Where to get a business line of credit is a question that many entrepreneurs face. A business line of credit can be a valuable tool for businesses of all sizes, providing flexible financing that can be used for a variety of purposes. From covering short-term cash flow needs to funding expansion, a business line of credit can be a lifeline for businesses looking to grow and succeed.

This guide will provide a comprehensive overview of business lines of credit, including the different types available, eligibility requirements, how to find the right lender, the application process, and best practices for managing a business line of credit. We’ll also explore alternative financing options and discuss when they might be a better fit for your business.

Understanding Business Lines of Credit

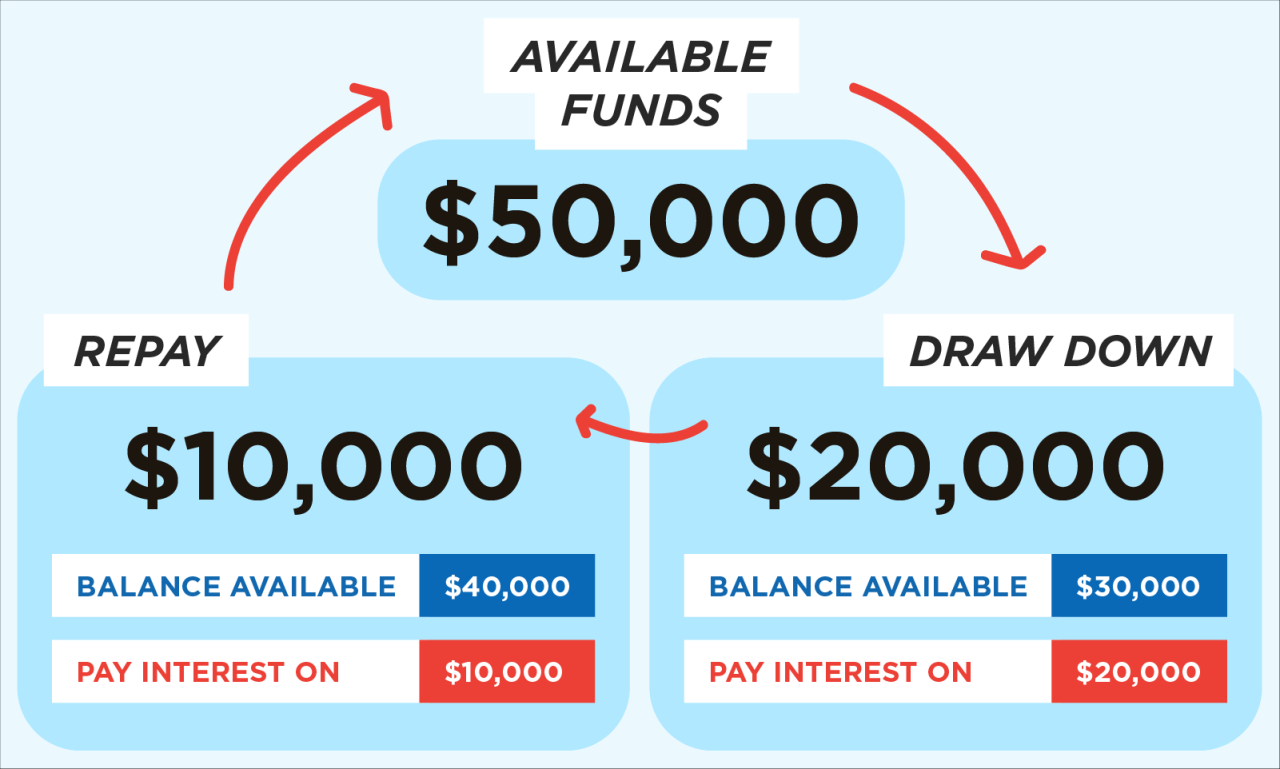

A business line of credit is a revolving credit facility that allows businesses to borrow money as needed, up to a pre-approved credit limit. It’s like a credit card for businesses, providing flexibility and access to funds when unexpected expenses arise or opportunities present themselves.

