Which bank is best for business line of credit – Which bank offers the best business line of credit? This question is crucial for entrepreneurs seeking flexible funding to manage their cash flow and seize opportunities. Choosing the right bank can significantly impact your business’s financial health, so understanding the factors involved in this decision is essential.

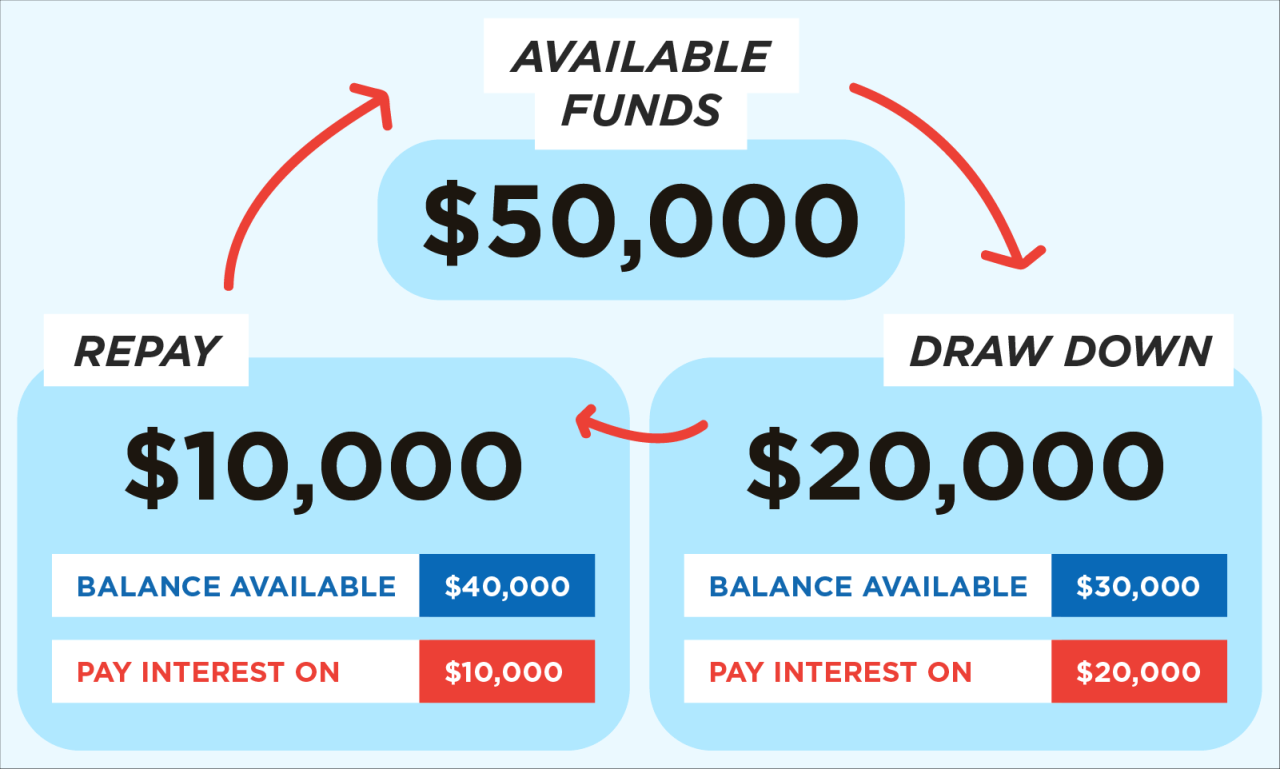

A business line of credit is a revolving credit facility that allows you to borrow funds as needed, up to a predetermined limit. It provides businesses with a safety net, enabling them to cover unexpected expenses, finance seasonal fluctuations, or invest in growth opportunities.

Understanding Business Lines of Credit

A business line of credit is a revolving credit account that businesses can use to access funds as needed. It’s like a credit card for businesses, allowing them to borrow money up to a pre-approved limit and pay it back over time.

Purpose of a Business Line of Credit

A business line of credit can be used for various purposes, including:

* Working Capital: This is the most common use, as it helps businesses cover day-to-day expenses like payroll, rent, and inventory.

* Seasonal Fluctuations: Businesses with seasonal peaks and dips in revenue can use a line of credit to manage cash flow during slow periods.

* Unexpected Expenses: Unexpected repairs, equipment failures, or other unforeseen events can be handled with a business line of credit.

* Short-Term Investments: Businesses may use a line of credit to fund short-term investments, such as purchasing new equipment or expanding into a new market.

Benefits of Using a Business Line of Credit

A business line of credit offers several benefits, including:

* Flexibility: Businesses can access funds as needed, without having to apply for a loan each time.

* Lower Interest Rates: Lines of credit typically have lower interest rates than short-term loans.

* Improved Credit Score: Making timely payments on a line of credit can help improve a business’s credit score.

