fees. Look for lenders that specialize in working with businesses like yours.

Building a Strong Business Credit History

- Start Early: The sooner you begin establishing business credit, the better. Applying for a business credit card or a small business loan, even for a small amount, can help you build a positive credit history.

- Pay Bills on Time: Timely payments are essential for building a strong credit score. Set up automatic payments or reminders to ensure you meet your obligations on time. Late payments can negatively impact your credit rating.

- Use Credit Wisely: Avoid overextending your credit. Use credit responsibly and pay down balances promptly. This demonstrates financial discipline and responsible credit management.

- Monitor Your Credit Report: Regularly check your business credit report for accuracy and any potential errors. You can obtain a free credit report from each of the major credit bureaus annually.

Managing Business Credit Responsibly

- Set a Budget and Stick to It: Create a realistic budget for your business and track your expenses carefully. This helps you avoid overspending and ensures you can meet your financial obligations.

- Avoid Excessive Debt: While credit can be a valuable tool, it’s crucial to use it responsibly. Avoid taking on excessive debt that you may struggle to repay.

- Review Credit Agreements Carefully: Before signing any credit agreement, read the terms and conditions thoroughly. Understand the interest rates, fees, and repayment terms.

- Seek Professional Advice: If you’re unsure about managing business credit or need assistance, consider consulting a financial advisor or accountant. They can provide valuable insights and guidance.

Outcome Summary

Building and maintaining a positive business credit score is an ongoing process that requires attention and strategic planning. By understanding the different types of business credit, carefully selecting a provider, and following the steps Artikeld in this guide, you can lay the groundwork for a strong financial future for your business. Remember, good credit opens doors to opportunities, allowing you to pursue your entrepreneurial goals with confidence.

FAQ Guide

What is the difference between a business credit card and a business loan?

A business credit card is a revolving line of credit that you can use for business expenses and pay back over time. A business loan is a lump sum of money that you borrow and repay with interest over a set period.

How long does it take to build business credit?

Building business credit takes time and consistent effort. It typically takes several months to a year to establish a credit history and see a significant improvement in your score.

Can I use my personal credit to apply for business credit?

While your personal credit score can be a factor in some business credit applications, it’s generally not the primary factor. Most business credit providers will assess your business’s financial history and performance.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!