Types of Business Lines of Credit

There are various types of business lines of credit, each tailored to different business needs and credit profiles.

- Unsecured Business Lines of Credit: These lines of credit are not backed by collateral, making them easier to obtain but typically come with higher interest rates. They are ideal for businesses with strong credit history and a proven track record.

- Secured Business Lines of Credit: These lines of credit require collateral, such as real estate or equipment, to secure the loan. They often come with lower interest rates due to the reduced risk for lenders. This option is suitable for businesses with assets to pledge as collateral.

- Revolving Lines of Credit: These lines of credit allow businesses to borrow and repay funds repeatedly, as long as they stay within their credit limit. They offer flexibility and convenience for managing cash flow.

- Term Lines of Credit: These lines of credit have a fixed repayment period, often with a specific interest rate. They provide a structured approach to borrowing and repayment.

- Invoice Financing: This type of line of credit allows businesses to borrow against their outstanding invoices. It’s particularly helpful for businesses with long payment terms from their clients.

Benefits of a Business Line of Credit

Business lines of credit offer several advantages to businesses, including:

- Flexibility: Businesses can borrow funds as needed, without having to go through a lengthy loan application process each time.

- Access to Capital: Lines of credit provide a readily available source of funding for unexpected expenses, growth opportunities, or working capital needs.

- Improved Credit Score: Responsible use of a business line of credit can improve a business’s credit score, making it easier to secure future financing.

- Predictable Interest Rates: Most business lines of credit have fixed interest rates, providing businesses with a predictable cost of borrowing.

- Build Credit History: Utilizing a business line of credit responsibly can help establish a business’s credit history, making it easier to access financing in the future.

Considerations for Obtaining a Business Line of Credit

Before applying for a business line of credit, businesses should consider several factors:

- Credit Score: Lenders typically require a good credit score to approve a business line of credit. Businesses should review their credit score and address any negative factors before applying.

- Repayment Capacity: Businesses should ensure they have sufficient cash flow to repay the line of credit. Lenders will assess a business’s ability to meet its financial obligations.

- Interest Rates: Businesses should compare interest rates from different lenders to find the most favorable terms. It’s important to consider the overall cost of borrowing, including any fees.

- Terms and Conditions: Businesses should carefully review the terms and conditions of the line of credit, including the credit limit, repayment period, and any fees. Understanding the terms will help businesses make informed decisions.

- Collateral Requirements: Some business lines of credit require collateral. Businesses should assess their assets and determine if they are willing to pledge them as security for the loan.

Eligibility and Requirements

Securing a business line of credit hinges on your company’s financial health and creditworthiness. Lenders evaluate various factors to assess your business’s ability to repay the loan.

Common Eligibility Requirements

Lenders typically have a set of general requirements that businesses must meet to be eligible for a line of credit. These include:

- Established Business: Lenders usually prefer businesses that have been operating for at least a year, demonstrating a track record of stability and profitability.

- Good Credit Score: A strong business credit score, reflecting responsible financial management, is essential for securing favorable loan terms.

- Revenue and Profitability: Lenders assess your business’s revenue and profitability to determine its capacity to repay the loan. They may require financial statements, such as income statements and balance sheets, to verify this information.

- Collateral: While not always mandatory, some lenders may require collateral, such as equipment or real estate, as security for the loan. This reduces the lender’s risk in case of default.

Documentation Required for Application

To apply for a business line of credit, lenders typically require the following documentation:

- Business Plan: This Artikels your business’s objectives, strategies, and financial projections.

- Financial Statements: Including income statements, balance sheets, and cash flow statements, these provide a comprehensive view of your business’s financial performance.

- Tax Returns: These documents verify your business’s revenue and profitability.

- Personal Credit Report: In some cases, lenders may request your personal credit report, especially for small businesses where the owner’s personal finances are intertwined with the business.

- Bank Statements: These demonstrate your business’s cash flow and banking activity.

- Proof of Business Ownership: This includes documentation like articles of incorporation or a business license.