* Predictable Payments: Businesses can choose a fixed or variable interest rate, providing predictability in their monthly payments.

Key Factors to Consider When Choosing a Business Line of Credit

When choosing a business line of credit, businesses should consider the following factors:

* Interest Rate: This is the cost of borrowing money. Look for a competitive interest rate that fits your budget.

* Credit Limit: This is the maximum amount of money you can borrow. Choose a limit that meets your business’s needs.

* Fees: There may be annual fees, transaction fees, or other fees associated with a line of credit.

* Terms: Pay attention to the repayment terms, including the interest rate, repayment period, and any penalties for late payments.

* Eligibility Requirements: Each lender has its own eligibility requirements, such as minimum revenue, credit score, and time in business.

Key Factors to Consider

Choosing the right business line of credit involves careful consideration of several key factors. These factors can significantly impact your borrowing experience and financial well-being.

Interest Rates and Fees

Interest rates and fees are crucial aspects to consider when comparing different banks. They directly affect the overall cost of your line of credit.

- Variable vs. Fixed Interest Rates: Variable interest rates fluctuate with market conditions, potentially making your monthly payments unpredictable. Fixed interest rates offer stability and predictable payments, but they might be higher initially.

- Annual Percentage Rate (APR): APR reflects the total cost of borrowing, including interest rates and fees. Comparing APRs between different banks allows you to accurately assess the overall cost of each line of credit.

- Fees: Banks often charge various fees, such as origination fees, annual fees, and late payment fees. Understanding these fees and their impact on your overall borrowing cost is essential.

Credit Score Requirements

Each bank sets its own credit score requirements for business line of credit approval. A higher credit score generally translates to better interest rates and terms.

- Minimum Credit Score: Banks typically require a minimum credit score for business lines of credit. This minimum score can vary depending on the bank and the specific line of credit offered.

- Credit Score Impact on Interest Rates: Borrowers with higher credit scores usually qualify for lower interest rates, while those with lower credit scores may face higher rates.

Loan Terms and Repayment Options

Understanding the loan terms and repayment options available is essential for managing your line of credit effectively.

- Draw Period: This period allows you to access the credit line and borrow funds as needed.

- Repayment Period: This period determines how long you have to repay the borrowed funds. Banks offer various repayment options, such as fixed monthly payments or interest-only payments.

- Repayment Flexibility: Some banks offer flexible repayment options, allowing you to make larger payments to reduce your debt faster or make smaller payments when cash flow is tight.

Application Process and Approval Timeframes

The application process and approval timeframes can vary significantly between banks.

- Application Requirements: Banks typically require various documents, including financial statements, tax returns, and business plans, to assess your creditworthiness.

- Approval Timeframes: Approval times can range from a few days to several weeks, depending on the bank and the complexity of your application.

Customer Service and Support

Excellent customer service and support are crucial for a positive borrowing experience.

- Availability of Support: Banks should offer readily available customer service channels, such as phone, email, and online chat.

- Responsiveness: Timely responses to inquiries and concerns are essential for a smooth borrowing experience.

Popular Banks for Business Lines of Credit

Choosing the right bank for a business line of credit can be a significant decision. It’s essential to consider various factors, such as interest rates, fees, credit score requirements, and loan terms.

Popular Banks for Business Lines of Credit

Here’s a table comparing the features and benefits of some popular banks for business lines of credit:

| Bank Name | Interest Rates | Fees | Credit Score Requirements | Loan Terms |

|---|---|---|---|---|

| Bank of America | Variable, starting at prime rate + 0.50% | Annual fee, transaction fees, late payment fees | 680+ | 1-10 years |

| Chase | Variable, starting at prime rate + 0.75% | Annual fee, transaction fees, late payment fees | 680+ | 1-10 years |

| Wells Fargo | Variable, starting at prime rate + 0.50% | Annual fee, transaction fees, late payment fees | 680+ | 1-10 years |

| Citibank | Variable, starting at prime rate + 0.75% | Annual fee, transaction fees, late payment fees | 680+ | 1-10 years |

| U.S. Bank | Variable, starting at prime rate + 0.50% | Annual fee, transaction fees, late payment fees | 680+ | 1-10 years |

It’s important to note that interest rates, fees, and credit score requirements can vary depending on your specific business and creditworthiness. It’s always recommended to compare offers from multiple lenders before making a decision.

Additional Considerations

While researching and comparing banks for your business line of credit is crucial, several other factors deserve careful consideration. These can significantly impact your overall borrowing experience and the success of your business.

Bank Reputation and Reviews, Which bank is best for business line of credit

A bank’s reputation and customer reviews offer valuable insights into its trustworthiness and reliability. It’s essential to research the bank’s history, track record, and customer satisfaction levels. Reputable banks typically have positive reviews and a strong track record of supporting businesses. You can find this information on websites like the Better Business Bureau (BBB), Trustpilot, and online banking forums.