Creditworthiness Factors Considered

Lenders assess your business’s creditworthiness based on several factors, including:

- Credit History: This reflects your business’s past borrowing and repayment behavior. A positive credit history demonstrates financial responsibility and increases your chances of approval.

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt to equity financing your business uses. A lower ratio suggests greater financial stability.

- Current Assets: These represent the assets your business can readily convert into cash, such as inventory or accounts receivable. A healthy level of current assets indicates your business’s ability to meet short-term obligations.

- Cash Flow: This represents the movement of cash into and out of your business. Consistent positive cash flow demonstrates your ability to generate revenue and repay debt.

- Industry Trends: Lenders may consider the overall health and growth prospects of your industry to assess your business’s potential for success.

- Management Team: Lenders evaluate the experience, expertise, and track record of your management team to assess their ability to lead the business effectively.

Finding the Right Lender

Finding the right lender for your business line of credit is crucial. You want to find a lender that offers competitive interest rates and fees, as well as the features and benefits that are most important to you.

Comparing Lenders

Before applying for a business line of credit, it’s important to compare different lenders and their offerings. You should consider the following factors:

- Interest rates: Interest rates vary depending on the lender, your credit score, and the amount of credit you need. Compare interest rates from several lenders to find the best deal.

- Fees: Lenders may charge various fees, such as annual fees, origination fees, and late payment fees. Be sure to factor in all fees when comparing lenders.

- Credit limit: The credit limit is the maximum amount of money you can borrow. Make sure the credit limit is sufficient for your business needs.

- Repayment terms: Repayment terms vary depending on the lender. Some lenders offer fixed repayment terms, while others offer flexible terms. Choose a repayment term that fits your business’s cash flow.

- Customer service: Look for a lender that offers excellent customer service. You want to be able to easily contact your lender and get the help you need.

Reputable Lenders Offering Business Lines of Credit

There are many reputable lenders that offer business lines of credit. Some of the most popular options include:

- Banks: Traditional banks, such as Bank of America, Chase, and Wells Fargo, offer business lines of credit. These banks typically have a wide range of loan products and services.

- Credit unions: Credit unions are member-owned financial institutions that often offer competitive interest rates and fees on business lines of credit.

- Online lenders: Online lenders, such as Kabbage, OnDeck, and LendingClub, offer quick and easy access to business lines of credit. These lenders typically have more flexible eligibility requirements than traditional banks.

- Small Business Administration (SBA): The SBA offers loan programs that can help small businesses obtain financing, including business lines of credit.

Features and Benefits of Different Lenders, Where to get a business line of credit

Different lenders offer different features and benefits. Some of the most common features include:

- Variable or fixed interest rates: Some lenders offer variable interest rates, which fluctuate based on market conditions. Others offer fixed interest rates, which remain the same for the duration of the loan.

- Draw periods and repayment terms: Draw periods allow you to borrow money as needed, up to your credit limit. Repayment terms specify the amount of time you have to repay the loan.

- Rewards programs: Some lenders offer rewards programs that can help you earn cash back or points on your purchases.

- Early repayment options: Some lenders allow you to repay your loan early without penalty.

Application Process

The application process for a business line of credit is generally straightforward and can be completed online or in person at a lender’s office. It’s crucial to gather all necessary documentation beforehand to streamline the process and increase your chances of approval.

Application Steps

The application process typically involves the following steps:

- Gather Required Documents: Before starting the application, ensure you have all the necessary documents readily available. This includes your business’s financial statements (income statement, balance sheet, cash flow statement), tax returns, business plan, and proof of identity.

- Complete the Application: Once you have all the required documents, you can start filling out the application form. The application will ask for information about your business, including its legal structure, industry, revenue, expenses, and credit history.

- Submit the Application: After completing the application form, you can submit it online, by mail, or in person at a lender’s office. Make sure to review the application carefully before submitting it to avoid any errors.

- Review and Approval: Once the lender receives your application, they will review it and assess your creditworthiness. The lender will consider factors such as your business’s financial history, credit score, debt-to-income ratio, and industry outlook. The review process can take anywhere from a few days to a few weeks, depending on the lender and the complexity of your application.

- Funding: If your application is approved, the lender will fund your line of credit. The funds will be deposited into your business bank account, and you can start using the line of credit for your business needs.

Preparing a Strong Application

A well-prepared application can significantly increase your chances of approval and secure favorable terms. Here are some tips for preparing a strong application:

- Maintain Good Credit: A strong credit score is crucial for obtaining a business line of credit. Make sure to pay your bills on time and keep your credit utilization low.

- Provide Detailed Financial Information: Lenders require detailed financial information to assess your business’s financial health. Provide accurate and complete financial statements, tax returns, and other relevant documentation.

- Develop a Comprehensive Business Plan: A well-written business plan demonstrates your understanding of your business and your future plans. It should include information about your target market, competitive landscape, marketing strategy, and financial projections.

- Highlight Your Business Strengths: Emphasize your business’s strengths and unique selling propositions. This could include your strong management team, established customer base, or innovative products or services.

- Be Transparent: Be honest and transparent about your business’s financial history and any challenges you may have faced. Lenders appreciate honesty and will be more likely to work with you if you are upfront about your situation.

Factors Influencing Approval Time

The approval time for a business line of credit can vary depending on several factors:

- Lender’s Policies: Each lender has its own policies and procedures for reviewing and approving applications. Some lenders have faster approval times than others.

- Complexity of Application: Applications that require extensive documentation or involve complex financial situations may take longer to process.

- Creditworthiness: Your business’s creditworthiness is a major factor influencing approval time. Lenders may take longer to review applications from businesses with a lower credit score or a history of financial difficulties.

- Industry Outlook: Lenders consider the overall industry outlook when assessing loan applications. Applications from businesses in industries experiencing rapid growth or strong demand may be approved faster than those in struggling industries.

- Lender’s Workload: The lender’s current workload can also impact approval time. If the lender is busy, it may take longer to review your application.

Managing a Business Line of Credit

A business line of credit is a valuable financial tool, but it requires responsible management to avoid accumulating debt and maximize its benefits. This section will Artikel essential strategies for utilizing a business line of credit effectively.

Tracking Credit Utilization and Payments

Regularly monitoring your credit utilization and payment history is crucial for responsible management. This ensures you stay within your credit limit and maintain a healthy credit score.

- Keep track of your outstanding balance: Regularly review your account statements to monitor the amount you owe and the interest accrued.

- Make timely payments: Pay your outstanding balance on time to avoid late fees and damage to your credit score.

- Set up payment reminders: Utilize online banking tools or calendar reminders to ensure you don’t miss any payment deadlines.

Strategies for Maximizing the Benefits

Utilizing a business line of credit strategically can provide significant advantages for your business. Here are some strategies to maximize its benefits:

- Use it for short-term financing: A business line of credit is ideal for covering temporary cash flow gaps, such as seasonal fluctuations or unexpected expenses.

- Pay down the balance quickly: If possible, aim to repay the outstanding balance as soon as you can to minimize interest charges.

- Maintain a good credit score: A strong credit score will qualify you for lower interest rates and better terms.

- Avoid using it for long-term financing: A business line of credit is not intended for long-term investments or large capital expenditures.

Alternatives to Business Lines of Credit

A business line of credit is a valuable financing tool, but it may not be the best fit for every business. Other financing options can provide more flexibility or better suit specific needs.

This section explores alternative financing options for businesses and compares their pros and cons. It also provides examples of situations where alternative financing may be more suitable.

Term Loans

Term loans are a common financing option for businesses that need a fixed amount of money for a specific purpose, such as purchasing equipment or expanding operations.

- Pros:

- Fixed monthly payments, making budgeting easier.

- Lower interest rates than credit cards or short-term loans.

- Longer repayment terms, providing more time to repay the loan.

- Cons:

- Requires a strong credit score and good financial history.

- Can be more time-consuming to secure than a line of credit.

- May have stricter eligibility requirements than a line of credit.

Example: A bakery needs a new oven to increase production. A term loan could provide the necessary funds with fixed monthly payments over a longer period.

SBA Loans

The Small Business Administration (SBA) offers government-backed loans to small businesses through participating lenders.