“Checking a bank’s reputation is like performing a background check on a potential business partner. It ensures you’re dealing with a reliable and trustworthy entity.”

Industry-Specific Needs

Different industries have unique financial requirements and challenges. For example, a technology startup might require a line of credit with flexible repayment terms to accommodate rapid growth, while a retail business might need a line of credit with a longer repayment period to manage seasonal fluctuations in sales. Banks with expertise in your specific industry can offer tailored solutions and valuable insights into your business needs.

“Choosing a bank with industry-specific knowledge can be like having a dedicated advisor who understands your business challenges and can provide tailored financial solutions.”

Negotiating Favorable Loan Terms

Negotiating favorable loan terms is crucial to securing a line of credit that aligns with your business needs. This includes factors like interest rates, fees, and repayment terms. Researching market rates and comparing offers from different banks can give you a better understanding of what’s available and help you negotiate better terms. You can also leverage your business’s financial strength, credit history, and potential for growth to negotiate favorable conditions.

“Negotiating loan terms is like haggling for a better price at a market. Preparation, knowledge, and a strong bargaining position can lead to favorable outcomes.”

Maintaining a Strong Credit History

A strong credit history is vital for securing a business line of credit with favorable terms. Banks carefully assess your creditworthiness before approving loans. Maintaining a good credit score through responsible borrowing and timely payments demonstrates your financial responsibility and increases your chances of getting approved for a line of credit with lower interest rates and better terms.

“A strong credit history acts like a credit score passport, opening doors to better loan terms and financial opportunities.”

Alternatives to Traditional Banks: Which Bank Is Best For Business Line Of Credit

Sometimes, traditional banks might not be the best fit for your business needs, especially when it comes to obtaining a line of credit. Fortunately, there are alternative lending options available that can cater to a wider range of businesses. These alternatives offer a different approach to lending, often with more flexibility and quicker approval processes.

Online Lenders

Online lenders are becoming increasingly popular for businesses seeking financing. They operate entirely online, simplifying the application process and often providing faster funding decisions. Here are some of the advantages and disadvantages of using online lenders:

Pros of Using Online Lenders

- Faster Approval Process: Online lenders typically have streamlined application processes and use automated decision-making systems, which can lead to quicker approval times compared to traditional banks.

- More Flexibility: Online lenders often have less stringent requirements than traditional banks, making them a better option for businesses with less-than-perfect credit or those that are newer or smaller.

- Access to Funding for Businesses That Might Be Rejected by Traditional Banks: Online lenders are more willing to consider businesses that might be deemed risky by traditional banks, such as startups or businesses with lower credit scores.

Cons of Using Online Lenders

- Higher Interest Rates: Because online lenders often take on more risk, they typically charge higher interest rates than traditional banks. This is especially true for businesses with lower credit scores or those that are newer or smaller.

- Shorter Loan Terms: Online lenders often offer shorter loan terms than traditional banks, which can make it more difficult to repay the loan if your business experiences financial difficulties.

- Limited Customer Service: Online lenders typically have limited customer service options compared to traditional banks. This can make it more difficult to resolve issues or get help with your loan.

Interest Rates and Fees

Interest rates and fees for online lenders can vary significantly depending on factors such as your business’s credit score, revenue, and loan amount. Generally, online lenders offer interest rates ranging from 8% to 30% APR, with higher rates for businesses with lower credit scores. Fees can include origination fees, late payment fees, and other charges.

It’s important to carefully compare the interest rates and fees offered by different online lenders before making a decision.

Closure

Selecting the best bank for your business line of credit requires careful consideration of your specific needs and financial situation. By comparing interest rates, fees, credit score requirements, and loan terms, you can find an option that aligns with your business goals. Don’t hesitate to explore alternative lenders, as they can offer competitive rates and flexible terms. Ultimately, a well-researched decision can help you secure the funding you need to drive your business forward.

Clarifying Questions

What is the average interest rate for a business line of credit?

Interest rates for business lines of credit vary depending on factors like your credit score, business revenue, and loan amount. However, the average interest rate is typically between 5% and 10%.

How long does it take to get approved for a business line of credit?

The approval process for a business line of credit can range from a few days to several weeks. The time frame depends on the lender, your credit history, and the complexity of your application.

What are the common fees associated with a business line of credit?

Common fees include annual fees, origination fees, and interest charges. Some banks may also charge monthly maintenance fees or inactivity fees.

What is the difference between a business line of credit and a business loan?

A business line of credit is a revolving credit facility, allowing you to borrow funds as needed, up to a predetermined limit. A business loan is a fixed amount of money that is repaid over a set period.

Norfolk Publications Publications ORG in Norfolk!

Norfolk Publications Publications ORG in Norfolk!