- Pros:

- Lower interest rates and longer repayment terms than conventional loans.

- Less stringent eligibility requirements than traditional loans.

- Access to counseling and training resources from the SBA.

- Cons:

- Can be more time-consuming to secure than other loan options.

- May require a business plan and other documentation.

- Not all businesses qualify for SBA loans.

Example: A startup tech company needs funding to develop its product. An SBA loan could provide the necessary capital with more favorable terms than a traditional bank loan.

Equipment Financing

Equipment financing is a specialized form of financing that allows businesses to purchase equipment with a loan specifically designed for that purpose.

- Pros:

- Lower interest rates than other financing options.

- Flexible repayment terms, including lease options.

- Can be used to purchase a wide range of equipment, from computers to heavy machinery.

- Cons:

- May require a down payment.

- May have specific eligibility requirements based on the type of equipment being financed.

- May not be available for all types of equipment.

Example: A construction company needs a new excavator. Equipment financing can provide the funds with a loan tailored to the purchase of heavy machinery.

Invoice Factoring

Invoice factoring is a financing option that allows businesses to sell their unpaid invoices to a factoring company at a discount.

- Pros:

- Immediate access to cash, improving cash flow.

- No need for collateral or a credit check.

- Can be a good option for businesses with a high volume of invoices.

- Cons:

- Factoring companies charge a fee for their services, which can be significant.

- Businesses lose control over their invoices.

- May not be suitable for all businesses.

Example: A landscaping company has a large number of outstanding invoices from clients. Invoice factoring can provide immediate cash flow by selling the invoices to a factoring company.

Crowdfunding

Crowdfunding is a method of raising funds from a large number of people, typically through online platforms.

- Pros:

- Can be a good option for businesses that are looking to raise a small amount of money.

- Can help build a community around the business.

- Can provide valuable feedback from potential customers.

- Cons:

- Can be time-consuming and challenging to raise funds.

- May not be suitable for all businesses.

- May not be a reliable source of funding for larger amounts.

Example: A startup coffee shop needs to raise funds to open its first location. Crowdfunding can help them raise the necessary capital from a large number of supporters.

Venture Capital

Venture capital is a type of investment made by investors in early-stage companies with high growth potential.

- Pros:

- Access to large amounts of funding.

- Expertise and guidance from venture capitalists.

- Can help accelerate business growth.

- Cons:

- High risk investment, as most startups fail.

- Venture capitalists typically demand a significant equity stake in the business.

- May not be suitable for all businesses.

Example: A software company with a revolutionary new product is looking to expand rapidly. Venture capital can provide the necessary funds and expertise to support their growth.

Outcome Summary

Securing a business line of credit can be a smart move for businesses seeking to navigate the complexities of financial management. By understanding the different types of lines of credit, eligibility criteria, and application processes, you can make informed decisions to find the right financing solution for your needs. Remember to carefully consider the terms and conditions of each lender, including interest rates, fees, and repayment terms, to ensure you’re making the most advantageous choice for your business.

FAQ Guide: Where To Get A Business Line Of Credit

What is the difference between a business line of credit and a business loan?

A business line of credit is a revolving credit facility that allows you to borrow money as needed up to a pre-approved limit, while a business loan is a fixed amount of money that you receive upfront and repay over a set period. A line of credit offers flexibility and access to funds as needed, while a loan provides a fixed amount for specific purposes.

How much can I borrow with a business line of credit?

The amount you can borrow depends on your creditworthiness, business history, and the lender’s policies. Lenders typically assess factors like your revenue, debt-to-equity ratio, and credit score to determine your borrowing limit.

What are the interest rates and fees associated with a business line of credit?

Interest rates and fees vary depending on the lender, your creditworthiness, and the loan amount. It’s important to compare rates and fees from different lenders before making a decision.

What are the risks of using a business line of credit?

The main risk is overspending and accumulating excessive debt. It’s crucial to use a business line of credit responsibly and only borrow what you need. Failing to make payments on time can damage your credit score and make it difficult to obtain financing in the future.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!